《鄉民大學問EP.36》字幕版|韓院長的突襲!藍綠白委員見“韓國魚”驚呼!謝龍介不敢睡 稱愈晚愈high在忙那椿?葉元之公開立院頭號女戰神是“她”!王世堅自豪這點連韓國瑜也比不上!|NOWnews

NOW影音

更多NOW影音焦點

更多焦點-

民進黨立委剉咧等?郭正亮看郭智輝入閣 示警「台灣問題很嚴重」

有「斜槓經濟人」稱號的崇越科技集團董事長郭智輝將出任經濟部長,根據官網顯示資訊,崇越為台積電供應鏈,主要業務涵蓋半導體設備、材料;近年則橫跨生技、光電、綠能、環保、健康及運動等,領域相當多元。對此,前

2024-04-19 08:19

-

追究襲擊以色列責任!伊朗遭制裁 外長赴聯合國會議被限制活動

伊朗上週末在攻擊以色列本土後,美國與英國18日宣布,對伊朗實施新一輪制裁,旨在嚇阻伊朗與其代理人繼續發動攻擊,避免中東局勢惡化升級。美國並對正在紐約出席聯合國會議的伊朗代表團,實施了額外的行動限制,包

2024-04-19 08:05

-

陳芳語撇清謝和弦沒用!網友嘲諷「絕對X過」 她憤怒回5字反擊

音樂圈爆發桃色蜘蛛網情節!朱軒洋劈腿吳卓源,意外扯出謝和弦前妻Keanna與陳芳語(Kimberley)的陳年恩怨,Keanna堅稱謝和弦婚內劈腿,與陳芳語在錄音室密室交歡,怒控她是「假面甜心」,當事

2024-04-18 17:57

-

淡水泡棉工廠深夜陷火海!爆是大型違建 毒災隊緊急出動

昨(18)日深夜10時半,新北市淡水區小中寮一處泡棉工廠傳出火警,消防人員獲報到場時,現場為3層樓鐵皮工廠,存放大量易燃物、禁水性化學物質,不斷飄出陣陣刺鼻味,且位於水源缺乏區,火勢蔓延迅速,情況危急

2024-04-19 07:59

精選專題

要聞

更多要聞-

民進黨立委剉咧等?郭正亮看郭智輝入閣 示警「台灣問題很嚴重」

有「斜槓經濟人」稱號的崇越科技集團董事長郭智輝將出任經濟部長,根據官網顯示資訊,崇越為台積電供應鏈,主要業務涵蓋半導體設備、材料;近年則橫跨生技、光電、綠能、環保、健康及運動等,領域相當多元。對此,前

2024-04-19 08:19

-

1年創50億效益!高雄「演唱會經濟」發燙 黃暐瀚點出關鍵1原因

高雄「演唱會經濟」發燙,去年創下近50億元效益,今年又有多名國外天王、藝人天后級藝人登台。資深媒體人黃暐瀚分析,高雄演唱會經濟成功,最關鍵因素為「環保選擇」,直呼「唱起來,人進來,高雄發大財!」黃暐瀚

2024-04-19 08:10

-

蔡英文最愛閣員是他們!8年前上任後從未異動 這4人動向備受關注

準閣揆卓榮泰今(18)日將開記者會,公布第四波內閣新人事案。目前約15位閣員名單尚未公布,包括外交部、國防部、陸委會、退輔會等部會,且目前公布的準閣員當中,只有準副閣揆鄭麗君、準內政部長劉世芳2名女性

2024-04-19 08:00

-

第四波新內閣人事今揭曉 傳新增3女性閣員掌勞部、環部、客委會

準行政院長卓榮泰將於今(19)日上午10時公布第四波新內閣人事,傳農業部長將由現任代理部長陳駿季真除,勞動部長傳由行政院副秘書長何佩珊接掌,衛福部長傳已內定邱泰源出任,環境部長則傳以商研院副院長張皇珍

2024-04-19 07:59

新奇

更多新奇-

台大AV女優宣布徒步環台!首日狂走20公里「腳起水泡」 現況曝光

去年考上國立台灣大學的AV女優魏喬安,日前在社群平台上宣布要徒步環島旅行,第一天就狂走20公里,從台北車站走到三峽,也讓她腳上起水泡,再加上同行夥伴遭野狗咬傷,只能暫時回台北休養,不過她也強調,到下週

2024-04-18 20:05

-

一堆人到巴黎錢包被偷!黃大謙帶「8個錢包」實測 驚人結局曝光

法國的首都巴黎是擁有數千年歷史的古都,也是許多遊客到訪歐洲必去的浪漫城市。但當地治安卻總是亮起黃燈,一堆人都曾在當地錢包、財物失竊,當有人要去巴黎時,幾乎被提醒的第一句都是「小心錢包被偷」。對此,Yo

2024-04-18 18:38

-

佛心蛋「1顆賣1元」!每人限5顆 阿姨買100顆遭拒狂酸:還怕人買

不要糟蹋別人的心意!近期雞蛋價格雖然沒有去年「蛋荒」時昂貴,但想要買到一顆1元的雞蛋,仍可以說是天方夜譚。近期就有民眾表示,爸爸退休後迷上養雞、鴨,產生的蛋自家吃不完,就打算便宜販售,訂出「1顆蛋1元

2024-04-18 18:38

-

政大景觀池命名票選!「金玟池」得票63%暫居第一 超紅原因曝光

韓流魅力真的太強了!近期國立政治大學要達賢圖書館旁的景觀池命名,更舉辦了人氣票選比賽,也開放校外民眾參加,沒想到除了許多諧音梗紛紛出籠之外,還有韓星「金玟池」的名字也在其中,甚至還突破6成得票率暫居第

2024-04-17 21:53

娛樂

更多娛樂-

《康熙來了》試卷陳漢典信心滿滿!分數出爐蔡康永笑瘋:捨身救我

《康熙來了》自2016年停播至今已經8年,仍能看節目片段在網路上流傳,可見不少觀眾對節目相當懷念。近日,有網友特別製作一份考卷來測試鐵粉,連主持人蔡康永也來參戰,結果只拿到28分,身為主持人之一的陳漢

2024-04-19 08:07

-

舒淇罕見告白馮德倫!歡慶48歲生日趴 「羞曬親親照」甜喊愛你

性感女星舒淇16日迎來48歲生日,今(19)日凌晨她曬出老公馮德倫為她準備派對的照片,同時也慶祝兩人結婚週年紀念日,舒淇罕見放閃甜喊「LOVE U」,還PO出兩人的接吻照,羨煞不少人,不到1小時就超過

2024-04-19 01:24

-

「反骨男孩」正妹陳語謙升格2寶媽 甜蜜大喊:是幸孕的生日

加入「反骨男孩」走紅的網紅陳語謙,2022年與男友登記結婚,隔年便生下愛女妍妍。昨(17)日陳語謙在IG上喜迎28歲生日,並宣布自己時隔1年再度懷孕即將升格「2寶媽」,並在IG上甜蜜地大喊:「是幸孕的

2024-04-18 22:18

-

林志玲罕見向婆婆「請假4天」!不捨2歲兒:離開最久的極限

林志玲從兒子出生起就時刻陪伴,雖然5年沒在大銀幕上出現,但仍心繫電影。去年林志玲重返金馬獎頒獎,老公AKIRA也到台北電影獎擔任頒獎人,可見十分相挺。今(18)日林志玲再度受邀出席第14屆北京國際電影

2024-04-18 22:06

運動

更多運動-

NBA附加賽完整賽程、戰況懶人包 生死鬥!老9公牛、國王最後一搏

(更新日期:4/18) NBA附加賽首輪「生死鬥」結局出爐,西區勇士中箭落馬,Curry神情落寞,勇士10年4冠王朝陣容也瀕臨崩解,東區老鷹則也率先出局。休兵一日,附加賽最終篇將上演,西區由鵜鶘對決國

2024-04-19 05:40

-

Klay Thompson季前不續約恐後悔莫及 美媒直言:勇士陣容必解體

西區第10種子NBA金州勇士在附加賽不敵西區第9種子沙加緬度國王,勇士也提前放暑假結束本季,其中勇士射手「K湯」Klay Thompson表現荒腔走板,成為球評、球迷砲轟的對象,更有球評直言,勇士陣容

2024-04-19 05:38

-

全中運/兩人三破大會紀錄 後起之秀!何盈禕、王昱鈞同日登頂

113年全國中等學校運動會舉重項目在臺北市大直高中展開,臺南市大內國中何盈禕在國女組40公斤級以抓舉50公斤、挺舉60公斤,總和110公斤,「3破」大會紀錄,並衛冕金牌。國男組55公斤級臺中市成功國中

2024-04-19 05:37

-

全中運/自由車場地賽、台中市包7金 西松高中秦力恩逆轉摘金

113年全國中等學校運動會自由車場地賽,在臺中市立自由車場進行第2天賽事,再頒出國男組、高男組、國女組和高女組爭先賽4金及個人追逐賽4金,臺中市再度展現強大實力,囊括7金,臺中市大甲高中獨佔3金、臺中

2024-04-19 05:25

財經生活

更多財經生活-

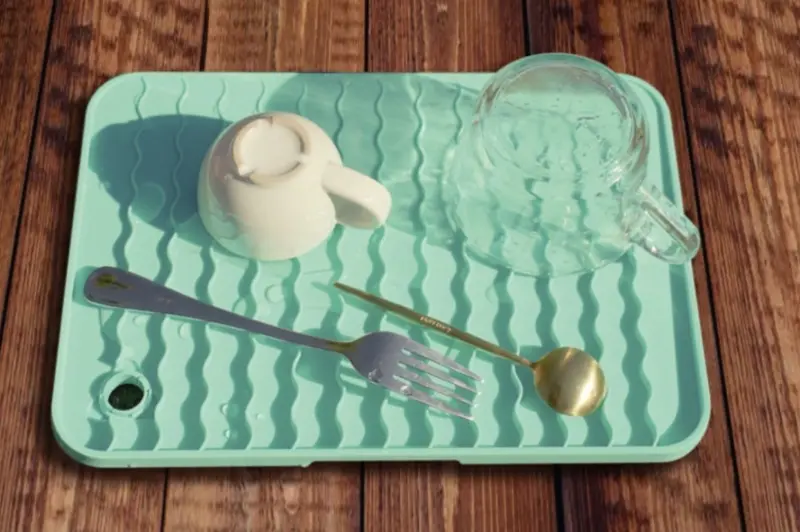

股東紀念品「今年最強不是中鋼了」!股民爽領這2間:水準真的高

中鋼股東紀念品已經不是最強了!過去一直被股民笑稱中鋼是「被鋼鐵業耽誤的紀念品商」,原因是每年中鋼所推出的股東紀念品都是具有實用性、設計感也非常不錯,讓125萬廣大的股民好評不斷。然而,近幾年不讓中鋼專

2024-04-19 07:57

-

天氣預報/今午後又下雨!六日把握短暫好天氣 鋒面下週二再襲台

昨日受到鋒面尾端通過影響,北部下了很大一陣降雨,隨鋒面結構快速減弱,降雨在上午止於台中,午後西半部平地反而呈現晴時多雲的好天氣,溫度也跟著上升,僅北部溫度轉涼較明顯,今(19)日午後在中北部、中南部山

2024-04-19 07:33

-

天王星5隻貓全奇蹟存活!躲貓貓冠軍「歐膩」也回家了 貓奴飆淚

花蓮在月初時遇到規模7.2的強震,造成一棟天王星大樓民宅傾斜,相關單位經過2個多禮拜才全數拆除完畢,然而,當下因為狀況緊急,裡面的住戶在撤離時也沒有時間找愛貓在哪裡,無法一起逃生,只能自行先離開,而截

2024-04-19 07:06

-

穀雨前夕財神躲起來!威力彩頭獎槓龜 4/18「最新獎號」一次對完

明(19)日就是節氣穀雨,今(18)日晚間威力彩第113000032期開獎,本期頭獎為2億元,不過最終沒有頭獎幸運兒出現,今彩539部分也沒有開出頭獎。4/18威力彩中獎號碼(第113000032期)

2024-04-18 22:10

全球

更多全球-

追究襲擊以色列責任!伊朗遭制裁 外長赴聯合國會議被限制活動

伊朗上週末在攻擊以色列本土後,美國與英國18日宣布,對伊朗實施新一輪制裁,旨在嚇阻伊朗與其代理人繼續發動攻擊,避免中東局勢惡化升級。美國並對正在紐約出席聯合國會議的伊朗代表團,實施了額外的行動限制,包

2024-04-19 08:05

-

VTuber很好賺?一個月直播上百小時 魔競娛樂:台灣高時數是必須

近年來,虛擬直播主(VTuber)崛起,形成了龐大的市場以及產業鏈,也傳出有不少成功的VTuber賺的口袋滿滿,使得許多人對於該行業抱持憧憬。不過VTuber背後的辛苦卻也常常被忽視,包括得進行長時間

2024-04-19 08:00

-

以巴衝突持續延燒!巴勒斯坦申請正式加入聯合國 遭美國一票否決

聯合國安理會當地時間18日﹐針對巴勒斯坦申請成為正式會員國的決議案進行投票,遭到美國否決而沒了下文,批評者認為,美國此舉損害了巴勒斯坦的權益、只為聲援以色列,現任巴勒斯坦總統(巴勒斯坦自治政府主席)阿

2024-04-19 07:23

-

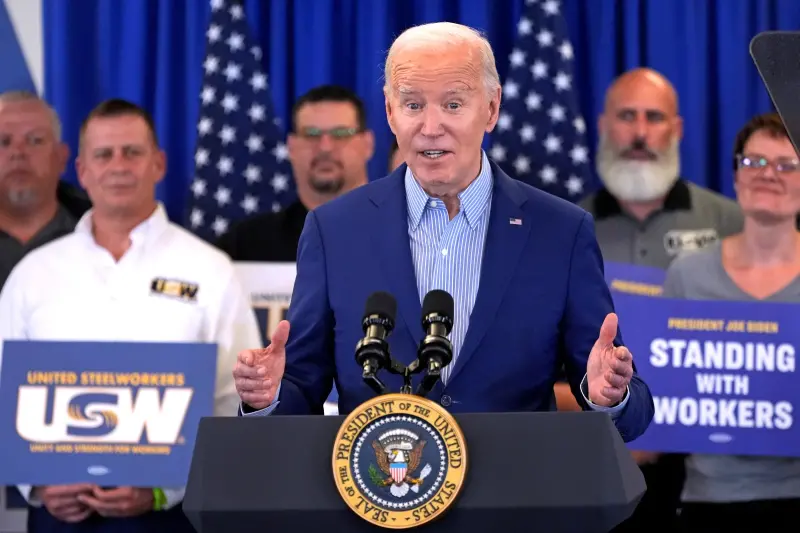

自爆叔叔二戰失蹤「疑被食人族吃掉」!拜登發言遭官方資料打臉

美國拜登(Joe Biden)17日前往賓州匹茲堡出席造勢活動時,參觀了戰爭紀念碑,並在稍後於鋼鐵工會總部發表演說時,講述叔叔小芬尼根(Ambrose Finnegan Jr)二戰駕駛偵察機,疑似在新

2024-04-19 06:47