《鄉民大學問EP.38》直播|你反廢死嗎?王世堅:廢死是“慷被害人之慨”!趙少康提:公投決定!你支持?藍黨團提520後 邀賴清德立院國情報告!韓國瑜將正面對上 藍綠攻防?|NOWnews

NOW影音

更多NOW影音焦點

更多焦點-

秘書長吳三龍答詢瞎扯!被黃國昌罵「看顏色辦事」 司法院澄清了

司法院祕書長吳三龍昨在立院備詢時被問到,2016年5月20日前夕,時任司法院長賴浩敏請辭,是因為任期將屆。民眾黨立法院黨團總召黃國昌痛罵吳三龍,答詢內容背離事實,竟淪為配合民進黨進行政治操作的棋子。黃

2024-04-25 16:47

-

夫人涉貪遭調查 西班牙總理考慮辭職

(中央社馬德里24日綜合外電報導)西班牙一間法院對總理夫人葛梅茲(Begona Gomez)展開貪污調查後,總理桑傑士(Pedro Sanchez)今天表示正在「衡量」辭職的可能性。法新社報導,桑傑士

2024-04-25 16:50

-

《淚之女王》金智媛結婚現場!韓劇CP御用飯店 玄彬孫藝真也愛這

金秀賢、金智媛搭擋的Netflix韓劇《淚之女王》,開播後一路維持高收視率,目前距離tvN電視台收視率第一的紀錄僅一步之遙。本週末《淚之女王》將播出完結篇,讓不少粉絲都十分期待金秀賢與金智媛這對CP可

2024-04-24 17:39

-

指稱黃國昌「硬上女學生」!周玉蔻遭求償百萬 法院判決結果曝

媒體人周玉蔻去年在臉書PO文指稱,民眾黨立委黃國昌在「教室硬上女學生」等語,黃國昌獲悉後,立刻反嗆對方惡意捏造,並提告求償100萬元,案經審理,台北地方法院今(25)日判處周玉蔻應賠償30萬元、移除文

2024-04-25 16:37

精選專題

要聞

更多要聞-

秘書長吳三龍答詢瞎扯!被黃國昌罵「看顏色辦事」 司法院澄清了

司法院祕書長吳三龍昨在立院備詢時被問到,2016年5月20日前夕,時任司法院長賴浩敏請辭,是因為任期將屆。民眾黨立法院黨團總召黃國昌痛罵吳三龍,答詢內容背離事實,竟淪為配合民進黨進行政治操作的棋子。黃

2024-04-25 16:47

-

真廢死被殺的人只能認倒楣?郭正亮示警:恐催生「報仇隊」

憲法法庭日前召開死刑辯論庭,死刑存廢再度引發外界討論。前立委郭正亮對此研判,若3個月後結果與社會脫節,「台灣有一些人就會自己組報仇隊。」郭正亮昨(24)日在節目中分析,目前僅看到廢死的攻防爭辯,卻不見

2024-04-25 16:39

-

潘孟安接總統府秘書長 周春米讚:屏東人光榮「我屏東我驕傲」

總統當選人賴清德國安首長人事今(25)日亮相,前屏東縣長潘孟安接任總統府秘書長。對此,現任屏東縣長周春米表示,潘孟安是咱屏東人的光榮,祝福潘孟安秘書長,「我屏東我驕傲,進擊為我台灣我驕傲!」針對新人事

2024-04-25 16:38

-

台智光、市北科案延燒!民眾黨團喊話蔣萬安:柯維拉該下投手丘

台北市長蔣萬安今(25)日赴台北市議會民眾黨團,向議員說明市府本會期重大政策、法案、議案及預算。台北市議會民眾黨黨團總召陳宥丞呼籲市政議題上別再「拉柯打蔣」,並指出該讓「柯維拉」下投手丘。蔣萬安致詞時

2024-04-25 16:37

新奇

更多新奇-

24歲台妹當性工作者!驚爆「每月薪水60萬」:台灣8成男人買過春

台灣知名脫口秀演員曾博恩昨(24)日推出新節目《初識啦!阿博》,試播集題材就相當辛辣,找來24歲的性工作者女子以及男友進行訪談,對方更驚爆「每月薪水60萬」,並認為台灣有8成男人買過春。▲可愛表示,現

2024-04-25 15:05

-

被《關鍵時刻》誤認成東大教授!有吉弘行看到了 本人回應超幽默

台灣政論節目《關鍵時刻》,由知名主持人劉寶傑領銜,時常針對各種時事進行語氣激昂的講解。不過近期在談論423地震話題時,誤將日本知名諧星主持人有吉弘行當成日本東京大學地震權威教授笠原順三,截圖瞬間在網路

2024-04-24 22:31

-

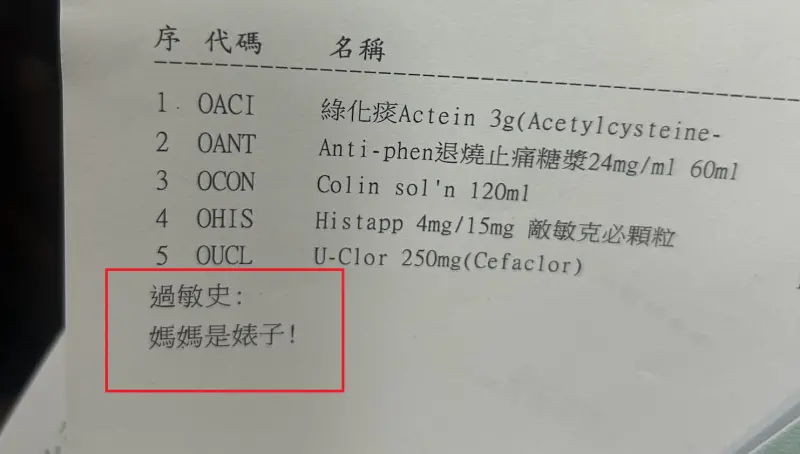

基隆醫院藥單上標註「媽媽是婊子」!人妻一看傻眼 護理師急道歉

(更新時間10:10)一位媽媽今(24)日帶著孩子前往衛生福利部基隆醫院看診,沒想到拿到藥單時,卻看到上面過敏史竟寫上:「媽媽是婊子!」讓她當場傻眼,詢問醫院究竟是怎麼回事,護理師同樣納悶,也立刻向她

2024-04-24 21:09

-

世界100大美食最新排行曝光!台灣竟成「吊車尾」:連英國都輸了

許多國際遊客來台一定會品嘗珍奶、小籠包、雞排、滷肉飯,甚至勇敢一點的還能嘗試看看臭豆腐。卻有國際美食榜單,將台灣美食排名列在榜單末端,甚至還有頗具權威性的美食評論刊物,2023年度最新榜單只給台灣第7

2024-04-24 18:43

娛樂

更多娛樂-

孫盛希緋聞男友KIRE「1分鐘激戰片段」流出!火辣女模正面曝光

孫盛希緋聞男友、潮流音樂人KIRE凱爾,在新歌〈dont stop〉MV當中化身「禁忌情人」,與火辣女模上演大尺度激吻戲,騎乘式深吻、十指緊扣深吻、濕身深吻樣樣來,在影片中連續激吻長達1分鐘,創下MV

2024-04-25 16:32

-

這11首西洋歌超過20歲!艾薇兒、黑眼豆豆太經典 樂迷一聽嘆老了

2000年前後,除了王心凌〈愛你〉、林俊傑〈豆漿油條〉、周杰倫〈星晴〉等經典華語歌外,還有多首烙印在你我記憶庫裡的西洋金曲,近日有網友分享11首發行至今超過20年的西洋歌,如艾薇兒、黑眼豆豆的成名曲,

2024-04-25 16:09

-

千黛亞《挑戰者》陷入誘惑三角戀!場上、場下激情開戰2兄弟

導演盧卡格達戈尼諾的全新作品《挑戰者》由千黛亞擔任主演,飾演直率、自信滿滿的網球奇才「塔希」,年輕時介入一對死黨派屈克(喬許歐康納 飾演)與亞特(麥克費斯 飾演)之間,使他們關係生變,但多年後3人卻在

2024-04-25 15:27

-

五月天甩假唱流言!北京鳥巢嗨唱10場 五迷憂:不想再看阿信吸氧

搖滾天團五月天為紀念出道25週年,舉辦「5525回到那一天」世界巡迴演唱會,昨(24)日所屬的相信音樂在粉專宣布,五月天將在5月18至6月1日重返北京鳥巢開唱,且一共唱10場,粉絲又開始擔心阿信的聲音

2024-04-25 13:20

運動

更多運動-

利物浦0:2爆冷輸艾佛頓!輸掉英超爭冠希望 兵工廠、曼城搶冠軍

英超聯賽利物浦在今(25)日補賽爆冷以0:2敗給同城死敵艾佛頓,加上兵工廠先前5:0大勝切爾西,而曼城即將於26日凌晨3點對上布萊頓,目前兵工廠、利物浦和曼城積分已經拉開差距,其中利物浦想要實現英超冠

2024-04-25 16:19

-

湖人大鎖Jarred Vanderbilt復出「跳票」!G3誰守Jamal Murray?

洛杉磯湖人陷入系列賽0:2險境,首輪季後賽G3回到主場,但球隊兩名在傷兵名單中的球員Christian Wood和Jarred Vanderbilt依然缺陣。根據《The Athletic》記者Sha

2024-04-25 16:07

-

被球員評比為最「過譽」選手!Rudy Gobert無奈:我想他們誤解我

NBA美國職籃明尼蘇達灰狼隊當家中鋒Rudy Gobert,近期以13.6%的得票率,被超過百名球員匿名票選為最「過譽」的球員,對此Rudy Gobert在昨(24)日賽後,也向記者表示,「我想他們有

2024-04-25 15:28

-

張育成回來了!擺脫傷病陰霾、3A打復健賽 同時心繫台灣地震

台灣連日地震不斷,花蓮地區災情頻傳,全台籠罩在餘震陰影,而遠在美國打拚的台灣好手張育成今(25)日發文關心,「希望大家都能平安,不要再有災情發生。」此外,也透露自身近況,表示已經順利結束復健賽,將準備

2024-04-25 15:14

財經生活

更多財經生活-

車庫露營以為鬼壓床!他睜眼見「身上長6顆毛球」 13萬人被萌爆

露營竟遇到最可愛的鬼壓床!日本一名網友帶著睡袋到父母家車庫露營時,半夜突然感覺到身體一陣沉重,正當他害怕地睜開眼睛時,發現原來是有6隻超萌的貓咪,闖入車庫陪他一起睡覺,「睡袋長出貓」的照片曝光後,也立

2024-04-25 15:05

-

雨彈狂炸全台!開除濕機「省電3神招」必學 台電認證:每年省8%

近期台灣受到鋒面影響,北中南各地都有降雨機率,室內濕氣也因此暴增,除濕機開始長時間上工。那麼除濕機該如何使用才最省電呢?台電就曾點出3個必學祕訣,不僅可以每年省下8%用電,還能讓除濕機更有效運作,將室

2024-04-25 14:25

-

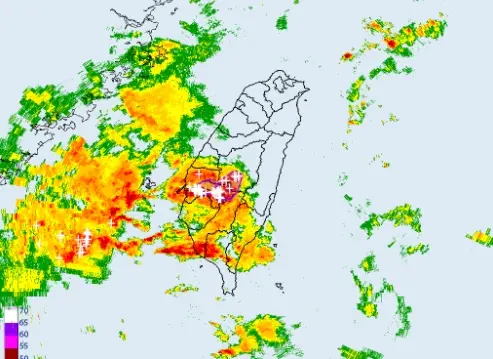

不斷更新/下班注意!高雄等3縣市「大雷雨警戒」 嘉義山區暴雨

今(25)日另一鋒面逐漸接近,天氣不穩定,降雨範圍廣,西半部、東北部地區及澎湖、金門、馬祖有短暫陣雨或雷雨,並有局部大雨發生。尤其是台中以南暴雨來襲,中央氣象署也發布「大雷雨即時訊息」和災防告警資訊,

2024-04-25 13:56

-

獨/高三生太強!開發地震APP、合作氣象署 800元地震站能裝你家

繼921後,0403花蓮7.2地震成為近25年來最強震,不斷餘震更搞的人心惶惶,紛紛尋求能提早得知地震消息的管道,2023年上路且廣受好評的「DPIP災害天氣與地震速報」目前擁有破10萬使用者,而在這

2024-04-25 13:23

全球

更多全球-

「35歲詛咒」糾纏中國白領!年齡歧視斷飯碗 遭裁員工吐心酸

中國經濟復甦不如預期,就業環境也十分嚴峻,不僅年輕的大學畢業生學歷加速貶值,找工作困難;已經在工作的人也無法掉以輕心,才30多歲就要開始擔心隨時會被炒魷魚。「35歲」現已成為中國就業的「詛咒」,特別是

2024-04-25 16:30

-

影/泰熱了!曼谷體感溫度飆破52°C 發布「極端危險」高溫警報

泰國新年宋干節、俗稱潑水節在近期落幕,吸引大量國際旅客前往朝聖。不過,曼谷昨(24)日發布高溫警報,當地氣溫達到39C,體感溫度更是飆破52C,達到「極端危險」的程度,呼籲民眾避免在室外活動,若想去曼

2024-04-25 15:49

-

中國雲南導遊又被爆威脅遊客高額消費 撂話不花錢別想平安

中國雲南導遊威脅遊客購物狀況相當知名,近期再度出現一例,一名導遊被拍攝影片爆料,在遊覽車上恫嚇遊客花掉該花的錢,撂話若不聽話,他是有手段用無道德底線的方式讓旅客不平安的結束旅程。根據澎湃新聞報導,一名

2024-04-25 15:32

-

日本自民黨再爆醜聞!已婚議員閃辭 被揭當乾爹頻點「外送茶」

日本執政黨自民黨籍眾議員、前防衛副大臣宮澤博行23日突辭去眾議員職務,傳出週刊將登出其醜聞,果不其然,日本知名爆料雜誌週刊文春隔日就揭露,已婚的且現年49歲的宮澤高調包養28歲年輕女子至租屋處,近期更

2024-04-25 13:56