《鄉民大學問EP.39》字幕版|#柯文哲 的三大案連環爆!涉貪污遭列被告 陳智菡曝內幕!蔡正元:離總統路更近!民眾黨再演宮鬥劇?柯文哲與黃國昌竟是這關係?#韓國瑜 立院霸氣喊“閉嘴” 2028真再戰?

NOW影音

更多NOW影音焦點

更多焦點-

爸媽注意!國家兩廳院推出「演出中孩童陪伴服務」 可安心看表演

國家兩廳院今(8)日正式宣佈,即起提供兒童與其照顧者全新預約制「藝童PLAY Fun House」演出中孩童陪伴服務,凡是在國家兩廳院四廳內演出的所有節目,在演出期間均提供此服務,讓孩童照顧者可以安心

2024-05-08 23:14

-

完成申報了嗎?財政部提醒「自行報稅者」3件事:都要確實完成

5月報稅季,不少民眾採取網路自行報稅,財政部今(8)日提醒,申報及繳稅都要確實完成,也須留意有無應檢附證明文件給國稅局,在走完報稅流程要看到申報成功才表示完成申報。財政部表示,報稅需注意申報完成、繳稅

2024-05-08 20:22

-

她被Energy簽唱會害到沒業績!22年後變「成員老婆」在台下尖叫

最殺舞蹈男團Energy時隔22年復出,5日在信義區舉辦簽唱會,現場聚集超過5000名粉絲,他們簽到凌晨3點才結束,其中成員阿弟(蕭景鴻)的老婆Mei也到場支持,今(8)日發文分享,當年她仍在當櫃姐,

2024-05-08 21:00

-

彰化伸港3姊弟遭撞!10歲姊姊病況才好轉 月初急性水腦症再昏迷

彰化伸港鄉今年2月間發生一起嚴重車禍,當時陳姓3姊弟過馬路慘遭一名無照老翁駕駛休旅車撞飛,雖就讀小學的弟弟僅受輕傷,但2名姊姊卻雙雙呈現昏迷,經彰化秀傳醫院救治,10歲姊姊昏迷指數一度回升到11,不料

2024-05-08 22:20

精選專題

要聞

更多要聞-

總統赴立院特別席!王世堅曾「誤坐」下場曝光 他嘆:會付出代價

國民黨立法院黨團提案,邀準總統賴清德到立法院國情報告。過去從不曾有總統到立法院國情報告,若賴清德確定到立院國情報告,將是史上第一人,他的位置將坐在立法院長韓國瑜的左方。不過這總統的特別保留席,過去也有

2024-05-08 21:10

-

力挺徐巧芯未洩密!馬文君質詢外交部高官 台灣竟怕中共打壓?

國民黨立委徐巧芯爆料外交部援助烏克蘭1千萬美金,金流有恐有問題,遭外交部提告洩密。國民黨立委馬文君說,早在今年3月26日,捷克外交部的官方刊物《現代經濟外交》,就已經完整揭露以上內容,甚至比外交部報告

2024-05-08 20:44

-

徐巧芯要賣房也被嗆「賺暴利」媒體人嘆:真的要花時間無腦攻擊嗎

國民黨立委徐巧芯近期話題不斷,近日被指2021年曾在京華城附近買一間中古屋,質疑她靠內線消息獲利、該房未來可賣6000萬元,引發討論。徐巧芯今(8)日再度回擊,願意用4000萬元賣出,要的話明天立即交

2024-05-08 19:03

-

騙越多關越久!政院明擬通過「打詐新四法」 網站勸不聽最重封網

國內詐騙氾濫引發民怨,為此行政院將修改「打詐新四法」,包括《詐欺犯罪危害防制條例》、《洗錢防制法》、《科技偵查及保障法》與《通訊保障及監察法》,並預計於明日行政院會通過後送立院審議,並計劃由行政院長陳

2024-05-08 18:53

新奇

更多新奇-

面試寫明「無經驗可」!新鮮人到場秒受挫:都被騙了 前輩戳真相

一年一度的畢業季又快到了,許多人的身分也將從學生轉變成求職者,陸續面臨「面試」這個難關。近期就有位新鮮人訴苦,很多職缺寫上「無經驗可」,面試時卻被公司方不斷嫌棄。讓她超級受挫,詳細遭遇曝光,也引來一票

2024-05-08 22:27

-

全世界最危險的地方!旅行家點名「7個國家」沒事別去:差點沒命

全世界一共有多達200多個國家與地區存在,每個地方都有不同的生活面貌,理當也暗藏著不同的危險。近期走遍全球197個國家的旅行家賓斯基(Drew Binsky),分享各國遊歷的12年間,最瀕臨死亡的5次

2024-05-08 21:26

-

影/韓團StrayKids出席Met Gala 慘被現場攝影笑:他們是機器人

被視為時尚圈奧斯卡的Met Gala日前登場,韓國大勢男團StrayKids首次亮相,同場韓星還有第2次參加Met Gala的Blackpink成員Jennie。未料,一段現場攝影師閒話StrayKi

2024-05-08 20:24

-

茶湯會店員玩「養樂多挑戰」!朝水槽嘔吐客轟噁心 總公司發聲了

網路挑戰再度釀成食安疑慮!日前在影音平台Tiktok上,「養樂多挑戰」突然爆紅,許多年輕人挑戰狂灌乳酸飲,看喝到底幾杯會吐。沒想到有手搖飲店員工在店裡進行嘗試,卻將嘔吐物吐在工作區域水槽中,畫面引爆譁

2024-05-08 18:26

娛樂

更多娛樂-

吳慷仁脫進坎城!爆私下較勁《破浪》2女星 孤寂4男女激戰整夜

「金馬前進坎城」計畫,即將於5月16日在「坎城影展市場」登場,今(8)日舉辦行前記者會,楊雅喆執導電影《破浪男女》,揭開當代約炮文化下激情卻孤寂的靈魂,展開4個都會男女的愛情寓言,金馬影帝吳慷仁參演本

2024-05-08 21:33

-

朱軒洋劈腿「鄉民老婆」吳卓源神隱!九把刀:大家都該去一趟地獄

朱軒洋劈腿交往7年的網紅女友Cindy,與「鄉民老婆」吳卓源在公園接吻被拍,緋聞事件爆發後,至今仍消失蹤影。2024金馬前進坎城記者會今(8)日登場,曾劈腿主播周亭羽被拍的「大前輩」九把刀,帶來與朱軒

2024-05-08 18:18

-

柯震東PO媽媽年輕照片!正到撞臉周迅、吳倩蓮 根本文青女明星

「國民俗仔」柯震東12年前以國片《那些年,我們一起追的女孩》竄紅,勇奪金馬獎最佳新演員獎,後來再憑《再見瓦城》、《金錢男孩》提名金馬獎男主角,近年轉行當導演、接拍影集《愛愛內含光》、《不夠善良的我們》

2024-05-08 17:21

-

余苑綺罹癌搬出婆家原因令人心痛 女兒童言童語:爸爸都在打電動

余天女婿、次女余苑綺(已改名余泳澐)老公Gary(陳鑒),日前涉嫌擔任詐騙集團車手頭,在板橋捷運站遭壓制逮捕,目前被依詐欺罪羈押中,今(8)日Gary遭余家親友爆料,余苑綺癌症復發後搬出婆家租房子,余

2024-05-08 15:40

運動

更多運動-

Anthony Edwards你不知道的5件事:為何叫「蟻人」?本有望打NFL

明尼蘇達灰狼球星「蟻人」Anthony Edwards在今年季後賽用勁爆的球風和攻防俱佳的表現征服球迷,不少人認為他的氣質和動作與「飛人」Michael Jordan相似,並深信他就是NBA下一個門面

2024-05-09 00:38

-

Kevin Durant重返勇士?美媒建議5換1交易 再度聯手Curry爭冠

鳳凰城太陽和金州勇士在季後賽和附加賽接連遭到淘汰,在休賽季尋求改變,成為這兩支球隊必須要做的事,由於太陽和勇士目前薪資空間不足,無法在自由市場花大錢簽下即戰力補強,而美國媒體也建議兩隊之間來一筆交易,

2024-05-09 00:15

-

中職/真王牌!勝騎士跨季12連勝、近一年未吞敗 統一8:0勝兄弟

中華職棒統一獅近況火燙,昨(8)日客場碰上中信兄弟,全場敲出12支安打,加上先發投手勝騎士主投6局0失分,投打俱佳,終場8:0完封兄弟,穩居龍頭寶座。統一獅上半季已進行了26場比賽,總計只吞下6敗,成

2024-05-09 00:10

-

中職/投手戰!黃子鵬6次四壞球釀禍 味全4:0完封樂天喜迎3連勝

衛冕軍味全龍今(8)日在天母主場迎戰樂天桃猿,先發投手艾璞樂主投5.2局0失分,之後3名投手接力完封,終場味全龍4:0擊敗樂天,收下3連勝。本場比賽形成投手戰,前一場才奪勝的樂天王牌投手黃子鵬,今先發

2024-05-08 22:39

財經生活

更多財經生活-

新北裕德國際學校爆集體食物中毒!百名師生上吐下瀉 校方發聲了

又傳出集體食物中毒事件!新北市土城裕德國際學校昨(7)日共有113名師生,在食用台中新社農會推廣部提供的食品後,出現疑似食物中毒的狀況。對此,校方也在今(8)日發布聲明,學生所有用餐食物,台中新社已經

2024-05-08 21:06

-

啤酒別直接喝!內行「倒酒神級手法」一秒豪華升級:口感變超綿密

近年來由於消費者對生活品味的重視與追求,連帶對於啤酒風味及品質更趨於講究,百年德國啤酒品牌艾丁格,特別分享道地的德國啤酒喝法,只要簡單改變倒酒手法,就能喚醒啤酒中的酵母活性,瞬間打造出如雲朵般的啤酒泡

2024-05-08 18:39

-

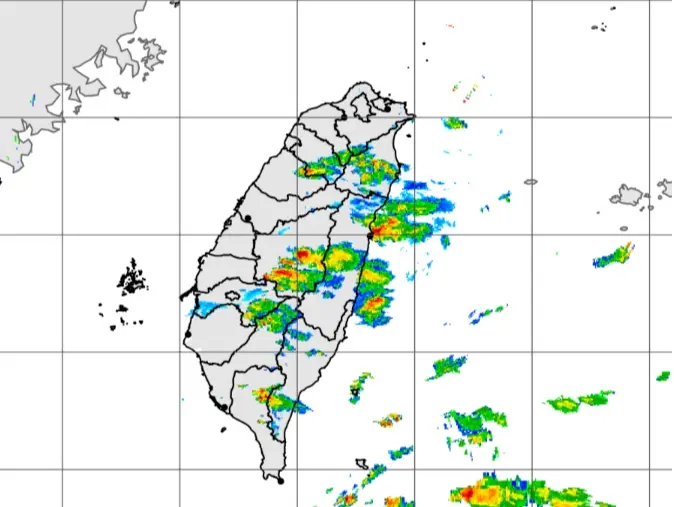

天氣預報/母親節全台濕透!明北台灣仍偏涼 下週颱風生成變數大

今(8)日受到華南雲系影響,中南部山區出現較大雨勢,中央氣象署預報員黃恩鴻表示,明(9)日水氣將減少,各地天氣回穩到週六(5/11),週日母親節(5/12)鋒面接近,全台有雨到下週一(5/13),菲律

2024-05-08 18:29

-

快訊/下班路注意!台中、高雄等10縣市「大雨特報」 防雷擊強風

(更新時間16:39)今天(8日)東北季風逐漸增強,迎風面的東半部局部地區斷斷續續有短暫陣雨,且降雨明顯,晚上東北部地區有較大雨勢出現的機率,而北部地區雲量較多,在大臺北山區偶有零星飄雨,其他地區則為

2024-05-08 16:40

全球

更多全球-

南韓掀搶買黃金潮!金條成「超商三寶」 30多歲買氣最狂熱

黃金熱席捲南韓?韓國便利商店近期出現購買迷你黃金的熱潮,除了拉麵和香腸,金條頓時成為了韓國便利商店的熱門商品,甚至有超商的自動販賣機也跟著賣迷你金圓,跟上這波銷售潮流。據財經網站《CNBC》報導,自4

2024-05-08 23:54

-

泰國旅遊注意了!泰總理正式下令修改大麻政策 年底重新列為毒品

泰國於2022年開放大麻作為娛樂用途,全面大麻合法化,吸引許多外國遊客爭相到往。不過,這項政策在泰國總理賽塔(Srettha Thavisin)去年九月上任後,情況出現了變化,賽塔始終表達反對娛樂大麻

2024-05-08 22:11

-

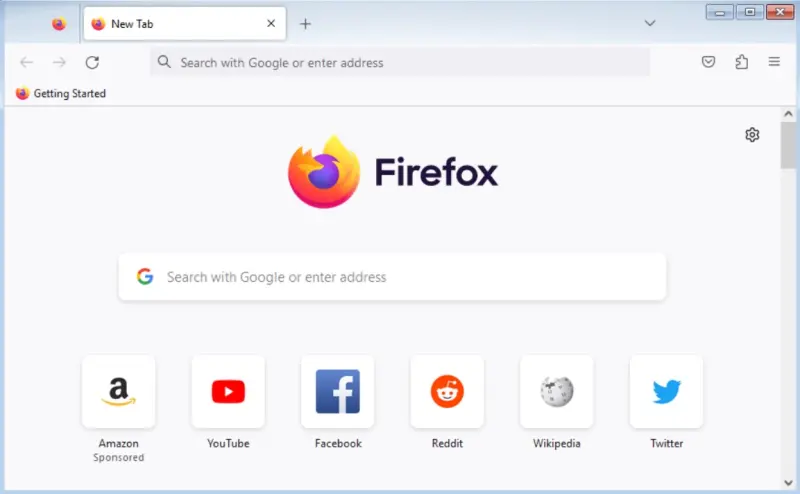

Firefox超級用戶同時開「7470個瀏覽分頁」!失手全關靠1設定救回

國外一名軟體工程師,在她的Macbook中,開了7470個Firefox瀏覽器分頁,這些分頁陸續累積時間長達兩年,都沒有關掉,但就在一次失手之下全被關閉,她能救回嗎?這名Firefox超級用戶「haz

2024-05-08 21:14

-

2024「全球百大富有國家」排名!台灣竟能位居第14 超越日韓

美國財經雜誌《全球金融》(Global Finance)近日公布「2024年全球100個富有國家或地區」排名,結果由盧森堡拔得頭籌。值得注意的是,在該份榜單中,台灣竟能位居第14,還領先了韓國和日本。

2024-05-08 19:05