《鄉民大學問EP.38》字幕版|藍營2028的超級戰術!黃暐瀚:民調洩民進黨這弱點!廢死引爆民怨 是蔡英文挖坑給賴清德?台電屢跳電 萬美玲曝內幕:竟是小鳥惹的禍?!賴清德赴立院國情報告?將對上韓國瑜?

NOW影音

更多NOW影音焦點

更多焦點-

網路卡卡!多縣市網友哀嚎回報「斷網災情」 中華電信公告曝光

近來餘震頻頻,各地災情不斷,有網友更哀嚎地震後網路斷斷續續、時常斷線,訊息都傳不出去,並上網詢問「有沒有中華電信固網的卦」,多個縣市都傳出斷網回報;而根據了解,NCC發言人翁柏宗日前就曾表示,3大電信

2024-04-25 23:04

-

經濟增速緩、滯脹風險增!美股道瓊重挫375點 Meta股價瀉10.56%

美國上季經濟增速大幅放緩,第一季GDP年增1.6%,遠低於經濟學家之前預期的2.4%,同時主要通膨指標急升,個人消費支出(PCE)平減指數初報為3.4%,遠高於上一季的1.8%,加深了通膨持續的擔憂。

2024-04-26 06:06

-

《淚之女王》金智媛結婚現場!韓劇CP御用飯店 玄彬孫藝真也愛這

金秀賢、金智媛搭擋的Netflix韓劇《淚之女王》,開播後一路維持高收視率,目前距離tvN電視台收視率第一的紀錄僅一步之遙。本週末《淚之女王》將播出完結篇,讓不少粉絲都十分期待金秀賢與金智媛這對CP可

2024-04-24 17:39

-

愛犬遭台灣土狗咬死!飼主怒提告求償60餘萬元 法院判決結果出爐

(中央社記者張已亷高雄25日電)高男愛犬「EGO」遭陸姓女子飼養台灣土狗「阿財」咬死,高男求償新台幣61萬多元。橋頭地院認犬隻與飼主關係不構成精神慰撫金賠償要件,判陸女賠13萬多元,全案可上訴。橋頭地

2024-04-25 22:22

精選專題

要聞

更多要聞-

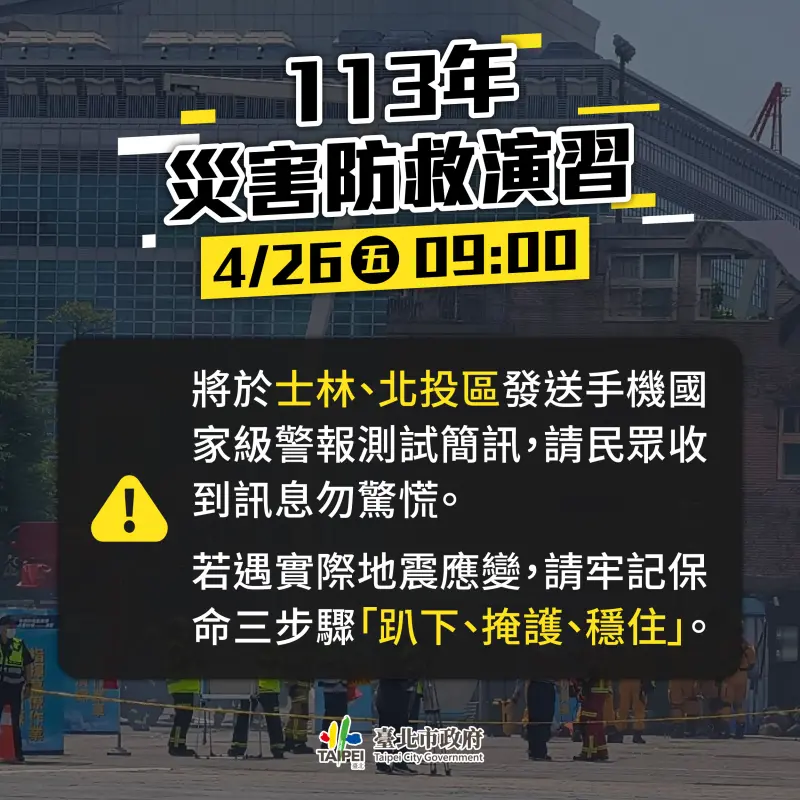

手機響別慌!北市北投、士林4/26上午9點「發布國家級警報測試」

0403花蓮7.2強震造成嚴重災情,台北市政府為「模擬山腳斷層南段發生規模6.6地震」災害防救演習,將於明(26)日上午9時,針對士林區、北投區發放手機國家級警報測試,提醒民眾接到測試警報後不用驚慌。

2024-04-25 20:19

-

行政院召開會議研擬「震災復原重建方案」 總經費超過200億賑災

為即刻完善0403地震災後復原重建工作迫切需求,行政院副院長鄭文燦今(25)日召開研商「0403震災復原重建方案」會議,邀集相關單位共同研議安全、有效、迅速「震災復原重建方案」,整合及運用中央與地方各

2024-04-25 19:55

-

司委會表決散會!吳思瑤嘆:國民黨認真撐不過3小時

立法院司法法制委員會今(25)日進行國會改革法案審查,最終國民黨在下午5時許提出散會動議並以5比4通過,對此民進黨立法院黨團幹事長吳思瑤嘆,國民黨認真果然撐不了3小時,又提散會動議沒收法案審查,而傅崐

2024-04-25 19:09

-

徐巧芯大姑涉詐騙洗錢 王世堅:代表政府打詐有一定成效

國民黨立委徐巧芯大姑與其丈夫涉入詐騙洗錢案,對此民進黨立委王世堅今(25)日表示,從徐巧芯家人的詐騙案就可以知道,政府打擊詐騙還是有一定成效,認為一切等司法調查就會有結果,徐巧芯現在講的都只是欲蓋彌彰

2024-04-25 18:24

新奇

更多新奇-

24歲台妹當性工作者!驚爆「每月薪水60萬」:台灣8成男人買過春

台灣知名脫口秀演員曾博恩昨(24)日推出新節目《初識啦!阿博》,試播集題材就相當辛辣,找來24歲的性工作者女子以及男友進行訪談,對方更驚爆「每月薪水60萬」,並認為台灣有8成男人買過春。▲可愛表示,現

2024-04-25 15:05

-

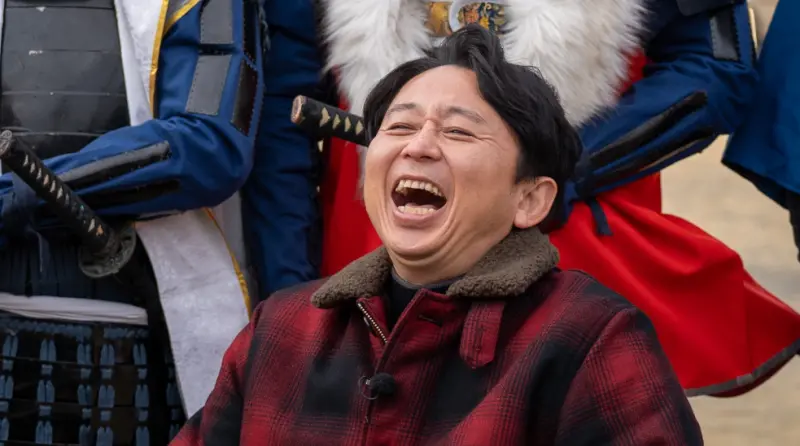

被《關鍵時刻》誤認成東大教授!有吉弘行看到了 本人回應超幽默

台灣政論節目《關鍵時刻》,由知名主持人劉寶傑領銜,時常針對各種時事進行語氣激昂的講解。不過近期在談論423地震話題時,誤將日本知名諧星主持人有吉弘行當成日本東京大學地震權威教授笠原順三,截圖瞬間在網路

2024-04-24 22:31

-

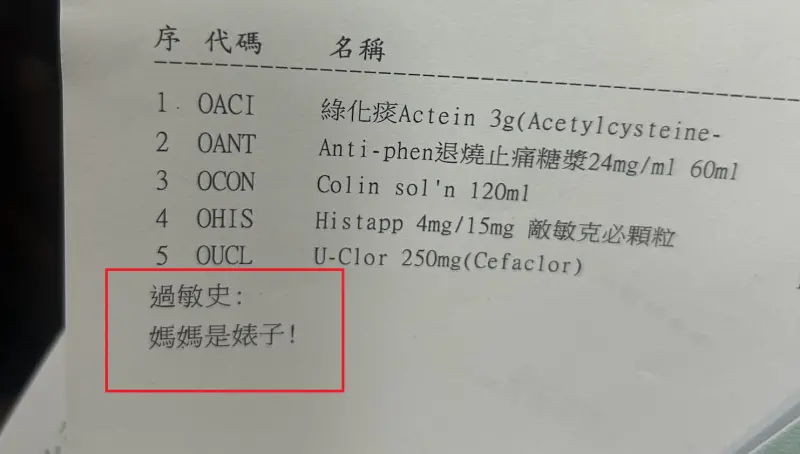

基隆醫院藥單上標註「媽媽是婊子」!人妻一看傻眼 護理師急道歉

(更新時間10:10)一位媽媽今(24)日帶著孩子前往衛生福利部基隆醫院看診,沒想到拿到藥單時,卻看到上面過敏史竟寫上:「媽媽是婊子!」讓她當場傻眼,詢問醫院究竟是怎麼回事,護理師同樣納悶,也立刻向她

2024-04-24 21:09

-

世界100大美食最新排行曝光!台灣竟成「吊車尾」:連英國都輸了

許多國際遊客來台一定會品嘗珍奶、小籠包、雞排、滷肉飯,甚至勇敢一點的還能嘗試看看臭豆腐。卻有國際美食榜單,將台灣美食排名列在榜單末端,甚至還有頗具權威性的美食評論刊物,2023年度最新榜單只給台灣第7

2024-04-24 18:43

娛樂

更多娛樂-

抗日神劇女星爆潛規則內幕!演員為求上位「鑽老闆胯下」極樂挑逗

日本女星井上朋子因為在中國大陸留學被相中出道,曾演過多部中國抗日劇;近日,井上朋子在日媒訪問中揭露「陸娛潛規則」內幕,提到有女星為求演出機會,當眾開約老闆一夜情,還鑽到老闆褲襠底下色誘對方。井上朋子不

2024-04-25 22:27

-

田馥甄遭封殺2年解禁!預告中國開唱陸網炸鍋 主辦滅火:一家人

2022年在裴洛西訪台期間,Hebe田馥甄只因為在社群平台發布「吃義大利麵照片」,就被中國大陸網友貼上「台獨」標籤。時隔2年後,天津「泡泡島音樂與藝術節」日前宣布,田馥甄將在5月2日壓軸登場開唱,消息

2024-04-25 21:19

-

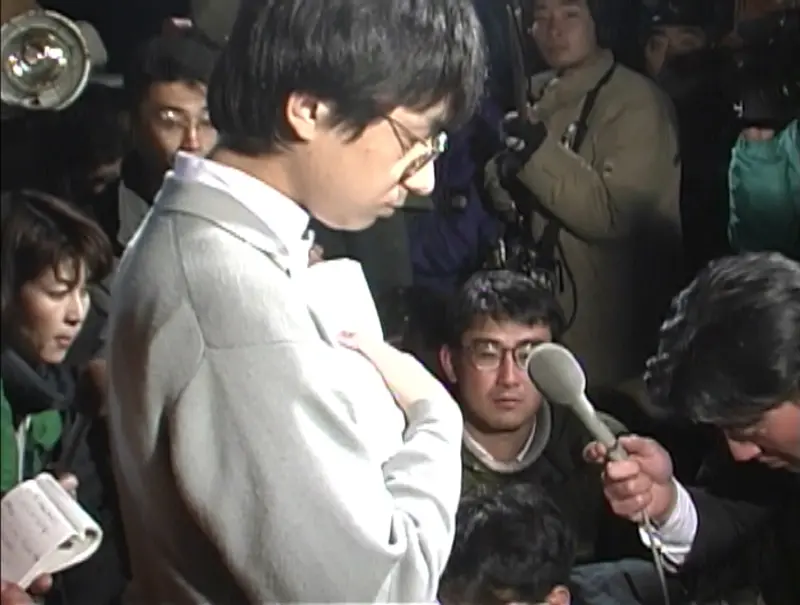

《A》揭邪教真面目!東京地鐵「放毒氣殺千人」29年前轟動全球

「台灣國際紀錄片影展(TIDF)」與國家影視中心共同企劃「記錄.紀錄:TIDF回顧精選」單元,精選6部各具特色與代表性的作品。紀錄片《A》、《A2》描述,日本奧姆真理邪教曾在東京地鐵放毒氣,造成上千人

2024-04-25 20:12

-

影/劉涵竹長9公分子宮肌瘤:與它和平共處 是否影響生育這樣說

42歲前主播劉涵竹去年3月做健檢時,發現子宮長6顆息肉還有9公分大的肌瘤,已經壓迫到膀胱,她今(25)日主持「響應『2024國際玫瑰斑月』避免玫瑰斑復發」活動,透露治療後子宮肌瘤已經縮小,目前與病灶和

2024-04-25 18:00

運動

更多運動-

大谷翔平跟YOASOBI成了同門師兄妹?解密美國超大型經紀公司CAA

大谷翔平跟YOASOBI成了同門師兄妹?日本超人氣音樂組合YOASOBI在2023年因為動漫《我推的孩子》主題曲《Idol》風靡全球,今年1月曾來台舉辦演唱會在開賣前造成網站系統癱瘓,瞬間秒殺一票難求

2024-04-26 05:14

-

大谷翔平被盜5億沒差!不受水原醜聞影響 外媒揭代言收入逾21億

洛杉磯道奇隊球星大谷翔平日前經歷水原一平詐欺案,遭竊取超過1600萬美元(約新台幣5.2億)。帳戶憑空消失如此龐大的金額,而大谷本人卻毫不知情,也令外界十分納悶。結合日媒《full count》針對大

2024-04-26 03:24

-

高球/殘念!兩台將吳芷昀、陳萱並列第二 泰國帕查拉朱達封后

總獎金10萬美元的2024 ICTSI路易西塔女子邀請賽,在路易西塔高爾夫鄉村俱樂部(Luisita Golf and Country Club)展開最後一回合賽事。台灣女將陳萱與泰國選手帕查拉朱達(

2024-04-26 02:18

-

籃球/「巨獸」德古拉狂轟41分仍無法取勝 台灣野馬錯過TAT季軍

亞洲巡迴賽The Asian Tournament(簡稱TAT)在中國廣州佛山舉行的首站賽事,進行最後1天賽程,台灣野馬隊雖有頭號洋將「巨獸」德古拉(Samuel Deguara)轟進全場最高41分,

2024-04-26 01:23

財經生活

更多財經生活-

今彩539頭獎800萬開2注!4/25獎落「新北、台南」 威力彩槓龜了

今(25)日晚間今彩539第113000100期開獎,最終開出2注800萬元頭獎,獎落台南市永康區東橋里東橋一路111號1樓「迎東橋彩券行」、新北市新店區中興路三段1號「大偉投注站」;威力彩第1130

2024-04-25 22:23

-

快訊/威力彩頭獎保證2億!「4/25完整獎號」出爐 中了直接退休

威力彩第113000034期今(25)日晚間開獎,本期頭獎為2億元,就在剛剛「完整獎號」已經完全開出,快拿起手邊彩券對獎,看看是否有財神降臨吧!🟡4/25威力彩中獎號碼(第113000034期)第一

2024-04-25 20:48

-

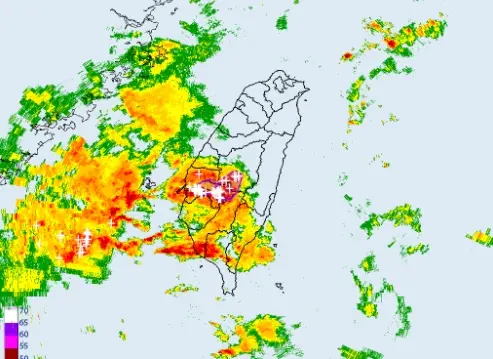

不斷更新/高雄外海出現渦旋!恐伴龍捲風、冰雹 影響範圍曝光

(更新時間:22:20)今(25)日另一鋒面逐漸接近,天氣不穩定,降雨範圍廣,西半部、東北部地區及澎湖、金門、馬祖有短暫陣雨或雷雨,並有局部大雨發生。尤其是台中以南暴雨來襲,中央氣象署也發布「大雷雨即

2024-04-25 20:38

-

半導體封測大廠京元電明暫停交易 重大訊息待公布

半導體封測大廠京元電今 (25) 日公告,因有重大訊息待公布,經證交所同意,上市普通股及以其為標的之認購 (售) 權證也同時暫停交易,待前開重大訊息公布後,再申請恢復交易,業界認為應與財報或併購有關。

2024-04-25 18:55

全球

更多全球-

經濟增速緩、滯脹風險增!美股道瓊重挫375點 Meta股價瀉10.56%

美國上季經濟增速大幅放緩,第一季GDP年增1.6%,遠低於經濟學家之前預期的2.4%,同時主要通膨指標急升,個人消費支出(PCE)平減指數初報為3.4%,遠高於上一季的1.8%,加深了通膨持續的擔憂。

2024-04-26 06:06

-

美國第一季GDP成長不如預期!美股開盤重挫 道瓊崩跌逾600點

美國公佈最新經濟數據,第一季GDP年增1.6%,遠低於經濟學家之前預期的2.4%,個人消費支出(PCE)平減指數初報為3.4%,遠高於上一季的1.8%,加深了通膨持續的擔憂。經濟疲軟與通膨威脅雙重夾擊

2024-04-25 22:55

-

大逆轉!紐約最高法院推翻溫斯坦強姦定罪 他曾是MeToo代表人物

好萊塢前金牌製片人溫斯坦(Harvey Weinstein)在2020年遭紐約法院判處2項性犯罪成立,獲判23年徒刑,他也成為「#MeToo」運動最初最具代表性的人物。然而,紐約最高法院今(25)日推

2024-04-25 22:09

-

與台斷交衝擊大!宏都拉斯6成白蝦養殖場倒閉 蝦農轟錯誤的選擇

宏都拉斯去年與台灣斷交、轉與北京建交,台灣本來是宏國白蝦的主要出口地,台宏外交關係生變,也直接衝擊宏國蝦農生計。當地媒體最新表示,已有6成白蝦養殖廠關門,今年第一季水產業損失達2000萬美元,養蝦業瀕

2024-04-25 21:09