《鄉民大學問EP.36》字幕版|韓院長的突襲!藍綠白委員見“韓國魚”驚呼!謝龍介不敢睡 稱愈晚愈high在忙那椿?葉元之公開立院頭號女戰神是“她”!王世堅自豪這點連韓國瑜也比不上!|NOWnews

NOW影音

更多NOW影音焦點

更多焦點-

民進黨人才庫出現斷層?不分區立委迄今無人入閣 王義川難遞補

準閣揆卓榮泰陸續公布未來的內閣成員,目前除正副院長、秘書長、政院發言人外,未來的閣員已有16人曝光。不過特別的是,相較於2016年民進黨首度組閣,時任不分區立委鄭麗君轉任文化部長,接下來也陸續有不分區

2024-04-20 07:00

-

伊拉克「親伊朗」軍事基地大爆炸!1死6傷 美國、以色列否認施襲

美國《有線電視新聞網》(CNN)、《路透社》20日引述伊拉克安全部門消息人士,聲稱位於巴格達南部巴比倫省的伊拉克民兵組織「人民動員」(PMF),其卡爾蘇軍事基地(Kalsu military base

2024-04-20 09:48

-

陳亞蘭久違扮花旦索吻!莊凱勛粉墨登場「擔心遭影迷追殺」

推廣歌仔戲不遺餘力的陳亞蘭,與莊凱勛兩位金鐘視帝聯手合作,共演歌仔戲職人劇《勇氣家族》,今(19)日舉辦開播記者會,在劇中飾演夫妻的陳亞蘭及莊凱勛盛重以歌仔戲扮相出場,過去反串男性角色居多的陳亞蘭,久

2024-04-19 18:18

-

國道驚險瞬間曝光!處理車禍事故險遭撞擊 女警機靈狂閃躲死劫

本月7日上午,國道5號北向7.5公里處,發生小客車自撞車禍事故,當時2名國道警察獲報後到場協助管制,沒想到就在擺放三角錐時,一台轎車經過發現事故減速慢行,後方來車卻閃避不及直接追撞,甚至險些撞到路旁的

2024-04-20 08:39

精選專題

要聞

更多要聞-

民進黨人才庫出現斷層?不分區立委迄今無人入閣 王義川難遞補

準閣揆卓榮泰陸續公布未來的內閣成員,目前除正副院長、秘書長、政院發言人外,未來的閣員已有16人曝光。不過特別的是,相較於2016年民進黨首度組閣,時任不分區立委鄭麗君轉任文化部長,接下來也陸續有不分區

2024-04-20 07:00

-

黨部主委登記截止!余天退選新北蘇巧慧同額競選、台南2人登記

2年辦理1次的民進黨黨職幹部改選工作,今(19)日登記截止。新北黨部主委部分,在前立委余天宣布退選後,僅蘇巧慧一人登記;至於台南市黨部主委,則有立委郭國文、隸屬湧言會的前議員陳金鐘登記。余天原先表態參

2024-04-19 18:40

-

民進黨改選中投黨部「桶箍」換人做 彰縣主委楊富鈞尋求連任

2年辦理1次的民進黨黨職幹部改選工作,今天登記截止,中彰投3位主委僅綠色友誼連線、彰化楊富鈞尋求連任。台中市李天生已2任屆滿;南投縣則是有主委不尋求連任的傳統,現任主委縣議員蔡銘軒宣佈不參選,由綠色友

2024-04-19 17:40

-

3倍價民間購電挨批缺電 台電搬出台積電澄清:短時需量購電較好

特定人士質疑4/15夜尖峰時段,台電向用電大戶買電,每度12元,為成本3倍,其中包含半導體、電子、石化、鋼鐵業等10多家大型企業參與,而遭立委質疑凸顯政府電力供應不足。對此,台電今(19)日傍晚回應表

2024-04-19 17:38

新奇

更多新奇-

全美語幼稚園校外教學去資收場 家長氣炸:我小孩不會接觸這工作

孩子是國家未來的主人翁,不少幼稚園(幼兒園)會安排各項體驗活動,探訪警察局、走訪博物館,加深孩子對社會的了解。不過,一名家長近期抱怨,花大錢送孩子讀全美語幼稚園,結果校外教學居然去參觀資源回收場,質疑

2024-04-19 11:32

-

台大AV女優宣布徒步環台!首日狂走20公里「腳起水泡」 現況曝光

去年考上國立台灣大學的AV女優魏喬安,日前在社群平台上宣布要徒步環島旅行,第一天就狂走20公里,從台北車站走到三峽,也讓她腳上起水泡,再加上同行夥伴遭野狗咬傷,只能暫時回台北休養,不過她也強調,到下週

2024-04-18 20:05

-

一堆人到巴黎錢包被偷!黃大謙帶「8個錢包」實測 驚人結局曝光

法國的首都巴黎是擁有數千年歷史的古都,也是許多遊客到訪歐洲必去的浪漫城市。但當地治安卻總是亮起黃燈,一堆人都曾在當地錢包、財物失竊,當有人要去巴黎時,幾乎被提醒的第一句都是「小心錢包被偷」。對此,Yo

2024-04-18 18:38

-

佛心蛋「1顆賣1元」!每人限5顆 阿姨買100顆遭拒狂酸:還怕人買

不要糟蹋別人的心意!近期雞蛋價格雖然沒有去年「蛋荒」時昂貴,但想要買到一顆1元的雞蛋,仍可以說是天方夜譚。近期就有民眾表示,爸爸退休後迷上養雞、鴨,產生的蛋自家吃不完,就打算便宜販售,訂出「1顆蛋1元

2024-04-18 18:38

娛樂

更多娛樂-

黃子佼又爆噁心行徑!背著孟耿如問非素人女孩:單身不會有需要嗎

黃子佼被指控早年對少女強制猥褻、性騷擾甚至強制性交得逞,另購買多部色情影片,其中7部為未成年少女不雅影片,被害人年紀有12、13到17歲,內容非一般裸露而是違反意願的偷拍、性虐待等,令人髮指。加入吹哨

2024-04-20 09:35

-

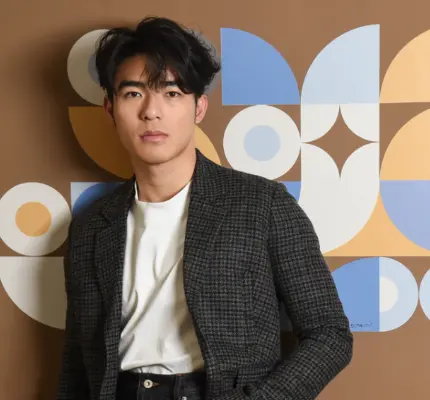

賀軍翔《不夠善良》打破花美男形象展演技!高富帥經典角色一次看

40歲男神賀軍翔長相帥氣,在近期的新戲《不夠善良的我們》甩開花美男形象,詮釋滄桑的中年男性,展現紮實演技,令許多影迷對他刮目相看,直呼「我錯怪賀軍翔的演技了!」賀軍翔的造型還意外撞臉新北市長侯友宜,意

2024-04-20 09:00

-

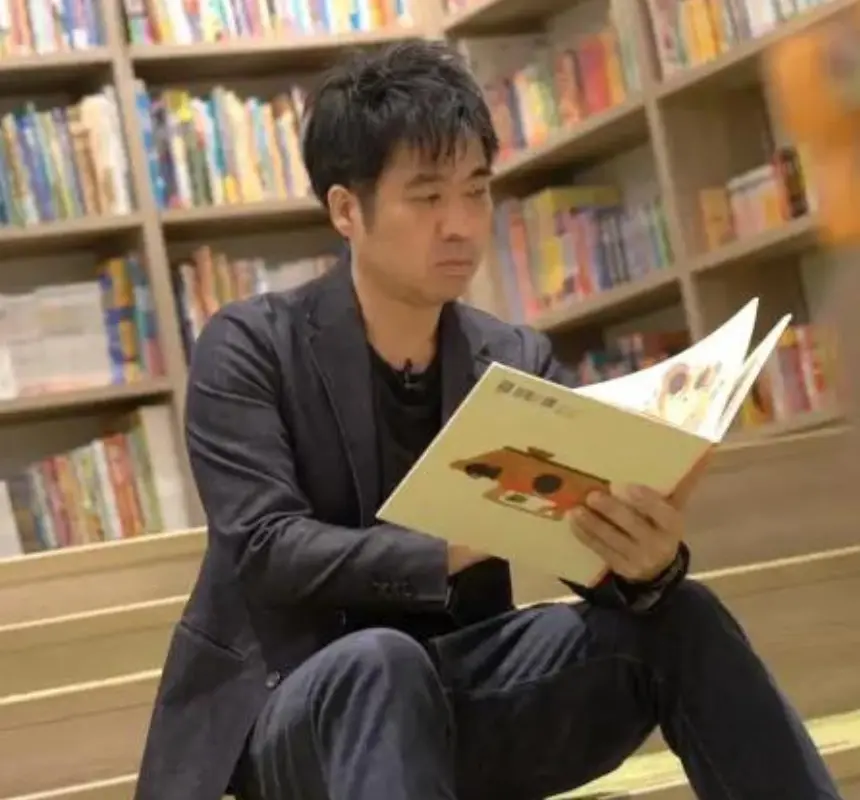

台灣導演揚威日舞、威尼斯影展 謝文明慶幸世上瘋子多:我不寂寞

動畫導演謝文明以驚悚異色風格為人所知。美術系所科班出身的他,擅長手繪、素描動畫,他將所學發揮得淋漓盡致,角色人物的肌里紋路,背景細緻到令人發毛。製作動畫十多年,謝文明屢獲國際影展肯定,溫文爾雅是他,瘋

2024-04-20 08:30

-

《婆婆》黃姵嘉父喪「被男友簡訊分手」心寒 邱昊奇:尊重她感受

黃姵嘉曾經入圍金馬新演員獎,戲劇代表作有《寶米恰恰》、《我的婆婆怎麼那麼可愛》系列,2018年以《台北歌手》拿下金鐘視后,與演員邱昊奇交往近2年的她,父親3月初感染新冠肺炎引發併發症去世,沒想到,辦完

2024-04-20 08:20

運動

更多運動-

NBA附加賽/熱火112:91勝公牛!英雄哥24分準大三元 晉級季後賽

沒有Jimmy Butler也沒問題!邁阿密熱火今(20)日在主場與芝加哥公牛進行的東區附加賽,在沒有「士官長」Jimmy Butler的情況下,靠著堅強團隊防守以及「英雄哥」Tyler Herro攻

2024-04-20 09:26

-

NBA季後賽/湖人目標復仇!Austin Reaves:從沒討論過要避開金塊

洛杉磯湖人後衛Austin Reaves近期在受訪時直言「湖人是來復仇的」!NBA美國職籃台灣時間明(21)日早上8:30,洛杉磯湖人即將要在客場踢館衛冕軍丹佛金塊,儘管外界在過去有「陰謀論」傳出,認

2024-04-20 09:08

-

運動維納斯/曾是全台最強職籃啦啦隊!芊芊3歲就開始學舞

芊芊從3歲開始學舞,一路國小國中高中大學都是舞蹈科班,擅長各種舞風,大學時主修現代,現在最喜歡的是街舞,她覺得自己為了跳舞而生,現在隨時隨地都想的跳舞,自由自在的舞動身軀,就是她的生活,大家都叫她「舞

2024-04-20 09:00

-

稱金塊是湖人「爸爸」!Pierce對衛冕軍有信心:首戰將贏至少15分

洛杉磯湖人隊將於明天在鮑爾體育館對陣衛冕軍丹佛金塊隊,這也是去年西區決賽的重演,湖人士氣高昂,他們在例行賽找到正確的先發陣容後,最後15戰拿下12勝,最終贏下附加賽、以第7種子晉級。不過前塞爾提克球星

2024-04-20 08:50

財經生活

更多財經生活-

汽車臨停「車上擺9顆麻將」!真實用途曝光 2.9萬人愣:實在聰明

汽車臨停這招還真的沒看過!有在開車的人都知道,有時候出門到了某些地方車位總是非常難找,因而車子有時候會停在尷尬的地點,像是可能借停別人家門口等等,但有道德的車主,總是會留下自己的電話號碼,希望如果真的

2024-04-20 08:31

-

身分證拿出來!「姓名中1字」免費吃帝王蟹 中2碼鮭魚壽司吃到飽

4月已經來到中下旬,餐飲業有許多餐廳除了4月的活動也即將告一段落,下個月的「母親節」也有業者已經提前開跑!王品牛排母親節「尋人活動」從即日起開跑至5月31日,只要是媽媽身分顧客,名字對中「真、心、謝、

2024-04-20 07:41

-

人妻整理房間挖到「30年前大金塊」!眾眼睛全亮 真實價格賺翻了

近來黃金價格屢創新高,包括投資人、部分國家央行都變成黃金買家,漲勢非常的驚人。然而,近日就有網友分享自己在整理房間的時候,翻出一條大約30年前的大金塊,當時候購入時要價1萬400元,不知道現在的價格是

2024-04-20 07:16

-

升溫飆36°C!全家霜淇淋第2支10元 GODIVA買1送1、哈根達斯半價

週六、週日(20日、21日)各地大多可來到33到35度,中央氣象署也發布高溫示警,明(20)日局部地區恐飆到攝氏36度!天氣熱先來點冰品消暑,全家霜淇淋今起至4月21日第2支10元,7-11霜淇淋指定

2024-04-20 06:00

全球

更多全球-

特斯拉開始被擠出中國市場!外媒專欄作家揭「養套殺」陷阱

電動車大廠特斯拉(Tesla)近期股價遭受打擊,除了裁員10%,還面臨來自中國新興電動車的激烈競爭。有外媒專欄作家分析,特斯拉的例子揭露中國對外商的「養套殺」模式,從一開始的市場誘惑,到中企的合資、收

2024-04-20 08:04

-

美股也迎黑色星期五?道瓊雖漲 納指大跌逾2%、輝達挫10%

伊朗淡化以色列的軍事報復行動,市場憧憬2國衝突應能避免進一步升級,美股主要指數週五個別發展,不過雖然道指收漲逾200點,但大型科技股受壓,納指下瀉超過2%,與標指都連跌6個交易日,顯示近期地緣政治衝突

2024-04-20 07:08

-

與以色列有關?闖伊朗駐法使館威脅要「自爆」 男子稱為兄弟報仇

19日發生以色列疑似對伊朗發起報復空襲的事件,震撼全球,雖然事發後伊朗有意淡化遭到攻擊一事,雙方衝突暫時未見升級之勢,不過同一天剛好發生有人闖進伊朗駐法國領事館,揚言要「自我引爆」的事件,在區域緊張之

2024-04-20 06:46

-

比特幣減半在即!前夕遇以色列、伊朗衝突 價格如坐雲霄飛車

比特幣(Bitcoin)將於台灣時間20日迎來第4次「減半」,有分析認為這將凸顯比特幣的稀缺性,挖礦公司正在整頓業務,以趕在供應萎縮、導致利潤減半之前,減少對這種加密貨幣的依賴。根據《香港經濟日報》報

2024-04-20 06:12