《鄉民大學問EP.36》字幕版|韓院長的突襲!藍綠白委員見“韓國魚”驚呼!謝龍介不敢睡 稱愈晚愈high在忙那椿?葉元之公開立院頭號女戰神是“她”!王世堅自豪這點連韓國瑜也比不上!|NOWnews

NOW影音

更多NOW影音焦點

更多焦點-

天后也有派對!大甲媽明赴苗栗田間「三媽會」 網喊我的女神好甜

台中海線有名的「三媽會」,通常是行蹤飄忽不定的白沙屯媽,進香途中偕山邊媽到大甲鎮瀾宮團聚,不曾見遶境路線固定的大甲媽主動探姊妹。明天下午在苗栗苑裡的田裡,大甲媽和通霄拱天宮白沙屯媽、苑裡慈和宮香燈媽將

2024-04-19 10:47

-

又有2金控有興趣?京城銀招親股價早盤重摔逾7% 再發重訊說明

針對京城銀行有意招親找買家,在傳出中信金有意併購之外,現在又傳永豐金及元大金也興趣,甚至傳出這2家金控已通過第一關。對此,京城銀今(19)日發出重訊表示,目前公司董事會並無任何決議,而元大金、永豐金也

2024-04-19 10:44

-

張蘭瞎扯大S派臥底勾引汪小菲出軌!張穎穎喊告:一切不會私了

汪小菲和大S(徐熙媛)離婚劇情越來越離奇,他婚內出軌網紅張穎穎,只好配合大S簽下離婚協議,結果遭到母親張蘭阻止,未能修成正果,今年和新歡馬筱梅(曼蒂Mandy)求婚成功,即將再婚當人夫。不過,張蘭最近

2024-04-19 10:34

-

高雄氣爆1死7傷!獨居男騎樓擺3瓦斯桶 案發前醉喊:大家一起死

高雄市三民區褒揚街某民宅今(19)日凌晨驚傳氣爆,釀成1死7傷,起火點位於266巷8號透天厝騎樓,現場擺放3支瓦斯桶,並於後方防火巷發現49邱姓屋主,全身大面積燒燙傷,目前仍在與死神拔河。警方不排除縱

2024-04-19 10:30

精選專題

要聞

更多要聞-

環境部長爆黑馬!氣象達人彭啟明出任 透露答應入閣「1大原因」

準行政院長卓榮泰今(19)日上午10時公布第四波內閣新人事,其中,環境部長爆出一大黑馬,由氣象達人彭啟明出任。外界好奇彭啟明答應入閣原因,彭啟明表示,來自產業界的自己的確曾經天人交戰,但在全球推動淨零

2024-04-19 10:42

-

率5內閣亮相!彭啟明接環境部 卓榮泰:為進入國際市場買門票

新任內閣人事第四場發佈會今(19)日登場,準行政院長卓榮泰率5位新閣員一同亮相,包含環境部長、衛福部長、勞動部長、客委會主委、原民會主委。卓榮泰表示,期待新內閣成員秉持誠實面對問題、務實提出方法、踏實

2024-04-19 10:35

-

快訊/年改復議案將重新投票 民眾黨不投票:反對藍綠操作議題

立法院院會在上週五處理年金改革復議案時,發生國民黨立委盧縣一「幽靈選票」事件,引發綠營質疑。立法院長韓國瑜日前裁示,該表決案「另定期處理」,今(19)日將重新表決。對此,民眾黨今日表示,支持年金改革,

2024-04-19 10:20

-

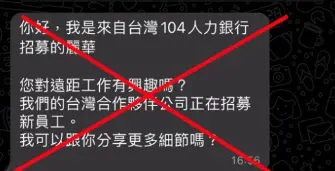

「麗華」你哪位?詐騙黑手伸進求職網 104提醒辨識真偽「3撇步」

最近陸續有民眾收到WhatsApp或簡訊,發自「+44」開頭的變造電話,內容是「你好,我是來自台灣104人力銀行招募的麗華,您對遠距工作有興趣嗎?我們的台灣合作夥伴公司正在招募新員工。我可以跟你分享更

2024-04-19 09:42

新奇

更多新奇-

台大AV女優宣布徒步環台!首日狂走20公里「腳起水泡」 現況曝光

去年考上國立台灣大學的AV女優魏喬安,日前在社群平台上宣布要徒步環島旅行,第一天就狂走20公里,從台北車站走到三峽,也讓她腳上起水泡,再加上同行夥伴遭野狗咬傷,只能暫時回台北休養,不過她也強調,到下週

2024-04-18 20:05

-

一堆人到巴黎錢包被偷!黃大謙帶「8個錢包」實測 驚人結局曝光

法國的首都巴黎是擁有數千年歷史的古都,也是許多遊客到訪歐洲必去的浪漫城市。但當地治安卻總是亮起黃燈,一堆人都曾在當地錢包、財物失竊,當有人要去巴黎時,幾乎被提醒的第一句都是「小心錢包被偷」。對此,Yo

2024-04-18 18:38

-

佛心蛋「1顆賣1元」!每人限5顆 阿姨買100顆遭拒狂酸:還怕人買

不要糟蹋別人的心意!近期雞蛋價格雖然沒有去年「蛋荒」時昂貴,但想要買到一顆1元的雞蛋,仍可以說是天方夜譚。近期就有民眾表示,爸爸退休後迷上養雞、鴨,產生的蛋自家吃不完,就打算便宜販售,訂出「1顆蛋1元

2024-04-18 18:38

-

政大景觀池命名票選!「金玟池」得票63%暫居第一 超紅原因曝光

韓流魅力真的太強了!近期國立政治大學要達賢圖書館旁的景觀池命名,更舉辦了人氣票選比賽,也開放校外民眾參加,沒想到除了許多諧音梗紛紛出籠之外,還有韓星「金玟池」的名字也在其中,甚至還突破6成得票率暫居第

2024-04-17 21:53

娛樂

更多娛樂-

田馥甄曬亂髮照大嘆離譜!自比「王世堅髮型」 41歲素顏狀態曝光

女子天團S.H.E成員田馥甄(Hebe),近年來單飛後發行多張個人專輯,還拿下第32屆金曲獎金曲歌后,事業蒸蒸日上。田馥甄常在社群上跟粉絲分享生活日常,昨(18)日她開心曬出自己插花的照片,她不僅素顏

2024-04-19 10:12

-

51歲鄭秀文突自稱「高齡產婦」!疑祕密生子 她回應:不用疑問了

51歲香港天后鄭秀文(Sammi)近日為了演唱會努力練習,她也在IG分享練舞過程,坦言年紀大了記舞步更花時間,有粉絲表示「記不住就跳少一點,有看到妳就好了!」鄭秀文回應「真體貼我這位高齡產婦人士。」一

2024-04-19 09:27

-

《康熙來了》試卷陳漢典信心滿滿!分數出爐蔡康永笑瘋:捨身救我

《康熙來了》自2016年停播至今已經8年,仍能看節目片段在網路上流傳,可見不少觀眾對節目相當懷念。近日,有網友特別製作一份考卷來測試鐵粉,連主持人蔡康永也來參戰,結果只拿到28分,身為主持人之一的陳漢

2024-04-19 08:07

-

舒淇罕見告白馮德倫!歡慶48歲生日趴 「羞曬親親照」甜喊愛你

性感女星舒淇16日迎來48歲生日,今(19)日凌晨她曬出老公馮德倫為她準備派對的照片,同時也慶祝兩人結婚週年紀念日,舒淇罕見放閃甜喊「LOVE U」,還PO出兩人的接吻照,羨煞不少人,不到1小時就超過

2024-04-19 01:24

運動

更多運動-

Kawhi Leonard收到美國男籃球衣「面癱」!球迷:世界最無趣的人

美國籃協在近日公布今年法國巴黎奧運男籃隊名單,陣中除了由LeBron James(現效力洛杉磯湖人)、Stephen Curry(現效力金州勇士)、Kevin Durant(現效力鳳凰城太陽)領軍,隊

2024-04-19 10:31

-

Jimmy Butler因傷缺陣附加賽!約戰「元凶」 說要和Oubre打一架

邁阿密熱火球團今(19)日公布當家球星「士官長」Jimmy Butler的傷情,他因右膝內側腹韌帶扭傷,確定將缺陣對芝加哥公牛的最後一場附加賽。消息公布後,Jimmy Butler對該回合起身封蓋、導

2024-04-19 10:22

-

金州勇士王朝還可以持續多久?Steve Kerr:保持三巨頭很有價值

金州勇士主帥Steve Kerr近期被問到勇士隊因為在NBA附加賽被沙加緬度國王隊淘汰,面臨球隊再度重建的危機,他不但再次強調自己希望「三巨頭」可以留下來,Draymond Green、Stephen

2024-04-19 10:18

-

Jimmy Butler對公牛關鍵戰役無法出賽!熱火NBA附加賽晉級有危機

NBA東區第8種子NBA邁阿密熱火將在明(20)日將在東區附加賽生死戰中,交手東區第9種子芝加哥公牛,兩隊將爭取東區季後賽的最後一張門票,但熱火卻在今(19)日傳出壞消息,陣中主力「士官長」Jimmy

2024-04-19 09:33

財經生活

更多財經生活-

藏壽司、壽司郎「神級服務」瘋傳!老饕眼睛全亮 店員認超多人點

台灣有不少人喜愛吃日式料理,以相對平價的日式料理來說,大家一定都會立刻想到「迴轉壽司」,近幾年知名連鎖品牌「藏壽司」、「壽司郎」就來台開設許多家分店,一家還比一家大間,每到用餐時段總是高朋滿座。然而,

2024-04-19 10:37

-

喝了再上!經典能量飲料康貝特全新升級 超商限定優惠手刀嚐鮮

面對生活與工作上種種難關,總是需要能為我們提起精神的好物,除了喝咖啡、吃B群外,能量飲料是許多人的選擇。市面上能量飲料種類越來越多,但若要說到最經典的,莫過於康貝特了!尤其那句耳熟能詳的Slogan「

2024-04-19 10:07

-

只限今天!CoCo「2款輕乳茶」第2杯0元 星巴克買1送1爽喝3天

奶茶控絕對不能錯過!CoCo都可今(19)限時推出2款奶茶飲品「第2杯0元」優惠,不過只限使用「CoCo都可訂線上點餐」,憑券享「沐春風 輕乳茶」、「日落錫蘭 輕乳茶」2款飲品買1送1優惠。此外,為慶

2024-04-19 10:05

-

癮君子長期咳嗽又氣虛?醫師示警風險!一招潤肺有解

俗話總說「沒有一根煙解決不了的事情」,但長期抽菸會讓身體暴露在各種風險之中,尤其長期抽菸的癮君子,三不五時會出現咳嗽、卡痰、氣虛等問題,嚴重一點則是一說話就咳嗽,喉嚨總是有痰,講個兩、三句話就得時常清

2024-04-19 10:00

全球

更多全球-

中國駭客「伏特颱風」已入侵美國!FBI警告:23家基建公司成目標

美國聯邦調查局(FBI)局長雷伊(Chris Wray)週四在一場演講時公開提到,中國政府正在進行名為「伏特颱風」(Volt Typhoon)的駭客活動,目標是美國23家基礎建設營運公司。據《路透》報

2024-04-19 09:45

-

以色列的反擊開始了?伊朗、敘利亞和伊拉克多地驚傳爆炸

以色列《耶路撒冷郵報》報導,當地時間19日凌晨,伊朗中部的伊斯法罕(Isfahan)、敘利亞南部的蘇韋達省(As-Suwayda)、伊拉克的巴格達(Baghdad area)、巴比倫省(Baghdad

2024-04-19 09:38

-

追究襲擊以色列責任!伊朗遭制裁 外長赴聯合國會議被限制活動

伊朗上週末在攻擊以色列本土後,美國與英國18日宣布,對伊朗實施新一輪制裁,旨在嚇阻伊朗與其代理人繼續發動攻擊,避免中東局勢惡化升級。美國並對正在紐約出席聯合國會議的伊朗代表團,實施了額外的行動限制,包

2024-04-19 08:05

-

VTuber很好賺?一個月直播上百小時 魔競娛樂:台灣高時數是必須

近年來,虛擬直播主(VTuber)崛起,形成了龐大的市場以及產業鏈,也傳出有不少成功的VTuber賺的口袋滿滿,使得許多人對於該行業抱持憧憬。不過VTuber背後的辛苦卻也常常被忽視,包括得進行長時間

2024-04-19 08:00