《鄉民大學問EP.38》直播|你反廢死嗎?歡迎來戰!廢死憲法法庭激辯!公投決定你支持?藍黨團提520後 邀賴清德立院國情報告!韓國瑜將正面對上 藍綠攻防?|NOWnews

NOW影音

更多NOW影音焦點

更多焦點-

傅崐萁赴陸行沒取消!同行藍委這句話嗆爆民進黨:是在擔心什麼?

國民黨立法院黨團總召傅崐萁將在明天立法院會結束後,帶領黨籍立委赴陸,不過在花蓮餘震不斷情況下出國,遭綠營批「這是有史以來最鴨霸的黨團總召」。對此,同行的國民黨立委翁曉玲今(25)日提及,民進黨政府擔心

2024-04-25 12:02

-

存股族快看!這7家金控今年配息出爐 目前現金殖利率最高是這家

去(2023)年金融業獲利亮眼,國內14家上市金控去年合計賺超過3652億元,年成長近3成,也讓股東們尤其是存股族,對股利發放有更多期待。目前已有7家金控今年股利政策,除新光金因去年虧損不配股利之外,

2024-04-25 12:00

-

《淚之女王》金智媛結婚現場!韓劇CP御用飯店 玄彬孫藝真也愛這

金秀賢、金智媛搭擋的Netflix韓劇《淚之女王》,開播後一路維持高收視率,目前距離tvN電視台收視率第一的紀錄僅一步之遙。本週末《淚之女王》將播出完結篇,讓不少粉絲都十分期待金秀賢與金智媛這對CP可

2024-04-24 17:39

-

北市詭異命案!林森北路25歲女「塑膠袋套頭、雙手遭綁」陳屍住處

台北市中山區林森北路145巷、六條通巷內一棟大樓,今(25)日清晨發生一起離奇死亡案,25歲的曾姓女子被發現陳屍家中,遺體被塑膠袋套住頭部,正面雙手也被鞋帶綑綁,已經明顯死亡多時、呈現屍僵。員警稍早通

2024-04-25 11:59

精選專題

要聞

更多要聞-

新內閣金光閃閃!郭智輝、鄭麗君、林佳龍、顧立雄 身價都破億元

準總統賴清德520將上任,新任內閣名單也陸續公布,其中準副閣揆鄭麗君、準外交部長林佳龍、準國防部長顧立雄,以及準經濟部長郭智輝,身家都上億元,堪稱金光閃閃內閣。新內閣中身家最高者,當數現任崇越集團董事

2024-04-25 11:49

-

叫錯名好尬!介紹國安局長蔡明彥 賴清德全口誤蔡明「ㄧ ㄠ ˋ」

準總統賴清德今(25日)親自公布最後一波內閣名單,亮相國安團隊,不過,在介紹國安局長蔡明彥時,全程都叫錯名字,將其叫成蔡明「ㄧ ㄠ ˋ」,意外的插曲也引發媒體議論。賴清德今公布第六波新任內閣與國安人事

2024-04-25 11:42

-

扁系人馬班師回朝 洪孟楷要賴清德表態「是否支持特赦陳水扁」

準總統賴清德陸續公布新內閣名單,前總統陳水扁執政時期獲重用的羅文嘉、馬永成、林德訓,外傳也會在520後擔任要職,有藍委直言「賴清德下一步就是要特赦陳水扁」。對此,國民黨立委洪孟楷今(25)日呼籲,賴清

2024-04-25 11:41

-

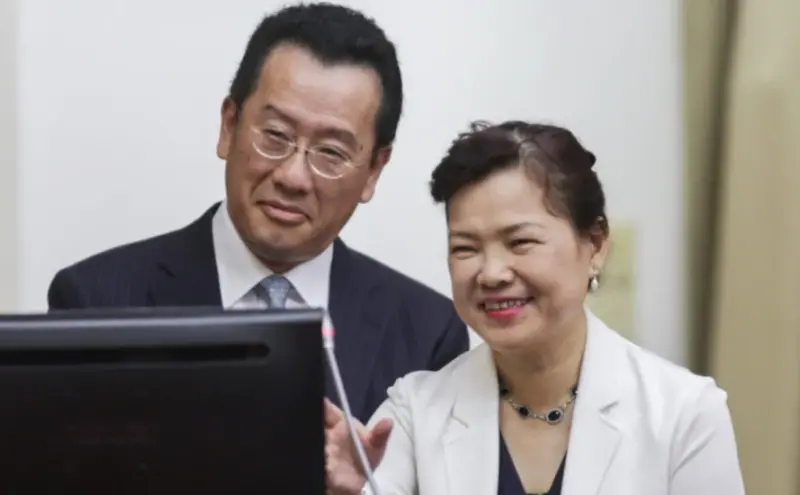

身家傲人!顧立雄王美花擁百萬名錶、576萬珠寶 住北投上億豪宅

準總統賴清德今(25)日公布最後一波新內閣名單,其中國安會秘書長顧立雄將轉任國防部長,是史上第7位文人部長。顧立雄與經濟部長王美花不只是綠營有名的夫妻檔,兩人身家也傲人,根據最近一次財產申報資料,顧立

2024-04-25 11:35

新奇

更多新奇-

被《關鍵時刻》誤認成東大教授!有吉弘行看到了 本人回應超幽默

台灣政論節目《關鍵時刻》,由知名主持人劉寶傑領銜,時常針對各種時事進行語氣激昂的講解。不過近期在談論423地震話題時,誤將日本知名諧星主持人有吉弘行當成日本東京大學地震權威教授笠原順三,截圖瞬間在網路

2024-04-24 22:31

-

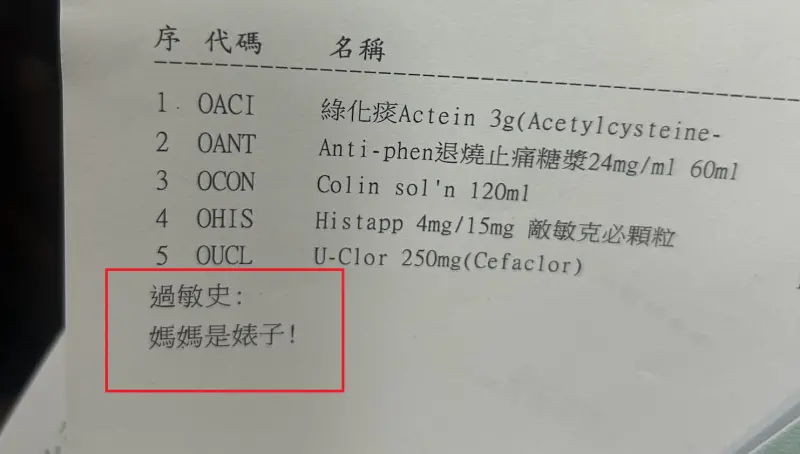

基隆醫院藥單上標註「媽媽是婊子」!人妻一看傻眼 護理師急道歉

(更新時間10:10)一位媽媽今(24)日帶著孩子前往衛生福利部基隆醫院看診,沒想到拿到藥單時,卻看到上面過敏史竟寫上:「媽媽是婊子!」讓她當場傻眼,詢問醫院究竟是怎麼回事,護理師同樣納悶,也立刻向她

2024-04-24 21:09

-

世界100大美食最新排行曝光!台灣竟成「吊車尾」:連英國都輸了

許多國際遊客來台一定會品嘗珍奶、小籠包、雞排、滷肉飯,甚至勇敢一點的還能嘗試看看臭豆腐。卻有國際美食榜單,將台灣美食排名列在榜單末端,甚至還有頗具權威性的美食評論刊物,2023年度最新榜單只給台灣第7

2024-04-24 18:43

-

全聯「稀有水果4顆99元」!隱藏福利曝:送保鮮盒 眾錯過再等1年

先別管60元便當了!全聯福利中心因為經常推出許多新品,或者是期間限定的產品,因此婆媽常常會在臉書社團上討論分享。然而近日就有不少人分享去全聯購買「寶石紅奇異果」,並且開箱分享口感,沒想到卻釣出內行婆媽

2024-04-24 18:29

娛樂

更多娛樂-

籃籃根本沒包袱!新髮型激撞「文才」許冠英 一比對差點認錯人

「樂天女孩」隊長兼CEO籃籃(籃靖玟),擁有稚齡娃娃臉、時而呆萌時而慧黠的性格,2021年起陸續接下綜藝節目主持棒,還入圍金鐘獎,不僅是啦啦隊員成功轉型為藝人的始祖,還寫下首位現役啦啦隊員敲鐘的紀錄。

2024-04-25 11:22

-

籃籃狂抖復刻「小學生動動影片」被評毫無違和 本人笑瘋5字回應

2002年由謝震武主持的益智節目《超級大富翁》單元「自然科學小小大富翁」,主持人會先介紹國小四到六年級參賽者,依序介紹完畢後,進行下列的遊戲。近日網路上瘋傳小學生介紹片段,在當年還沒有特效Boomer

2024-04-25 11:09

-

餘震太多引恐慌!唐綺陽說話了 「這時間點以前」不能掉以輕心

花蓮外海4月3日發生規模7.2強震,如今半個多月過去,大小餘震仍頻繁發生,最大震度達到6級以上,讓民眾人心惶惶,星座專家唐綺陽昨(24)日在臉書指出:「五月底之前還不能掉以輕心。」吸引超過2萬人瀏覽、

2024-04-25 10:45

-

蔡依林恩師遭控性騷「碰模特兒私處」稱有證據 張勝豐火大反擊了

知名舞蹈老師張勝豐,過去曾為蔡依林、王心凌等大咖編舞,2022年他陷入人生低潮,「已經被傷到生無可戀了,我決定要走了,要離開這個傷心的人世間」,所幸張勝豐最後並沒有想不開,還被目擊在餐廳端盤子,體驗各

2024-04-25 10:21

運動

更多運動-

Tyler Herro爆發!熱火哈隊賽前餵「雞湯」:你20歲就擊敗過綠軍

邁阿密熱火今(25)日以111:101在首輪季後賽第2戰擊敗波士頓塞爾提克,將系列賽扳成1:1。熱火「英雄哥」Tyler Herro此役命中6記三分球、砍下24分,還傳出14次助攻。賽後,Herro透

2024-04-25 11:26

-

士官長Jimmy Butler無情「開嘴」!熱火贏球後速發文嘲諷塞爾提克

美國職籃NBA今(25)日波士頓塞爾提克在主場續戰邁阿密熱火,儘管綠衫軍「雙J」連線合砍61分,但南灘大軍全隊將士用命,外圍手感超火燙,團隊一共飆進23記三分球、打破隊史季後賽紀錄,終場以111:10

2024-04-25 10:57

-

大谷遠征客場沒有愛妻陪伴!一句話逗笑全場 談水原背叛臉色大變

洛杉磯道奇隊大谷翔平近日接受媒體採訪時,談到與新婚妻子田中真美子的生活,大谷翔平透露,由於大聯盟賽程緊湊,夫妻倆沒有規劃整天的時間出遊,大多在休息日一起散步,原本聊著輕鬆的話題,但當一名記者問到被前翻

2024-04-25 10:50

-

熱火扳平戰局!「英雄哥」嗆聲還沒結束 透露Butler傳的簡訊內容

NBA首輪季後賽G2,邁阿密熱火用43投23中的團隊三分球表現,攻破TD花園廣場,以111:101爆冷在客場擊敗波士頓塞爾提克,將系列賽扳成1:1。儘管少了球星「士官長」Jimmy Butler,但熱

2024-04-25 10:49

財經生活

更多財經生活-

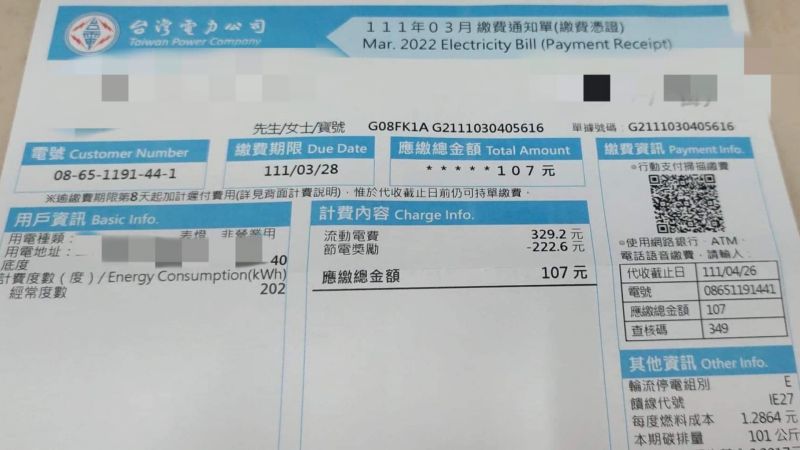

電費調漲也不怕!7-11「隱藏優惠」繳帳單賺回饋:2步驟爽領200元

夏季用電量大加上電價調漲,讓不少民眾看到帳單心驚驚,對此,7-11推出隱藏優惠,到門市繳費前先上網登錄活動,並且使用OPENPOINT繳費,即可獲得11%回饋,最多爽賺200點,相當於200元現金,除

2024-04-25 11:30

-

新兵訓練「一票家長求長官拍照」狂喊+1!對話曝光傻眼:當夏令營

當兵是不少人的共同回憶之一,每每談論到類似議題就有討論聲浪。擁有「不敗教主」封號的理財達人陳重銘近日就分享,有家長在孩子去當兵後,竟在LINE群組詢問軍中長官,是否有新兵訓練的照片可供下載觀看,且還有

2024-04-25 11:27

-

降息預期延後!趁勢布局美百大企業債、掌握息價雙收

中東地緣政治影響下油價推升通膨上揚、聯準會降息預期延後,5月份利率決策會議前,各天期美債殖利率攀升至4.6%至5.4%水準。專家指出,聯準會僅是延後降息時點,降息不會不到只是遲到,市場預期10年期美債

2024-04-25 11:15

-

神明保庇老天賞臉!罕見「天公酒」蔘香金高 今絕品上市

你或許聽過一種說法,某些運氣大好的人會被長輩稱為「天公仔囝」,意旨老天爺所眷顧的孩子;但你很可能不知道,在老饕口耳相傳裡,金門酒廠也有一款久久才會出現一次的「天公酒」─ 蔘香高粱。為什麼陳年高粱裡會有

2024-04-25 11:00

全球

更多全球-

華為新機AI修圖「一秒讓妹子變爆乳」惹議 公司承認:有漏洞

華為今年新機「HUAWEl Pura 70」本月18日正式開售,但近期被許多中國3C玩家和用戶發現,華為Pura70的「AI一鍵修圖」的功能,竟能讓原先穿著一般的妹子「一秒變低胸爆乳」,引發爭議。華為

2024-04-25 11:40

-

Meta首季財報優於預期 卻因祖克柏「一句話」股價盤後暴跌15%

本周為美股超級財報周,今日Facebook母公司Meta公布第一季財報,表現優於市場預期,然而,創辦人兼執行長祖克柏(Mark Zuckerberg)在電話會議中表示,要將Meta轉型成領先全球的AI

2024-04-25 10:43

-

北海道恐變空城!日本30年生育年齡女性減半 744城鎮有消失風險

日本少子化問題嚴重,近來日本「人口戰略會議」發布報告指出,由於到了2050年,介於20至39歲、主要生育年齡的女性人口將會減少一半,全國將會有744個市町村,也就是將近4成城鎮面臨消失的風險,政府需要

2024-04-25 10:42

-

日圓貶破155大關!國際經濟學者卻一致預測日本央行「不會升息」

日圓兌美元匯率周三(24日)跌破155日圓價位,創下30多年來最弱,今(25)天召開的央行貨幣會議,是否會做出進一步決策受到關注,市場也研判,這提高了日本當局入市干預的風險。但外媒近期調查54名經濟學

2024-04-25 09:50