《鄉民大學問EP.38》字幕版|藍營2028的超級戰術!黃暐瀚:民調洩民進黨這弱點!廢死引爆民怨 是蔡英文挖坑給賴清德?台電屢跳電 萬美玲曝內幕:竟是小鳥惹的禍?!賴清德赴立院國情報告?將對上韓國瑜?

NOW影音

更多NOW影音焦點

更多焦點-

毛孩是重要家人! 加長靈車豪華告別式 民代曝葬禮行情比人類高

現代人將寵物視為家庭成員,台中市每年約有1萬4千隻毛小孩死亡,3分之1飼主希望比照人類模式辦理後事。台中市議員江和樹今(26)日質詢時指出,台中是全國首個通過寵物生命紀念館等相關自治條例的城市,10幾

2024-04-26 19:43

-

H5N1禽流感在美國大流行!20%零售牛奶遭感染 專家擔憂病毒突變

美國食品藥物管理局(FDA)週四表示,最新發現有20%的美國零售牛奶樣本中含有禽流感病毒,樣本來自全美,不過FDA並未詳細說明樣本數目在各州的分布狀況,這似乎意謂著禽流感很可能已在美國大流行。根據《N

2024-04-26 20:41

-

張書偉、謝京穎公布婚期!深V性感婚紗曝光 「一家4口」甜蜜合影

藝人張書偉、謝京穎2人去年12月已完成登記結婚,今(26)日公開婚紗照,並選定4個對他們十分有意義的場景,來拍攝2人的甜蜜婚紗。其中,張書偉、謝京穎2人還與寵物貓「哥哥」、「呀呀」共同拍婚紗,謝京穎的

2024-04-26 19:46

-

地震速報

04/26 20:28左右花蓮地區發生有感地震,預估震度3級以上地區:彰化、花蓮。

2024-04-26 20:28

精選專題

要聞

更多要聞-

中火以氣換煤遭疑偷渡5成發電量 藍黨團不滿將發動抗爭

台電推動中火以氣換煤計劃,地方原盼中部空污有望改善,未料台電新提出第二期新建燃氣機組計畫,赫見加上未來的4部機組後,可望將目前10部燃煤機組550萬瓩的發電量,增加到810萬瓩,儲氣槽也將由5個增加到

2024-04-26 18:46

-

寶林茶室監測結案!疾管署:通報35例造成2死、仍有4人住加護病房

寶林茶室食物中毒案自3月底爆發至今已有1個月,疾管署表示,至今通報35例、2人死亡、33例邦克列酸(原譯米酵菌酸)陽性、2例陰性,目前仍有4人在加護病房治療中。「寶林茶室信義A13店專案」通報專區,通

2024-04-26 18:11

-

范雲稱被黃國昌噴滿臉口水!民眾黨批「造瑤累范」:停止巨嬰行為

立法院今(26)日再度上演表決大戰立法院,民進黨團提案三案變更議程,其中與國會改革有關的兩案遭國民黨團提出異議,民進黨立委范雲在提案遭封殺後,不滿民眾黨團未對國會改革相關的反性騷擾案投票,與民眾黨團總

2024-04-26 17:47

-

影/卸任倒數!蔡英文玩賽車遊戲機當飆仔 狂飆160公里超開心

即將在5月20日卸任的總統蔡英文,今(26)日出席活動時大玩賽車遊戲機,「駕駛魂」噴發的她,笑容滿滿地直接狂飆160公里;被問到好玩嗎?她豎起大拇指大讚「非常好玩」;玩完賽車機後,她也玩起夾娃娃機,夾

2024-04-26 17:42

新奇

更多新奇-

台灣泡麵「隱藏王牌」爆出來了!每碗37元吃過上癮 老饕改買這碗

台灣泡麵在市面上販售的口味非常眾多,除了定期的新品之外,也有許多老字號的泡麵長年稱霸排行榜,成為台灣泡麵的一大特色。然而,近日就有網友分享一款台灣泡麵隱藏版,由於平常沒有在各大通路上架,因此只有內行人

2024-04-26 18:29

-

試管嬰兒站出來!婦產科蔡醫師迷因爆紅 本尊「是世界名醫」驚呆

2024最新迷因爆紅!最近在社群平台上,出現一名「活體迷因」,一位婦產科蔡醫師大爆紅,不僅有IG、Tik Tok的追蹤人數暴衝,甚至還有許多粉絲做了蔡醫師的各種周邊商品,由於過去蔡醫師還開投票讓粉絲表

2024-04-26 18:26

-

林叨囝仔七寶媽學歷曝!「最強外語」大學畢業 自嘲專長:生小孩

35歲的網紅「林叨囝仔」七寶媽(陳珮芬)歧視資源班言論遭炎上,不少人好奇七寶媽學歷為何?「七寶媽 學歷」在Google熱搜中快速飆升。據悉,七寶媽從小就是個學霸,國小到大學成績都名列前茅,她曾在部落格

2024-04-26 11:26

-

快訊/網紅七寶媽笑資源班遭轟!刪直播二度道歉:請原諒我的無知

網紅「林叨囝仔The Lins'Kids」七寶媽去年陷入多起爭議,好不容易才悄悄復出,結果日前直播上疑似嘲笑資源班的言論,讓她再度炎上。日前七寶媽Sydney深夜開直播道歉,但卻被批評是「把過

2024-04-26 09:15

娛樂

更多娛樂-

卜學亮談黃子佼!表態不會因此切割:做錯事要自己去承擔跟面對

黃子佼MeToo案持續延燒,同為「張小燕家族」的卜學亮今(26)日出席綜藝節目《我的明星村長》記者會時,被問及黃子佼事件,嚴肅地表示:「錯就是錯,我的看法就是當事人要自己去承擔跟面對。」卜學亮也被問到

2024-04-26 20:24

-

影/田馥甄到大陸開唱被轟:表態立場再來賺人民幣 女神高EQ回應

金曲歌后田馥甄(Hebe)今(26)日和林柏宏出席酒品代言活動,她5月將到大陸音樂節表演,部分大陸網友重提台獨疑雲,要田馥甄表態立場再來賺錢,對此,田馥甄低調表示:「能唱想唱的歌就覺得很珍惜。」▲田馥

2024-04-26 16:32

-

《雲之羽》女星證實未婚懷孕!金靖曝工作想吐「靠大笑掩飾害喜」

去年因熱播陸劇《雲之羽》受矚目的31歲大陸女星金靖,昨(25)日突發文自爆已懷孕,「一家四口一起迎接第五位家庭成員」,她也透露另一半為導演舒奕橙。金靖8年前以綜藝節目《今夜百樂門》出道,個性爽朗的她自

2024-04-26 15:46

-

鄭靚歆女女大婚!美魔女媽「透明薄紗內衣全露」 母女前晚爆爭執

28歲鄭靚歆(Jin)從節目《我愛黑澀會》出道,參加《全明星運動會4》收獲不少粉絲,她去年6月和大5歲德國女友采熙(Aky)登記結婚,今(26)日終於舉辦婚宴,鄭靚歆的美魔女媽媽胡文英透視薄紗裡只穿比

2024-04-26 15:29

運動

更多運動-

影/湖人「Dlo」得0分還不聽戰術!躲一旁滑手機、吃東西 被噴爆

只爆發了一場之後,洛杉磯湖人後衛「Dlo」DAngelo Russell在今(26)日湖人和丹佛金塊系列賽G3得分「掛蛋」,球隊以105:112輸掉關鍵戰,系列賽0:3遭到聽牌。耐人尋味的是,湖人在比

2024-04-26 19:21

-

中信兄弟兩大女神峮峮和邊荷律限定毛巾秒殺!30分狂賣2000條以上

遭遇暴雨侵襲,中華職棒今(26日)台中洲際的統一獅與中信兄弟之戰因雨延賽,中信兄弟啦啦隊Passionsisters兩位韓籍成員邊荷律、李丹妃第一次到洲際棒球場,卻未能應援,製作晴天娃娃,希望明後天球

2024-04-26 19:11

-

全大運5月4日在台中揭開序曲 巴黎奧運國手林昀儒、王冠閎也參賽

113年全國大專校院運動會將在5月4日將在國立台灣體育運動大學田徑場開幕,展開為期五天賽事。由於距離巴黎奧運已不到百日內,部分中華隊國手也將參賽,以賽代訓,備戰奧運。位於台中的台灣體大於創校63年期間

2024-04-26 18:36

-

澄清湖球場驚見30公分鋼筋條!難怪洪總抓狂 花上億元整修成笑話

澄清湖球場真的很可怕!高雄市澄清湖棒球場在24日二軍比賽,發現比賽中一壘側有異物,經檢查後發現竟然是埋有30公分的鋼條,當下中職聯盟趕緊暫停比賽,但卻嚴重令人感到憂心,因為這裡不但是台鋼雄鷹大本營,台

2024-04-26 18:06

財經生活

更多財經生活-

快訊/大樂透頭獎保證1億!「4/26完整獎號」曝 中了秒財富自由

大樂透第113000047期今(26)日晚間開獎,台彩保證本期頭獎為1億元,就在剛剛完整獎號皆已開出,快拿起手邊彩券,看看能不能實現財富自由吧!🟡4/26大樂透中獎號碼(第113000047期)由小

2024-04-26 20:48

-

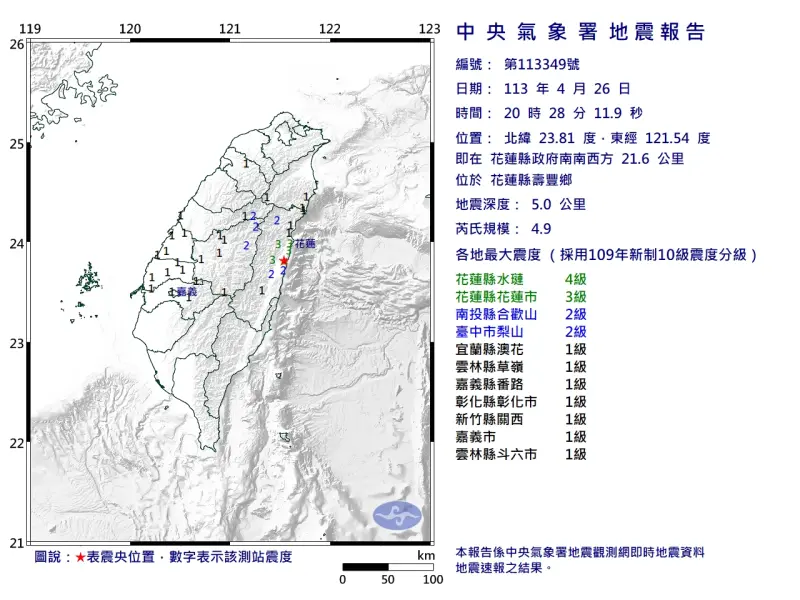

快訊/花蓮20:28極淺層地震!「規模4.9」最大震度4級 台北有感

今(26)日晚間20時28分,花蓮發生規模4.9地震,地震深度5公里,震央位於花蓮縣政府南南西方21.6公里(花蓮縣壽豐鄉),最大震度為4級,出現在花蓮縣水璉區,就連台北也有感搖晃。

2024-04-26 20:38

-

七寶媽怎忍心笑資源班!特教師淚揭:學生剛離世 他們比誰都努力

35歲的網紅七寶媽(陳珮芬)歧視資源班言論遭炎上,這些歧視言論對特教生、特教生家長與特教老師傷還有多大?台灣特教工作專業人員協會理事金采蓁向《NOWnews今日新聞》分享教育現場小故事,透露她在特教學

2024-04-26 20:00

-

天氣預報/明暴雨還沒停!鋒面逐漸北移 「北台灣雨最猛」時機曝

明(27)日鋒面持續影響,各地都有降雨機會,今晚至明天白天降雨熱區為中南部,不過明晚到週日(28日)鋒面逐漸往北移動,降雨熱區轉為東部以北,留意短暫陣雨或雷雨,下週一(29日)為天氣相對穩定的一天,不

2024-04-26 18:08

全球

更多全球-

H5N1禽流感在美國大流行!20%零售牛奶遭感染 專家擔憂病毒突變

美國食品藥物管理局(FDA)週四表示,最新發現有20%的美國零售牛奶樣本中含有禽流感病毒,樣本來自全美,不過FDA並未詳細說明樣本數目在各州的分布狀況,這似乎意謂著禽流感很可能已在美國大流行。根據《N

2024-04-26 20:41

-

台積電美國廠面臨「3大挑戰」!美媒:工作文化衝突未見好轉

台積電本月8日宣布獲美國晶片法案最高可達66億美元的直接補助,同時拍板美國亞利桑那州設立第三座晶圓廠,消息傳出後掀起熱議,不過對於台積電美國廠能否成功的擔憂從未減少,美國科技媒體《Apple Insi

2024-04-26 18:55

-

澳洲大規模鯨魚擱淺!29頭不幸死亡 專家:救回130頭已屬了不起

澳洲西南部的托比灣(Tobys Inlet),週四驚見大規模鯨魚擱淺,約160頭領航鯨(pilot whales)在沙灘上動彈不得,參與救援的當地鯨魚研究員威斯(Ian Wiese)直呼從未見過如此多

2024-04-26 17:33

-

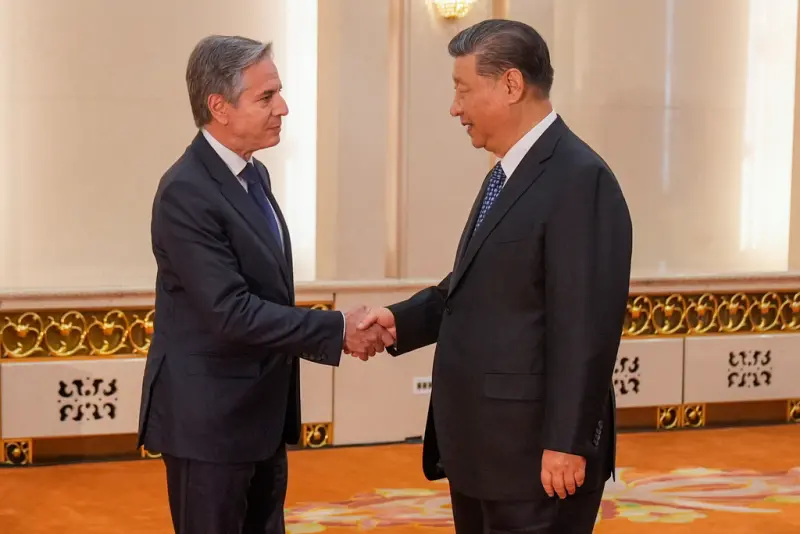

習近平晤布林肯!稱中美應做夥伴而非對手:不是「做一套說一套」

美國國務卿布林肯(Antony Blinken)今(26)日下午於北京人民大會堂與中國國家主席習近平會晤,根據央視新聞報導,習近平表示「兩國應該做夥伴,而不是當對手;應該言必信、行必果,而不是說一套、

2024-04-26 17:00