《鄉民大學問EP.35》字幕版|韓國瑜被針對?!賴清德找卓榮泰掌政院 黃暐瀚:論功行賞?!為陳其邁鋪路?馬見習提九二共識 柯文哲:恐違主流民意?黃子佼事件登BBC 高嘉瑜表態 女大生嗆:閹割執法!

NOW影音

更多NOW影音焦點

更多焦點-

花蓮震災善款累計9.8億元!海外善款累計3500萬 日本就佔60%

花蓮4月3日發生芮氏規模7.2的強震,造成當地嚴重受創,賑災基金會專案募款帳戶至4月16日16:00募得9.8億元,總捐贈筆數15.9萬筆,其中國泰金控捐款3000萬元,為目前最高的單筆捐款;海外捐款

2024-04-16 17:12

-

台灣半導體今年產值達成長13.6% 2030年台灣仍是IC製造產能重心

半導體市場能見度更明朗,根據資策會今(16)日發布台灣半導體產業預測,庫存調整接近尾聲,終端應用產品出貨恢復正成長,加上車用、HPC、AIoT等長期需求支持,對半導體產業復甦有正面助益,並預估今年全球

2024-04-16 17:09

-

小S自爆4年後收山!靠殘酷減肥法維持身材 僅1習慣改不掉

綜藝一姐小S復出後,以綜藝節目《小姐不熙娣》穩固收視保證,成為網友最愛的主持天后,她最近自曝6月將滿46歲,50歲後要收山,不會在節目上耍性感、勾引異性,現在要把握時間,在鎂光燈前呈現性感、漂亮的自己

2024-04-16 15:45

-

台南驚見逼車仔!怪男沿路伸腳側踹機車 惡意重煞釀無辜騎士慘摔

台南一名郭姓女子昨(15)日中午騎車行經安明路時,突然遭另名機車騎士逼車,對方除出腳作勢要踹人外,還刻意衝至郭女車頭再緊急煞車,導致郭女反應不及當場摔車,全身受有多處擦挫傷,警方獲報後已第一時間展開追

2024-04-16 16:53

精選專題

要聞

更多要聞-

巷仔內/楊寶楨合作基隆市政府!反罷免、爭曝光互蒙其利

民眾黨前發言人、立院黨團副主任楊寶楨2月落淚請辭黨內雙職務。基隆市政府今日舉行記者會,宣布楊寶楨5月中旬起將擔任「2024基隆政策推廣大使」。對於面臨罷免危機的基隆市長謝國樑、尋找政治舞台的楊寶楨,都

2024-04-16 17:20

-

批蔡英文搶先曝國安人士「2個不尊重」 黃揚明:賴清德皮繃緊了

準總統賴清德內閣人事尚未完全公布,總統蔡英文今(16)日上午接見外賓時,卻先宣布總統府秘書長林佳龍將接任外交部長,而外交部長吳釗燮將轉任國安會秘書長。對此,資深媒體人黃揚明認為,這事件凸顯蔡英文的2大

2024-04-16 17:08

-

揪甘心!台中修改鼓勵辦法 中學運動聯賽冠軍選手月領4千營養費

台中市為培育及獎勵優秀運動人才,定有《績優運動選手培訓獎助金發給辦法》,原僅限個人賽選手,但隨著各種聯賽在全國大放異彩,市府今天通過修法,只要中等學校聯賽全國前3名都有培訓獎助金,冠軍選手每人每月可獲

2024-04-16 16:29

-

王鴻薇控郭智輝違反證交法 準行政院發言人證實:商務糾紛所致

新任經濟部長將由崇越集團董事長郭智輝接任,國民黨立委王鴻薇則質疑,郭智輝不但曾違反證交法被判緩刑,其律師還是國安會祕書長顧立雄。對此,準行政院發言人陳世凱今(16)日表示,崇越公司已多次說明,該公司旗

2024-04-16 16:28

新奇

更多新奇-

俄國妹領所有存款來台灣!向台籍男友求婚 霸氣喊「沒錢我養你」

為了追尋真愛勇氣十足!一位俄羅斯女孩Mila,透過交友軟體認識台灣男子,雙方迅速墜入愛河,後續Mila更直接帶了所有存款飛來台灣,還主動求婚,甚至霸氣喊「沒錢我養你」,主動追愛的過程曝光,也讓大批觀眾

2024-04-16 17:01

-

陸網紅Sean爆「兒子被台灣拒絕入境」!真相大反轉 台人失望退追

中國知名網紅「Sean」肖恩與好友「陳老師」去年數度來台旅遊,拍攝許多Vlog遊記,更因為談吐風趣而爆紅,但近期卻出現掉粉危機!4月11日時,Sean在個人頻道上發出影片,聲稱「兒子被台灣拒絕入境」,

2024-04-16 14:01

-

竊賊爽中1.6億樂透!苦主「信用卡遭盜刷」想分獎金 結局揭曉了

天上掉下驚喜橫財卻只能用看的!日前在英國有兩名竊賊,盜用他人信用卡拿去購買樂透彩券,卻意外贏得400萬英鎊(約新台幣1.6億元)大獎,後續遭警方查明真相後逮捕,並傳喚被盜刷的苦主嘉書亞(Joshua

2024-04-15 20:20

-

電線杆貼滿廣告紙!他撕毀遭警察制止「這樣是毀損罪」 真相反轉

台灣街頭巷尾能看到許多電線杆、變電箱,上頭常常會有許多白白的殘膠,因為常會有各種業者張貼小廣告,清除後又再度出現,造成市容髒亂,也讓相關單位煩惱不已。近期銀行家「尼莫」就目睹小廣告張貼的瞬間,並感慨「

2024-04-14 16:14

娛樂

更多娛樂-

直擊SBS一日飯經/(G)I-DLE舒華師弟街上發貼紙!叫做事不敢說NO

南韓電視台SBS音樂節目《THE SHOW》每週二韓國時間6點播出,當日會開放事先抽選的觀眾入場為宣傳的偶像應援,《NOWnews今日新聞》赴電視台採訪,恰巧碰到準備打歌的男團NOWADAYS成員振赫

2024-04-16 17:10

-

孫藝真「有望2次訪台」企劃提前曝光!羞笑:想帶先生玄彬一起來

南韓女星孫藝真今(16)日旋風來到台灣,也是她出道25年至今首次來台,在美妝品牌的邀請下與台灣媒體們見面,而被主持人阿KEN問到,下次還會不會想要來台灣?孫藝真則希望下次是以「家庭旅遊」的目標來台工作

2024-04-16 17:10

-

孫藝真宛如「仙女降臨」中文超流利!掛念台灣1美食:我最期待它

南韓女星孫藝真出道25年首度來到台灣,今(16)日下午降臨桃園機場,一下飛機就造成轟動,稍早更出席知名品牌代言活動,怎料,42歲的孫藝真,臉上完全看不出歲月痕跡,並以一套粉紅色連身洋裝現身,氣質不斷散

2024-04-16 16:27

-

黃子佼被搜出4TB硬碟「緊張CALL律師求救」 孟耿如在場目睹一切

黃子佼被指控早年對少女強制猥褻、性騷擾甚至強制性交得逞,另購買多部色情影片,其中7部為未成年少女不雅影片,被害人年紀有12、13到17歲,內容非一般裸露而是違反意願的偷拍、性虐待等,令人髮指。據了解,

2024-04-16 16:11

運動

更多運動-

就是相信大谷翔平的棒子!道奇主帥Roberts:我對他抱有很大期望

美國職棒MLB洛杉磯道奇隊今(16)日在主場迎戰華盛頓國民,日籍二刀流球星大谷翔平全場3打數1安打,並幫助球隊跑回2分,還跑出1次盜壘成功,道奇先發投手Tyler Glasnow本場比賽落難,主投5局

2024-04-16 15:12

-

不忍清寒祖孫3人吃即期飯糰!職籃球星余純安「超暖善行」被讚爆

T1職籃聯盟今(16)日傳出一件為善不欲人知的善行,高雄全家海神隊長余純安在社群網站上透露自己最近幫助了一家經濟拮据的祖孫3人,此舉受到網友的稱讚。余純安表示,自己就是單純行善,不是想要炫耀,也低調婉

2024-04-16 13:55

-

中職最資深裁判蘇建文引退儀式!4月20日澄清湖球場「最後一舞」

長達33年的裁判生涯,中華職棒聯盟資深裁判蘇建文將正式迎來引退,在今年的中職開幕戰進行第3381場,同時也是生涯最終場執法賽事,蘇建文的裁判生涯畫下完美句點,為感謝蘇建文裁判對中華職棒的長期付出,4月

2024-04-16 13:55

-

大谷翔平敲安又盜壘!Tyler Glasnow5局狂失6分 道奇4:6又輸國民

大谷翔平穿上42號球衣還是帥氣!洛杉磯道奇今(16)日在主場道奇球場迎戰華盛頓國民,日本「二刀流」球星大谷翔平單場3打數1安、跑回2分,並跑出1次盜壘。道奇先發投手Tyler Glasnow落難,只投

2024-04-16 13:34

財經生活

更多財經生活-

《波拉西亞戰記》開創前所未有玩法!「遊戲2大核心系統」公開

遊戲橘子旗下首款限制級遊戲《波拉西亞戰記》今(16)日正式釋出遊戲三大核心系統,為遊戲玩法增添豐富層次。特色「圖騰獸系統」擁有三種守護神型態,賦予玩家戰略性的關鍵效果;獨家「黑劍系統」緊扣旅團經營策略

2024-04-16 17:16

-

0403花蓮強震「餘震900次」!氣象署:2週內還有規模4以上地震

花蓮發生芮氏規模7.2強震已經過了快2週,餘震情況雖有平息,但仍在持續,截至今(16)日下午2時,總餘震數正式達到900起,規模5以上共有30起,中央氣象署地震測報中心主任吳健富提醒,餘震頻率會越來約

2024-04-16 15:22

-

代理手遊簽約金破3億!眾愣:怎回本 「3大誘因」讓玩家乖乖課金

人手一機的時代,手機遊戲成為現代人一定接觸過的元素,甚至在一些大作中常能看見花大把鈔票玩遊戲的「課金戰士」,近日有網友分享,一名在遊戲相關公司任職的朋友近半年瘋狂加班,只為了替公司取得中國某「武俠遊戲

2024-04-16 15:01

-

重機夜闖淡水輕軌軌道!騎士爽喊「沒人能比我狂」 下秒進修車廠

真的好危險!近期有民眾投訴,在網路上頗具知名度的重機騎士,夜間將重機騎上淡水輕軌軌道,甚至還拍下照片打卡發文「應該沒人能比我更狂了吧」,但後續愛車卻慘進修車廠,還可能面臨相關單位的罰款。騎重機夜闖捷運

2024-04-16 14:50

全球

更多全球-

小甘迺迪自稱遭川普邀任副手 成立反疫苗團體募集4600萬美元

正以獨立身分競逐美國總統的小羅伯特甘迺迪(Robert F. Kennedy Jr.)週一(15)稱獲共和黨籍前總統川普團隊邀請擔任副手,同時又遭外媒指出,他成立的反疫苗團體在新冠疫情期間籌措到數百萬

2024-04-16 16:49

-

影/喬治亞國會大亂鬥!議員後腦勺遭憤怒鐵拳重擊 聲音清脆響亮

喬治亞國會15日爆發激烈衝突,執政黨「喬治亞之夢黨」計畫推動在國內飽受爭議的「外國代理人法案」,場外掀起抗議,國會殿堂內也爆發全武行,力推該法案的執政黨議員姆迪納拉澤(Mamuka Mdinaradz

2024-04-16 16:23

-

德國總理蕭茲訪中!德媒曝:代表團攜空白手機、回國視情況報廢

德國總理蕭茲(Olaf Scholz),本週率領多名企業家訪問中國,16日並與中國國家主席習近平在北京釣魚台國賓館會晤,有德媒報導稱,代表團成員遵循國安單位建議,盡量攜帶不儲存敏感資料的空白手機或電子

2024-04-16 14:57

-

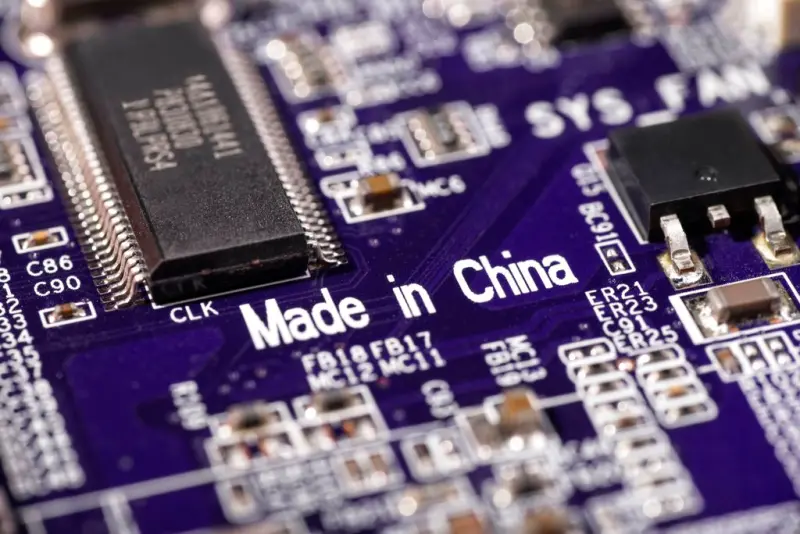

上萬家「中國芯」公司倒死神懷裡!中媒曝:畫大餅反被投資人看上

美國晶片禁令重挫中國半導體,中國國家主席習近平持續高喊中國芯(晶片)自主,近年來展開「大煉芯」行動,眾多晶片公司雨後春筍般冒出,但來得快也去得快。中媒今(16)日揭露,光是去年就有破萬家的晶片相關公司

2024-04-16 14:57