《鄉民大學問EP.37》搶先看|網傳妹妹黃智賢帳號被盜 轉綠?黃偉哲發誓曝真相!陳亭妃、王定宇、林俊憲 鴨子市長選戰划水?邱明玉大膽預測台南市下一步!|NOWnews

NOW影音

更多NOW影音焦點

更多焦點-

80年老隧道漏水!台鐵集集支線部分停駛 拚114年底完工

台鐵集集支線老隧道啟用80年漏水,為了徹底整修,台鐵宣布濁水站至車埕站區間停駛,改採公路接駁,改善工程預計114年12月底完工通車。台鐵說明,集集支線1號、2號及3號隧道使用至今已逾80年,長期累積發

2024-04-23 17:53

-

地震不斷!花蓮今停班 最新退票從寬處理措施一次看

由於地震不斷,花蓮縣今(23)日停止上班,為顧及支票存款戶資金調度受到影響,有關存款不足退票紀錄,中央銀行公布台灣票據交換所退票從寬處理2大措施。央行指出,根據台灣票據交換所訂定的「台灣票據交換所因應

2024-04-23 17:53

-

一粒姊姊甜蜜官宣男友宋嘉翔!現身樂天2軍球場 戀情早有跡可循

台鋼雄鷹啦啦隊成員「一粒」因「葉保弟應援曲」的魔性舞步爆紅,連帶仙氣十足的雙胞胎姊姊Joy也跟著爆紅。今(23)日,Joy也在IG上甜蜜公開球員男友,是樂天桃猿潛力「大物」捕手宋嘉翔。事實上,Joy早

2024-04-23 16:58

-

死刑存廢憲法法庭激辯!人權律師對陣檢察司長 5大爭執點一次看

台灣37名定讞的死囚,集體向司法院憲法法庭聲請釋憲,包括羈押最久的邱和順、年紀最大的王信福等,認為死刑剝奪生命權、生命尊嚴,又違反憲法比例原則,有違憲之虞,今(23)日上午10時憲法法庭開庭言詞辯論,

2024-04-23 17:48

精選專題

要聞

更多要聞-

蘇貞昌扮「水獺阿公」說故事 蘇巧慧虧:功力不減但頭髮少了點

4月23日世界閱讀日登場,立委蘇巧慧經營podcast頻道《水獺媽媽巧巧話》推出特別企劃,邀請行政院長前院長蘇貞昌化身「水獺阿公」擔任特別來賓,父女首次空中同台大展聲音演技,蘇巧慧自曝小時候都聽蘇貞昌

2024-04-23 17:30

-

連收4封死亡威脅信 黃捷:不滿檢驗徐巧芯、不許我再發聲

民進黨立委黃捷曾在上月收到恐嚇信,要求24小時內匯款800萬元,否則她與其團隊將有人身安全。未料今(23)日又在社群平台表示,從本月中起又連收到4封恐嚇信,透過內容判斷,是不滿她對徐巧芯的檢驗與質疑,

2024-04-23 16:33

-

花蓮狂震仍堅持訪中!傅崐萁曝為4件事努力:責無旁貸的公務行程

國民黨花蓮立委傅崐萁原本預計25日將帶隊藍委訪中,但因花蓮餘震不斷,至今已逾千起,訪中行程是否如期前往,備受關注。傅崐萁今(23)日表示,率立委訪問大陸,是為了恢復兩岸交流觀光、為農漁產品打通外銷大陸

2024-04-23 16:19

-

國民黨控家族賺紅錢 鄭麗君嘆:婚後避免惡意攻擊早已撤資中國

國民黨今(23)日召開記者會,指控準行政院副院長鄭麗君,其家族長期透過子公司當白手套,大賺「紅錢」,對此鄭麗君透過辦公室回應,說明其丈夫在2010年婚後就不曾再到中國,此外為避免惡意的攻擊,婚後已經撤

2024-04-23 16:03

新奇

更多新奇-

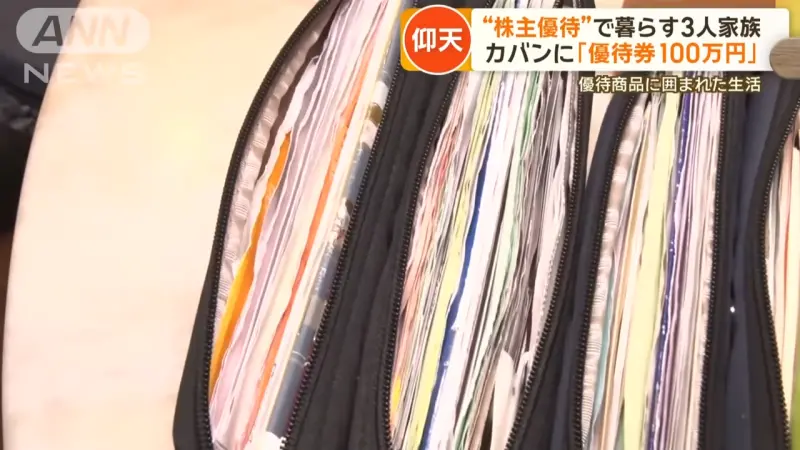

7年買710支股票不賣!1家3口靠「股東福利」活超爽:出門不用花錢

台灣進入股東大會旺季,各家公司開始發放股東會紀念品,例如六福(2705)會發放價值1199元門票給6萬名股東,中鋼(2002)則送出超實用的抗菌多功能不鏽鋼砧板組,總是引發廣大討論。而在日本,更有奇人

2024-04-23 16:56

-

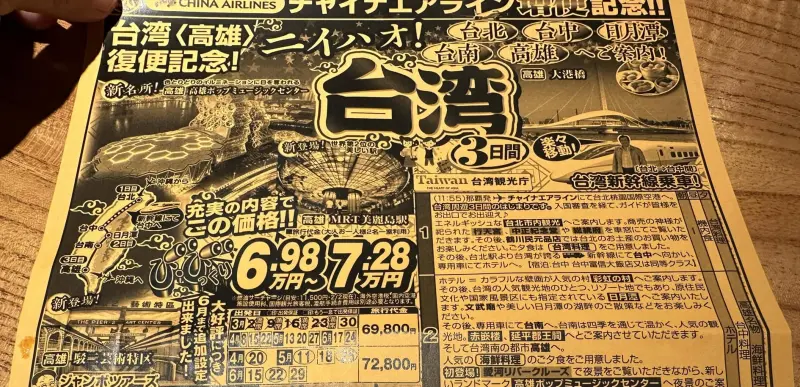

日本旅社推台灣3日遊!團費「不到1萬5」超俗 眾見完整行程嚇壞

這幾年台灣的國旅住宿價格備受關注,許多民眾皆抱怨「飛出國比在台灣玩便宜」,輿論持續發酵,也讓今年農曆春節連假時不少旅宿業者的訂房率慘澹。不過近期就有日本旅行社推出的台灣3天2夜的行程,團費竟然只要1萬

2024-04-23 16:09

-

統神YouTube頻道「經營6年失言遭刪」!火大發聲 申訴2次遭打槍

知名實況主「統神」張嘉航日前因為評論黃子佼爭議事件時,語出驚人講錯話,而引爆爭議,隨後不僅被多家遊戲廠商終止合作,經營6年的YouTube頻道更是直接被官方刪除。對此,統神22日晚間首度發文透露近況,

2024-04-23 08:28

-

自助餐店荷包蛋特好吃!她在家還原沒成功 行家揭關鍵:不是煎的

雞蛋可說是現代人餐桌上最常見的食材,美味的雞蛋料理從小孩到老人幾乎都愛不釋手。就有主婦表示,自己覺得自助餐店荷包蛋特好吃,但在家嘗試還原卻都沒成功過,讓她只好上網求助,沒想到貼文曝光後,許多行家道破關

2024-04-21 21:53

娛樂

更多娛樂-

金秀賢甜蜜放閃金智媛!「曖昧細節」流出 粉絲受不了:請去結婚

Netflix韓劇《淚之女王》精彩的故事讓收視率屢屢創新高,男主角金秀賢也大放送,在IG秀出與金智媛在薰衣草花田裡甜蜜放閃的照片,只見照片中金秀賢幫金智媛撐傘,滿滿的細節讓粉絲們直呼:「你們快去結婚!

2024-04-23 16:50

-

王彩樺拭淚心疼「女兒」孟耿如被罵!怒轟黃子佼:犯錯要自己負責

藝人黃子佼近期接連爆發私藏未成年不雅片、MeToo風波,引發全民怒火,就連妻子孟耿如都選擇關閉所有社群平台,直接神隱不再對外發聲。為此,與孟耿如交情要好的王彩樺,今(23)日出席母親節服裝品牌推廣大使

2024-04-23 16:32

-

《死侍與金鋼狼》限制級預告公開!光頭「神祕角色」打趴金鋼狼

2024年最受漫威影迷們期待的《死侍與金鋼狼》,將於7月24日(三)搶先在全美、全台大銀幕上映,2大漫威救世主「死侍」與「金鋼狼」終於夢幻合體,讓影迷們都十分興奮。漫威影業昨(22)日晚間釋出《死侍與

2024-04-23 14:36

-

親姐認愛樂天球星宋嘉翔!啦啦隊一粒一臉茫然 羞笑:我也很混亂

台鋼雄鷹啦啦隊女神一粒(趙宜莉)爆紅,也讓人挖出她的雙胞胎姊姊,同樣也是美到不行,姊妹倆一舉一動都成為球迷關注話題。近期卻傳出一粒的姊姊與樂天桃猿的大物新人捕手宋嘉翔交往中,怎料一粒姊姊不藏了,直接在

2024-04-23 13:54

運動

更多運動-

影/遭Murray絕殺!紫金大軍0:2落後金塊 李亦伸堅信湖人能逆轉

美國職籃NBA首輪季後賽今(23)日丹佛金塊靠著Jamal Murray神來一投絕殺洛杉磯湖人,系列賽取得2:0領先,晉級下一輪機會濃厚,不過資深球評李亦伸仍堅信湖人能夠逆轉前進下一輪。本場比賽湖人隊

2024-04-23 17:06

-

39歲詹皇超神!寫NBA季後賽史上最老紀錄 盼湖人回主場扭轉頹勢

NBA季後賽西區首輪洛杉磯湖人今(23)日以99:101不敵丹佛金塊,苦吞對戰10連敗,但39歲「詹皇」LeBron James 仍繳出26分、8籃板、12助攻、2抄截和2阻攻的全能表現,成為NBA史

2024-04-23 17:05

-

李亦伸專欄/洛杉磯湖人「技不如人」!若丟G3這個賽季將宣告結束

跟上季西決湖人被金塊0:4橫掃劇本很像,湖人系列賽G2該贏沒贏,金塊101:99逆轉絕殺,湖人七戰四勝制陷入0:2落後。上季西決,湖人G2、G4都曾經取得兩位數以上領先,但都在第四節和最後五分鐘被金塊

2024-04-23 16:34

-

「全力詹」難救湖人!LeBron James兩場打79分鐘 吞季後賽6連敗

洛杉磯湖人今(23)錯失好局,以99:101在客場慘遭丹佛金塊逆轉,系列賽以0:2落後。「詹皇」LeBron James此役出賽38分鐘,19投9中,得到26分12助攻8籃板,可惜無法幫助球隊取勝。湖

2024-04-23 16:25

財經生活

更多財經生活-

CYBERBIZ瞄準智慧零售趨勢 2024推出OMO全通路解決方案

致力成為台灣數位轉型軍火商的 CYBERBIZ順立智慧,成立屆滿10年,繳出漂亮成績單,至今已累積超過35,000家品牌客戶,不重複會員數累計突破千萬人,2023年度整體瀏覽量與消費次數也節節攀升,分

2024-04-23 17:00

-

天氣預報/雨勢升級!明半個台灣防大雨 「下波鋒面更強」變暴雨

鋒面影響天氣將達顛峰!中央氣象署預報員劉宇其表示,今(23)日晚間開始,台灣西半部的雨勢將會變大,直到明(24)日一整天,將是本波鋒面降雨最多的時段,週四(4/25)另一波鋒面接近,並在週五至週日(4

2024-04-23 16:45

-

花蓮強震太扯!台灣「4月地震」已1234起 數量直逼前2年總和

2024年4月3日,花蓮發生規模7.2強震,後續餘震不斷,4月22日至4月23日期間又再出現破200起餘震,據中央氣象署地震測報中心資料統計,光是2024年4月,台灣總地震數就來到1234起,震央大多

2024-04-23 16:10

-

台北101遇強震毫髮無傷!「最猛功臣」登上CNN:連60樓都幾乎沒晃

台灣4月3日發生規模7.2的強震,今(23)日凌晨2時26分及2時32分左右,花蓮連續發生顯著有感地震,規模最大6.2,震度達到「5弱」,截至目前為止,花蓮7.2強震的餘震已經突破1000起,更傳出不

2024-04-23 16:04

全球

更多全球-

路透點名技嘉等3大廠成破口 中國10單位買伺服器產品獲輝達晶片

美國去年底開始收緊針對中國的AI高階晶片禁令,但中國仍不斷嘗試從各種管道突破。一度還有背包客走私晶片的消息傳出。《路透》今(23)日揭露,直指10個中國研究機構透過美超微(Super Micro Co

2024-04-23 17:40

-

馬斯克不重視員工安全?SpaceX工傷率遠高同業 有單位甚至高9倍

美國富豪馬斯克(Elon Musk)旗下火箭公司「SpaceX」,被外媒揭露工傷率遠超過同業平均,根據2023年的數據,SpaceX在德州布朗斯維爾(Brownsville)的工廠,每100名員工中有

2024-04-23 17:20

-

京都清水寺「產寧坂」百年櫻花樹突倒塌 6旬男遊客骨折送醫

日本京都熱門觀光景點清水寺旁「產寧坂」(三年坂),今(23)日上午1棵櫻花樹突然倒塌,壓倒了一名男遊客,警消到場後將男子送醫急救,目前正調查樹木倒塌原因。根據NHK報導,京都市東山區清水3丁目的產寧坂

2024-04-23 16:21

-

憂機密外洩!韓國擬禁止攜iPhone入軍事建築 Android系統不受限

由於擔心敏感訊息遭到錄音外洩,韓國軍方正在考慮全面禁止在軍事建築中使用iPhone,至於使用安卓(Android)系統的智慧手機則不在管制範圍內,因為蘋果iOS系統不允許第三方介入,韓國軍方推出的行動

2024-04-23 16:18