《鄉民大學問EP.39》字幕版|#柯文哲 的三大案連環爆!涉貪污遭列被告 陳智菡曝內幕!蔡正元:離總統路更近!民眾黨再演宮鬥劇?柯文哲與黃國昌竟是這關係?#韓國瑜 立院霸氣喊“閉嘴” 2028真再戰?

NOW影音

更多NOW影音焦點

更多焦點-

力挺徐巧芯未洩密!馬文君質詢外交部高官 台灣竟怕中共打壓?

國民黨立委徐巧芯爆料外交部援助烏克蘭1千萬美金,金流有恐有問題,遭外交部提告洩密。國民黨立委馬文君說,早在今年3月26日,捷克外交部的官方刊物《現代經濟外交》,就已經完整揭露以上內容,甚至比外交部報告

2024-05-08 20:44

-

完成申報了嗎?財政部提醒「自行報稅者」3件事:都要確實完成

5月報稅季,不少民眾採取網路自行報稅,財政部今(8)日提醒,申報及繳稅都要確實完成,也須留意有無應檢附證明文件給國稅局,在走完報稅流程要看到申報成功才表示完成申報。財政部表示,報稅需注意申報完成、繳稅

2024-05-08 20:22

-

周杰倫點名好友挑戰經典歌曲!林書豪演唱影片曝光:來個8.7分吧

「亞洲天王」周杰倫與前NBA球星林書豪的麻吉情眾所周知,2人時常在社群平台上互動,展現好交情。近日,林書豪在比賽時遭對手撞傷,導致右側眉骨撕裂傷。昨(6)日林書豪臉上頂著腫包,深情演唱周杰倫的經典歌曲

2024-05-07 15:47

-

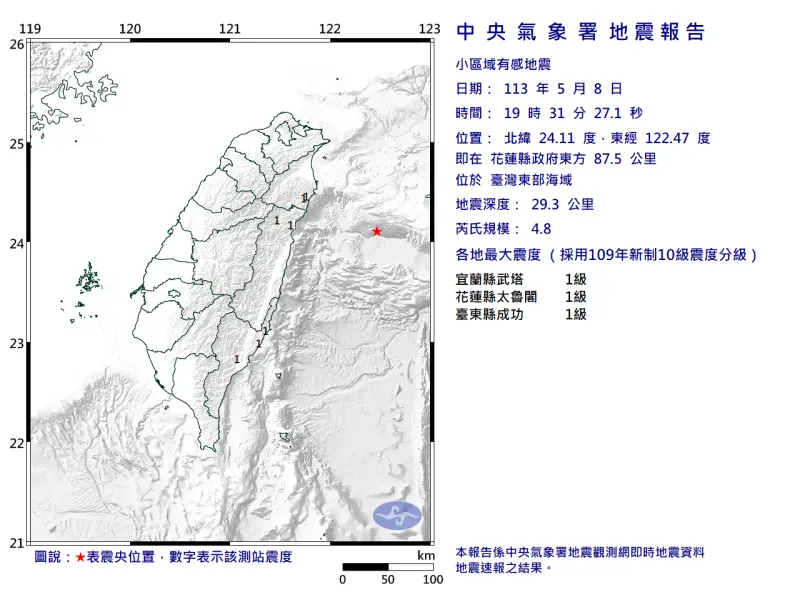

快訊/宜蘭晃了一下!19:31東部海域「規模4.8」地震 最大震度1

地牛又翻身!據中央氣象署地震測報中心資料,今(8)日晚間19時31分發生規模4.8地震,震央位於花蓮縣政府東方 87.5 公里,即臺灣東部海域,地震深度29.3公里,屬於極淺層地震,全台3縣市有搖晃感

2024-05-08 19:48

精選專題

要聞

更多要聞-

力挺徐巧芯未洩密!馬文君質詢外交部高官 台灣竟怕中共打壓?

國民黨立委徐巧芯爆料外交部援助烏克蘭1千萬美金,金流有恐有問題,遭外交部提告洩密。國民黨立委馬文君說,早在今年3月26日,捷克外交部的官方刊物《現代經濟外交》,就已經完整揭露以上內容,甚至比外交部報告

2024-05-08 20:44

-

徐巧芯要賣房也被嗆「賺暴利」媒體人嘆:真的要花時間無腦攻擊嗎

國民黨立委徐巧芯近期話題不斷,近日被指2021年曾在京華城附近買一間中古屋,質疑她靠內線消息獲利、該房未來可賣6000萬元,引發討論。徐巧芯今(8)日再度回擊,願意用4000萬元賣出,要的話明天立即交

2024-05-08 19:03

-

騙越多關越久!政院明擬通過「打詐新四法」 網站勸不聽最重封網

國內詐騙氾濫引發民怨,為此行政院將修改「打詐新四法」,包括《詐欺犯罪危害防制條例》、《洗錢防制法》、《科技偵查及保障法》與《通訊保障及監察法》,並預計於明日行政院會通過後送立院審議,並計劃由行政院長陳

2024-05-08 18:53

-

徐巧芯稱捷克早公開資料?外交部反駁了:徐傷害我國友好關係

國民黨立委徐巧芯與外交部的援助烏克蘭洩密議題持續交火。徐巧芯提出捷克官媒在3月早已公開兩國合作相關資料指出,這些早已不是密件。外交部今(8)日發布新聞稿指出,台捷兩國不曾將雙方簽署的約文對外公開。外交

2024-05-08 18:47

新奇

更多新奇-

影/韓團StrayKids出席Met Gala 慘被現場攝影笑:他們是機器人

被視為時尚圈奧斯卡的Met Gala日前登場,韓國大勢男團StrayKids首次亮相,同場韓星還有第2次參加Met Gala的Blackpink成員Jennie。未料,一段現場攝影師閒話StrayKi

2024-05-08 20:24

-

茶湯會店員玩「養樂多挑戰」!朝水槽嘔吐客轟噁心 總公司發聲了

網路挑戰再度釀成食安疑慮!日前在影音平台Tiktok上,「養樂多挑戰」突然爆紅,許多年輕人挑戰狂灌乳酸飲,看喝到底幾杯會吐。沒想到有手搖飲店員工在店裡進行嘗試,卻將嘔吐物吐在工作區域水槽中,畫面引爆譁

2024-05-08 18:26

-

蚊子快被滅族了!神人捕蚊燈配「1神物」成果太狂 誘惑主因曝光

炎熱夏天到了!許多人家中,也開始出現許多蚊子,飛來飛去惱人,有些蚊子還特別狡猾,總在要睡著時才出現叮人一開燈又不見了,只好拿出捕蚊燈來吸引牠們的注意力。就有民眾分享自己的「滅蚊神招」,讓蚊子直接被魅惑

2024-05-08 17:50

-

世界最危險的地方!旅遊達人警告「這7國」千萬別去:離死亡太近

全世界一共有多達200多個國家與地區存在,每個地方都有不同的生活面貌,理當也暗藏著不同的危險。近期走遍全球197個國家的旅遊達人賓斯基(Drew Binsky),分享各國遊歷的12年間,最瀕臨死亡的5

2024-05-08 16:06

娛樂

更多娛樂-

朱軒洋劈腿「鄉民老婆」吳卓源神隱!九把刀:大家都該去一趟地獄

朱軒洋劈腿交往7年的網紅女友Cindy,與「鄉民老婆」吳卓源在公園接吻被拍,緋聞事件爆發後,至今仍消失蹤影。2024金馬前進坎城記者會今(8)日登場,曾劈腿主播周亭羽被拍的「大前輩」九把刀,帶來與朱軒

2024-05-08 18:18

-

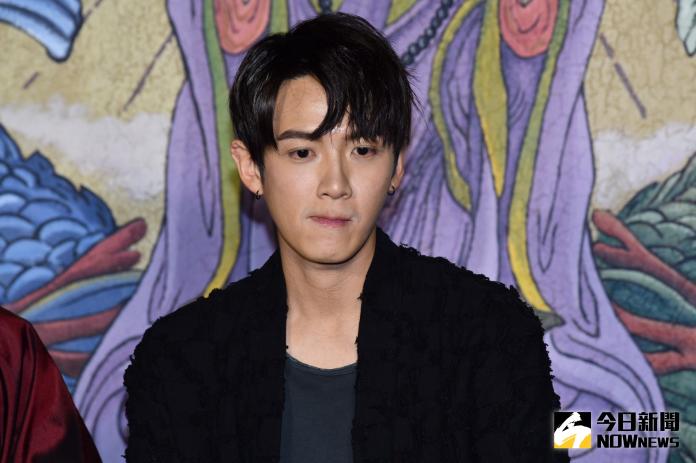

柯震東PO媽媽年輕照片!正到撞臉周迅、吳倩蓮 根本文青女明星

「國民俗仔」柯震東12年前以國片《那些年,我們一起追的女孩》竄紅,勇奪金馬獎最佳新演員獎,後來再憑《再見瓦城》、《金錢男孩》提名金馬獎男主角,近年轉行當導演、接拍影集《愛愛內含光》、《不夠善良的我們》

2024-05-08 17:21

-

余苑綺罹癌搬出婆家原因令人心痛 女兒童言童語:爸爸都在打電動

余天女婿、次女余苑綺(已改名余泳澐)老公Gary(陳鑒),日前涉嫌擔任詐騙集團車手頭,在板橋捷運站遭壓制逮捕,目前被依詐欺罪羈押中,今(8)日Gary遭余家親友爆料,余苑綺癌症復發後搬出婆家租房子,余

2024-05-08 15:40

-

劉亦菲現身擠爆商場!零死角生圖美到發亮 保全「偷看」搶盡風采

「神仙姐姐」劉亦菲日前出席,位在中國大陸三亞市的一場品牌活動,穿著一身金色深V禮服性感亮相,「無修生圖」展現超高顏值!挾帶超高人氣的她,造成現場人潮擠得水泄不通,負責維護人員安全的保全人員,一幕「忍不

2024-05-08 14:49

運動

更多運動-

全大運閉幕交棒長榮大學!葉柏廷跳高破全國 北市大92金最大贏家

113年全國大專校院運動會今(8)日圓滿落幕。本屆田徑賽場,公開男生組跳高決賽,虎尾科大葉柏廷跳出2公尺30,超越原本向俊賢保持9年的2公尺29全國紀錄,震驚全場。此外田徑女子七項,公開女生組臺灣師大

2024-05-08 18:29

-

NBA/SGA技壓Doncic!雷霆攻防都贏獨行俠 李亦伸看好G2繼續贏

NBA次輪季後賽G1,奧克拉荷馬雷霆在少主「SGA」 Shai Gilgeous-Alexander攻下29分9助攻9籃板的出色表現下,以117:95戰勝達拉斯獨行俠。球評李亦伸認為SGA和雷霆在第一

2024-05-08 17:57

-

Kevin Durant重返勇士?美媒建議5換1交易 再度聯手Curry爭冠

鳳凰城太陽和金州勇士在季後賽和附加賽接連遭到淘汰,在休賽季尋求改變,成為這兩支球隊必須要做的事,由於太陽和勇士目前薪資空間不足,無法在自由市場花大錢簽下即戰力補強,而美國媒體也建議兩隊之間來一筆交易,

2024-05-08 16:49

-

歐冠4強/巴黎聖日耳曼遭淘汰 多特蒙德睽違11年再度殺進決賽

歐冠聯賽4強第2回合,多特蒙德客場對上巴黎聖日耳曼,多特蒙德在首回合於主場1:0擊敗巴黎聖日耳曼,本場比賽客場出戰,雖在各項數據都落後給巴黎聖日耳曼,但多特蒙德在下半場第50分鐘,靠著角球,由Mats

2024-05-08 16:30

財經生活

更多財經生活-

啤酒別直接喝!內行「倒酒神級手法」一秒豪華升級:口感變超綿密

近年來由於消費者對生活品味的重視與追求,連帶對於啤酒風味及品質更趨於講究,百年德國啤酒品牌艾丁格,特別分享道地的德國啤酒喝法,只要簡單改變倒酒手法,就能喚醒啤酒中的酵母活性,瞬間打造出如雲朵般的啤酒泡

2024-05-08 18:39

-

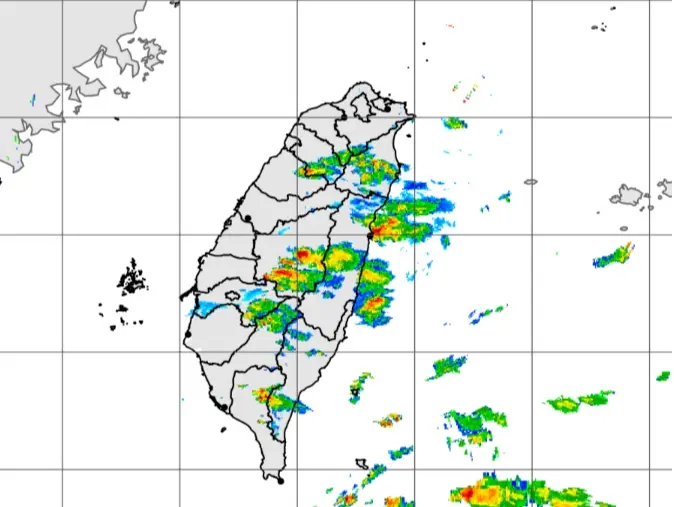

天氣預報/母親節全台濕透!明北台灣仍偏涼 下週颱風生成變數大

今(8)日受到華南雲系影響,中南部山區出現較大雨勢,中央氣象署預報員黃恩鴻表示,明(9)日水氣將減少,各地天氣回穩到週六(5/11),週日母親節(5/12)鋒面接近,全台有雨到下週一(5/13),菲律

2024-05-08 18:29

-

快訊/下班路注意!台中、高雄等10縣市「大雨特報」 防雷擊強風

(更新時間16:39)今天(8日)東北季風逐漸增強,迎風面的東半部局部地區斷斷續續有短暫陣雨,且降雨明顯,晚上東北部地區有較大雨勢出現的機率,而北部地區雲量較多,在大臺北山區偶有零星飄雨,其他地區則為

2024-05-08 16:40

-

NIKE母親節快閃降價!熱門鞋款「下殺4折」 Dunk、AJ1挑戰最低價

NIKE官網母親節大特價!今(8)起超過1300項商品降價,包括新上市的單品、服飾、熱門鞋款,指定特惠商品額外還有7折優惠,換算下來約4折購入,包括Nike Dunk 低筒鞋只要1427元、Air J

2024-05-08 16:29

全球

更多全球-

2024「全球百大富有國家」排名!台灣竟能位居第14 超越日韓

美國財經雜誌《全球金融》(Global Finance)近日公布「2024年全球100個富有國家或地區」排名,結果由盧森堡拔得頭籌。值得注意的是,在該份榜單中,台灣竟能位居第14,還領先了韓國和日本。

2024-05-08 19:05

-

中國人專騙中國人!男子在澳洲假扮警察誆女留學生

中國人專騙中國人又一案例!一名在澳洲的中國男子近期被警方逮獲,長時間冒充中國警察身分,誆騙一名中國女留學生涉及洗錢案,並要求支付高額保釋金。根據《澳洲廣播公司》(ABC)報導,一名22歲中國男子張哲銘

2024-05-08 18:40

-

泰警11人閃電突襲飯店!假辦案真勒索5名中國客 3嫌至今逍遙法外

泰國曼谷近期出現一起離奇綁架案件,5名中國客在飯店內,遭到數名自稱泰國警察的人士闖入房間調查,並指其涉及信用卡盜刷案,須接受調查。事實上這些闖入的人士卻是綁架團成員。然而,泰國警方調查發現,綁架團成員

2024-05-08 17:12

-

古都變垃圾場!「超限旅遊」困擾京都 遊客擠爆公車、亂丟垃圾

受到日圓走貶影響,大批外國旅客近日湧入日本觀光,再加上上週正是日本大型連假黃金週,擁有傳統氛圍的古都京都,遭到「內外夾擊」,不僅觀光人潮擠滿街道,觀光景點的道路上還能看見滿地垃圾,「超限旅遊」造成的亂

2024-05-08 16:17