《鄉民大學問EP.40》字幕版|#柯文哲 的最大危機?弊案纏身 天天上頭條 聲量超過黃國昌?!昔友柯高嘉瑜不忍了猛攻京華城案有瑕疵!黃暐瀚稱高:毀柯召集人!王鴻薇挺徐巧芯 現場怒嗆高 場面火爆!

NOW影音

更多NOW影音焦點

更多焦點-

雞蛋產量回升「天熱買氣差」!蛋商陷賣壓 曝批發每斤合理價

近期天氣持續轉熱,雞蛋進入淡季,產量明顯回升卻碰上銷量不佳、供過於求,使得蛋價不斷調降,台北市蛋商公會今(14)日決議將蛋價緩降,並稱「每斤合理價應不超過45元」,後續價格是否調整,會以本週買氣產銷狀

2024-05-14 23:13

-

Uber Eats併購foodpanda!勞動部喊話公平會:維護外送員權益

外送平台UberEats宣布,以9.5億美元併購Delivery Hero旗下「foodpanda台灣外送事業」,Uber今(14)日表示,希望於2025年有機會能獲得併購核准,公平會稱尚未收到業者的

2024-05-14 23:59

-

三重滅門慘案就在家後面!《戲說台灣》女星李宇柔震驚發聲

近日,新北市三重區的滅門慘案讓不少人人心惶惶,曾演出《戲說台灣》的54歲資深女星李宇柔(現名:陳蔓菲)今(12)日傍晚在臉書上發文,震驚表示:「三重全家滅門血案,就在我家後面!」▲女星李宇柔過去是《戲

2024-05-12 22:17

-

台東深夜嚴重車禍!轎車自撞電杆衝進排水溝 1男1女命危緊急送醫

台東市大學路一處平交道附近,今(14)日晚間傳出一起嚴重車禍,當時一部自小客車不明原因撞上變電箱,隨後又失控衝入排水溝中,導致車內2人當場失去生命跡象,目前警消已趕抵現場救援,詳細情形還有待進一步釐清

2024-05-14 22:00

精選專題

要聞

更多要聞-

台智光延燒!柯文哲嘆「太好笑了」:當檢舉人反被調查

針對台智光、北士科、京華城三大案爭議,民眾黨主席柯文哲連日親上火線回應不實指控,昨(13)日晚間起一連三天,在YouTube節目「柯P揪時在」當中直球對決,節目今(14)日晚間播出Part2,針對台智

2024-05-14 21:45

-

4字總結宴請黨籍立委!賴清德溫情喊:要把民意放在心中最高位

在就任總統前夕,準總統賴清德今(14)晚在福華飯店宴請黨籍立委,並交換意見。民進黨立法院黨團幹事長吳思瑤會後透露,賴清德在會中呼籲,大家應捍衛民進黨價值、要把民意放在心中最高的位置,而總結今晚,能用「

2024-05-14 21:14

-

陸軍新任士官督導長林榮華曝光 勤走基層力推強化士官職能方案

陸軍新任士官督導長林榮華今(14)日前往第3作戰區主持「強化士官職能、教育、經管作為」巡迴座談,披露當下國防部推動強化士官職能方案部分內容,並承諾盡力爭取更佳的待遇,積極留用願意為國效力的優秀人才。陸

2024-05-14 21:14

-

影/賴清德宴請黨籍立委兩度發言 綠委曝:一開始氣氛沈重

副總統暨民進黨主席賴清德,今(14)日晚間6時於福華大飯店宴請黨籍立委,過程長達2個多小時,結束後民進黨立法院黨團幹事長吳思瑤受訪透露,過程中一開始氣氛有點沈重,因立院面臨表決必輸的狀況,但大家共識是

2024-05-14 21:00

新奇

更多新奇-

foodpanda被Uber Eats併購 熊貓外送員歡呼:以後沒有送上樓規定

台灣外送圈震撼彈!Uber Eats以9.5億美元(約新台幣308億元)現金,併購台灣foodpanda,合併案引發外送員討論,有熊貓外送員歡呼表示,以後少了「送上樓」規定,實在太好了。Uber Ea

2024-05-14 17:35

-

Uber Eats併購台灣foodpanda 吳柏毅改名「吳柏熊」!粉絲笑瘋了

Uber和foodpanda母公司Delivery Hero SE已經簽署協議,由Uber 以9.5億美元(約新台幣308億元)現金併購foodpanda台灣外送事業,預計2025上半年完成交易,一旦

2024-05-14 13:32

-

直接訂日本旅館虧大了!行家「多1步驟」秒省3千多塊:已變成常態

受到日幣大幅度貶值的影響,近幾年飛日本玩已經不再奢侈,當地好玩又好買,成為全球觀光客聚集的旅遊天堂。但日前卻不斷開始傳出,當地餐廳甚至飯店都制定出「觀光客價格」,相關證據也被遊客逐漸發現,同時也有行家

2024-05-14 12:03

-

看5萬部謎片多人已陣亡!平台再徵「謎片分類員」 薪資、條件曝

成人直播平台 SWAG 今年寒假公開招募「謎片分類員」,工作要看超過5萬部成人影片並分類引發討論,時隔4個月,不少分類員已「陣亡」,業者今(14)再度公開徵人,要年滿18歲,熟悉謎片類型、姿勢的大學生

2024-05-14 11:45

娛樂

更多娛樂-

韓長腿女神李雅英想婚了!自爆暗戀對象是「他」 親曝理想3條件

有「全民表妹」之稱的韓國啦啦隊女神李雅英,自從宣布加盟職籃T1聯盟台啤永豐雲豹後,一舉一動都是粉絲們關注的重點,每每上場應援都能收獲一大批台灣粉絲,隨後加盟富邦Fubon Angels,更成為球場大砲

2024-05-14 19:20

-

李多慧私下醜照曝光!雙層下巴、大鼻孔嚇人 散布人是閨密籃籃

「小龍女」韓籍成員李多慧跳槽味全龍後爭議不斷,日前被爆料拍廣告時,經紀公司堅持她必須站C位,要求更改已經排好的站位表,慘遭換角,公司後來解釋是「提議取消C位」,被酸越描越黑。李多慧心情似乎沒被風波影響

2024-05-14 18:38

-

NewJeans將被冷凍?家長爆公司要讓孩子「放長假」 HYBE出面反擊

韓國最大娛樂公司「HYBE娛樂」與旗下廠牌「ADOR」代表閔熙珍的紛爭一波未平一波又起。近日,有韓國媒體爆料有NewJeans成員的父母出面接受採訪,爆料「HYBE娛樂」的CEO朴智元稱:「要給孩子們

2024-05-14 18:23

-

Energy坤達、TORO是高中同學!風雲人物曾回母校 制服嫩照被挖出

「最殺舞蹈男團」Energy牛奶(葉乃文)、阿弟(蕭景鴻)、書偉(張書偉)、TORO(郭葦昀)、坤達(謝坤達)單飛不解散15年合體回歸樂壇,重燃6、7、8年級生的青春回憶,賣的是情懷也是天生藝人的實力

2024-05-14 17:57

運動

更多運動-

中信特攻奪冠班底少2人!金恩、林秉聖離隊太傷?劉志威不這麼看

新北中信特攻在季後賽以2:3遭到淘汰,無緣打進總冠軍賽,衛冕失敗。去年奪冠後,特攻面臨主力傷病和離隊的問題,雖然他們撐過了一個賽季,但最終一些影響還是在這個系列賽展現出來。林秉聖和金恩兩位冠軍功臣的離

2024-05-15 02:21

-

網球/許育修台將單打唯一希望 壽星吳東霖惜敗、雙打再出發

2024華國三太子國際男子網球挑戰賽,臺灣單打5虎將同日登場,然而僅「臺灣一哥」許育修順利過頭關,其餘四人止步首輪,也讓許育修成為臺將僅存的單打唯一希望。許育修上演甜蜜復仇,7-6(7-5),6-3力

2024-05-15 02:08

-

25年最大重量級拳擊冠軍戰 !「烈火擂台」福瑞、烏希克頂尖對決

近25年來拳擊界最盛大的一場對決「烈火擂台」將於本周末登場!WBC和正統冠軍「吉普賽之王」泰森福瑞(Tyson The Gypsy King Fury)將對上WBO、IBF、WBA統一冠軍亞歷山大烏希

2024-05-15 02:00

-

T1/林秉聖帶病上陣!坦言已氣力放盡 淘汰特攻直言「很感動」

臺北戰神後衛林秉聖成為上賽季拿下T1總冠軍的球員中唯一還留在季後賽之中的人,在今年季後賽,他幫助戰神以總比分3:2擊敗前東家新北中信特攻,晉級總冠軍賽。賽後他透露自己身體欠佳,感染流感,但自己真的很想

2024-05-14 23:18

財經生活

更多財經生活-

大樂透5/14槓龜!下期頭獎「上看1.7億」 第113000052期獎號查詢

大樂透第113000052期今(14)日晚間開獎,本期頭獎為1.7億元,但派彩結果顯示,頭獎、貳獎皆槓龜,下期頭獎上看1.7億元。🟡5/14大樂透中獎號碼(第113000052期)由小到大依序為06

2024-05-14 22:16

-

Toyz 5/16入監!明晚最後直播「有話和大家說」 粉絲淚送:刑安

知名直播主Toyz(劉偉健)因涉嫌販賣二級毒品大麻菸彈,遭法院判處4年2個月,三審全案定讞。據悉,Toyz將在16日上午前往台中地檢署報到,並於當日發監至台中監獄服刑。而明(15)晚將是Toyz最後一

2024-05-14 22:03

-

快訊/大樂透頭獎1.7億!「5/14完整獎號」全開出 幸運7碼快來對

大樂透第113000052期今(14)日晚間開獎,本期頭獎為1.7億元,就在剛剛完整獎號已全數出爐。另外,今彩539、3星彩、4星彩也在今晚同步開獎,快拿起手邊彩券對獎,看看幸運之神是否降臨身邊吧!?

2024-05-14 20:48

-

孫收編浪貓「奶奶堅決反對」!結局180度翻轉 她上山採茶都要抱

許多長輩對於飼養寵物都抱持反對意見,但最終都還是會被可愛毛孩融化心房。一名網友日前就帶了流浪貓回家,原本家中奶奶堅決反對,沒想到不久後,奶奶和貓咪的感情竟急速升溫,就連奶奶上山採茶都要抱著貓咪工作。祖

2024-05-14 20:09

全球

更多全球-

鮑爾喊話耐心讓高利率發揮作用!美股平盤開出 觀望最新通膨發展

美國勞工部14日公布4月生產者物價指數(PPI),月增0.5%高於預期的0.3%,年增2.2%則符合預期。美國聯準會(Fed)主席鮑爾(Jerome Powell)稱今年的通膨數據高於預期,因此必須保

2024-05-14 23:27

-

澳洲名醫採「自創療法」治腦癌!腫瘤近1年未復發 直呼是奇蹟

澳洲名醫史柯勒(Richard Scolyer)是研究黑色素瘤的權威,在2023年6月不幸被檢查出罹患腦癌後,史柯勒並未被打倒,決定採用自己發明、全球首創的全新療法來對抗病魔。而他今(14)日宣布,最

2024-05-14 22:31

-

法國運囚車遭遇伏擊!押車警官2死3傷、1犯人逃獄 馬克宏震怒

法國今(14)日發生一起震驚全國的劫囚案,當地時間早上11點左右,諾曼第大區盧昂市(Rouen)附近一處高速公路收費站,一輛從法院運送囚犯到監獄的運囚車遭到伏擊,嫌犯持重武器攻擊警察,造成車上警員2死

2024-05-14 21:13

-

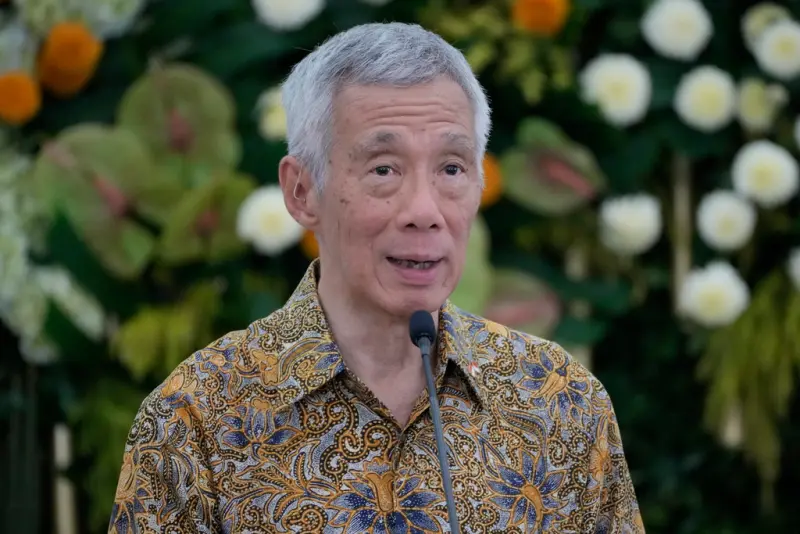

新加坡總理李顯龍明卸任!開退休書單 點名想看台灣作家著作

新加坡總理李顯龍15日即將卸任,交棒給副總理兼財長黃循財,李顯龍近日受訪被問及退休後想做什麼,他透露想學習AI以及攝影,同時也點名想閱讀台灣作家齊邦媛的著作。根據新加坡《聯合早報》報導,李顯龍先前已接

2024-05-14 19:59