《鄉民大學問EP.38》直播|你反廢死嗎?歡迎來戰!廢死憲法法庭激辯!公投決定你支持?藍黨團提520後 邀賴清德立院國情報告!韓國瑜將正面對上 藍綠攻防?|NOWnews

NOW影音

更多NOW影音焦點

更多焦點-

520交接後司法院院長請辭無憲政慣例?黃國昌痛批「睜眼說瞎話」

2016年因總統換人,時任司法院正副院長請辭,現在520將屆,司法院正副院長要不要循憲政慣例請辭,引發關注。對此,司法院秘書長吳三龍昨日在立院答詢時表示,他不便代替回覆,但就他的認知,應該沒有此憲政慣

2024-04-25 10:28

-

台積電4月加碼2.4億美元金融債!散戶與大咖就差一檔00933B的距離

細看近期的官股銀行買賣超排行榜,除了大家耳熟能詳的高股息ETF外,竟出現了「金融債ETF」,連護國神山台積電及全球最大主權基金都在買金融債,且持續加碼。國泰投信ETF研究團隊表示,相較小股民本金少,容

2024-04-25 10:18

-

《淚之女王》金智媛結婚現場!韓劇CP御用飯店 玄彬孫藝真也愛這

金秀賢、金智媛搭擋的Netflix韓劇《淚之女王》,開播後一路維持高收視率,目前距離tvN電視台收視率第一的紀錄僅一步之遙。本週末《淚之女王》將播出完結篇,讓不少粉絲都十分期待金秀賢與金智媛這對CP可

2024-04-24 17:39

-

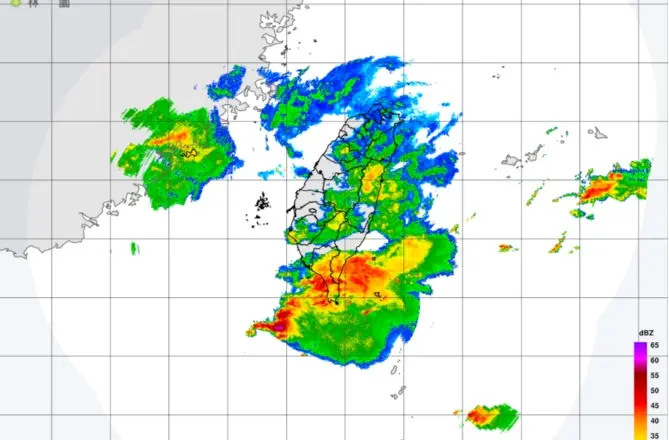

大雨特報/國家警報響!11縣市列「大雨警戒區」 防雷擊及強陣風

鋒面接近,易有短延時強降雨,國家級警報響了!中央氣象署上午10時發布大雨特報,提醒今(25)日苗栗至屏東及臺東地區有局部大雨發生的機率,請注意雷擊及強陣風,低窪地區請慎防積水,山區請慎防坍方及落石。?

2024-04-25 10:25

精選專題

要聞

更多要聞-

綠稱立院邀請國情報告賴清德「就會去」 朱立倫:絕對要說到做到

國民黨主席朱立倫昨天在中常會上表示,立法院黨團5月20日後將邀請準總統賴清德赴立法院國情報告,民進黨發言人吳崢回應,只要立法院有做出決議和邀請,「賴清德都會來到國會向大家報告」。對此,朱立倫今(25)

2024-04-25 10:04

-

快訊/賴清德亮最後一波國安團隊!府祕潘孟安、防長顧立雄

總統當選人賴清德將在5月20日上任,首任內閣人事布局大致底定,今(25)日釋出最後一波國安內閣名單,包含外交部長、國防部長、海基會董事長等,而賴清德也親自到場主持 ,宣布總統府秘書長將由屏東前縣長潘孟

2024-04-25 10:01

-

直播/賴清德親自公布國安團隊!最後一波內閣名單搶先看

準總統賴清德即將於520上任,他今(25)日將親上火線公佈最後一波內閣人事名單,包含外交部長、國防部長、海基會等,最新消息,請鎖定《NOWnews今日新聞》直播。

2024-04-25 10:00

-

轟傅崐萁執意赴中捧習近平LP 知名網紅追回200萬善款「不捐了」

近期餘震不斷,花蓮再傳出災情,國民黨立法院黨團總召傅崐萁仍執意訪中,更強調為恢復兩岸交流,「是責無旁貸的公務行程」引發熱議,對此知名團購網紅486先生(陳延昶)今(25)日表示,地震如此嚴重,餘震又如

2024-04-25 09:44

新奇

更多新奇-

被《關鍵時刻》誤認成東大教授!有吉弘行看到了 本人回應超幽默

台灣政論節目《關鍵時刻》,由知名主持人劉寶傑領銜,時常針對各種時事進行語氣激昂的講解。不過近期在談論423地震話題時,誤將日本知名諧星主持人有吉弘行當成日本東京大學地震權威教授笠原順三,截圖瞬間在網路

2024-04-24 22:31

-

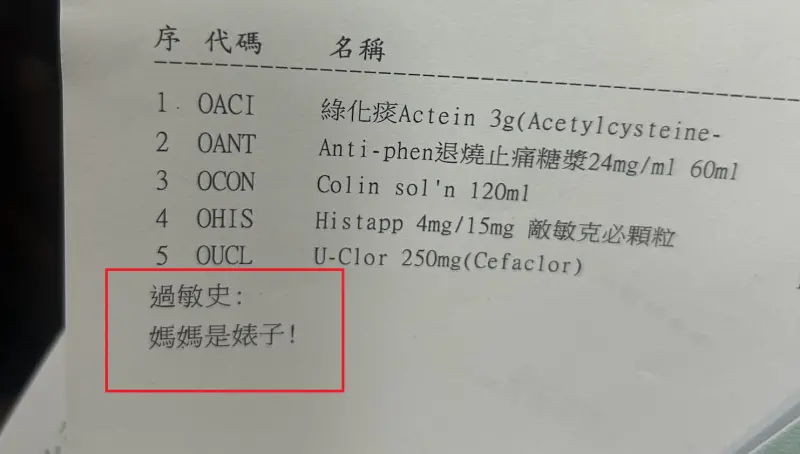

基隆醫院藥單上標註「媽媽是婊子」!人妻一看傻眼 護理師急道歉

(更新時間10:10)一位媽媽今(24)日帶著孩子前往衛生福利部基隆醫院看診,沒想到拿到藥單時,卻看到上面過敏史竟寫上:「媽媽是婊子!」讓她當場傻眼,詢問醫院究竟是怎麼回事,護理師同樣納悶,也立刻向她

2024-04-24 21:09

-

世界100大美食最新排行曝光!台灣竟成「吊車尾」:連英國都輸了

許多國際遊客來台一定會品嘗珍奶、小籠包、雞排、滷肉飯,甚至勇敢一點的還能嘗試看看臭豆腐。卻有國際美食榜單,將台灣美食排名列在榜單末端,甚至還有頗具權威性的美食評論刊物,2023年度最新榜單只給台灣第7

2024-04-24 18:43

-

全聯「稀有水果4顆99元」!隱藏福利曝:送保鮮盒 眾錯過再等1年

先別管60元便當了!全聯福利中心因為經常推出許多新品,或者是期間限定的產品,因此婆媽常常會在臉書社團上討論分享。然而近日就有不少人分享去全聯購買「寶石紅奇異果」,並且開箱分享口感,沒想到卻釣出內行婆媽

2024-04-24 18:29

娛樂

更多娛樂-

蔡依林恩師遭控性騷「碰模特兒私處」稱有證據 張勝豐火大反擊了

知名舞蹈老師張勝豐,過去曾為蔡依林、王心凌等大咖編舞,2022年他陷入人生低潮,「已經被傷到生無可戀了,我決定要走了,要離開這個傷心的人世間」,所幸張勝豐最後並沒有想不開,還被目擊在餐廳端盤子,體驗各

2024-04-25 10:21

-

林襄暴瘦PO比基尼照!「雙峰完全沒縮水跡象」被狠酸 本人回應了

啦啦隊尤物林襄從樂天女孩跳槽小龍女後,工作邀約接踵而至,身高160公分的她,忙到體重只剩下39.4公斤,應援時肋骨明顯凸出,嚇到不少人,她昨(24)日久違在粉專分享比基尼照,雖然體態清瘦,E罩杯上圍依

2024-04-25 09:56

-

NewJeans成員被譽為迪士尼公主!氣質神韻太驚人 撞臉年輕版大S

南韓女團「NewJeans」打著BTS師妹名號出道,由3位韓籍成員加上2位越澳、韓澳籍成員組成,平均年齡只有16歲的她們,以清新無害的清純外表、多變活潑的曲風擄獲大家的心。其中19歲的成員Daniel

2024-04-25 09:25

-

吳淡如估「理髮師月入12萬」比教師薪水高!揭現實面:AI不易取代

59歲知名作家吳淡如去年到大陸湖南大學攻讀歷史博士,常在社群上分享當學生的日常。22日她分享在當地巷內理髮店剪頭髮的經驗,花了20分鐘只要台幣180元,她也試著推算兩個師傅的薪水,「每個月收入可能有台

2024-04-25 08:16

運動

更多運動-

快評/熱火靠三分攻破TD花園 塞爾提克的陣地戰「心魔」仍沒解決

邁阿密熱火以111:101在首輪季後賽G2擊敗波士頓塞爾提克,攻破塞爾提克主場TD花園,將系列賽扳成1:1。熱火三分「火燙」的手感讓人難以置信,但塞爾提克自己也有問題需要解決,而不是將這場失利歸咎於運

2024-04-25 10:15

-

巨人20億賽揚強投Blake Snell怎麼了?防禦率破11、還進傷兵名單

Blake Snell還好嗎!美國職棒MLB舊金山巨人隊賽揚強投Blake Snell,賽季開打前不久才以2年6200萬美元(約20.2億新台幣)加盟巨人隊,不過似乎是調整不到位的關係,至今表現不佳,

2024-04-25 10:12

-

渡邊雄太NBA夢醒選擇返日!同年級生大谷翔平吐心情「有點寂寞」

NBA明尼蘇達灰熊隊日籍球員渡邊雄太因追求更多出場機會,近日決定結束NBA的生涯,選擇回到日本發展。對此,MLB洛杉磯道奇日本明星大谷翔平也向媒體分享自己的心情。作為1994年同年級生,大谷給予渡邊雄

2024-04-25 09:56

-

NBA季後賽/熱火111:101退塞爾提克!單場飆23記三分球 系列賽1:1

NBA美國職籃首輪系列賽G2,今(25)日波士頓塞爾提克在主場續戰邁阿密熱火,此役熱火「士官長」Jimmy Butler依舊因傷缺陣,綠衫軍「雙J」連線也合砍61分,但「南灘大軍」全隊將士用命,外圍手

2024-04-25 09:47

財經生活

更多財經生活-

天氣預報/鋒面斷裂重整!氣象署示警中南部大雨 雨勢趨緩等這天

昨(25)日在西半部地區有較明顯的對流系統發展,苗栗山區雨勢最猛,累積雨量達160毫米,今(25)日鋒面斷裂又重整,西半部地區受影響還是比東半部要來得大,可能有局部較大雨勢發生機會,氣象署針對苗栗至屏

2024-04-25 10:22

-

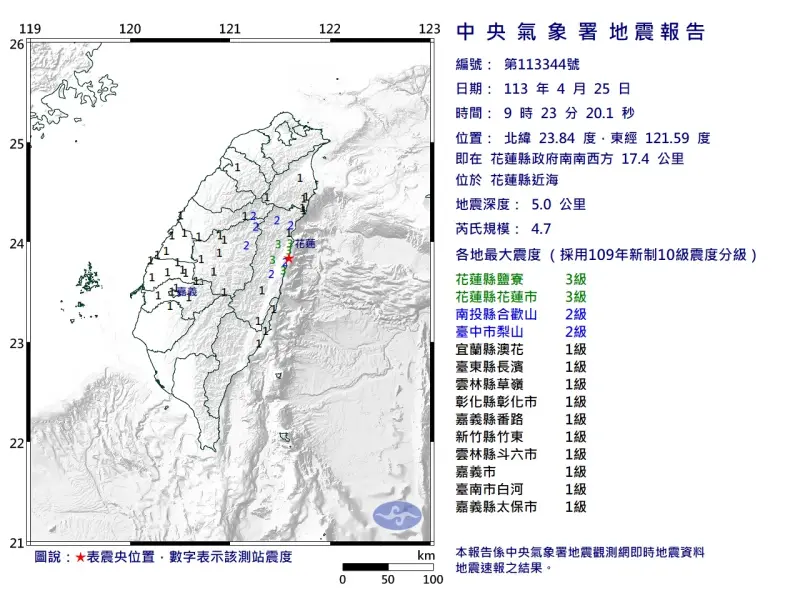

快訊/一早搖不停!9:23花蓮「規模4.7」極淺層地震 最大震度3級

今(25)日凌晨2時11分發生規模5.6地震,一早地牛再翻身4次,今天上午9時23分花蓮縣近海發生芮氏規模4.7地震,震央在花蓮縣政府南南西方17.4公里處,深度5公里,屬於極淺層地震。這起地震觀測到

2024-04-25 09:39

-

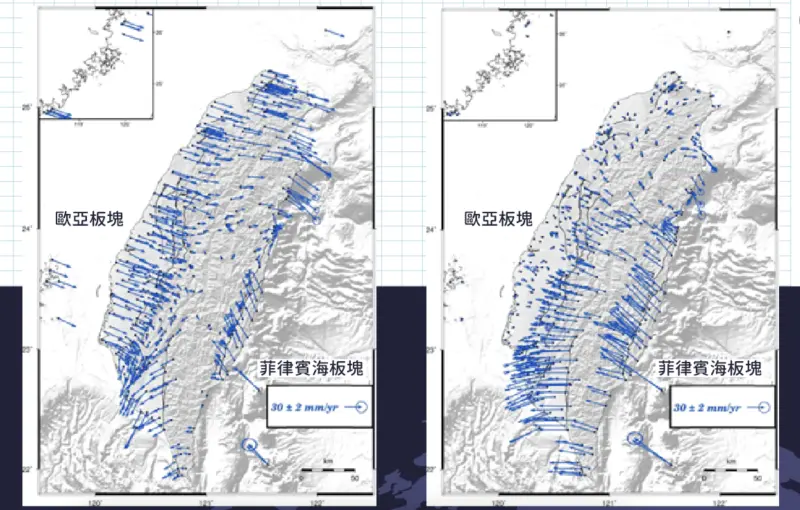

經歷大地震「台灣移動了」!氣象署曬9年變化對比 眾驚:差很多

花蓮0403規模7.2大地震後,台灣至今已經歷破千個大小餘震。事實上,中央氣象署2年前曾表示,大型地震會造成明顯地表位移,同時公布2009年至2018年的「台灣移動對比圖」,發現台灣在9年間真的明顯往

2024-04-25 09:37

-

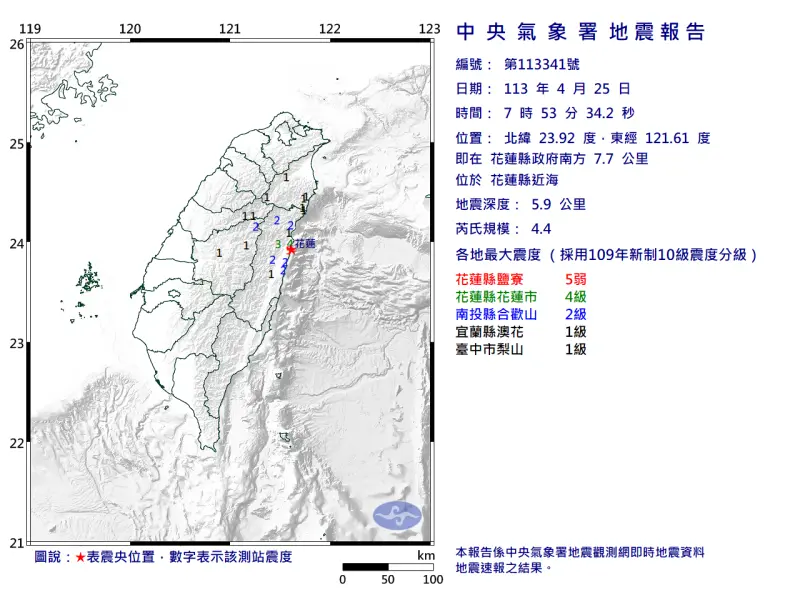

快訊/花蓮7:53「26分鐘連3震」!最大震度5弱 3縣市有感搖晃

今(25)日凌晨2時11分才發生規模5.6地震,一早再度地牛翻身,上午7時53分發生規模4.4地震,地震深度5.9公里,震央位在花蓮縣政府南方7.7公里(花蓮縣近海),最大震度為5弱,出現在鹽寮區。上

2024-04-25 08:36

全球

更多全球-

日圓貶破155大關!國際經濟學者卻一致預測日本央行「不會升息」

日圓兌美元匯率周三(24日)跌破155日圓價位,創下30多年來最弱,今(25)天召開的央行貨幣會議,是否會做出進一步決策受到關注,市場也研判,這提高了日本當局入市干預的風險。但外媒近期調查54名經濟學

2024-04-25 09:50

-

米蘭擬午夜後禁「飲食外帶」!網哀號:請放過義式冰淇淋、披薩

義大利米蘭最近以遏止噪音、保障居民安寧為由,有意立法禁止午夜後在鬧區外帶飲食,包含象徵性的義式冰淇淋(gelato)以及披薩(pizza)。此事引發不少業者、民眾、遊客不滿,認為該法案違背當地文化,就

2024-04-25 09:47

-

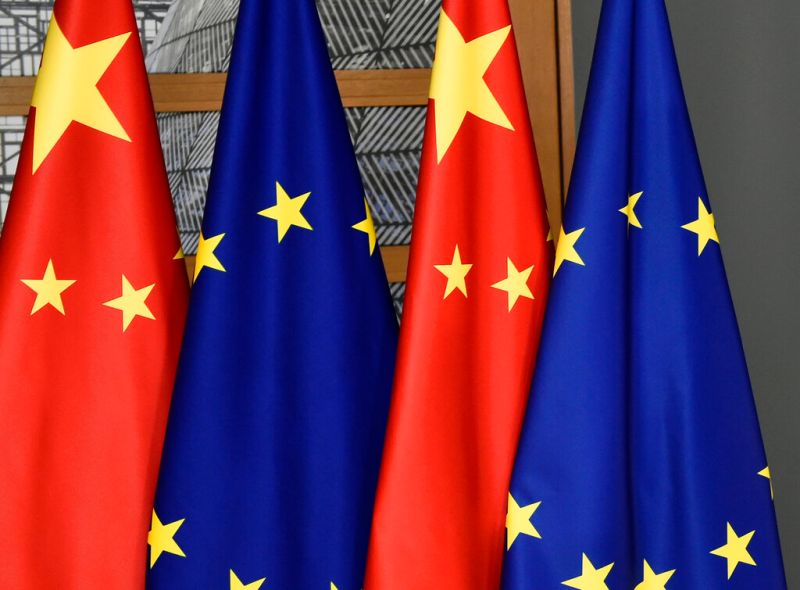

涉嫌海外補貼!歐盟突襲搜查中企 北京氣炸喊:堅決維護正當權益

歐盟委員會執法機關23日突襲搜查一間中國企業,位於荷蘭及波蘭的辦公地點,中國安檢設備生產商「同方威視」(Nuctech)24日證實,遭搜查的就是該公司,此事引起北京強烈不滿,揚言會盡力維護中企在歐權利

2024-04-25 08:35

-

遭美國要求「不賣就禁」!TikTok執行長放話:哪也不去、會告到底

美國國會本月表決通過熱門短影音平台Tiktok的「去中國化」法案,要求TikTok與其中國母公司「字節跳動」(ByteDance)分道揚鑣,「字節跳動」需於9個月內出售在美國的資產,否則TikTok將

2024-04-25 07:34