《鄉民大學問EP.38》直播|你反廢死嗎?歡迎來戰!廢死憲法法庭激辯!公投決定你支持?藍黨團提520後 邀賴清德立院國情報告!韓國瑜將正面對上 藍綠攻防?|NOWnews

NOW影音

更多NOW影音焦點

更多焦點-

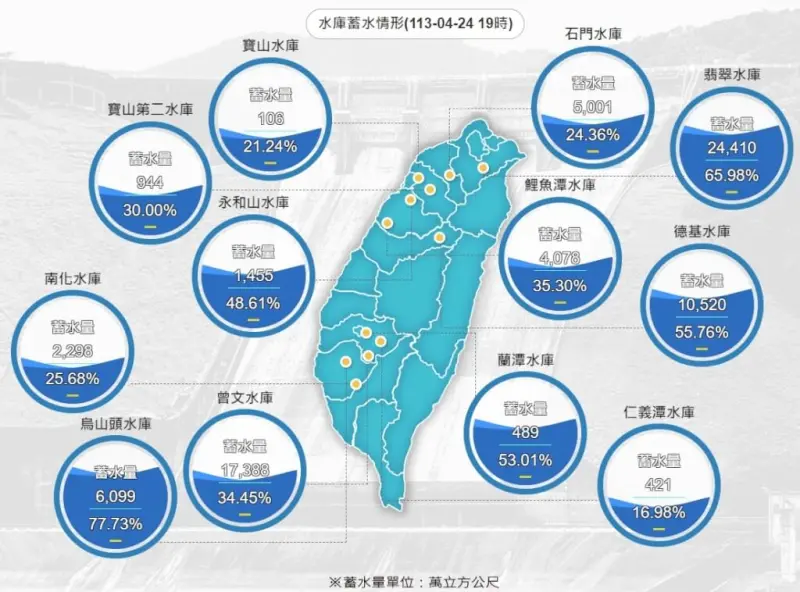

鋒面挹注全台水庫逾4千萬噸 中部受益最大南部進帳有限

(中央社記者曾智怡台北24日電)鋒面來襲,近日全台水庫降雨效益估達4114萬噸,其中,中部水庫受益最大,並以鯉魚潭水庫進帳破千萬噸居首。水利署指出,即使部分降雨未發生在集水區,但田間水量增加,對水庫蓄

2024-04-24 21:32

-

證實美軍駐台為「公開秘密」 美國會報告:去年41名軍事人員駐台

美國國會日前表決通過了一項950億美元的對外撥款法案,將對烏克蘭、以色列及台灣提供軍事援助,表決前一日美國國會研究處也提供了議員們一份《台灣防衛議題》(Taiwan Defense Issues fo

2024-04-24 21:26

-

《淚之女王》金智媛結婚現場!韓劇CP御用飯店 玄彬孫藝真也愛這

金秀賢、金智媛搭擋的Netflix韓劇《淚之女王》,開播後一路維持高收視率,目前距離tvN電視台收視率第一的紀錄僅一步之遙。本週末《淚之女王》將播出完結篇,讓不少粉絲都十分期待金秀賢與金智媛這對CP可

2024-04-24 17:39

-

遭闖紅燈廂型車撞飛!台體大棒球員頭部重創昏迷 搶救3日仍不治

就讀台灣體育大學大一的楊姓學生,21日上午8時騎車行經台中西屯區台灣大道四段與工業區一路口時,遭一輛闖紅燈廂型車撞飛,導致顱內嚴重出血,雖第一時間送往加護病房插管搶救,無奈最終仍於今(24)日晚間宣告

2024-04-24 21:44

精選專題

要聞

更多要聞-

黃偉哲不做滿為幫某人助攻南市長?賴清德向陳亭妃保證:不可能

民進黨地方黨部主委改選競爭激烈,牽動2026年縣市長佈局。民進黨立委陳亭妃今(24)日臉書指出,近來一直有人在台南放一種聲音說,台南市長黃偉哲不會做滿任期,會由中央派代理市長,專心爲某人的初選助攻,她

2024-04-24 21:22

-

藍委訪中挨批 陳玉珍反嗆:民進黨爸爸無能又「家暴」國民黨媽媽

立法院國民黨團總召傅崐萁規劃率同黨立委訪問中國,但因正值立法院會議期間及逢花蓮強震引發抨擊。準備跟傅崐萁一起訪中的國民黨立委陳玉珍今(24)日批,民進黨像家裡的爸爸,面對「隔壁鄰居」中國欺壓,爸爸不敢

2024-04-24 21:14

-

陳玉珍喻綠營像爸爸家暴國民黨 林俊憲:不要半路亂認好嗎?

國民黨立法院黨團總召傅崐萁在花蓮又傳災情之際,執意率團赴中,更強調為恢復兩岸交流,「是責無旁貸的公務行程」引發熱議,對此藍委陳玉珍今(24)日緩頰稱,民進黨做不到就別批評,更認為綠營就像家中的爸爸,國

2024-04-24 20:26

-

賴清德爆「賴皮寮」比徐巧芯的錶便宜!價值僅17萬引起民眾想競標

近日藍營質疑準總統賴清德有多支「總價破百萬」勞力士未申報,賴清德今(24)日在中執會澄清,自己擁有三支錶,最貴的第三支價值約10萬元的勞力士,因為出國需求買的,並非媒體報的那種最高等級。賴清德對此怒轟

2024-04-24 19:50

新奇

更多新奇-

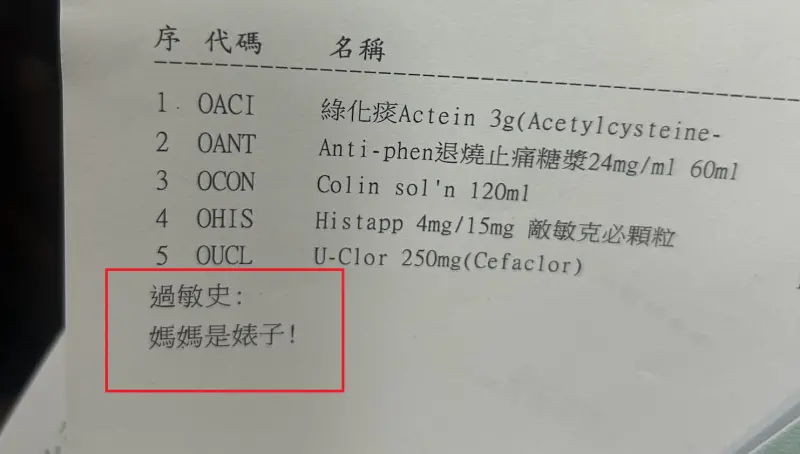

基隆醫院藥單上標註「媽媽是婊子」!人妻一看傻眼 護理師急道歉

一位媽媽今(24)日帶著孩子前往衛生福利部基隆醫院看診,沒想到拿到藥單時,卻看到上面過敏史竟寫上:「媽媽是婊子!」讓她當場傻眼,詢問醫院究竟是怎麼回事,護理師同樣納悶,也立刻向她道歉,藥單曝光後,隨即

2024-04-24 21:09

-

世界100大美食最新排行曝光!台灣竟成「吊車尾」:連英國都輸了

許多國際遊客來台一定會品嘗珍奶、小籠包、雞排、滷肉飯,甚至勇敢一點的還能嘗試看看臭豆腐。卻有國際美食榜單,將台灣美食排名列在榜單末端,甚至還有頗具權威性的美食評論刊物,2023年度最新榜單只給台灣第7

2024-04-24 18:43

-

全聯「稀有水果4顆99元」!隱藏福利曝:送保鮮盒 眾錯過再等1年

先別管60元便當了!全聯福利中心因為經常推出許多新品,或者是期間限定的產品,因此婆媽常常會在臉書社團上討論分享。然而近日就有不少人分享去全聯購買「寶石紅奇異果」,並且開箱分享口感,沒想到卻釣出內行婆媽

2024-04-24 18:29

-

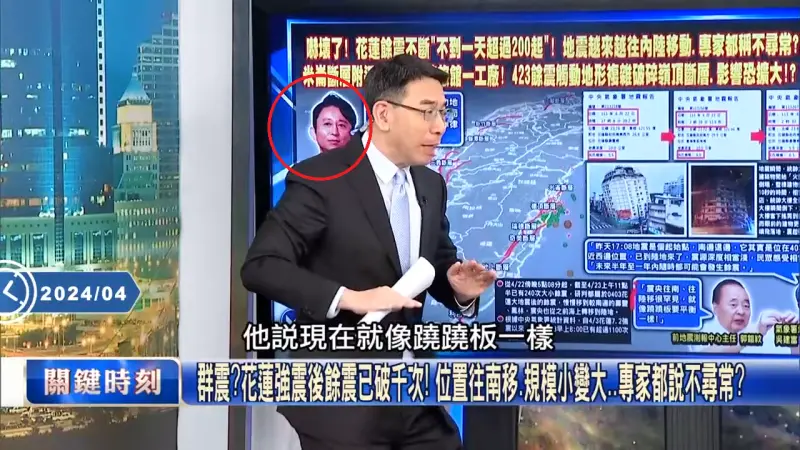

劉寶傑《關鍵時刻》誤植「有吉弘行」照片!粉絲笑翻:變地震專家

知名政論節目主持人劉寶傑所主持的《關鍵時刻》,因為語氣激昂的強烈風格,深獲許多民眾的喜愛。日前更因為談論天團BTS(防彈少年團)金泰亨入伍的片段,因此在南韓爆紅。不過沒想到近期《關鍵時刻》節目組卻在談

2024-04-24 13:39

娛樂

更多娛樂-

傳賣梁朝偉香港3億豪宅「海賺9千萬」 劉嘉玲獲讚理財有方

香港女星劉嘉玲日前才剛曝光上海的5億豪宅,近日又被香港媒體報導要將持有13年的4房豪宅以7380萬元港幣(約3億1011萬元台幣)的價格賣出,獲利超過2100萬港幣(約8855萬元台幣),讓不少粉絲都

2024-04-24 21:01

-

傳黃子佼1億換孟耿如3年不離婚!作家估算月薪273萬 粉絲全傻眼

黃子佼MeToo事件持續延燒,涉嫌性騷擾、持有未成年不雅影片,形象一落千丈。近期,有周刊指出黃子佼提出給太太孟耿如1億安家費,要求孟耿如3年內不離婚,對此作家「凱薩琳・孔」估算,如果孟耿如同意這項提議

2024-04-24 20:39

-

Lulu宣布離開台灣!飛往印度洋小島:生命裡壞的當成養分

今(24)日是Lulu黃路梓茵33歲生日,昨日她在IG上發文表示自己要暫時離開台灣,前往印度洋的小島,並且「進入飛航模式」,並表示:「可以把生命裡好的跟壞的都當成養分。」不少粉絲都在猜測Lulu是想逃

2024-04-24 20:00

-

《河谷鎮》女星出遊遇險!慘遭「面具惡徒」瘋狂無差別攻擊

雷尼哈林執導驚悚恐怖電影《嗜殺路人甲》,改編2008年經典驚悚片始祖《陌路狂殺》,邀來人氣紅星《河谷鎮》曼德萊娜佩奇、《少年狼》弗洛伊古鐵雷斯主演。片中無辜的情侶因汽車拋錨住進偏僻小鎮的木屋,夜晚卻被

2024-04-24 18:56

運動

更多運動-

中華男籃尋歸化洋將出現曙光!國籍法完成初審 立委:完成約定

台灣男籃苦尋新歸化洋將困難,今(24)日總算出現曙光!立法院內政委員會初審通過國籍法部分條文修正草案,其中與籃球歸化最為相關的高專歸化,本次修法也放寬了外國高級專業人才申請歸化居留年限,從現行連續3年

2024-04-24 20:44

-

4/24NBA季後賽焦點球星/Doncic不是只有進攻 Siakam是溜馬核心

NBA季後賽場場關鍵,4/24日的主打球星,以達拉斯獨行俠的Luka Doncic、印第安納溜馬的Pascal Siakam,還有明尼蘇達灰狼隊的防守悍將Jaden McDaniels最為出色,其中,

2024-04-24 20:44

-

企業捐1500顆籃球給學校、福利機構 HBL衛冕軍南山高中代表受贈

營養補給品牌紐崔萊今(24)日上午,舉行三對三籃球的啟動儀式,同時宣布將捐贈1500顆籃球給基層學校以及福利機構,尤新科HBL衛冕軍南山高中籃球隊代表受贈。南山高中甫於3月中旬拿下112學年度高中甲級

2024-04-24 17:39

-

NBA季後賽/快艇Leonard急於復出卻淪為戰犯!正負值-8全隊最爛

NBA洛杉磯快艇今(24)日在季後賽首輪G2,於主場迎戰達拉斯獨行俠,獨行俠靠著Luka Doncic與Kyrie Irving合砍55分,以96:93拿下勝利。本場快艇輸球的頭號戰犯,無疑是傷癒復出

2024-04-24 16:36

財經生活

更多財經生活-

台股重返2萬點吐悶氣 AI與半導體衝!助攻3台股ETF完成填息

台股24日掀飆風,電子權值股帶領下,新光臺灣半導體30(00904)、復華台灣科技優息(00929)、永豐台灣ESG(00888)3檔台股ETF均完成填息紀錄,平均填息天數僅花3天內完成,連同上周台新

2024-04-24 21:00

-

母親節餐廳難訂!新光三越APP「訂位神招」:橘色涮涮屋也輕鬆搶

母親節熱門餐廳搶不到?新光三越今年APP推出隱藏功能,會員扣點即可優先訂位,共有40家餐廳、2000個預定席次,包括夜上海、教父牛排、名人坊、橘色涮涮屋通通輕鬆訂到,APP還集結了歷年母親節銷售數據,

2024-04-24 19:45

-

聯電Q1獲利探3年新低、EPS 0.84元 每股擬配3元股利

聯電今(24)日公佈2024年第一季營運報告,合併營收為新台幣546.3億元,較上季的549.6億元減少0.6%。與2023年第一季的542.1億元相比,本季的合併營收成長0.8%。第一季毛利率達到3

2024-04-24 19:19

-

免飛日本!SOGO百貨攜手迪士尼「達菲熊」 限定景點加送免費周邊

母親節要來了!遠東SOGO台北店於4月27日至5月12日,一連16天推出限定折扣,不僅有化妝品/香氛/服飾滿5000送400元電子抵用券、指定精品滿20000送2000元電子抵用券外,SOGO忠孝館更

2024-04-24 19:00

全球

更多全球-

證實美軍駐台為「公開秘密」 美國會報告:去年41名軍事人員駐台

美國國會日前表決通過了一項950億美元的對外撥款法案,將對烏克蘭、以色列及台灣提供軍事援助,表決前一日美國國會研究處也提供了議員們一份《台灣防衛議題》(Taiwan Defense Issues fo

2024-04-24 21:26

-

難忍台積電高工時、壓力大!美國員工「樂於離職」轉投英特爾

台積電宣布獲得美國政府補助,也拍板美國亞利桑那州設立第三座晶圓廠,但科技媒體《Rest of World》一篇以〈台積電在美國沙漠慘敗〉為標題的長文報導,點出這家被譽為「護國神山」的公司在美國面臨的困

2024-04-24 20:06

-

美工程師遭台積電同事影射「白人種豬」 文化衝擊員工難適應

台積電本月8日宣布獲美國晶片法案最高可達66億美元的直接補助,同時拍板美國亞利桑那州設立第三座晶圓廠,消息傳出後掀起市場樂觀情緒和熱議,不過在科技媒體《Rest of World》一篇以〈台積電在美國

2024-04-24 20:05

-

高空中的浪漫!機長用廣播向空姐女友求婚 兩人幸福擁吻真愛啟航

波蘭航空(Polish Airlines)一位機長,日前在自己駕駛的從華沙(Warsaw)飛往克拉科夫(Krakow)的航班上,利用機上廣播向深愛的空姐女友求婚。又驚又喜的女友爽快答應,當場戴上戒指,

2024-04-24 18:06