《鄉民大學問EP.36》字幕版|韓院長的突襲!藍綠白委員見“韓國魚”驚呼!謝龍介不敢睡 稱愈晚愈high在忙那椿?葉元之公開立院頭號女戰神是“她”!王世堅自豪這點連韓國瑜也比不上!|NOWnews

NOW影音

更多NOW影音焦點

更多焦點-

民進黨人才庫出現斷層?不分區立委迄今無人入閣 王義川難遞補

準閣揆卓榮泰陸續公布未來的內閣成員,目前除正副院長、秘書長、政院發言人外,未來的閣員已有16人曝光。不過特別的是,相較於2016年民進黨首度組閣,時任不分區立委鄭麗君轉任文化部長,接下來也陸續有不分區

2024-04-20 07:00

-

美股也迎黑色星期五?道瓊雖漲 納指大跌逾2%、輝達挫10%

伊朗淡化以色列的軍事報復行動,市場憧憬2國衝突應能避免進一步升級,美股主要指數週五個別發展,不過雖然道指收漲逾200點,但大型科技股受壓,納指下瀉超過2%,與標指都連跌6個交易日,顯示近期地緣政治衝突

2024-04-20 07:08

-

陳亞蘭久違扮花旦索吻!莊凱勛粉墨登場「擔心遭影迷追殺」

推廣歌仔戲不遺餘力的陳亞蘭,與莊凱勛兩位金鐘視帝聯手合作,共演歌仔戲職人劇《勇氣家族》,今(19)日舉辦開播記者會,在劇中飾演夫妻的陳亞蘭及莊凱勛盛重以歌仔戲扮相出場,過去反串男性角色居多的陳亞蘭,久

2024-04-19 18:18

-

律師洩密詐團!北檢第4波最大規模搜索 約談10律師、8交保1限居

台北地檢署調查,包括律師鄭鴻威等19名律師在內,因涉外洩偵查秘密給詐騙集團首腦,目前鄭鴻威已被羈押,而北檢持續擴大偵辦,本月18日,發動第4波最大規模的搜索行動,於北、中、南等地區搜索,並約談10名替

2024-04-20 07:07

精選專題

要聞

更多要聞-

民進黨人才庫出現斷層?不分區立委迄今無人入閣 王義川難遞補

準閣揆卓榮泰陸續公布未來的內閣成員,目前除正副院長、秘書長、政院發言人外,未來的閣員已有16人曝光。不過特別的是,相較於2016年民進黨首度組閣,時任不分區立委鄭麗君轉任文化部長,接下來也陸續有不分區

2024-04-20 07:00

-

黨部主委登記截止!余天退選新北蘇巧慧同額競選、台南2人登記

2年辦理1次的民進黨黨職幹部改選工作,今(19)日登記截止。新北黨部主委部分,在前立委余天宣布退選後,僅蘇巧慧一人登記;至於台南市黨部主委,則有立委郭國文、隸屬湧言會的前議員陳金鐘登記。余天原先表態參

2024-04-19 18:40

-

民進黨改選中投黨部「桶箍」換人做 彰縣主委楊富鈞尋求連任

2年辦理1次的民進黨黨職幹部改選工作,今天登記截止,中彰投3位主委僅綠色友誼連線、彰化楊富鈞尋求連任。台中市李天生已2任屆滿;南投縣則是有主委不尋求連任的傳統,現任主委縣議員蔡銘軒宣佈不參選,由綠色友

2024-04-19 17:40

-

3倍價民間購電挨批缺電 台電搬出台積電澄清:短時需量購電較好

特定人士質疑4/15夜尖峰時段,台電向用電大戶買電,每度12元,為成本3倍,其中包含半導體、電子、石化、鋼鐵業等10多家大型企業參與,而遭立委質疑凸顯政府電力供應不足。對此,台電今(19)日傍晚回應表

2024-04-19 17:38

新奇

更多新奇-

全美語幼稚園校外教學去資收場 家長氣炸:我小孩不會接觸這工作

孩子是國家未來的主人翁,不少幼稚園(幼兒園)會安排各項體驗活動,探訪警察局、走訪博物館,加深孩子對社會的了解。不過,一名家長近期抱怨,花大錢送孩子讀全美語幼稚園,結果校外教學居然去參觀資源回收場,質疑

2024-04-19 11:32

-

台大AV女優宣布徒步環台!首日狂走20公里「腳起水泡」 現況曝光

去年考上國立台灣大學的AV女優魏喬安,日前在社群平台上宣布要徒步環島旅行,第一天就狂走20公里,從台北車站走到三峽,也讓她腳上起水泡,再加上同行夥伴遭野狗咬傷,只能暫時回台北休養,不過她也強調,到下週

2024-04-18 20:05

-

一堆人到巴黎錢包被偷!黃大謙帶「8個錢包」實測 驚人結局曝光

法國的首都巴黎是擁有數千年歷史的古都,也是許多遊客到訪歐洲必去的浪漫城市。但當地治安卻總是亮起黃燈,一堆人都曾在當地錢包、財物失竊,當有人要去巴黎時,幾乎被提醒的第一句都是「小心錢包被偷」。對此,Yo

2024-04-18 18:38

-

佛心蛋「1顆賣1元」!每人限5顆 阿姨買100顆遭拒狂酸:還怕人買

不要糟蹋別人的心意!近期雞蛋價格雖然沒有去年「蛋荒」時昂貴,但想要買到一顆1元的雞蛋,仍可以說是天方夜譚。近期就有民眾表示,爸爸退休後迷上養雞、鴨,產生的蛋自家吃不完,就打算便宜販售,訂出「1顆蛋1元

2024-04-18 18:38

娛樂

更多娛樂-

泰勒絲有threads了!歌迷完成「1任務」即獲尊貴徽章 彩蛋全曝光

美國流行歌手泰勒絲(Taylor Swift)在今(19)日正式迎來最新專輯《THE TORTURED POETS DEPARTMENT》發行,有趣的是,社群平台Threads竟然特別為了她打造一個專

2024-04-19 21:54

-

遭謝和弦揭噁心性事!Keanna嗆「渣男幻想文」:回台灣後絕對提告

謝和弦前妻Keanna日前爆料,陳芳語與背著她與男方在錄音室發生關係,引發討論。陳芳語則是透過經紀公司發聲喊告,「內容純屬子虛烏有!」而謝和弦則回應是記錯人,並揭露Keanna私下的噁心行徑。對此,K

2024-04-19 21:32

-

NONO性騷後神隱!老婆朱海君「燦笑現蹤高雄」 友人曝她慘淡近況

知名藝人NONO自從去年捲入MeToo風波,遭多名女子控訴涉嫌性侵,目前還有官司持續偵辦中,而他的妻子朱海君則是照常工作,但從未對外發聲,舉動低調且神祕。近日,朱海君再度現蹤廟宇,並擔任高雄旗山天后宮

2024-04-19 21:08

-

獨家/遭葛斯齊質疑婚內出軌!大S「啪啪啪」曬高清圖:不想告了

大S徐熙媛與汪小菲離婚後,火速嫁給舊情人具俊曄,日前,具俊曄更在韓綜上獨家曝光與大S在電梯裡的甜蜜合照,怎料卻引來不少酸民質疑是大S離婚前拍的,讓「婚內出軌」四個字再登版面,就連狗仔葛斯齊都說「跟我想

2024-04-19 19:44

運動

更多運動-

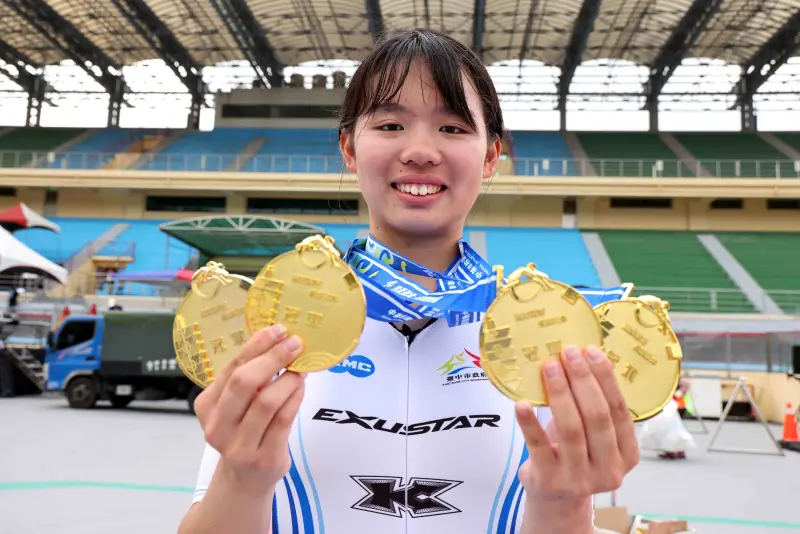

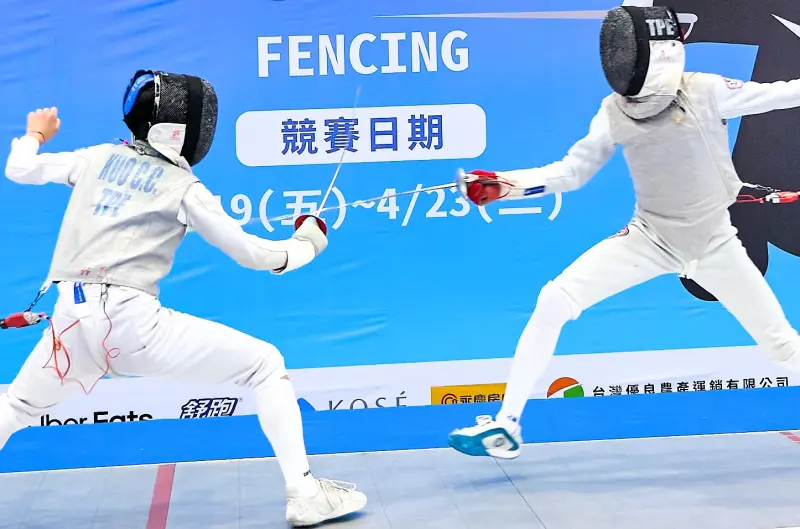

全中運/國女組團體銳劍連奪下3金 高女組團體鈍劍完成3連霸

113年全國中等學校運動會擊劍項目日在臺北市成功高中點燃戰火,首日舉行高男組、國女組銳劍,以及高女組、國男組軍刀等6項團體競賽,臺北市代表隊展現地主強勢風範,頻傳佳績;來自臺北市的中正高中在高男組團體

2024-04-20 05:49

-

全中運/國男組、國女組4量舉重登場 台南市包辦2金成最大贏家

113年全國中等學校運動會舉重項目,在臺北市大直高中舉行第2天的4個量級賽程,臺南市入袋2金,分別是國女組55公斤級臺南市東原國中黃秀玉,與國男組67公斤級臺南市大內國中顏邑達。國男組61公斤級由雲林

2024-04-20 05:42

-

全中運/射箭項目開幕!超級新星江侑軒國一就奪金 積極尋求衛冕

113年全國中等學校運動會射箭項目在臺北市立南港高工進行國中反曲弓個人賽事,國男組、國女組32強盡數出爐,包括尋求衛冕男單金牌的地主選手臺北市南門國中江侑軒。首日賽事上午先進行國男組雙局個人排名賽,再

2024-04-20 05:37

-

勇士「三巨頭」6大傳奇紀錄畫上句點?季後是否拆夥 Green這樣看

金州勇士在2023-24賽季附加賽被沙加緬度國王隊給擊敗,球季提前結束。遭遇如此巨大的挫敗,勇士「三巨頭」Stephen Curry、Klay Thompson、Draymond Green未來是否還

2024-04-20 05:00

財經生活

更多財經生活-

升溫飆36°C!全家霜淇淋第2支10元 GODIVA買1送1、哈根達斯半價

週六、週日(20日、21日)各地大多可來到33到35度,中央氣象署也發布高溫示警,明(20)日局部地區恐飆到攝氏36度!天氣熱先來點冰品消暑,全家霜淇淋今起至4月21日第2支10元,7-11霜淇淋指定

2024-04-20 06:00

-

六日咖啡優惠!7-11大杯美式、拿鐵10元多一杯 全家特濃拿鐵38元

本週六日咖啡優惠來了!限時2天有7-11美式、厚乳拿鐵、精品美式第2杯10元;全家則有特濃拿鐵第2杯10元,原價65元、特價38元,每杯下殺5.9折,現擠霜淇淋也有第2支10元優惠;萊爾富寄杯美式32

2024-04-20 05:00

-

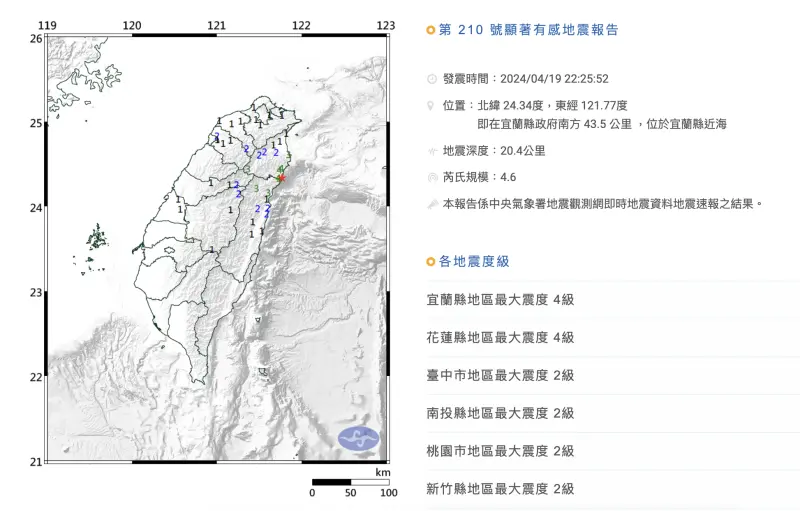

快訊/22:25宜蘭極淺層地震!「規模4.6」最大震度4級 台北有感

今(19)日晚間22時25分發生地震,本次地震芮氏規模4.6,地震深度為20.4公里,震央位於宜蘭縣近海(宜蘭縣政府南方43.5公里處)。本次地震屬於極淺層地震,最大震度為4級,分別出現在宜蘭縣澳花、

2024-04-19 22:39

-

大樂透4/19槓龜!下期頭獎「保證1億」 第113000045期獎號查詢

大樂透第113000045期今(19)日晚間開獎,本期頭獎為1億元,但派彩結果顯示,頭獎及貳獎均槓龜,台彩保證下期頭獎仍有1億。🟡4/19大樂透中獎號碼(第113000045期)由小到大依序為07、

2024-04-19 22:13

全球

更多全球-

美股也迎黑色星期五?道瓊雖漲 納指大跌逾2%、輝達挫10%

伊朗淡化以色列的軍事報復行動,市場憧憬2國衝突應能避免進一步升級,美股主要指數週五個別發展,不過雖然道指收漲逾200點,但大型科技股受壓,納指下瀉超過2%,與標指都連跌6個交易日,顯示近期地緣政治衝突

2024-04-20 07:08

-

與以色列有關?闖伊朗駐法使館威脅要「自爆」 男子稱為兄弟報仇

19日發生以色列疑似對伊朗發起報復空襲的事件,震撼全球,雖然事發後伊朗有意淡化遭到攻擊一事,雙方衝突暫時未見升級之勢,不過同一天剛好發生有人闖進伊朗駐法國領事館,揚言要「自我引爆」的事件,在區域緊張之

2024-04-20 06:46

-

比特幣減半在即!前夕遇以色列、伊朗衝突 價格如坐雲霄飛車

比特幣(Bitcoin)將於台灣時間20日迎來第4次「減半」,有分析認為這將凸顯比特幣的稀缺性,挖礦公司正在整頓業務,以趕在供應萎縮、導致利潤減半之前,減少對這種加密貨幣的依賴。根據《香港經濟日報》報

2024-04-20 06:12

-

中東緊張暫歇!華爾街鬆口氣美股道瓊開盤走高 但台積電ADR續跌

受到以色列襲擊伊朗的消息影響,亞洲股市19日哀鴻遍野,台股創下史上最大跌點,日本股市也大跌1011.35點。不過,以色列與伊朗後續反應趨於低調,中東局勢的擔憂暫消,華爾街投資人鬆一口氣,截至寫稿時間為

2024-04-19 22:59