《鄉民大學問EP.36》字幕版|韓院長的突襲!藍綠白委員見“韓國魚”驚呼!謝龍介不敢睡 稱愈晚愈high在忙那椿?葉元之公開立院頭號女戰神是“她”!王世堅自豪這點連韓國瑜也比不上!|NOWnews

NOW影音

更多NOW影音焦點

更多焦點-

世新大學宿舍每學期9萬!校方回應「4大特點」:24小時控管

世新大學今年落成全新宿舍「新苑宿舍」,但住宿費每學期高達9萬引發爭議。對此,世新大學回應,新宿舍有24小時門禁控管,且也有其他相對低價宿舍可以滿足學生多元需求。根據世新大學113學年度宿舍收費標準,每

2024-04-20 14:15

-

報復基地被襲?伊拉克武裝組織證實 派無人機攻擊以色列南部城市

伊拉克的親伊朗民兵組織「人民動員」(PMF),其卡爾蘇軍事基地(Kalsu military base),當地時間19日晚間遭遇襲擊,釀成人員傷亡,雖然以色列跟美國都否認涉案,但最新外媒消息指出,有伊

2024-04-20 14:30

-

陳亞蘭久違扮花旦索吻!莊凱勛粉墨登場「擔心遭影迷追殺」

推廣歌仔戲不遺餘力的陳亞蘭,與莊凱勛兩位金鐘視帝聯手合作,共演歌仔戲職人劇《勇氣家族》,今(19)日舉辦開播記者會,在劇中飾演夫妻的陳亞蘭及莊凱勛盛重以歌仔戲扮相出場,過去反串男性角色居多的陳亞蘭,久

2024-04-19 18:18

-

衛生局稽查也出事!大直美麗新影城賣「血絲豬排」 顧客上吐下瀉

台灣食安危機頻傳,讓不少民眾憂慮吃下肚的食品是否安全。台北美麗新大直皇家影城,近期傳出販售「帶血絲」的豬排,民眾邊看電影邊用餐後,剩餘餐點帶回家,赫然發現豬排疑似沒熟,當天晚上7點就出現腸胃不適,3小

2024-04-20 14:19

精選專題

要聞

更多要聞-

停電頻傳!台電總經理傳請辭 立委張啓楷:應檢討整體能源政策

近期傳出限電危機後又連日發生跳電事件,桃園地區2日內更是停電4次。台電總經理王耀庭今(20)日向全民致歉並請辭,經濟部長王美花則希望能慰留。對此,民眾黨立委張啓楷表示,當務之急,應是致力於落實電網強韌

2024-04-20 14:13

-

出3考題!溫朗東向徐巧芯夫婦下戰帖:不敢戰就別廢話一堆

國民黨立委徐巧芯近期捲入大姑夫婦涉詐案,並被控財產申報不符,引發外界關注,針對徐巧芯稱時事評論員溫朗東以前辯論比賽都輸老公劉彥澧一事。溫朗東今(20)日表示,他出3道題目邀請徐巧芯夫婦辯論,並怒嗆徐巧

2024-04-20 13:19

-

YouBike 2.0E電輔車11月上路 騎上人行道竟「新北罰、北市不罰」

台北市、新北市YouBike 2.0E電輔車將在11月上路。國民黨台北市議員柳采葳說YouBike 2.0E最高時速25公里,從0KM加速到25KM只要短短15秒,若騎在人車共道的行人道上,恐威脅行人

2024-04-20 12:36

-

何佩珊掌勞動部 昔日老闆柯建銘喊:就看妳了!好好照顧勞工弱勢

準閣揆卓榮泰昨天宣布,勞動部長將由行政院副秘書長何佩珊接下,由於何佩珊過去曾擔任過民進黨立法院黨團總召柯建銘辦公室主任,柯也在臉書有感而發說,「佩珊接下來就看妳了,好好照顧勞工及弱勢」。柯建銘指出,何

2024-04-20 12:07

新奇

更多新奇-

水煮蛋「最神煮法」!日本政府認證:省超多水跟瓦斯 台灣也適用

水煮蛋「最神煮法」找到了!日前日本政府農林水產省,在社群上發文分享能以最少用水、瓦斯煮出美味水煮蛋的方法,簡單步驟在台灣也適用,更讓數萬日本民眾大讚實用,懊悔沒早點學起來,「之前煮蛋浪費了太多水跟瓦斯

2024-04-20 14:10

-

全美語幼稚園校外教學去資收場 家長氣炸:我小孩不會接觸這工作

孩子是國家未來的主人翁,不少幼稚園(幼兒園)會安排各項體驗活動,探訪警察局、走訪博物館,加深孩子對社會的了解。不過,一名家長近期抱怨,花大錢送孩子讀全美語幼稚園,結果校外教學居然去參觀資源回收場,質疑

2024-04-19 11:32

-

台大AV女優宣布徒步環台!首日狂走20公里「腳起水泡」 現況曝光

去年考上國立台灣大學的AV女優魏喬安,日前在社群平台上宣布要徒步環島旅行,第一天就狂走20公里,從台北車站走到三峽,也讓她腳上起水泡,再加上同行夥伴遭野狗咬傷,只能暫時回台北休養,不過她也強調,到下週

2024-04-18 20:05

-

一堆人到巴黎錢包被偷!黃大謙帶「8個錢包」實測 驚人結局曝光

法國的首都巴黎是擁有數千年歷史的古都,也是許多遊客到訪歐洲必去的浪漫城市。但當地治安卻總是亮起黃燈,一堆人都曾在當地錢包、財物失竊,當有人要去巴黎時,幾乎被提醒的第一句都是「小心錢包被偷」。對此,Yo

2024-04-18 18:38

娛樂

更多娛樂-

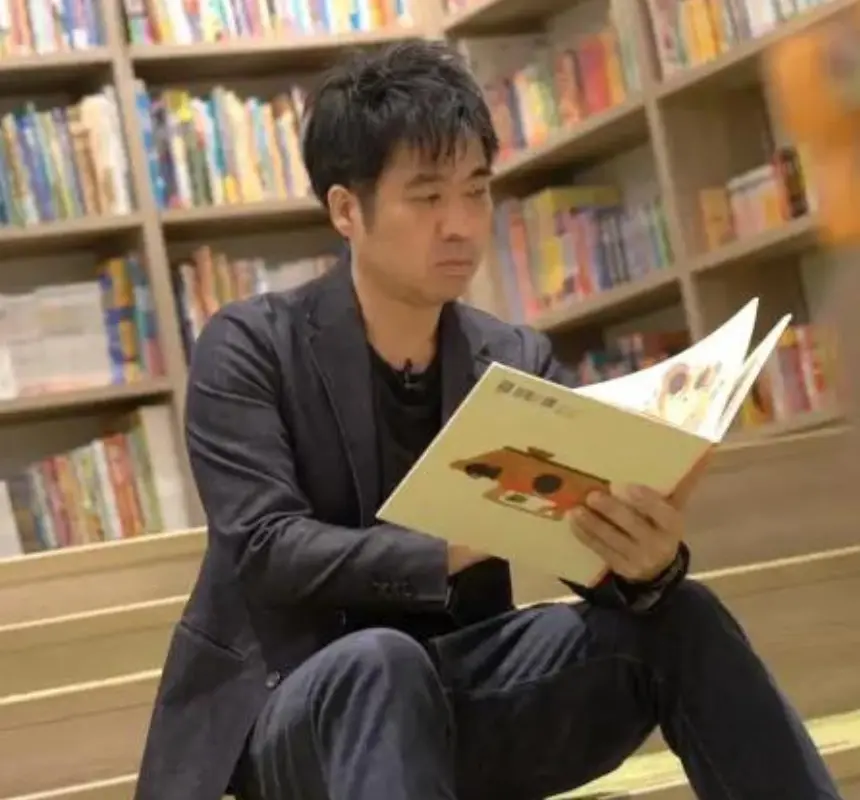

汪小菲失憶!想不起來去大S家咆哮、警局暴走:忘記我做什麼了

汪小菲3月22日兩度突襲前妻大S台北信義豪宅,在樓下咆哮「要找徐熙媛算帳」,與保全爆發爭執,被警察帶走後又揚言檢舉大小S濫用安眠藥,但筆錄沒做完就走回家,脫序行徑讓外界看傻眼。汪小菲本月18日在直播提

2024-04-20 14:18

-

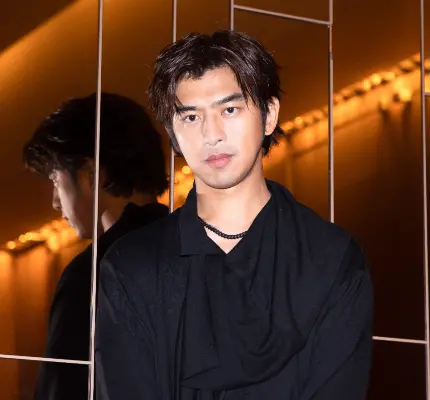

葛斯齊再槓大S!「提3點反擊」怒批:妳婚姻是否出軌自己最清楚

韓國藝人具俊曄日前在節目《脫掉鞋子恢單4Men》中,大方曬出8張與大S(徐熙媛)的親密合照,眼尖的粉絲發現大S的與具俊曄的定情刺青「Remember Together forever」沒有出現在照片中

2024-04-20 14:12

-

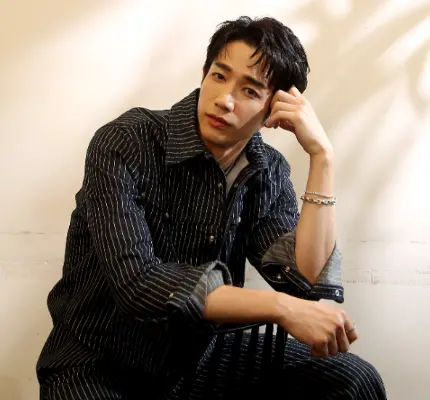

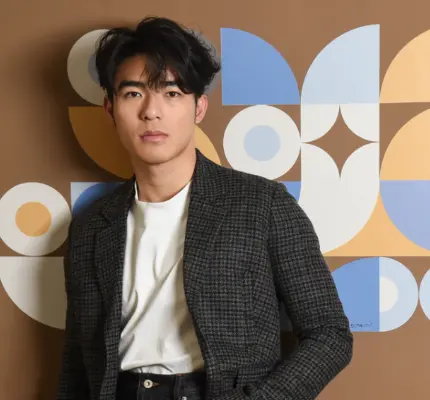

《木曜4超玩》重啟直播!全員到齊「沒有KID」 他接任陳百祥位置

知名網路節目《木曜4超玩》去年7月宣布暫停直播,接著又爆發一波離職潮,甚至一度傳出要解散的傳聞,就連元老級製作人「陳百祥」都宣布離職,讓不少粉絲都感到十分難過。睽違9個月後,官方在4月18日宣布將於每

2024-04-20 13:25

-

T-ara前成員雅凜宣布斷開男友!否認涉嫌詐欺案:我被毆打威脅

韓國人氣女團T-ara前成員雅凜3月底才爆出試圖輕生且昏迷的消息,後被爆出涉嫌與男友徐東勳(音譯)在半年內行騙數百萬元。對此,雅凜表示遭到毆打與威脅,已經與對方分手並決定提告。▲雅凜(左)與男友徐東勳

2024-04-20 13:07

運動

更多運動-

評論/時候到了!李智凱輝煌世代已過 體操裁判真的能操控比賽?

台灣好手李智凱在體操世界盃杜哈站暨奧運資格賽,用難度6.6的動作完美落地,但結局卻不完美,最後僅拿下銀牌,再度與奧運擦肩而過,賽後林育信痛批,被「硬生生做掉」,所有裁判都是中東國家的人,哈薩克選手Na

2024-04-20 14:30

-

鄧愷威又幫賽揚強投擦屁股!投一局丟5分 還對決台美混血Carroll

美國職棒MLB今(20)日舊金山巨人在主場迎戰亞利桑那響尾蛇,台灣好手鄧愷威再度獲得出賽機會,本場比賽卻遭到「震撼教育」,僅投1局就失掉5分,賽後防禦率暴增至9.82。巨人終場以1:17慘敗給響尾蛇,

2024-04-20 14:04

-

李智凱錯過體操世界盃拿門票 拚巴黎奧運剩下「兩途徑」機會渺茫

今年體操世界盃杜哈站暨奧運資格賽,台灣「鞍馬王子」李智凱屈居銀牌,遺憾錯過直接獲得奧運資格的機會,使得奧運之路越來越艱辛。若要前進巴黎奧運,現在只剩下兩個的途徑:在5月舉行的亞洲錦標賽中奪取全能金牌,

2024-04-20 13:27

-

快評/Brandon Ingram把握屬於他的時刻!鵜鶘洗刷「偽強隊」汙名

紐奧良鵜鶘今(20)日在主場以105:98沙加緬度國王,拿下西區最後一張季後賽門票,鵜鶘球星Brandon Ingram全場攻下24分,帶領球隊拿下西區第8種子。Ingram過去關鍵戰總是容易「軟手」

2024-04-20 13:18

財經生活

更多財經生活-

全球最大星巴克在台灣!破千坪豪華規模 將插旗信義Dream Plaza

統一企業集團全台首間新世代複合商場「Par K* Avenue」今(20)日開幕,由7-11、星巴克與統一精工一體建物構成。統一董事長羅智先、美麗事業董事長高秀玲今出席開幕典禮,也近一步透露信義誠品原

2024-04-20 14:16

-

比冷氣開幾度重要!電風扇「3種情況」別再吹了 台電認證危險S級

隨著夏天逐漸逼近,最近應該有不少人都能感受到天氣越來越炎熱,也有許多人家裡的電風扇都已經打開來吹,甚至還有人忍不住都先開了冷氣!然而,你知道你家電風扇是否還「健康」嗎?台電粉絲團就特別分享,家中電風扇

2024-04-20 13:38

-

超商咖啡隱藏優惠!7-11美式、拿鐵「聰明買法」:比買1送1更便宜

7-11限時2天祭出咖啡隱藏折扣,那就是美式、厚乳拿鐵、精品美式、咖啡珍珠歐蕾、香鑽水果茶同品項第2杯10元,剛好可搭配滿額現折活動,指定支付方式滿888元現折100元,精品美式換算下來單杯比半價更優

2024-04-20 12:19

-

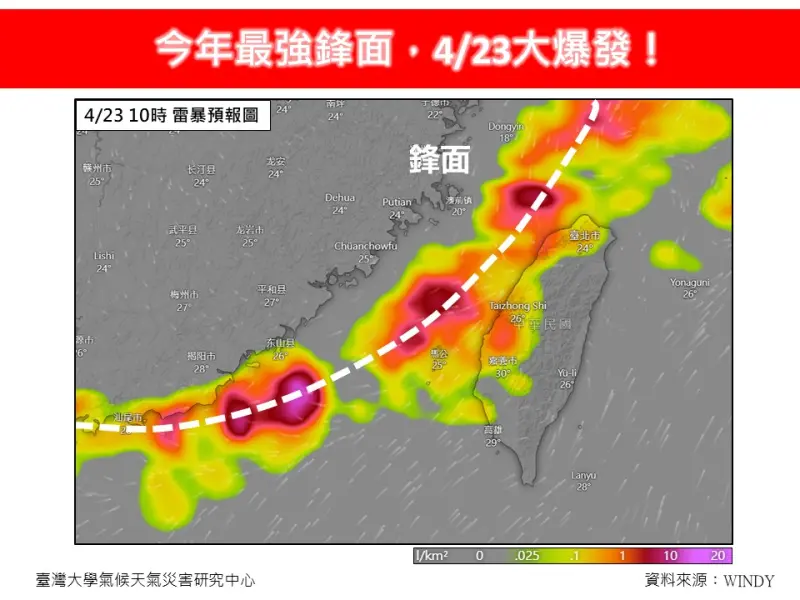

今年最強鋒面下週爆發!連6天「強降雨加雷擊」 專家示警恐釀災

今年最強鋒面要大爆發了!下週一(22日)起受鋒面接近影響,中部以北及山區轉雨,下週二(23日)日起雨勢最猛烈,對流發展旺盛時,常易伴隨短延時強降雨、雷擊及強陣風等劇烈天氣現象,至少會一路下6天,持續至

2024-04-20 11:35

全球

更多全球-

報復基地被襲?伊拉克武裝組織證實 派無人機攻擊以色列南部城市

伊拉克的親伊朗民兵組織「人民動員」(PMF),其卡爾蘇軍事基地(Kalsu military base),當地時間19日晚間遭遇襲擊,釀成人員傷亡,雖然以色列跟美國都否認涉案,但最新外媒消息指出,有伊

2024-04-20 14:30

-

史上第一人!台灣變裝皇后妮妃雅勇闖美《魯保羅變裝皇后秀》奪冠

四個月前,當多次獲獎的美國熱門實境節目秀《魯保羅變裝皇后秀》公布第16季名單時,一陣黃色炫風殺進了這個亞洲臉孔仍相對少數的圈子,來自台灣的變裝皇后「蕉佛」妮妃雅‧瘋(Nymphia Wind)頂著誇張

2024-04-20 11:00

-

伊拉克「親伊朗」軍事基地大爆炸!1死6傷 美國、以色列否認施襲

美國《有線電視新聞網》(CNN)、《路透社》20日引述伊拉克安全部門消息人士,聲稱位於巴格達南部巴比倫省的伊拉克民兵組織「人民動員」(PMF),其卡爾蘇軍事基地(Kalsu military base

2024-04-20 09:48

-

特斯拉開始被擠出中國市場!外媒專欄作家揭「養套殺」陷阱

電動車大廠特斯拉(Tesla)近期股價遭受打擊,除了裁員10%,還面臨來自中國新興電動車的激烈競爭。有外媒專欄作家分析,特斯拉的例子揭露中國對外商的「養套殺」模式,從一開始的市場誘惑,到中企的合資、收

2024-04-20 08:04