《鄉民大學問EP.39》字幕版|#柯文哲 的三大案連環爆!涉貪污遭列被告 陳智菡曝內幕!蔡正元:離總統路更近!民眾黨再演宮鬥劇?柯文哲與黃國昌竟是這關係?#韓國瑜 立院霸氣喊“閉嘴” 2028真再戰?

NOW影音

更多NOW影音焦點

更多焦點-

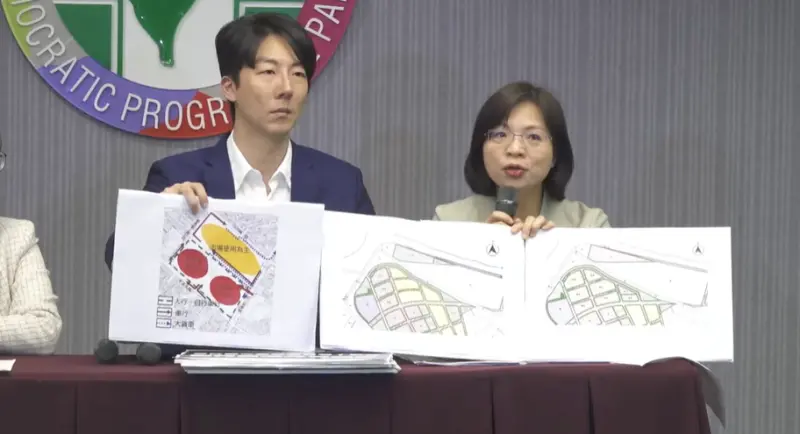

敢不敢講侯友宜?林淑芬再嗆「抓鬼隊長」黃國昌出來抓鬼、打球

蘆洲南北側專案通盤檢討案,引爆民進黨立委林淑芬與台灣民眾黨立委黃國昌隔空交鋒。林淑芬今(8)日再度痛斥黃國昌無知,「你這麼遵從新北市長侯友宜,請問侯這樣圖利財團敢不敢出來講兩句?」呼籲抓鬼大隊長黃國昌

2024-05-08 10:09

-

這原因美元轉強!日圓貶破155 新台幣早盤貶逾1角至32.471元

隨著美國公債殖利率收斂跌幅,加上美國聯準會(Fed)官員暗示今年可能不會降息,美元指數回升,日圓兌美元貶破155價位,新台幣兌美元今(8)日早盤也在美元轉強及台股走跌之下,貶破32.4元,並下探32.

2024-05-08 10:12

-

周杰倫點名好友挑戰經典歌曲!林書豪演唱影片曝光:來個8.7分吧

「亞洲天王」周杰倫與前NBA球星林書豪的麻吉情眾所周知,2人時常在社群平台上互動,展現好交情。近日,林書豪在比賽時遭對手撞傷,導致右側眉骨撕裂傷。昨(6)日林書豪臉上頂著腫包,深情演唱周杰倫的經典歌曲

2024-05-07 15:47

-

嘉義太保惡火3死!父獨扛生計養一家7口 抱3女兒逃出火場被燒傷

昨(7)日晚間7時許,嘉義縣太保市民生路96巷一處平房因不明原因發生火警,柯姓一家7口房屋全毀,造成41歲柯妻、7歲長子、3歲次子不幸喪生,只留下柯父與3名女兒,而柯父目前也因被濃煙嗆傷,插管住進加護

2024-05-08 10:08

精選專題

要聞

更多要聞-

徐巧芯爆料挨告洩密!苦苓:不是監督、揭弊 根本就是八婆的行為

國民黨立委徐巧芯爆料,外交部援助烏克蘭1千萬美元,流向有疑慮,外交部提告洩密。徐巧芯說不怕被告,會繼續爆料,身上沒傷痕不算將軍。作家苦苓說,徐巧芯不是監督、也不是揭弊,只有「打聽」和「謠傳」,根本就是

2024-05-08 09:59

-

陸委會報告稱「美仍估中共2027攻台」!軍方:國軍不避戰、不求戰

陸委會2024年第1季中國大陸情勢書面報告日前出爐,根據陸委會分析,中共對台將加大「反獨促統」力度,同時也提到美方再度提醒2027年共軍將「做好入侵台灣的事前準備」。對此,國防部副部長柏鴻輝今(8)日

2024-05-08 09:58

-

特赦扁非空穴來風?沈富雄曝「已在秘密作業」:賴清德會很感謝

總統蔡英文520卸任倒數,不過有媒體報導指出,蔡英文已決定520卸任前特赦前總統陳水扁,陳水扁則表示,「毫無所悉,無從回應。」對此,前立委沈富雄認為,這個消息不會是空穴來風,「我嗅到一種味道,就是已經

2024-05-08 09:46

-

蔡英文將特赦陳水扁?黃暐瀚揭「出手意圖」:這人也曾喊話馬英九

總統蔡英文520卸任倒數,不過有媒體報導指出,蔡英文已決定520卸任前特赦前總統陳水扁。對此,資深媒體人黃暐瀚指出,這個消息傳出,究竟讓要事成,還是要給蔡英文一個燙手山芋,還不一定;他也提到,過去陳菊

2024-05-08 09:32

新奇

更多新奇-

爸爸、哥哥、男友全都劈腿!「3人同1職業」女震撼:英國研究真準

身邊3個男人全部都偷吃!一名女網友最近發文分享抒發心情,表示自己的父親、哥哥以及現在的男友,職業全部都是「銷售業務」,然而全部共通點都是有劈腿的不良紀錄,讓她感到非常的無力直言:「我們家不知道是中什麼

2024-05-08 07:50

-

Energy坤達越老越帥!「21年前青澀照」出土 金秀賢也是同款男人

台灣男子團體Energy睽違20年合體復出,結果上週末在台北舉辦簽唱會,高人氣的他們竟然一路簽到凌晨三點,連團員坤達的老婆柯佳嬿都在社群平台上詢問:「簽完了嗎?」笑翻不少粉絲。然而,隨著Energy復

2024-05-08 07:11

-

全聯「隱藏任務」曝光了!結帳多1步驟倒賺40元 婆媽一看眼神死

全聯福利中心因為營業時間長,加上販售生鮮雜貨、日常生活用品應有盡有,成為不少上班族以及婆媽購物的首選之地,然而就有顧客最近去逛全聯發現,官方最近推出的最新活動,只要到全聯消費達到一定的次數、金額以及使

2024-05-08 06:23

-

不輸統一、維力!台灣泡麵「公認最可惜品牌」曝 眾吃過懷念10年

台灣泡麵市售品牌有非常多種類,近幾年更是引進許多國外泡麵提供民眾選擇,而本土的品牌也持續更新優化推出新口味,像是老字號的「維力」以及「統一」、「味丹」等等,到現在還是都有其新產品的誕生,也一直都是台灣

2024-05-08 06:15

娛樂

更多娛樂-

翁馨儀嫁張家11年「第一次和公公張菲合照」 親密勾手吐背後原因

31歲翁馨儀20歲帶球嫁大13歲張菲次子、同為演員的張少懷,結婚11年育有女兒「櫻桃」、兒子「栗子」。翁馨儀時常在粉專分享生活,不過鮮少提及公公張菲,昨(7)日她罕見公開和張菲的親密合照,居然是兩人首

2024-05-08 09:21

-

余天想養外孫「願支付開銷」 女婿Gary被爆情勒:先匯4000萬給我

余天女婿、次女余苑綺(已改名余泳澐)老公Gary(陳鑒)涉嫌和詐騙集團合作,擔任車手頭收受贓款,被依詐欺罪聲押獲准,余家上下聽聞Gary遭逮捕,第一反應就是去把兩個外孫接回來,據傳,余家在余苑綺癌逝後

2024-05-08 08:14

-

楊紫瓊盛裝出席Met Gala!遭虧身穿「揉皺錫箔紙」 登場依舊霸氣

2024年度的Met Gala在台灣時間7日早上舉行,奧斯卡影后楊紫瓊身穿一襲銀色晚禮服驚豔登場,被不少粉絲開玩笑說像是穿著揉皺的錫箔紙。雖說如此,楊紫瓊還是難掩霸氣氣場,所到之處都是鎂光燈及眾人的焦

2024-05-07 19:37

-

韓藝瑟搶當5月新娘!IG甜蜜公布與小10歲男友結婚喜訊:誰在乎呢

曾出演參演《九尾狐外傳》第2女主角爆紅,接著出演《幻想情侶》、《20世紀少男少女》、《Big Issue》等韓劇的42歲女演員韓藝瑟,今(7)日在IG上宣布自己與小10歲男友柳成宰登記結婚的喜訊,並在

2024-05-07 19:10

運動

更多運動-

NBA季後賽/Jaylen Brown轟32分!塞爾提克120:95大勝騎士拿下G1

波士頓塞爾提克今(8)日在NBA次輪季後賽G1迎戰克里夫蘭騎士,此役騎士一哥Donovan Mitchell狂轟全場最高33分,但「綠衫軍」靠著優異的團隊火力,Jaylen Brown、Derrick

2024-05-08 09:42

-

NBA季後賽/尼克中鋒Mitchell Robinson左腳踝再度受傷 將缺席G2

紐約尼克在季後賽次輪以121:117擊敗印第安納溜馬,但在第2戰開打前,尼克方面卻傳出壞消息,中鋒Mitchell Robinson因左腳踝傷勢,將不會出戰對陣溜馬的G2,Robinson的缺席對於尼

2024-05-08 09:31

-

Anthony Edwards不是喬丹!傳奇射手稱:他比較像有跳投的閃電俠

NBA明尼蘇達灰狼在西區季後賽交手丹佛金塊,在G1與G2靠著「蟻人」Anthony Edwards分別砍進43分與27分,順利在系列賽搶下2勝0敗的優勢。Anthony Edwards的好表現,被許多

2024-05-08 09:24

-

Jamal Murray往場內丟「熱敷袋」G3沒被禁賽!聯盟開出320萬罰單

NBA丹佛金塊隊昨(7)日在西區季後賽次輪G2,以80:106慘敗給明尼蘇達灰狼,系列賽0:2落後。此役在場上發生意外插曲,金塊主控Jamal Murray在次節將熱敷袋丟到場內,賽後遭到灰狼主帥嚴厲

2024-05-08 08:43

財經生活

更多財經生活-

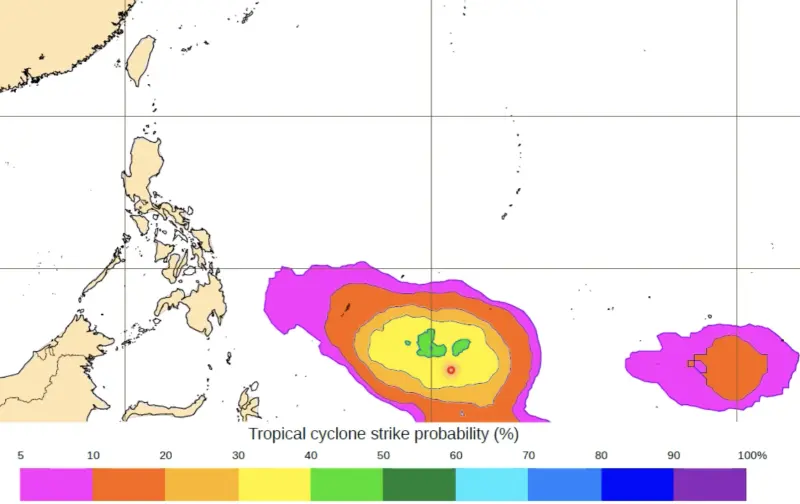

第1號颱風「艾維尼」要來了?賈新興揭生成機率 對台灣影響出爐

今年第一號颱風「艾維尼」(Ewiniar,米克羅尼西亞提供,原意為風暴之神)有機會在未來10天內生成,氣象專家、台灣整合防災工程技術顧問公司總監賈新興表示,目前各國預報模式分歧,以歐洲模式來看,在5月

2024-05-08 09:53

-

颱風「艾維尼」下週恐生成!今晚低溫跌1字頭 母親節後全台有雨

今(8)日東北季風增強、微弱鋒面通過,氣象專家、中央大學大氣系兼任副教授吳德榮表示,降雨主要集中在北海岸和東半部,山區午後有短暫陣雨,北台灣入夜氣溫驟降,低溫將來到攝氏19度左右,明後天(5/9、5/

2024-05-08 08:25

-

今起喝到母親節!7-11美式25元、拿鐵買1送1 全家寄杯奶茶買2送1

超商母親節優惠開跑!今(8)日起7-11美式、拿鐵、卡布奇諾買1送1,相當於濃萃美式單杯只要25元開喝,咖啡以外的品項則有黑糖珍珠撞奶、英式紅茶、青梅冰茶通通買1送1;全家則是限時3天推出私品茶買2送

2024-05-08 08:06

-

大樂透5/7頭獎槓龜!貳獎「一注獨得」爽領466萬 台灣富翁再+1

大樂透第113000050期今(7)日晚間開獎,本期頭獎為1.3億元,不過派彩結果顯示頭獎槓龜,貳獎則是一注獨得,幸運兒獲得獎金466萬8297元新台幣,詳細派彩公告仍需以台彩官網公佈為主。🟡5/7

2024-05-07 22:04

全球

更多全球-

巴哈馬承認巴勒斯坦為國家 稱「支持人民自由決定政治地位」

巴哈馬外交部7日發出聲明,宣布巴哈馬正式承認巴勒斯坦為一個國家,並稱支持巴勒斯坦人民自決,並重申支持兩國方案。巴哈馬外交部在聲明稿中表示,巴哈馬相信,承認巴勒斯坦國一事強烈表明,巴哈馬對《聯合國憲章》

2024-05-08 09:13

-

習近平的杯具頻受矚!訪法會談獨用「黑色水杯」 網:怕被下毒?

中國國家主席習近平近來展開五年來首次對歐洲國家的訪問行程,在結束對法國的國事訪問後,目前已經抵達塞爾維亞首都貝爾格勒。習近平這趟訪歐之旅,引起國際關注,除了到達法國時所承受的示威浪潮外,他在與法國總統

2024-05-08 08:44

-

台積電改變日本職場文化?鹿兒島企業嘆:年輕人跳槽門檻變低了

台積電於在日本熊本縣菊陽町設廠,成為近來台日工商業界的熱門話題。由於設廠帶來大量工作機會,有許多日本相關科系的學生,紛紛前往台積電日本廠求職。不過台積電熊本廠雖然帶來了錢潮,但也造成熊本縣其他企業面臨

2024-05-08 07:38

-

等重要經濟數據進入「冷靜期」!美股幾以平盤作收 道瓊連五紅

美國股市經過最近劇烈震盪後,在週二(7日)進入「冷靜期」,收盤接近開盤價。投資人正在等待將在本月公布的重要經濟數據。道瓊工業指數終場小幅收高32點,為連續第五個交易日收紅;標普500指數則為連續第四個

2024-05-08 06:28