《鄉民大學問EP.38》字幕版|藍營2028的超級戰術!黃暐瀚:民調洩民進黨這弱點!廢死引爆民怨 是蔡英文挖坑給賴清德?台電屢跳電 萬美玲曝內幕:竟是小鳥惹的禍?!賴清德赴立院國情報告?將對上韓國瑜?

NOW影音

更多NOW影音焦點

更多焦點-

產業界喊話核電延役「順水推舟」?黃暐瀚預言:2025退場倒數計時

我國能源議題再度成為焦點,核電究竟要不要延役或停役,也成為藍綠雙方攻防重點。資深媒體人黃暐瀚分析,和碩董事長童子賢公開主張核能延役,以核幫綠,外界對於準總統賴清德,會不會「順水推舟」?只要賴總統不打算

2024-04-26 08:13

-

前景不佳?英特爾Q2財測低於預期!拖累盤後股價跌逾8%

晶圓代工大廠英特爾昨(25)日公布第一季財報,雖然每股盈餘超出市場預期,不過營收卻低於預期,再加上本季財測也差強人意,顯示出要重返產業龍頭位置有點困難,因此拖累今(26)日盤後股價大跌超過8%。英特爾

2024-04-26 08:06

-

《淚之女王》金智媛結婚現場!韓劇CP御用飯店 玄彬孫藝真也愛這

金秀賢、金智媛搭擋的Netflix韓劇《淚之女王》,開播後一路維持高收視率,目前距離tvN電視台收視率第一的紀錄僅一步之遙。本週末《淚之女王》將播出完結篇,讓不少粉絲都十分期待金秀賢與金智媛這對CP可

2024-04-24 17:39

-

重案回顧1/北投豪宅滅門案、井口真理子遭分屍「頭顱」下落成謎

台灣目前共37名死刑犯,集體聲請死刑釋憲案,本月23日,由大法官組成的憲法法庭展開言詞辯論,死囚訴訟代理人、及法務部等均到場陳訴意見,專家學者也出席表達看法,共同討論死刑是否違憲。而過去,台灣發生過多

2024-04-26 08:00

精選專題

要聞

更多要聞-

嚴防黨內地位遭挑戰!賴清德用這幾招 卡住未來可能接班中生代

準總統賴清德昨公布新內閣外交國防團隊名單,總統府秘書長林佳龍準轉任外交部長、行政院秘書長鄭文燦轉任海基會董事長,林佳龍與鄭文燦在蔡英文執政末年都曾被點名接班,如今賴清德順利當選總統,鄭文燦與林佳龍卻被

2024-04-26 08:00

-

嘆香港文壇淪諂媚、奉承席近平 矢板明夫:希望台灣不要變成那樣

日本產經新聞台北支社長矢板明夫昨(25)晚在臉書發文感慨,表示看到香港作家馮睎乾的臉書,介紹了2首香港詩人最新發表的詩作,全是對中共和習近平吹捧的內容,不禁啞然。到幾年前為止,香港文化充滿了多元性。沒

2024-04-26 07:56

-

爆侯友宜不具參選黨主席資格 黃揚明:除非朱立倫「做這1事」

新北市長侯友宜傳出有意角逐下一屆國民黨主席之位,以便取得下一屆新北市長「提名權」。對此,資深媒體人黃揚明分析,侯友宜加入國民黨至今,未曾擔任過中央委員或中央評議委員,因此目前他根本不具黨主席參選資格。

2024-04-26 07:46

-

蔡政府8年內閣一次看!閣揆換過4人 政院發言人最難當共換過9人

準總統賴清德與準閣揆卓榮泰近日陸續曝光未來的新任內閣,520後的執政團隊就定位。回顧總統蔡英文執政8年期間的內閣,行政院長總共有4任,但相較於閣揆,內閣成員反而較穩定,幾乎都只換過2到3人。內閣成員中

2024-04-26 07:00

新奇

更多新奇-

開發地震App爆紅!「高三生沒獲授權」道歉了 揭氣象署合作進度

最近0403花蓮強震的餘震不斷,22日起連續兩天在深夜都發生芮氏規模5以上的餘震,甚至23日還有規模6.3的地震,讓民眾嚇到不敢入眠,也讓地震相關App有了「大量需求」。然而其中一款由高三生林子祐同學

2024-04-26 07:43

-

林叨囝仔7寶媽又出事!「恥笑資源班」深夜道歉 她怒比中指開嗆

網紅「林叨囝仔The Lins'Kids」7寶媽又炎上了!日前7寶媽Sydney在臉書業配直播當中失言,被質疑有恥笑、歧視「資源班」學生的意思,遭到網友砲轟,隨後就立刻遭到多家廠商切割,甚至讓

2024-04-26 07:14

-

24歲台妹當性工作者!驚爆「每月薪水60萬」:台灣8成男人買過春

台灣知名脫口秀演員曾博恩昨(24)日推出新節目《初識啦!阿博》,試播集題材就相當辛辣,找來24歲的性工作者女子以及男友進行訪談,對方更驚爆「每月薪水60萬」,並認為台灣有8成男人買過春。▲可愛表示,現

2024-04-25 15:05

-

被《關鍵時刻》誤認成東大教授!有吉弘行看到了 本人回應超幽默

台灣政論節目《關鍵時刻》,由知名主持人劉寶傑領銜,時常針對各種時事進行語氣激昂的講解。不過近期在談論423地震話題時,誤將日本知名諧星主持人有吉弘行當成日本東京大學地震權威教授笠原順三,截圖瞬間在網路

2024-04-24 22:31

娛樂

更多娛樂-

抗日神劇女星爆潛規則內幕!演員為求上位「鑽老闆胯下」極樂挑逗

日本女星井上朋子因為在中國大陸留學被相中出道,曾演過多部中國抗日劇;近日,井上朋子在日媒訪問中揭露「陸娛潛規則」內幕,提到有女星為求演出機會,當眾開約老闆一夜情,還鑽到老闆褲襠底下色誘對方。井上朋子不

2024-04-25 22:27

-

田馥甄遭封殺2年解禁!預告中國開唱陸網炸鍋 主辦滅火:一家人

2022年在裴洛西訪台期間,Hebe田馥甄只因為在社群平台發布「吃義大利麵照片」,就被中國大陸網友貼上「台獨」標籤。時隔2年後,天津「泡泡島音樂與藝術節」日前宣布,田馥甄將在5月2日壓軸登場開唱,消息

2024-04-25 21:19

-

《A》揭邪教真面目!東京地鐵「放毒氣殺千人」29年前轟動全球

「台灣國際紀錄片影展(TIDF)」與國家影視中心共同企劃「記錄.紀錄:TIDF回顧精選」單元,精選6部各具特色與代表性的作品。紀錄片《A》、《A2》描述,日本奧姆真理邪教曾在東京地鐵放毒氣,造成上千人

2024-04-25 20:12

-

影/劉涵竹長9公分子宮肌瘤:與它和平共處 是否影響生育這樣說

42歲前主播劉涵竹去年3月做健檢時,發現子宮長6顆息肉還有9公分大的肌瘤,已經壓迫到膀胱,她今(25)日主持「響應『2024國際玫瑰斑月』避免玫瑰斑復發」活動,透露治療後子宮肌瘤已經縮小,目前與病灶和

2024-04-25 18:00

運動

更多運動-

影/差點被爆頭!山本由伸沒收168公里強襲球 主播:不可思議

MLB洛杉磯道奇今(26)日在客場交手華盛頓國民,道奇派出「日本最強投手」山本由伸先發主投,他此役可說是展現完美壓制力,主投6局無失分、送出7次三振,表現精彩。比賽中,山本由伸更是展現美技,在對決國民

2024-04-26 07:50

-

MLB/大谷翔平熄火沒關係!山本由伸好投 道奇2:1勝國民奪4連勝

MLB華盛頓國民今(26)日在主場迎戰「邪惡帝國」洛杉磯道奇,此戰國民打線發揮不佳,僅靠Joey Meneses得點圈適時安打攻下1分,道奇靠著山本由伸6局無失分好投,與Teoscar Hernand

2024-04-26 07:41

-

大谷翔平跟YOASOBI成了同門師兄妹?解密美國超大型經紀公司CAA

大谷翔平跟YOASOBI成了同門師兄妹?日本超人氣音樂組合YOASOBI在2023年因為動漫《我推的孩子》主題曲《Idol》風靡全球,今年1月曾來台舉辦演唱會在開賣前造成網站系統癱瘓,瞬間秒殺一票難求

2024-04-26 05:14

-

大谷翔平被盜5億沒差!不受水原醜聞影響 外媒揭代言收入逾21億

洛杉磯道奇隊球星大谷翔平日前經歷水原一平詐欺案,遭竊取超過1600萬美元(約新台幣5.2億)。帳戶憑空消失如此龐大的金額,而大谷本人卻毫不知情,也令外界十分納悶。結合日媒《full count》針對大

2024-04-26 03:24

財經生活

更多財經生活-

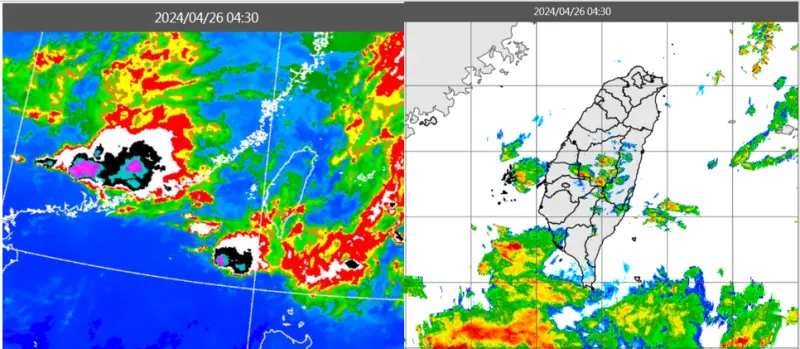

天氣預報/今明致災性降雨!不定時雷擊+瞬間大雨 好天氣等這天

今(26)明兩天受到鋒面加西南風增強影響,形成極不穩定的大氣,各地要留意不定時的劇烈天氣「雷擊、強風、瞬間大雨、冰雹⋯等」,週日(28)晚間雨勢漸歇,下週五、六(3、4日)滯留鋒遠離,天氣好轉。氣象專

2024-04-26 08:04

-

今天就喝!7-11美式買1送1、全家第2杯10元 勞動節咖啡51杯送51

7-11、全家五六日優惠今起開跑,7-11精品美式、特大杯美式買1送1,國際奶珠奶茶節,7-11珍珠奶茶系列限時6天同價位任選買1送1,有珍珠奶茶、冰胭脂紅茶珍珠歐蕾、珍珠奶茶,勞動節APP寄杯咖啡買

2024-04-26 07:45

-

今彩539頭獎800萬開2注!4/25獎落「新北、台南」 威力彩槓龜了

今(25)日晚間今彩539第113000100期開獎,最終開出2注800萬元頭獎,獎落台南市永康區東橋里東橋一路111號1樓「迎東橋彩券行」、新北市新店區中興路三段1號「大偉投注站」;威力彩第1130

2024-04-25 22:23

-

快訊/威力彩頭獎保證2億!「4/25完整獎號」出爐 中了直接退休

威力彩第113000034期今(25)日晚間開獎,本期頭獎為2億元,就在剛剛「完整獎號」已經完全開出,快拿起手邊彩券對獎,看看是否有財神降臨吧!🟡4/25威力彩中獎號碼(第113000034期)第一

2024-04-25 20:48

全球

更多全球-

暴雨沖壞監獄圍欄!奈及利亞118名囚犯趁機落跑 初步僅追回10人

非洲奈及利亞24日晚間遭暴雨侵襲,首都阿布賈(Abuja)附近的一座監獄遭到破壞,至少有118名囚犯趁亂越獄,當局急忙逮人之際,也呼籲民眾提高警覺,遇到可疑狀況隨時向警方通報。綜合《路透社》等外媒報導

2024-04-26 07:47

-

美校園爆挺巴示威!警察清場逮人 以色列總理:想起納粹德國

美國多間大學聲援巴勒斯坦的示威潮,近日越演越烈,紐約警方上週逮捕在哥倫比亞大學紮營抗議的學生,讓事態發展更加緊張,其他學校的學生紛紛也效法在校園內設置帳篷,聲援哥大示威者。美國警方數度出動人力,已逮捕

2024-04-26 07:00

-

經濟增速緩、滯脹風險增!美股道瓊重挫375點 Meta股價瀉10.56%

美國上季經濟增速大幅放緩,第一季GDP年增1.6%,遠低於經濟學家之前預期的2.4%,同時主要通膨指標急升,個人消費支出(PCE)平減指數初報為3.4%,遠高於上一季的1.8%,加深了通膨持續的擔憂。

2024-04-26 06:06

-

美國第一季GDP成長不如預期!美股開盤重挫 道瓊崩跌逾600點

美國公佈最新經濟數據,第一季GDP年增1.6%,遠低於經濟學家之前預期的2.4%,個人消費支出(PCE)平減指數初報為3.4%,遠高於上一季的1.8%,加深了通膨持續的擔憂。經濟疲軟與通膨威脅雙重夾擊

2024-04-25 22:55