《鄉民大學問EP.40》字幕版|#柯文哲的最大危機?昔日柯友高嘉瑜不忍了猛攻京華城案有瑕疵!黃暐瀚稱高:毀柯召集人!王鴻薇不滿徐巧芯公文案現場槓上 場面火爆!柯弊案纏身 天天上頭條 聲量超過黃國昌?!

NOW影音

更多NOW影音焦點

更多焦點-

曝北市府元大人壽3封關鍵信件!李正皓:對柯文哲是一刀斃命證據

民眾黨主席柯文哲擔任台北市長期間的北士科T17、18地上權、京華城容積率暴增爭議,並被北檢列他字案被告,元大人壽日前發出聲明,未曾與柯市府接觸,更無意競標北士科,不過有議員質疑,市府資料的確記載訪視紀

2024-05-11 11:12

-

不滿聯合國投票並認同巴勒斯坦會員資格!以色列怒碎憲章副本

聯合國大會(United Nations General Assembly)10日以壓倒性票數,143票贊成、9票反對、25票棄權,通過一項決議案,象徵性認可巴勒斯坦有資格成為聯合國會員國,並給予巴勒

2024-05-11 10:31

-

王彩樺受訪遇地震超淡定 心疼余天「喪女、女婿又捲詐騙案」

「國民岳母」王彩樺今(10)日出席品牌活動記者會,受訪時突然發生芮氏規模5.8的地震,雖然震央位於花蓮,但台北也明顯感受到搖晃。只見王彩樺表現十分淡定,反而被問到余天時,她的情緒比較滿,十分心疼余天遭

2024-05-10 18:09

-

基隆大武崙砲台山腰驚見女屍!現場血跡斑斑 警方研判遭殺害棄屍

11日上午7時許,基隆有晨運的民眾發現,大武崙砲台半山腰邊坡草叢,有一具死亡多時的外籍女屍,急忙通報警消到場協助,警方獲報趕抵,隨即封鎖現場採證,發現現場血跡斑斑,初步研判該女子疑遭殺棄屍,全案持續擴

2024-05-11 11:02

精選專題

要聞

更多要聞-

徐巧芯遭告洩密!藍委周三直球對決吳釗燮 他提這招「轉守為攻」

外交部告國民黨立委徐巧芯洩密,但全黨上下都力挺徐巧芯監督外交部援外金流。立法院外交國防委員會周三將邀外交部長吳釗燮,就「推動國際社會聲援我國參與世界衛生大會(WHA)執行現況」進行專案報告,屆時藍營將

2024-05-11 10:47

-

傳蔡英文下週將特赦 陳水扁親自洩態度「政治案件政治解決」

傳出總統蔡英文擬在下週特赦前總統陳水扁,不少網友湧入陳水扁的Threads社群平台詢問,陳水扁多以「毫無知悉」回應,不過陳也說,「政治案件就是政治解決,從未有透過法律途徑討公道的!」犯下龍潭購地等案遭

2024-05-11 10:26

-

網紅大撒幣!3000人擠爆瘋搶 游淑慧驚呆:只有我覺得很危險嗎?

1名網紅昨晚10點多,在台北信義區松壽路某巷弄發起「撒錢活動」,吸引約3000人推擠、瘋搶,警方就怕發生踩踏慘劇,到場關切勸離。國民黨台北市議員游淑慧說,「早上看到這個新聞,只有我覺得很危險嗎?」游淑

2024-05-11 09:58

-

獨/厭惡國會變菜市場!韓國瑜推「輕聲細語」 還要美化這角落

立法院長韓國瑜前天在立法院主持朝野協商時主動提到,希望各黨能約束成員,表決時不要太喧鬧,要保持「輕聲細語」,昨天在院會上韓國瑜再度重申這四個字。知情人士說,立法院訪賓多,韓國瑜很不希望立法院吵吵鬧鬧像

2024-05-11 08:48

新奇

更多新奇-

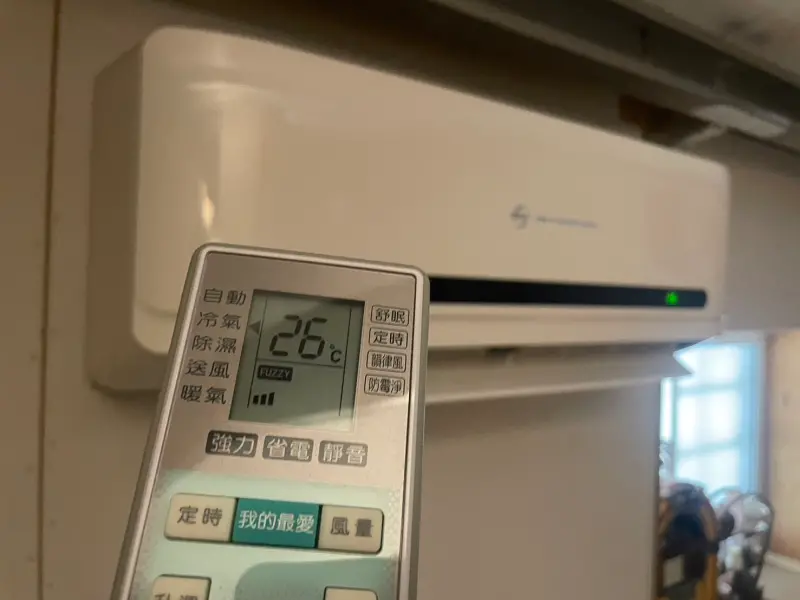

變頻冷氣「別只會裝日立、大金」!老闆改吹2品牌:水準意外超高

酷熱的夏天逐步逼近!不少人家中的老舊冷氣都準備要被汰換,以免夏天電費暴漲!然而說到現在冷氣市場選項百百種,從過往一線品牌獨霸的大金、日立、三重重工到國際牌,到現在越來越多人開始考慮二、三線品牌,其原因

2024-05-11 08:33

-

不是鳳梨酥、茶葉!韓國人伴手禮改買「台灣1特產」:實在太高級

台灣不論是美食還是小吃都在國際間非常有名,外國旅客來台旅遊時,除了品嚐各種小吃之外,也會帶台灣的伴手禮回去送人,然而說到台灣伴手禮,第一個一定會想到鳳梨酥、芋頭流心酥或者茶葉等等。然而就有網友發現,韓

2024-05-11 08:32

-

2024母親節紅包包多少、卡片怎麼寫?「行情、祝福語、金句」一覽

明(12)天就是母親節,若是還沒準備好禮物和蛋糕,最快的方式就是「包紅包」。根據yes123求職網調查,職場媽媽最期待的母親節禮物,冠軍正是「現金」,讓媽媽可以自由運用,或是買實際需要的東西。至於母親

2024-05-11 07:50

-

超商「詐騙包裹名單」店員全招了!手法升級傻爆眼:80%人難躲過

超商取包裹詐騙事件頻傳,現在越來越多詐騙集團手法不斷更新,民眾真的要小心!近日就有網友分享自己去超商取貨時,發現名字以及購買金額都沒錯,但要領取時卻被店員給阻止,因為「寄件的廠商名字」是被店員列入警示

2024-05-10 13:37

娛樂

更多娛樂-

AV女優多田有花爆被包養!親上火線公開老公身分:上市公司董事長

日本44歲「美魔女」AV女優多田有花過去曾擔任過空姐、老闆秘書,中年後為了證明自己的魅力,40歲時決定出道當AV女優,吸引不少粉絲。近日,日本社群平台上頻頻有人爆料多田有花長期被包養且四處約P。對此,

2024-05-11 10:50

-

王力宏4100萬資產解封!不甩「蕾神之鎚」勝訴 近9000萬賠償免了

金曲歌王王力宏3年前因為與前妻李靚蕾的糾紛,導致他丟失代言,廠商不僅要求解約,還向王力宏索賠2000萬人民幣(約8978萬元新台幣)賠償,2022年北京時之尚廣告公司向中國法院申請凍結王力宏公司的存款

2024-05-11 10:31

-

小S女兒Elly秀逆天長腿氣場如超模!背景意外洩「帝寶豪宅庭院」

藝人小S(徐熙娣)18歲大女兒Elly近日傳出申請上美國南加州大學(USC)、加州大學伯克萊分校(UC Berkeley),小S坦言很開心同時也捨不得,證實會跟女兒一起到美國,陪她安頓好一切再回來。E

2024-05-11 10:12

-

最美校花簡廷芮突「全身發軟」送急診!瞬間人生跑馬燈 病況曝光

32歲女星簡廷芮(Dewi)因演出《我的少女時代》中陶敏敏一角,被封為「最美校花」,知名度大增,2020年她嫁給圈外男友,育有一對子女。昨(10)日她在社群上透露,前一晚吃完晚餐後,突然全身發軟、肚子

2024-05-11 09:18

運動

更多運動-

姆巴佩宣布離開巴黎聖日爾曼!下一站加盟豪門皇馬 組最豪華陣容

法甲巴黎聖日耳曼(PSG)在歐州冠軍聯賽4強敗給來自德甲的多特蒙德後,25歲當家球星姆巴佩(Kylian Mbappe)正式宣布將離開巴黎聖日耳曼,下一站預計將加盟西甲豪門皇家馬德里。皇馬長期以來一直

2024-05-11 11:10

-

大谷翔平TJ手術後首度練投70球創新高 鬼神二刀流回歸指日可待

洛杉磯道奇隊日籍二刀流球星大谷翔平今(11)日在客場對陣聖地牙哥教士隊的比賽中,以先發指定打擊、第二棒登場。賽前大谷翔平進行今年的第20次傳接球,並進行投球訓練,總共投了70顆球,這也是大谷自去年9月

2024-05-11 10:45

-

大谷翔平季後賽重返投手丘?前天使教頭Maddon曝道奇「秘密武器」

洛杉磯道奇隊的日籍二刀流球星大谷翔平在2023年球季結束後進行了右肘韌帶重建手術,今年球季暫時封印「二刀流」專職打者,不過前天使隊總教練Joe Maddon近日在《MLB Network》節目上表示,

2024-05-11 10:15

-

Josh Hart前8戰跑42公里!達到「馬拉松」等級 G3終於下場休息了

紐約尼克「鐵人」Josh Hart終於下場休息了,今(11)日他在次輪季後賽G3「只打了43分鐘」,對其他人來說這都是很高的出賽時間,但對於前8戰跑了超過42公里、達到「馬拉松」水準的Hart來說,今

2024-05-11 09:55

財經生活

更多財經生活-

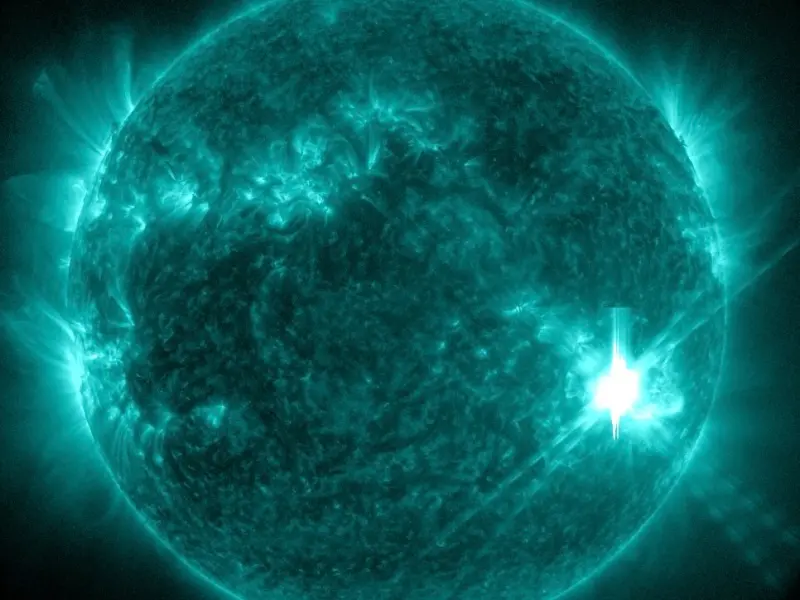

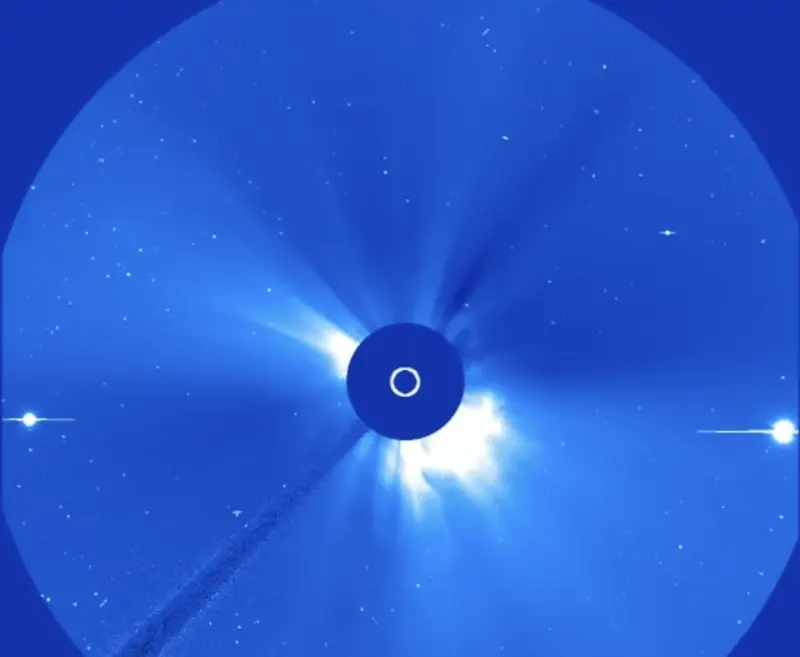

地球磁暴襲全球!「強烈太陽閃焰」又發生 鄭明典喊:系統過曝了

強烈「地球磁暴」正在發生中!因太陽表面活耀區(AR3664)於5月8日發生X1.0級太陽閃焰並伴隨產生顯著的日冕拋射物質事件(CME),預計從5月11日凌晨開始影響達24小時。前氣象局長鄭明典也發布相

2024-05-11 10:43

-

強烈磁暴發生中!鄭明典示警:比預期還強 注意電力、無線電通訊

中央氣象署罕見發布「地球磁暴」示警,太陽閃焰並伴隨產生顯著的日冕拋射物質事件,預估從5月11日凌晨通過近地太空環境,影響持續長達24小時。前氣象局長鄭明典今(11)日也發文示警,強烈磁暴發生中,比預期

2024-05-11 10:10

-

天氣預報/母親節全台變天!越晚出門雨越猛 北台灣低溫探15度

今(11)日高壓迴流,各地晴時多雲,高溫上看攝氏35度,是本週最熱的一天,母親節鋒面靠近台灣,全台各地轉有雨型態,越晚雨勢越猛烈,部分地區不定時雷雨發生機率。下週二、三的清晨,因「輻射冷卻」加成,北台

2024-05-11 09:22

-

母親節13元咖啡!7-11買一送一「有美式、拿鐵」 全家10元多一杯

歡慶溫馨母親節!四大超商、賣場推出現煮咖啡優惠,7-11有熱門七款飲品買1送1,含民眾最愛的美式以及拿鐵,APP行動隨時取推出買5送2組合,可以寄杯慢慢喝;全家經典美式、膠原拿鐵第2杯10元外,還有霜

2024-05-11 08:09

全球

更多全球-

不滿聯合國投票並認同巴勒斯坦會員資格!以色列怒碎憲章副本

聯合國大會(United Nations General Assembly)10日以壓倒性票數,143票贊成、9票反對、25票棄權,通過一項決議案,象徵性認可巴勒斯坦有資格成為聯合國會員國,並給予巴勒

2024-05-11 10:31

-

抖!傳美國將抬高中國電動車關稅 「25%拉至100%」、暴漲4倍

美國政府知情人士透露,拜登(Joe Biden)政府計劃,下週就會提高中國電動車和其他清潔能源產品關稅。根據《華爾街日報》報導,消息人士稱,對中國電動車的關稅稅率,不排除將上漲4倍,從原先的25%升至

2024-05-11 09:44

-

長榮「英勇空姐」阻外籍乘客互毆登外媒!CNN讚:機警化解衝突

長榮航空7日飛舊金山航班爆出旅客糾紛,有外籍乘客因鄰座旅客咳嗽感到不適,自行更換座位,遭到另名外籍旅客制止,雙方溝通過程爆發口角,甚至演變成互毆,幸得在場空姐勸架、肉身擋拳,才沒釀成更大禍事。此事外媒

2024-05-11 07:56

-

半導體逆轉世界版圖!台積電狂吸多國補貼 韓媒嘆自家「落後中」

近年半導體產業競爭激烈,在新冠疫情後重要性越發凸顯,儼然成為各國的重要戰略物資,台積電也成為台灣土地上、國際目光時時追隨的焦點之一。有韓媒報導稱,預計到2030年,台灣、美國、日本、歐洲,將吸引552

2024-05-11 07:00