《鄉民大學問EP.36》搶先看|韓國魚突襲立法委員辦公室!驚見不能說的秘密!謝龍介珍藏這個信物!王世堅突脫口:「你打過我們家的…」葉元之落跑被抓包?遇韓院長突立正站好!|NOWnews

NOW影音

更多NOW影音焦點

更多焦點-

力挺傅崐萁做萬年總召 林俊憲提2原因「拜託千萬別換人!」

國會三黨不過半,民進黨團從人數絕對優勢退居第二大黨,立院戰場揭幕,朝野紛爭不斷,對此民進黨立委林俊憲表示,若要給國民黨團總召一個期限,「我希望是,一萬年」,除了違憲擴權、刪特別預算救命錢條款、院會表決

2024-04-17 17:51

-

日本老牌家電東芝擬裁員5000人!加速進行重組

日本老牌家電東芝(Toshiba)去年底自東京證券交易所摘牌下市,私有化後加速進行企業重組,《日經新聞》今(17)日披露,東芝考慮在日本裁員5000人,相當於日本員工總數的7%左右,優先尋求自願退休者

2024-04-17 18:09

-

比汪小菲更甜!大S與具俊曄電梯玩自拍 「花式擁抱」羨煞旁人

大S(徐熙媛)和韓國歐巴具俊曄放閃不手軟,睽違20年的舊愛重逢,再婚2年依舊是蜜月期,具俊曄最近上韓國節目《脫掉鞋子恢單4Men》受訪,坦言兩人感情好到不行,每次外出時都會在電梯擁抱自拍,留下兩人甜蜜

2024-04-16 19:10

-

國道4號嚴重車禍!砂石車失控撞護欄衝落邊坡 駕駛重傷一度受困

國道4號今(17)日下午4時許發生一起嚴重車禍,當時一輛砂石車行經東向8.6K、神岡路段時,不明原因撞上護欄、衝出邊坡,除導致砂石車頭嚴重損毀外,年約30多歲的男駕駛也因此受困,頭部及肢體疑似有骨折情

2024-04-17 18:12

精選專題

要聞

更多要聞-

力挺傅崐萁做萬年總召 林俊憲提2原因「拜託千萬別換人!」

國會三黨不過半,民進黨團從人數絕對優勢退居第二大黨,立院戰場揭幕,朝野紛爭不斷,對此民進黨立委林俊憲表示,若要給國民黨團總召一個期限,「我希望是,一萬年」,除了違憲擴權、刪特別預算救命錢條款、院會表決

2024-04-17 17:51

-

韓國瑜以民主基金會董事長身分現身!與蔡英文同台「嚴肅0互動」

台灣民主基金會今(17)日舉辦「國際猶太大屠殺紀念日」活動,立法院長韓國瑜首度以民主基金會董事長身份出席,並與總統府秘書長林佳龍一同迎接蔡英文總統,整場活動下來蔡英文與韓國瑜互動不多,氣氛嚴肅。台灣民

2024-04-17 17:24

-

憲法法庭下周辯論死刑是否違憲 翁曉玲提醒:別忘7成5民意反廢死

死刑存廢與否一直是國內爭論不休的議題。憲法法庭23日將召開言詞辯論庭,就死刑制度是否違憲進行言詞辯論。國民黨立委翁曉玲說,廢除死刑,不是進步立法,當我們國民的法感情仍無法接受廢除死刑之際,大法官們若貿

2024-04-17 17:23

-

盧縣一不在場投票!王義川批韓國瑜比科長還不如 點名黃國昌踹共

立法院上周五表決大戰,藍綠甲級動員但都有立委未出席,其中原民藍委盧縣一不在場,卻出現投票紀錄。立法院長韓國瑜已表達,是有會場幹事誤認,會予以懲處。民進黨政策會執行長今(17)日記者會痛批,現場調錄影帶

2024-04-17 17:14

新奇

更多新奇-

搭北捷親子友善車廂!她驚見「小孩全都站著」太諷刺 家長掀共鳴

台北捷運是雙北首都圈核心的大眾運輸工具,許多人上班、出遊都會搭乘到。近期卻有家長帶著孩子進入親子友善車廂,卻發現車上所有小朋友都沒有位置可坐,貼文隨即掀起大批家長共鳴。一位家長在社群平台Threads

2024-04-17 16:42

-

政大景觀池命名票選!「金玟池」得票63%暫居第一 爆紅真相曝光

韓流魅力真的太強了!近期國立政治大學要達賢圖書館旁的景觀池命名,更舉辦了人氣票選比賽,也開放校外民眾參加,沒想到除了許多諧音梗紛紛出籠之外,還有韓星「金玟池」的名字也在其中,甚至還突破6成得票率暫居第

2024-04-17 13:41

-

俄國妹領所有存款來台灣!向台籍男友求婚 霸氣喊「沒錢我養你」

為了追尋真愛勇氣十足!一位俄羅斯女孩Mila,透過交友軟體認識台灣男子,雙方迅速墜入愛河,後續Mila更直接帶了所有存款飛來台灣,還主動求婚,甚至霸氣喊「沒錢我養你」,主動追愛的過程曝光,也讓大批觀眾

2024-04-16 17:01

-

陸網紅Sean爆「兒子被台灣拒絕入境」!真相大反轉 台人失望退追

中國知名網紅「Sean」肖恩與好友「陳老師」去年數度來台旅遊,拍攝許多Vlog遊記,更因為談吐風趣而爆紅,但近期卻出現掉粉危機!4月11日時,Sean在個人頻道上發出影片,聲稱「兒子被台灣拒絕入境」,

2024-04-16 14:01

娛樂

更多娛樂-

曝舒淇舊照遭轟跪算盤!馮德倫再爆夫妻私密面貌:為什麼要跪呢?

香港導演、演員馮德倫,2016年與「性感女神」舒淇結婚,夫妻倆結婚8年感情甜蜜,昨(16)日適逢舒淇48歲生日,「求生欲極低」的馮德倫居然曝光老婆陳年舊照,被太座點名:「算盤已備好⋯⋯」幽默的互動引起

2024-04-17 17:36

-

張立東約女友吃飯!手噴「1液體」濺到未來岳父 痛到對方掛急診

曾國城、巴鈺主持的節目《女王大人》日前邀請Eason、張立東、宇珊及蔡允潔,一同上節目分享自作聰明出事的荒謬經驗。沒想到張立東竟透露有次約女友的爸爸吃飯,主動獻殷勤時竟不小心把檸檬汁噴進未來岳父的眼睛

2024-04-17 16:55

-

AV女優「新幹線吃大肉包」被轟爆了!道歉也沒用 崩潰宣布退出X

39歲日本AV女優赤井美希擁有G罩杯好身材,2022年2月出道,累積不少作品,她近日搭新幹線,在車廂內大啖肉包,意外引發輿論攻擊,網友認為她不該在密閉公共場所吃味道太重的食物,赤井美希事後發文道歉,但

2024-04-17 16:38

-

吳慷仁低調現身香港機場!影帝人群中孤單排隊 這舉動讓粉絲讚爆

影帝吳慷仁去年才以《富都青年》奪得第60屆金馬獎,今年又靠《但願人長久》入圍香港電影金像獎最佳男配角,演技備受肯定。有粉絲日前在香港機場巧遇吳慷仁,只見吳慷仁在人群中毫無遮掩,跟著人群一同排隊,而吳慷

2024-04-17 16:37

運動

更多運動-

李亦伸專欄/勇士不敵國王被淘汰即將重建!八年四冠「王朝解體」

NBA季後賽附加賽勇士94:118倒在國王腳下,無緣季後賽,全世界Stephen Curry的球迷都要好一陣子睡不好,他們甚至不會想看今年NBA季後賽。八年六進總冠軍賽,奪下四座總冠軍,勇士建立前所未

2024-04-17 17:14

-

4/17NBA附加賽戰報/K湯1分未得被罵翻 勇士慘輸國王被提前淘汰

(16:43更新)NBA季後賽附加賽在今(17)日舉行兩場賽事,首場由洛杉磯湖人110:016擊敗紐奧良鵜鶘,第二場由金州勇士隊以94:118落敗,不敵沙加緬度國王,湖人晉級外,鵜鶘、國王還需要再打一

2024-04-17 16:53

-

「無冕王」CP3中斷連13年季後賽!生涯19年一冠難求 排史上第3長

NBA附加賽金州勇士今(17)日在客場94:118不敵國王,直接跟季後賽說掰掰,38歲資深後衛「CP3」Chris Paul中斷了自己連續13年晉級季後賽的紀錄。而Paul生涯在聯盟打滾19年,但至今

2024-04-17 16:48

-

備戰巴黎奧運 台灣拳擊女將陳念琴三度叩關!揚言:把金牌帶回來

巴黎奧運倒數進入100天,國訓中心今(17)日特別舉行誓師大會,奧運選手陳念琴、吳詩儀 、林昱堂和彭名揚等名將皆出席,盼能延續東京奧運氣勢,在創佳績。上屆東京奧運被稱為是中華隊的「黃金世代」,拿下隊史

2024-04-17 16:36

財經生活

更多財經生活-

天氣預報/外出要帶傘!半個台灣雷雨開轟 氣溫「跌到1字頭」

鋒面來襲,中央氣象署預報員劉宇其指出,明(18)日雨區範圍擴大,整個中部以北、東半部都有雷雨情況,中部以北還有局部較大雨勢,北台灣氣溫也將驟降,從近日攝氏30度的高溫降至攝氏24度,最低甚至可能跌到攝

2024-04-17 17:47

-

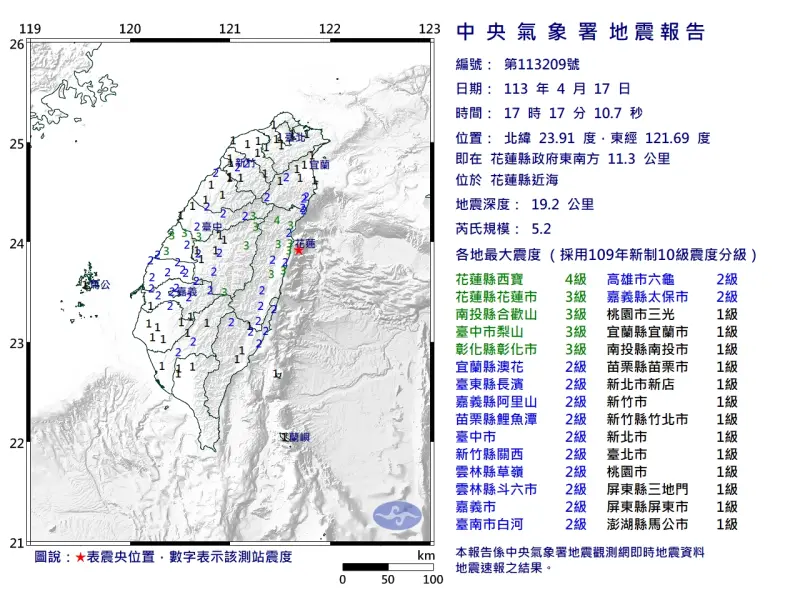

快訊/17:17花蓮地牛翻身!規模5.2「極淺層地震」 19縣市有感

中央氣象署地震測報中心表示,今(17)日下午5時17分左右,花蓮發生芮氏規模5.2有感地震,最大震度為4級,出現在花蓮西寶,震央位於花蓮縣政府東南方11.3公里的東部近海,地震深度19.2公里,屬於「

2024-04-17 17:21

-

李多慧露20吋螞蟻腰 感謝粉絲送靠得住涼感棉 網暈:真香

來自南韓的啦啦隊女神李多慧,去年加入中職樂天女孩後旋即在台引起風潮,如今轉戰味全龍啦啦隊人氣依然居高不下,昨日她在IG曬出在台多張生活照,分享自己喜歡的禮物,其中之一竟然是台灣製的靠得住茶樹涼感棉,網

2024-04-17 16:33

-

英國導遊來台灣定居1年半!被「台南3件事」震撼教育:我錯得離譜

台南擁有大量豐富古蹟及在地小吃,深受外國遊客喜愛。近日YouTube頻道《不要鬧工作室》上傳最新影片,團隊訪問來台南居住1年半的英國導遊Zoe,她點出台南與英國3個最大的差異,直呼自己真是「錯得離譜」

2024-04-17 16:02

全球

更多全球-

以色列音樂祭遭哈瑪斯血洗!倖存者曝近50人輕生:難回歸生活常軌

巴勒斯坦武裝團體哈瑪斯去年10月7日發動了對以色列南部邊境的「超新星音樂祭」(Nova Festival)的越境突襲,造成逾360人喪生。根據以色列媒體《i24 News》報導,有倖存者近日告訴以色列

2024-04-17 17:33

-

平壤「萬套住宅」落成!金正恩親自到場剪綵 現場超嗨宛如嘉年華

北韓領導人金正恩昨(16)日出席平壤和盛地區「萬套住宅」第二期計畫竣工典禮,金正恩乘坐俄羅斯總統蒲亭所贈予的豪車抵達現場,歡迎群眾擠爆空地,接著還施放了煙花與飛機飛行等大型表演,作為剪綵儀式後的餘興節

2024-04-17 17:02

-

美軍P-8A巡邏機今飛越台海上空 解放軍回應了:跟監警戒依規處置

美國國防部長奧斯汀(Lloyd Austin)和中國國防部長董軍週二(16)透過視訊會議進行通話,這是兩國防長近17個月來的首次對話,而就在兩人對話結束後不久,美國海軍第七艦隊今日表示,一架P-8A海

2024-04-17 15:42

-

巷仔內/中菲南海衝突燒!軍事佈署之餘 有招數能擋蠶食鯨吞?

中菲南海爭議持續延燒,美國總統拜登、日本首相岸田文雄和菲律賓總統小馬可仕(Ferdinand Marcos Jr.)近日在華盛頓舉行首次美日菲三方領導人峰會,會後明確表明中國武裝攻擊菲船都將援引共同防

2024-04-17 15:17