《鄉民大學問EP.38》直播|你反廢死嗎?歡迎來戰!廢死憲法法庭激辯!公投決定你支持?藍黨團提520後 邀賴清德立院國情報告!韓國瑜將正面對上 藍綠攻防?|NOWnews

NOW影音

更多NOW影音焦點

更多焦點-

花蓮富凱飯店遭強震震垮 「魯夫號」長臂大鋼牙25日晚間開拆

花蓮富凱大飯店受到連續2次規模6強震影響,大樓嚴重傾斜,花蓮縣政府緊急安排,確定在今(24)日晚間8時45分,由拆過天王星大樓的「魯夫號」長臂大鋼牙啟動24小時不間斷的拆除作業。據了解,富凱拆除作業與

2024-04-25 00:11

-

美國通過「950億美元」援外法案 拜登:幫助美國與盟友更加強健

美國總統拜登週三(24)正式簽署通過價值約950億美元的援助包裹法案,預計將對烏克蘭、以色列及台灣在內的印太國家與盟友提供援助預算,該法案也包含對伊朗實施新的制裁、要求TikTok母公司中國企業「字節

2024-04-25 01:20

-

《淚之女王》金智媛結婚現場!韓劇CP御用飯店 玄彬孫藝真也愛這

金秀賢、金智媛搭擋的Netflix韓劇《淚之女王》,開播後一路維持高收視率,目前距離tvN電視台收視率第一的紀錄僅一步之遙。本週末《淚之女王》將播出完結篇,讓不少粉絲都十分期待金秀賢與金智媛這對CP可

2024-04-24 17:39

-

地震速報

04/25 02:11左右東部海域發生有感地震,預估震度3級以上地區:宜蘭、花蓮。

2024-04-25 02:12

精選專題

要聞

更多要聞-

黃偉哲不做滿為幫某人助攻南市長?賴清德向陳亭妃保證:不可能

民進黨地方黨部主委改選競爭激烈,牽動2026年縣市長佈局。民進黨立委陳亭妃今(24)日臉書指出,近來一直有人在台南放一種聲音說,台南市長黃偉哲不會做滿任期,會由中央派代理市長,專心爲某人的初選助攻,她

2024-04-24 21:22

-

藍委訪中挨批 陳玉珍反嗆:民進黨爸爸無能又「家暴」國民黨媽媽

立法院國民黨團總召傅崐萁規劃率同黨立委訪問中國,但因正值立法院會議期間及逢花蓮強震引發抨擊。準備跟傅崐萁一起訪中的國民黨立委陳玉珍今(24)日批,民進黨像家裡的爸爸,面對「隔壁鄰居」中國欺壓,爸爸不敢

2024-04-24 21:14

-

陳玉珍喻綠營像爸爸家暴國民黨 林俊憲:不要半路亂認好嗎?

國民黨立法院黨團總召傅崐萁在花蓮又傳災情之際,執意率團赴中,更強調為恢復兩岸交流,「是責無旁貸的公務行程」引發熱議,對此藍委陳玉珍今(24)日緩頰稱,民進黨做不到就別批評,更認為綠營就像家中的爸爸,國

2024-04-24 20:26

-

賴清德爆「賴皮寮」比徐巧芯的錶便宜!價值僅17萬引起民眾想競標

近日藍營質疑準總統賴清德有多支「總價破百萬」勞力士未申報,賴清德今(24)日在中執會澄清,自己擁有三支錶,最貴的第三支價值約10萬元的勞力士,因為出國需求買的,並非媒體報的那種最高等級。賴清德對此怒轟

2024-04-24 19:50

新奇

更多新奇-

被《關鍵時刻》誤認成東大教授!有吉弘行看到了 本人回應超幽默

台灣政論節目《關鍵時刻》,由知名主持人劉寶傑領銜,時常針對各種時事進行語氣激昂的講解。不過近期在談論423地震話題時,誤將日本知名諧星主持人有吉弘行當成日本東京大學地震權威教授笠原順三,截圖瞬間在網路

2024-04-24 22:31

-

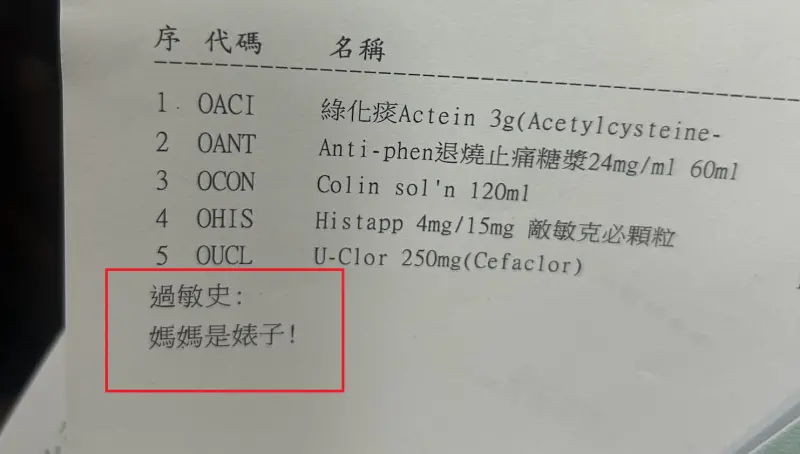

基隆醫院藥單上標註「媽媽是婊子」!人妻一看傻眼 護理師急道歉

(更新時間10:10)一位媽媽今(24)日帶著孩子前往衛生福利部基隆醫院看診,沒想到拿到藥單時,卻看到上面過敏史竟寫上:「媽媽是婊子!」讓她當場傻眼,詢問醫院究竟是怎麼回事,護理師同樣納悶,也立刻向她

2024-04-24 21:09

-

世界100大美食最新排行曝光!台灣竟成「吊車尾」:連英國都輸了

許多國際遊客來台一定會品嘗珍奶、小籠包、雞排、滷肉飯,甚至勇敢一點的還能嘗試看看臭豆腐。卻有國際美食榜單,將台灣美食排名列在榜單末端,甚至還有頗具權威性的美食評論刊物,2023年度最新榜單只給台灣第7

2024-04-24 18:43

-

全聯「稀有水果4顆99元」!隱藏福利曝:送保鮮盒 眾錯過再等1年

先別管60元便當了!全聯福利中心因為經常推出許多新品,或者是期間限定的產品,因此婆媽常常會在臉書社團上討論分享。然而近日就有不少人分享去全聯購買「寶石紅奇異果」,並且開箱分享口感,沒想到卻釣出內行婆媽

2024-04-24 18:29

娛樂

更多娛樂-

孔劉、宋慧喬「夢幻搭檔」!傳加盟超強金牌編劇新作:陣容超豪華

孔劉今(24)日被爆將與宋慧喬2人共同主演由南韓金牌編劇盧熙京所寫的新作品。過去,盧熙京曾打造出《我們的藍調時光》、《Live》、《世上最美麗的離別》、《那年冬天風在吹》、《沒關係,是愛情啊》等經典作

2024-04-24 22:22

-

傳賣梁朝偉香港3億豪宅「海賺9千萬」 劉嘉玲獲讚理財有方

香港女星劉嘉玲日前才剛曝光上海的5億豪宅,近日又被香港媒體報導要將持有13年的4房豪宅以7380萬元港幣(約3億1011萬元台幣)的價格賣出,獲利超過2100萬港幣(約8855萬元台幣),讓不少粉絲都

2024-04-24 21:01

-

傳黃子佼1億換孟耿如3年不離婚!作家估算月薪273萬 粉絲全傻眼

黃子佼MeToo事件持續延燒,涉嫌性騷擾、持有未成年不雅影片,形象一落千丈。近期,有周刊指出黃子佼提出給太太孟耿如1億安家費,要求孟耿如3年內不離婚,對此作家「凱薩琳・孔」估算,如果孟耿如同意這項提議

2024-04-24 20:39

-

Lulu宣布離開台灣!飛往印度洋小島:生命裡壞的當成養分

今(24)日是Lulu黃路梓茵33歲生日,昨日她在IG上發文表示自己要暫時離開台灣,前往印度洋的小島,並且「進入飛航模式」,並表示:「可以把生命裡好的跟壞的都當成養分。」不少粉絲都在猜測Lulu是想逃

2024-04-24 20:00

運動

更多運動-

全中運游泳/最終日3破大會紀錄 13歲「神童」林芷妍勇奪5金超威

113年全國中等學校運動會游泳進行最後一天賽程,再飆破3項大會紀錄,南門國中在國男組400混接力預、決賽雙破大會;新竹高商廖祐菲在高女組50公尺自由式再破大會紀錄,在廖祐菲最後一次全中運中貢獻個人三項

2024-04-25 03:12

-

中職快評/老鬼正夯!42歲雙雄潘威倫、林智勝還能締造多少歷史?

中華職棒今年焦點之一,絕對是42歲投打雙雄潘威倫和林智勝,今年最後一舞,能締造多少紀錄。套句球迷老話,「看一次,少一次!告別倒數計時。」繼日前統一獅潘威倫中繼拿下149勝之後,味全龍「大師兄」林智勝也

2024-04-25 02:11

-

中華男籃尋歸化洋將出現曙光!國籍法完成初審 立委:完成約定

台灣男籃苦尋新歸化洋將困難,今(24)日總算出現曙光!立法院內政委員會初審通過國籍法部分條文修正草案,其中與籃球歸化最為相關的高專歸化,本次修法也放寬了外國高級專業人才申請歸化居留年限,從現行連續3年

2024-04-24 20:44

-

4/24NBA季後賽焦點球星/Doncic不是只有進攻 Siakam是溜馬核心

NBA季後賽場場關鍵,4/24日的主打球星,以達拉斯獨行俠的Luka Doncic、印第安納溜馬的Pascal Siakam,還有明尼蘇達灰狼隊的防守悍將Jaden McDaniels最為出色,其中,

2024-04-24 20:44

財經生活

更多財經生活-

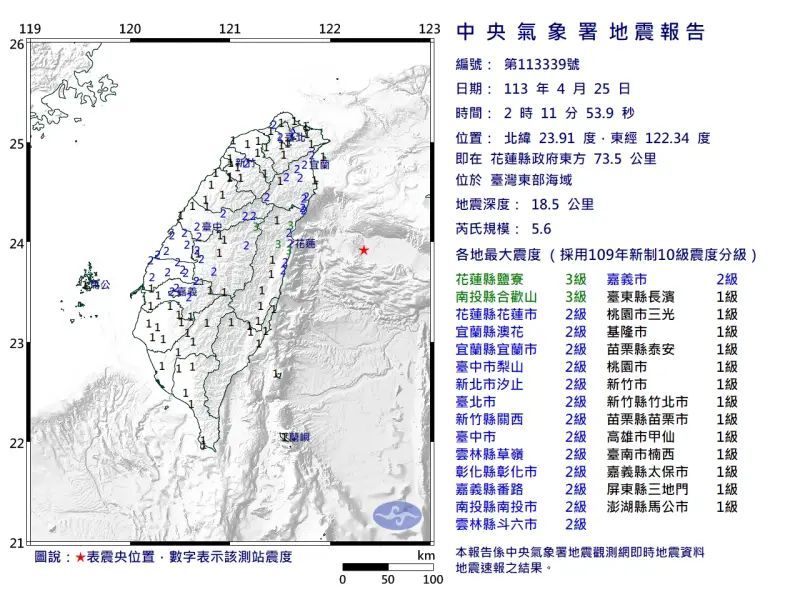

快訊/國家警報響了!02:11花蓮5.6地震 氣象署:不是403的餘震

中央氣象署地震測報中心指出,今(25)日凌晨2點11分左右,台灣東部外海發生芮氏規模5.6地震,深度18.5公里,震央在花蓮縣政府東方73.5公里處,測得最大震度為3級,出現在花蓮和南投,共20縣市有

2024-04-25 02:16

-

台股重返2萬點吐悶氣 AI與半導體衝!助攻3台股ETF完成填息

台股24日掀飆風,電子權值股帶領下,新光臺灣半導體30(00904)、復華台灣科技優息(00929)、永豐台灣ESG(00888)3檔台股ETF均完成填息紀錄,平均填息天數僅花3天內完成,連同上周台新

2024-04-24 21:00

-

母親節餐廳難訂!新光三越APP「訂位神招」:橘色涮涮屋也輕鬆搶

母親節熱門餐廳搶不到?新光三越今年APP推出隱藏功能,會員扣點即可優先訂位,共有40家餐廳、2000個預定席次,包括夜上海、教父牛排、名人坊、橘色涮涮屋通通輕鬆訂到,APP還集結了歷年母親節銷售數據,

2024-04-24 19:45

-

聯電Q1獲利探3年新低、EPS 0.84元 每股擬配3元股利

聯電今(24)日公佈2024年第一季營運報告,合併營收為新台幣546.3億元,較上季的549.6億元減少0.6%。與2023年第一季的542.1億元相比,本季的合併營收成長0.8%。第一季毛利率達到3

2024-04-24 19:19

全球

更多全球-

美國通過「950億美元」援外法案 拜登:幫助美國與盟友更加強健

美國總統拜登週三(24)正式簽署通過價值約950億美元的援助包裹法案,預計將對烏克蘭、以色列及台灣在內的印太國家與盟友提供援助預算,該法案也包含對伊朗實施新的制裁、要求TikTok母公司中國企業「字節

2024-04-25 01:20

-

快訊/拜登簽署950億元援台、以、烏法案!TikTok也難逃去中化

美國國會在經歷數月磋商,終於從參議院、眾議院表決通過價值950億美元的援助法案,根據這條法律美國將能夠向烏克蘭、以色列及台灣在內的印太地區國家與盟友提供援助因應局勢變化,該法案也包含對伊朗實施新的制裁

2024-04-24 23:50

-

妮妃雅奪冠嗨領20萬美元!被問「怎麼花」秒回:媽媽教我要錢滾錢

來自台灣的變裝皇后妮妃雅(Nymphia Wind)拿下美國《魯保羅變裝皇后秀》第16季的總冠軍,成為該節目自2009年開播以來首位奪冠的台灣選手,我國總統蔡英文也公開發文祝賀。在接受美媒訪問時,妮妃

2024-04-24 23:01

-

證實美軍駐台為「公開秘密」 美國會報告:去年41名軍事人員駐台

美國國會日前表決通過了一項950億美元的對外撥款法案,將對烏克蘭、以色列及台灣提供軍事援助,表決前一日美國國會研究處也提供了議員們一份《台灣防衛議題》(Taiwan Defense Issues fo

2024-04-24 21:26