《鄉民大學問EP.37》字幕版|台南政治版圖有變數?謝龍介有機會?黃偉哲全說了!台南市長前哨戰開打!陳亭妃、王定宇、林俊憲鴨子划水 邱明玉揭他勝算高!黃智賢轉綠?被哥哥盜帳號?黃偉哲霸氣回應現場笑翻!

NOW影音

更多NOW影音焦點

更多焦點-

陳時中傳任政委藍白都批爭議大!蔣萬安:民眾都會一起檢驗

準總統賴清德的新內閣人事布局陸續公布。衛福部前部長陳時中傳將接任行政院政務委員。民眾黨與國民黨都批評陳時中過去擔任部長期間爭議大,不擅於溝通,恐成為地下部長。針對昔日競選對手將接任政務委員,台北市長蔣

2024-04-24 11:30

-

群創秀高端miniLED與AI 3D列印 顯示器太陽眼鏡好吸睛

Touch Taiwan今(24)日登場,群創亦大秀高端AM miniLED可撓式柔性顯示技術、無限拼接AM miniLED技術與深化AI軟硬體整合實力。此外群創也將展出多型態次世代miniLED顯示

2024-04-24 11:29

-

一粒姊姊甜蜜官宣男友宋嘉翔!現身樂天2軍球場 戀情早有跡可循

台鋼雄鷹啦啦隊成員「一粒」因「葉保弟應援曲」的魔性舞步爆紅,連帶仙氣十足的雙胞胎姊姊Joy也跟著爆紅。今(23)日,Joy也在IG上甜蜜公開球員男友,是樂天桃猿潛力「大物」捕手宋嘉翔。事實上,Joy早

2024-04-23 16:58

-

彰化三合院凌晨突發大火!99歲嬤逃生不及葬身火窟 家屬崩潰

彰化縣埤頭鄉堤頭路一處三合院民宅,今(24)日凌晨4時5分發生火警,火勢一發不可收拾,火光更穿透房頂,消防局獲報後立即到場,5時15分撲滅火勢,不過居住在屋內99歲陳姓阿嬤行動不便,逃生不及,救出時已

2024-04-24 10:13

精選專題

要聞

更多要聞-

竹市民政處長抓造謠者!臉書po錄音檔 議員怒批:公審自己部屬

新竹市議員楊玲宜在政論節目上爆料,新竹市長高虹安男友李忠庭仍出入民政處。新竹市政府昨發新聞稿駁斥,民政局長施淑婷昨更在臉書上po出民政局專員錄音檔,痛斥楊玲宜烏龍爆料,籲請楊玲宜議員勿因政治攻擊而未經

2024-04-24 11:19

-

轟廢死大法官6人要退休「不符新民意」 趙少康喊:公投決定廢死

37名死囚認為死刑違反憲法平等權、生存權,聲請法規範憲法審查,憲法法庭昨(23)日召開言詞辯論庭,遭質疑審案的12名大法官,6人最晚10月就要退休,不符合最新民意。對此,前中廣董事長趙少康今(24)日

2024-04-24 11:11

-

李四川批柯文哲北士科案「大小眼」!蔣萬安:確實點出問題

前台北市長柯文哲任內通過的北士科設定地上權案屢遭藍綠議員質疑,台北市議會藍綠19名議員22日共同提案,建議議會成立專案小組調查。柯文哲昨日受訪表示,外界如果要罵人,應先講出哪裡有問題。台北市副市長李四

2024-04-24 11:06

-

賴清德明出席!最後一波內閣國安名單將揭曉 林佳龍、顧立雄入列

總統當選人賴清德將在5月20日上任,首任內閣人事持續布局中,預計明(26)天將釋出最後一波國安內閣名單,包含外交部長、國防部長、海基會等,而賴清德也將親自到場主持。賴清德4月10日公布首波內閣名單,宣

2024-04-24 11:05

新奇

更多新奇-

王彩樺是「台灣諧音始祖」!12年前神講解爆紅 觀眾挖出影片服她

相信有不少人之都知道台灣人真的非常愛用諧音,不過是餐廳、手搖飲甚至是健身房的名字,都能利用諧音來取名,像是知名連鎖飲料店「可不可(渴不渴)」、「鶴茶樓(喝茶嘍)」都是諧音。然而,近日就有網友挖出國民岳

2024-04-24 10:53

-

《池水抽光好吃驚》來台灣!抽光中興湖 驚見「激似鯊魚」外來種

日本知名綜藝節目《池水抽光好吃驚》在今年3月份來台灣,由主持人田村淳與興大生組成多達1百人的「池水台日隊」,抽光國立中興大學內的「中興湖」池水,結果捕撈出近3百隻生物,裡面甚至還有「激似鯊魚」的外來種

2024-04-23 18:07

-

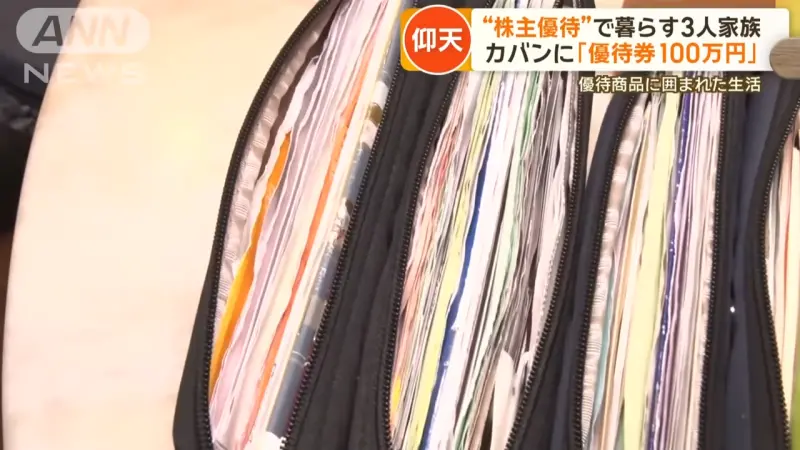

7年買710支股票不賣!1家3口靠「股東福利」活超爽:出門不用花錢

台灣進入股東大會旺季,各家公司開始發放股東會紀念品,例如六福(2705)會發放價值1199元門票給6萬名股東,中鋼(2002)則送出超實用的抗菌多功能不鏽鋼砧板組,總是引發廣大討論。而在日本,更有奇人

2024-04-23 16:56

-

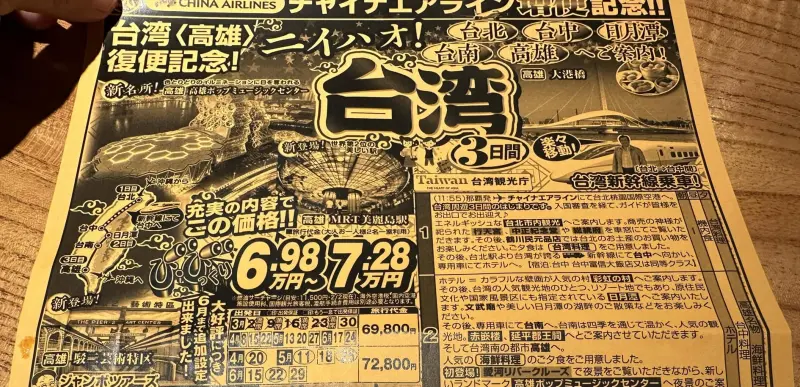

日本旅社推台灣3日遊!團費「不到1萬5」超俗 眾見完整行程嚇壞

這幾年台灣的國旅住宿價格備受關注,許多民眾皆抱怨「飛出國比在台灣玩便宜」,輿論持續發酵,也讓今年農曆春節連假時不少旅宿業者的訂房率慘澹。不過近期就有日本旅行社推出的台灣3天2夜的行程,團費竟然只要1萬

2024-04-23 16:09

娛樂

更多娛樂-

蕭閎仁哭「國家警報沒存到我號碼」被轟沒常識 本人:4月都沒響

花蓮外海4月3日發生規模7.2強震,半個月過去,大小餘震仍不斷發生,近日還出現6級以上震度,創作歌手蕭閎仁昨(23)日發文不解地問,為何自己沒有收到國家警報簡訊,有網友控訴提醒蕭閎仁要達4級才會被示警

2024-04-24 11:08

-

周星馳首度接下陸綜!3大新作曝光《喜劇之王》《食神》驚喜回歸

「喜劇天王」周星馳近年少有新作品推出,令大批「星爺」影迷想念不已,昨(23)日卻突然傳來好消息,周星馳在社群平台上分享一段宣傳影片,開心向外界宣布,他將首度接下中國大陸綜藝節目《喜劇之王單口季》的製作

2024-04-24 10:12

-

F.I.R.出道20週年!阿沁預約大巨蛋:建寧老師、詹雯婷不要吵架了

F.I.R.飛兒樂團昨(23)日迎來出道20週年,不過3位成員早已各奔東西,該團加入新主唱後,發表2張專輯宣布單飛不解散,吉他手阿沁轉為獨立製作人,原主唱Faye飛(詹雯婷)則和團長陳建寧撕破臉,兩人

2024-04-24 09:16

-

72歲張菲近照曝光!戴金錶看牙醫 何妤玟巧遇驚呼「體格壯碩」

綜藝大哥張菲(菲哥)2018年結束節目《綜藝菲常讚》主持工作後便淡出螢光幕,移居花蓮過著半退休生活,最近一次公開露面是去年3月替沈文程演唱會站台。女星何妤玟昨(23)日在粉專分享和張菲的親密合照,72

2024-04-24 08:05

運動

更多運動-

NBA季後賽/Pascal Siakam轟37分!溜馬125:108公鹿 還創一紀錄

NBA季後賽密爾瓦基公鹿今(24)日季後賽首輪G2在主場交手印第安納溜馬,此戰公鹿主力「字母哥」Giannis Antetokounmpo依舊因傷高掛免戰牌,由Damian Lillard單核帶隊,雙

2024-04-24 11:15

-

NBA季後賽/Jaden Mcdaniels狂攻25分!灰狼105:93戰勝太陽2連勝

NBA季後賽西區第二場,明尼蘇達灰狼在今(24)日交手鳳凰城太陽,本場灰狼能戰勝的關鍵除了太陽自亂陣腳,全場發生多達22次失誤,陣中防守悍將Jaden Mcdaniels的發揮也至關重要,他不僅砍進全

2024-04-24 10:31

-

76人虧大了!NBA關鍵報告讓尼克得利 Maxey:我討厭他們決定比賽

NBA季後賽費城76人在昨(23)日首輪G2以101:104不敵紐約尼克,目前系列賽以0勝、2敗落後尼克,NBA官方也在今(24)日給出這場比賽最後2分鐘的裁判報告,更出現4次漏判,且其中3次都對76

2024-04-24 10:04

-

快訊/大谷翔平連2場開轟!生涯177轟出爐 擊球初速高達191公里

(更新:道奇以4:1獲勝)大谷翔平又開轟!洛杉磯道奇隊大谷翔平,今(24)日出戰華盛頓國民,大谷不但在9局上開轟,還是發191公里的超速全壘打,這發全壘打也是他首度到國民隊主場開轟,為自己自我介紹,道

2024-04-24 09:45

財經生活

更多財經生活-

Touch Taiwan聚焦智慧座艙、Micro LED、AI商機 台廠秀硬實力

2024 Touch Taiwan今(24)日至26日登場,今年集結10國家312家指標廠商,使用882個攤位,展示除原有的智慧顯示與智慧製造之外,更跨足至半導體封裝技術以及電子製造設備領域,同期舉辦

2024-04-24 10:53

-

全台暴雨橫掃!好市多除濕機「現折2000元」 衛生紙快閃降價1天

鋒面席捲台灣上空,天氣預報指出今(24)日起至週日各地降雨機率高,好市多本週賣場優惠除了有惠而浦除濕機現折2000元,今(24)日還有夯品「舒潔抽取式衛生紙」現折84元,優惠只到今天,上一波衛生紙優惠

2024-04-24 10:42

-

雨勢起水情緩!全台主要水庫2天進帳469萬噸 日月潭水庫蓄達86%

近日全台各地均有零星降雨,雨勢於今(24)日早晨擴大,甚至有9縣市發布大雨特報,對水庫助益不少,緩解水情。根據水利署主要水庫進帳來看,全台各地水庫共進帳469萬噸,以中台灣的日月潭、霧社、德基、鯉魚潭

2024-04-24 10:40

-

不斷更新/小心淹水!台中、竹苗「大雷雨警戒」 苗栗日雨量破百

鋒面滯留、對流發展旺盛,今(24)日各地天氣都不穩定,中央氣象署也發布「大雷雨即時訊息」,苗栗縣後龍鎮單日雨量更是已經破百毫米,提醒民眾慎防劇烈降雨、雷擊,溪水暴漲,坍方、落石、土石流,低窪地區慎防淹

2024-04-24 10:35

全球

更多全球-

憲法法庭首次死刑存廢言詞辯論!全球還有多少國家保留死刑?

憲法法庭23日首次召開死刑存廢言詞辯論,掀起許多關注,司法院的直播更讓數千名網友觀看並討論。正反雙方針對死刑是否具嚇阻力等議題數次交鋒。死刑議題在各國皆有激烈討論,究竟還有哪些國家保有死刑,從近年的報

2024-04-24 10:49

-

希臘雅典迎致命夢幻橘光!北非沙塵暴襲來 當局發空汙警報

希臘在當地時間周二出現奇景,雅典全城被來自撒哈拉沙漠的沙塵吞噬,呈現一片如火星一般橘色,但當局提醒,這樣的空氣相當致命。根據《美聯社》報導,強烈的南風帶來了撒哈拉沙漠的沙塵,自北非跨過地中海,吞噬了希

2024-04-24 09:11

-

日本7月將換新鈔!日媒點出2大可能狀況 自動販賣機恐無法使用

日本將在7月3號正式發行新紙鈔,面額一萬、五千、一千將會改版,但舊鈔仍可持續使用。新鈔發行後將面臨哪些問題?日媒近日提到,可能將更加推進無現金交易的比例,同時,在街頭常看到的自動販賣機,也將面臨無法吞

2024-04-24 08:25

-

美股四大指數勁揚!特斯拉財報慘澹 盤後股價卻強漲10%

美股週二(23日)收盤再度收紅,四大指數紛紛勁揚,本週適逢美國企業的超級財報週登場,美股科技七雄有四家將在本周陸續公布,率先於盤後公佈財報的特斯拉狀況如預期的慘澹,但盤後股價仍硬聲漲了10%。許多大型

2024-04-24 06:54