《鄉民大學問EP.37》搶先看|網傳妹妹黃智賢帳號被盜 轉綠?黃偉哲發誓曝真相!陳亭妃、王定宇、林俊憲 鴨子市長選戰划水?邱明玉大膽預測台南市下一步!|NOWnews

NOW影音

更多NOW影音焦點

更多焦點-

大法官可能做死刑違憲決議?藍委憂:送給蔡英文的卸任禮物

國內37名死囚主張「死刑」違憲,向司法院憲法法庭聲請釋憲;死刑憲法辯論今(23)日登場,大法官7月將作死刑是否違憲的宣告。對此,國民黨立委賴士葆表示,民進黨整個黨的方向就是廢死,大法官是否做出政治上解

2024-04-23 15:06

-

台股反攻訊號出現?外資結束連9賣、今日加碼14億

台北股市今(23)日回神,在權王台積電回神之際,再加上非電族群齊攻,最高來到19709點,終場上漲188.06點或0.97%,來到19599.28點,成交量為344.668億元;三大法人合計買超62.

2024-04-23 15:22

-

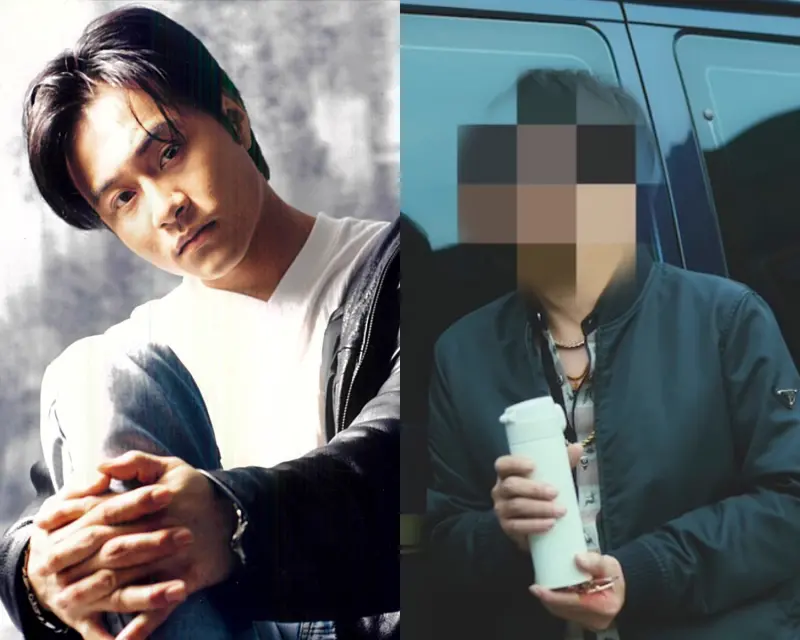

男歌手神似張國榮爆紅「消失螢幕30年」 現身《不夠善良的我們》

《不夠善良的我們》第5、6集有3大重量級客串人物登場,30年前曾以《我的憂傷不讓你看出來》爆紅的歌手陳逸達,當年因神似張國榮竄起,作品橫跨歌壇、影壇之際,卻突然銷聲匿跡棄影從商,這次被導演徐譽庭請來客

2024-04-22 16:16

-

求復合遭拒!高雄恐怖情人狂砍前女友30刀 法院一審判決曝

高雄一名余姓男子(33歲)因不滿吳姓女友(23歲)提出分手,遂於去年9月13日凌晨前往對方任職的超商持刀攻擊,導致吳女身中30多刀,所幸緊急送醫後無生命危險,案經調查,警方當晚6時許在左營區一間麥當勞

2024-04-23 14:36

精選專題

要聞

更多要聞-

大法官可能做死刑違憲決議?藍委憂:送給蔡英文的卸任禮物

國內37名死囚主張「死刑」違憲,向司法院憲法法庭聲請釋憲;死刑憲法辯論今(23)日登場,大法官7月將作死刑是否違憲的宣告。對此,國民黨立委賴士葆表示,民進黨整個黨的方向就是廢死,大法官是否做出政治上解

2024-04-23 15:06

-

國軍今年13官兵輕生!陸軍五支部聯保廠副廠長營外自傷亡

國軍從今年初開始爆發多人因故死亡案例,昨日再傳出陸軍第10軍團第五支部也發生憾事。第五支部嘉義聯保廠修理工廠張姓副廠長休假期間,因故在營外自傷身亡。對此,十軍團深表遺憾,將全力配合檢警調查,並撫慰家屬

2024-04-23 14:55

-

花蓮再傳災情!綠委指傅崐萁訪中「三不對」 籲以地方為重

近期全台餘震不斷,花蓮縣更是首當其衝,陸續傳出有建物傾斜甚至倒塌災情,而外界質疑國民黨立法院黨團總召傅崐萁計畫在後天訪中是否調整行程,對此民進黨立委陳冠廷今(23)日表示,區域立委應以選區事務為重,若

2024-04-23 14:50

-

貸38萬還52萬!融資貸款亂象橫行 民眾黨提案催生《融資公司法》

近年來,台灣坊間出現許多商品貸、機車貸、小額投資,號稱用小資產就可獲高額貸款,二胎、三胎皆可貸,但此類型公司並無管理、無徵信可貸、利率也無管制,讓許多民眾誤入財務陷阱痛苦不堪。有民眾貸款38萬,但被要

2024-04-23 14:27

新奇

更多新奇-

統神YouTube頻道「經營6年失言遭刪」!火大發聲 申訴2次遭打槍

知名實況主「統神」張嘉航日前因為評論黃子佼爭議事件時,語出驚人講錯話,而引爆爭議,隨後不僅被多家遊戲廠商終止合作,經營6年的YouTube頻道更是直接被官方刪除。對此,統神22日晚間首度發文透露近況,

2024-04-23 08:28

-

自助餐店荷包蛋特好吃!她在家還原沒成功 行家揭關鍵:不是煎的

雞蛋可說是現代人餐桌上最常見的食材,美味的雞蛋料理從小孩到老人幾乎都愛不釋手。就有主婦表示,自己覺得自助餐店荷包蛋特好吃,但在家嘗試還原卻都沒成功過,讓她只好上網求助,沒想到貼文曝光後,許多行家道破關

2024-04-21 21:53

-

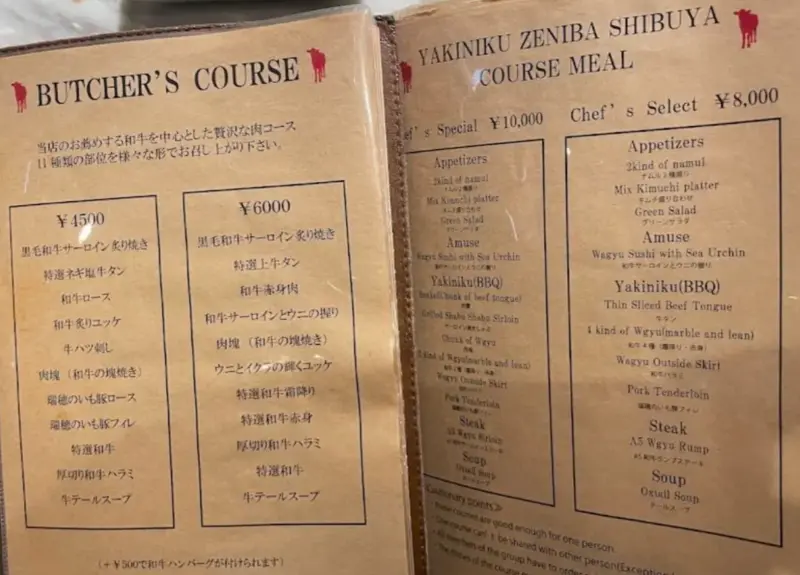

日本燒肉店「外國人菜單」貴4千!一堆台灣客上當 怒轟:超無恥

被台灣人視為第一名旅遊地的日本,竟也暗藏收費差異陷阱!近期有台灣旅客前往日本東京一間燒肉店用餐,結果店家發現一行人非當地人,竟給了「外國人菜單」,沒想到對比當地人菜單方案,不但價格要貴、份量還少了許多

2024-04-21 17:17

-

1萬元鈔票誤投碎紙機!神人花3周「從紙屑還原」 銀行一看給過了

強大的耐心與集中力的展現!一位日本民眾分享,自己爸爸不慎將1萬日元(約新台幣2103元)隨著廢棄文件投入碎紙機,當響起來了之後鈔票已經混入大量廢紙中,沒想到當事人竟發揮強大集中力,耗時3周把萬元鈔票紙

2024-04-21 16:22

娛樂

更多娛樂-

《死侍與金鋼狼》限制級預告公開!光頭「神祕角色」打趴金鋼狼

2024年最受漫威影迷們期待的《死侍與金鋼狼》,將於7月24日(三)搶先在全美、全台大銀幕上映,2大漫威救世主「死侍」與「金鋼狼」終於夢幻合體,讓影迷們都十分興奮。漫威影業昨(22)日晚間釋出《死侍與

2024-04-23 14:36

-

親姐認愛樂天球星宋嘉翔!啦啦隊一粒一臉茫然 羞笑:我也很混亂

台鋼雄鷹啦啦隊女神一粒(趙宜莉)爆紅,也讓人挖出她的雙胞胎姊姊,同樣也是美到不行,姊妹倆一舉一動都成為球迷關注話題。近期卻傳出一粒的姊姊與樂天桃猿的大物新人捕手宋嘉翔交往中,怎料一粒姊姊不藏了,直接在

2024-04-23 13:54

-

許美靜開唱划水!「台下怒喊退票」主辦方回應 5月演唱會急喊卡

49歲新加坡歌手許美靜以一曲《城裡的月光》走紅歌壇,20日她到大陸南京開演唱會,全長2個半小時她只有30分鐘真的開口唱歌,引發台下歌迷抗議怒喊退票。她的經紀團隊昨(22)日回應爭議,「低估觀眾想聽原唱

2024-04-23 13:21

-

啦啦隊「最仙女團長」Rina爆熱戀籃球明星!本人露面曖昧回答了

樂天女孩團長Rina(謝艾娜)今(23)日爆出與PLG台灣職籃桃園領航猿的球星陳昱瑞熱戀交往,還被拍到兩人同住一間住處,引發球迷討論,而在今日中午,Rina現身新莊活動擔任表演嘉賓,被問到戀情一事,R

2024-04-23 13:02

運動

更多運動-

Jokic第5次季後賽轟「20籃板大三元」 石佛、狼王加起來還不如他

NBA丹佛金塊對決洛杉磯湖人的首輪季後賽G2,金塊雙星Nikola Jokic和Jamal Murray打得比過去更加艱難,但是Jokic最終又是繳出27分20籃板10助攻的「超級大三元數據」,並且再

2024-04-23 14:43

-

DLo明顯被打臉了!詹皇嗆回放中心是狗屁 爆粗口飆罵:他X的愚蠢

洛杉磯湖人隊在季後賽首輪G2以99:101敗給丹佛金塊,在系列賽吞下2連敗。賽後,「詹皇」LeBron James對湖人後衛D'Angelo Russell被金塊前鋒Michael Porte

2024-04-23 14:42

-

湖人苦吞對戰金塊10連敗!DLo不氣餒:我喜歡球隊現在的狀態

NBA首輪季後賽今(23)日丹佛金塊在主場續戰洛杉磯湖人,儘管湖人一度握有20分領先優勢,但金塊在第四節急起直追,前三節表現不佳的Jamal Murray站出來扮演英雄,成功完成絕殺,率領金塊以101

2024-04-23 14:42

-

AD第四節神隱0分1籃板!體能問題浮現 守不住Murray絕殺湖迷心碎

NBA季後賽西區洛杉磯湖人今(23)日在客場以99:101不敵衛冕冠軍丹佛金塊,目前湖人在系列賽處於2敗落後。本場比賽,金塊的Jamal Murray投進中距離絕殺球,讓「詹皇」LeBron Jame

2024-04-23 14:17

財經生活

更多財經生活-

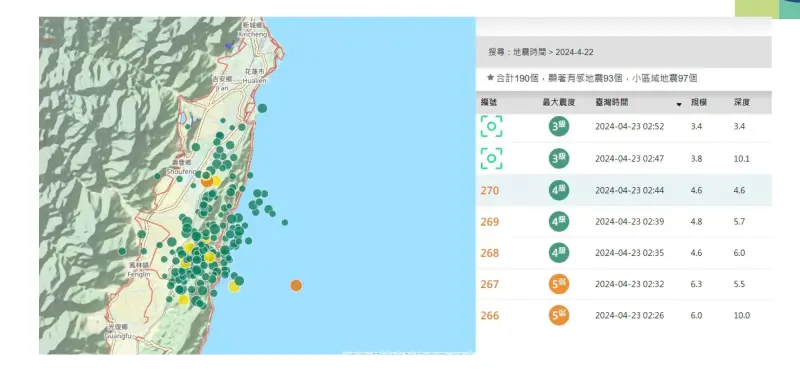

5.8強震花蓮大橋現場曝!電線桿、路標狂晃 轎車嚇壞迴轉不上橋

繼4月3日花蓮發生規模7.2大地震後,從昨(22)日傍晚開始大小地震不斷,今(23)日凌晨更出現兩起規模超過6的強震,也讓位於壽豐的花蓮大橋監視器一度中斷,到了上午8時4分又再度發生5.8強震,更讓現

2024-04-23 14:51

-

花蓮大型群震「1天破200起」!學者揭不斷地震原因:補齊釋放能量

花蓮0403發生規模7.2地震後,近兩天(4/22、4/23)花蓮地區又在10幾個小時內連續發生破200起地震,台大地質系研究所名譽教授陳文山表示,其實從7.2主震後,距離震央,也就是今天一直出現地震

2024-04-23 14:27

-

4/23武財神生日快樂!拜拜供品、禁忌懶人包 補財庫把握大好吉時

今(23)日農曆三月十五是武財神生日,這天也是難得一見的求財吉日,農曆三月十五武財神聖誕可準備供品到廟裡拜拜慶賀,再順道補財庫。《NOWnews》整理了武財神拜拜流程、供品禁忌、求財秘訣,趁現在把財神

2024-04-23 12:47

-

天氣越晚越差!雨彈連6天不定時亂炸 全台「下到發霉」時間出爐

今(23)日鋒面抵達影響台灣,中央氣象局簡任技正伍婉華指出,今天清晨一波降雨後,白天對流移入較少,雨勢略為趨緩,但午後部分地區仍要留意有局部大雨,尤其今晚至明(24)日,台灣上空對流發展旺盛,降雨越來

2024-04-23 12:40

全球

更多全球-

黃金周沒那麼開心了?逾6成日本人出遊難 受限通膨、日圓貶值

每年4月底至5月初是日本所稱的「黃金周」,往年這段期間,許多日本人都會偕親友出遊,目的地不僅限於其他國家,還有日本國內各大觀光熱區。不過今年受到通膨、日圓貶值等影響,有日媒民調顯示,逾6成受訪的日本民

2024-04-23 15:06

-

花蓮地震破千次!餘震南移規模小變大 國外地質學者認非典型

花蓮於4月3日發生芮氏規模7.2地震後,發生大量餘震,原在上週頻率才稍降低,但本周再度爆發,自22傍晚開始至今(23)日中午發生超過200次餘震,且在半夜規模最大來到6.3,這樣的地震活動狀況,就連國

2024-04-23 14:57

-

北約組織無意擴及印太地區!美副國務卿:這類傳聞是中俄認知作戰

美國副國務卿坎伯(Kurt Campbell)22日表示,美國及其歐洲夥伴無意將北約組織擴大至印太地區,並稱這類不實傳聞來自於俄羅斯及中國的認知作戰。根據《南華早報》報導,坎伯強調北約組織的夥伴以及參

2024-04-23 14:08

-

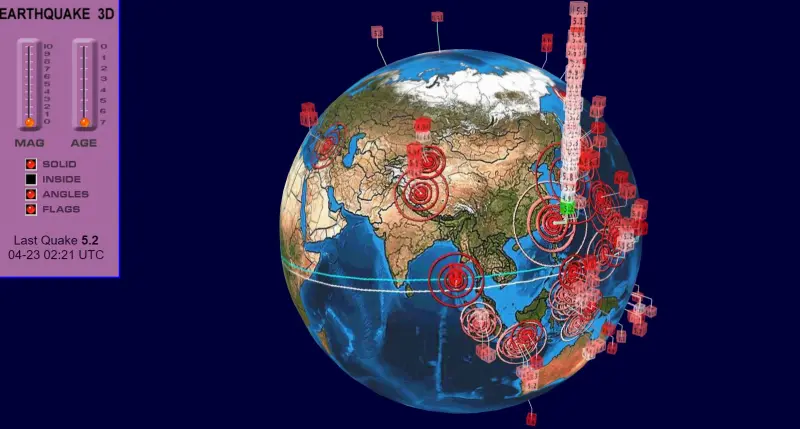

花蓮狂震破千起!「全球地震3D圖」赫見台灣變摩天大樓

花蓮0403強震至今已20天,期間餘震已破千起,22日傍晚起又開始一系列頻繁餘震,規模最大來到6.3。根據全球地震3D即時直播圖「Earthquake 3D Live」顯示,台灣的地震在3D圖疊疊呈現

2024-04-23 13:00