《鄉民大學問EP.36》字幕版|韓院長的突襲!藍綠白委員見“韓國魚”驚呼!謝龍介不敢睡 稱愈晚愈high在忙那椿?葉元之公開立院頭號女戰神是“她”!王世堅自豪這點連韓國瑜也比不上!|NOWnews

NOW影音

更多NOW影音焦點

更多焦點-

外送員神助攻逮毒販「脖子手刀拍下去」 盧秀燕大讚如來神掌

台中警方日前追捕一名年輕毒販,年近60的吳姓外送員騎機車經過,自後朝嫌犯「脖子手刀拍下去」,對方踉蹌跌倒被警方逮捕。台中市長盧秀燕今(19)日對他90度鞠躬敬禮,感謝「如來神掌」協助維護治安。在台中勤

2024-04-19 18:55

-

「黑色星期五」台股暴跌!盤點歷史單日大跌紀錄 多受1因素影響

台股今(19)日一度暴跌逾千點,終場下跌774.08點,跌幅3.81%,成交值7047.88億元,外資賣超約800億元,成史上單日收盤最大跌點、盤中歷史第二大跌點以及史上單日第三大成交值。美國股市昨(

2024-04-19 20:45

-

陳亞蘭久違扮花旦索吻!莊凱勛粉墨登場「擔心遭影迷追殺」

推廣歌仔戲不遺餘力的陳亞蘭,與莊凱勛兩位金鐘視帝聯手合作,共演歌仔戲職人劇《勇氣家族》,今(19)日舉辦開播記者會,在劇中飾演夫妻的陳亞蘭及莊凱勛盛重以歌仔戲扮相出場,過去反串男性角色居多的陳亞蘭,久

2024-04-19 18:18

-

黃子佼緩起訴恐生變!持有7部少女不雅片 高檢署命北檢續行偵查

黃子佼緩起訴恐生變!藝人黃子佼遭控對網紅性騷擾、性侵,全案終結,性侵部分罪嫌不足。不過,在檢調搜索時,被發現其電腦硬碟中,存有購自「創意私房論壇」的7部未成年少女偷拍片,由於黃子佼認罪,台北地檢署依法

2024-04-19 21:13

精選專題

要聞

更多要聞-

黨部主委登記截止!余天退選新北蘇巧慧同額競選、台南2人登記

2年辦理1次的民進黨黨職幹部改選工作,今(19)日登記截止。新北黨部主委部分,在前立委余天宣布退選後,僅蘇巧慧一人登記;至於台南市黨部主委,則有立委郭國文、隸屬湧言會的前議員陳金鐘登記。余天原先表態參

2024-04-19 18:40

-

民進黨改選中投黨部「桶箍」換人做 彰縣主委楊富鈞尋求連任

2年辦理1次的民進黨黨職幹部改選工作,今天登記截止,中彰投3位主委僅綠色友誼連線、彰化楊富鈞尋求連任。台中市李天生已2任屆滿;南投縣則是有主委不尋求連任的傳統,現任主委縣議員蔡銘軒宣佈不參選,由綠色友

2024-04-19 17:40

-

3倍價民間購電挨批缺電 台電搬出台積電澄清:短時需量購電較好

特定人士質疑4/15夜尖峰時段,台電向用電大戶買電,每度12元,為成本3倍,其中包含半導體、電子、石化、鋼鐵業等10多家大型企業參與,而遭立委質疑凸顯政府電力供應不足。對此,台電今(19)日傍晚回應表

2024-04-19 17:38

-

徐巧芯大姑涉詐案延燒 林亮君:若「喬利息」恐代誌大條

國民黨立委徐巧芯大姑涉詐騙洗錢案延燒,徐巧芯聲稱,老公的姊夫杜姓男子,2021年開公司,向娘家借2000萬元,婆婆因錢不夠,找銀行貸款,後來還不出利息。她除了幫忙「墊付」100萬元利息,並說「有幫忙處

2024-04-19 17:01

新奇

更多新奇-

全美語幼稚園校外教學去資收場 家長氣炸:我小孩不會接觸這工作

孩子是國家未來的主人翁,不少幼稚園(幼兒園)會安排各項體驗活動,探訪警察局、走訪博物館,加深孩子對社會的了解。不過,一名家長近期抱怨,花大錢送孩子讀全美語幼稚園,結果校外教學居然去參觀資源回收場,質疑

2024-04-19 11:32

-

台大AV女優宣布徒步環台!首日狂走20公里「腳起水泡」 現況曝光

去年考上國立台灣大學的AV女優魏喬安,日前在社群平台上宣布要徒步環島旅行,第一天就狂走20公里,從台北車站走到三峽,也讓她腳上起水泡,再加上同行夥伴遭野狗咬傷,只能暫時回台北休養,不過她也強調,到下週

2024-04-18 20:05

-

一堆人到巴黎錢包被偷!黃大謙帶「8個錢包」實測 驚人結局曝光

法國的首都巴黎是擁有數千年歷史的古都,也是許多遊客到訪歐洲必去的浪漫城市。但當地治安卻總是亮起黃燈,一堆人都曾在當地錢包、財物失竊,當有人要去巴黎時,幾乎被提醒的第一句都是「小心錢包被偷」。對此,Yo

2024-04-18 18:38

-

佛心蛋「1顆賣1元」!每人限5顆 阿姨買100顆遭拒狂酸:還怕人買

不要糟蹋別人的心意!近期雞蛋價格雖然沒有去年「蛋荒」時昂貴,但想要買到一顆1元的雞蛋,仍可以說是天方夜譚。近期就有民眾表示,爸爸退休後迷上養雞、鴨,產生的蛋自家吃不完,就打算便宜販售,訂出「1顆蛋1元

2024-04-18 18:38

娛樂

更多娛樂-

遭謝和弦揭噁心性事!Keanna嗆「渣男幻想文」:回台灣後絕對提告

謝和弦前妻Keanna日前爆料,陳芳語與背著她與男方在錄音室發生關係,引發討論。陳芳語則是透過經紀公司發聲喊告,「內容純屬子虛烏有!」而謝和弦則回應是記錯人,並揭露Keanna私下的噁心行徑。對此,K

2024-04-19 21:32

-

NONO性騷後神隱!老婆朱海君「燦笑現蹤高雄」 友人曝她慘淡近況

知名藝人NONO自從去年捲入MeToo風波,遭多名女子控訴涉嫌性侵,目前還有官司持續偵辦中,而他的妻子朱海君則是照常工作,但從未對外發聲,舉動低調且神祕。近日,朱海君再度現蹤廟宇,並擔任高雄旗山天后宮

2024-04-19 21:08

-

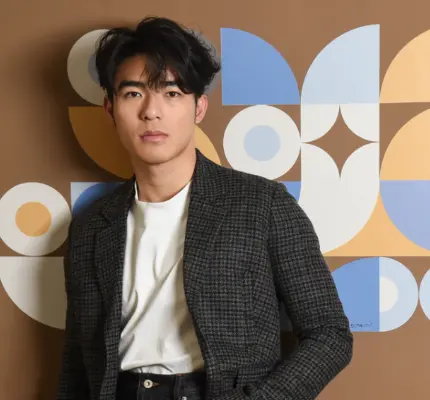

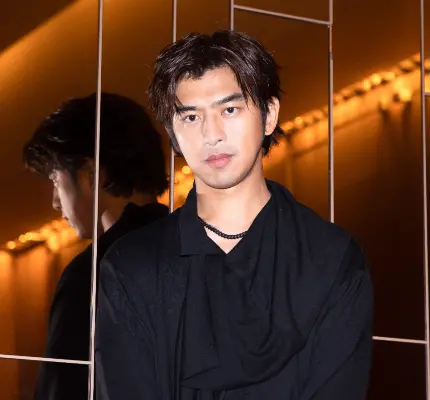

獨家/遭葛斯齊質疑婚內出軌!大S「啪啪啪」曬高清圖:不想告了

大S徐熙媛與汪小菲離婚後,火速嫁給舊情人具俊曄,日前,具俊曄更在韓綜上獨家曝光與大S在電梯裡的甜蜜合照,怎料卻引來不少酸民質疑是大S離婚前拍的,讓「婚內出軌」四個字再登版面,就連狗仔葛斯齊都說「跟我想

2024-04-19 19:44

-

蔡允潔生女兒曾收「黃子佼禮物」!害怕點開新聞:只看標題很震驚

擁有「製作人歌手」之稱的卜星慧,近期推出完全獨立創作專輯《不要試圖改變我》,今(19)日舉辦發片記者會暨新歌演唱會,好友草爺、蔡允潔以及啦啦隊女孩比熊(陳又禎)到場力挺祝賀。作為新手媽媽的蔡允潔,一聊

2024-04-19 18:50

運動

更多運動-

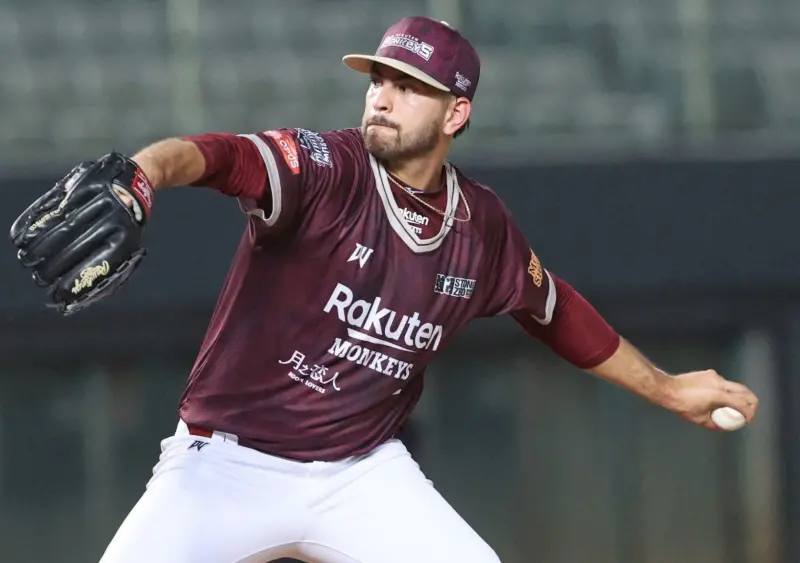

魔神樂初登板6.1局好投奪MVP!嚴宏鈞陽春砲 樂天3:0味全止3連敗

中華職棒例行賽樂天桃猿今(19)日作客味全龍,洋投魔神樂迎來初登板,先發6.1局僅被敲3支安打無失分,封鎖龍隊打線,嚴宏鈞配球引導有功之外,個人也貢獻2安打,包括一發陽春砲,終場樂天桃猿3:0擊敗味全

2024-04-19 21:28

-

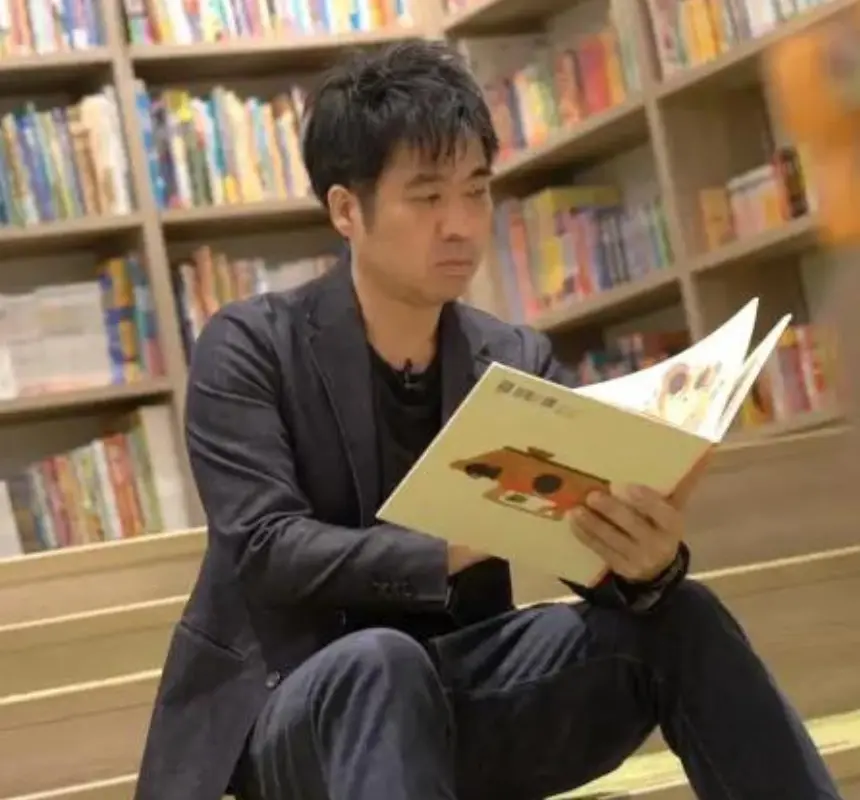

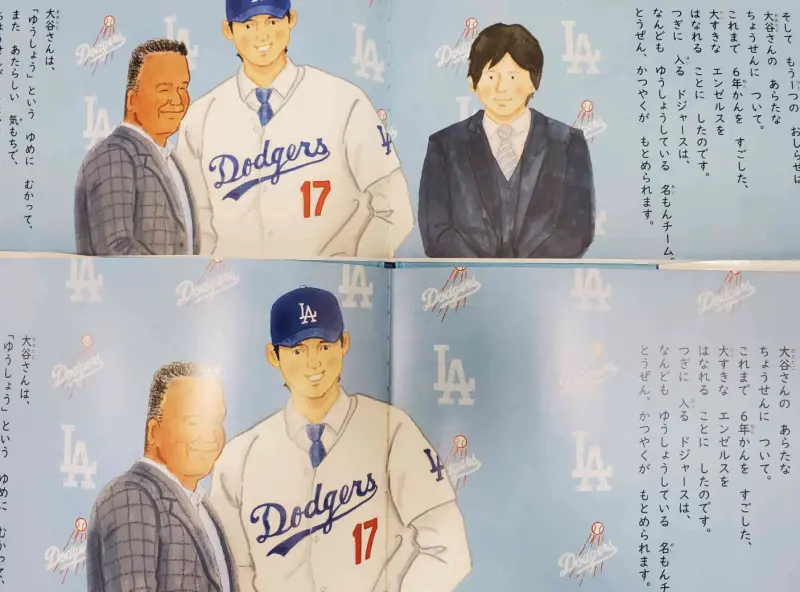

大谷翔平繪本將改版!水原一平消失了 母校也把傑出畢業生刪除

由洛杉磯道奇隊二刀流日本好手大谷翔平故事所製作的兒童繪本,即將在近期進行「改版」,由於這牽涉到大谷翔平想要推動棒球運動發展,希望讓親子都可以對棒球產生興趣,但是因為前翻譯水原一平涉賭,讓大谷翔平很不開

2024-04-19 20:07

-

MLB/旅美小將先發皆敲安!李灝宇單場雙安、陳聖平貢獻2打點

在美國職棒小聯盟2A層級的台灣選手今(19)日相繼先發出場,效力於底特律老虎2A的台灣怪力男李灝宇單場敲2安打、1打點;效力於匹茲堡海盜2A的鄭宗哲、亞利桑那響尾蛇2A的陳聖平都有安打表現。底特律老虎

2024-04-19 18:27

-

從數據看NBA冠軍!金塊、塞爾提克具備冠軍相 這4隊可能創造驚奇

NBA季後賽即將於4月21日開打,爭奪總冠軍最高榮譽。在過去44屆總冠軍中,只有14支球隊順利捧起金盃,顯示球隊一定程度的主宰力。根據數據統計結果,今年季後賽波士頓塞爾提克、奧克拉荷馬雷霆與丹佛金塊都

2024-04-19 18:18

財經生活

更多財經生活-

洗衣膠囊出包!好市多急發公告召回 會員「這區間購買」開放退貨

知名美式賣場好市多(COSTCO)近日發出最新商品召回公告,提醒會員若在2023年9月30日至2024年4月5日期間,曾購買「汰漬洗衣膠囊春天草地香」商品,因製造商發現產品包裝出現瑕疵,主動回收特定批

2024-04-19 21:10

-

快訊/大樂透頭獎保證1億!「4/19完整獎號」出爐 幸運7碼快來對

大樂透第113000045期今(19)日晚間開獎,由於已經連三期開出頭獎,台彩保證本期頭獎為1億元,就在剛剛完整獎號皆已開出,快拿出手邊彩券,看看是否幸運中大獎吧!🟡4/19大樂透中獎號碼(第113

2024-04-19 20:48

-

6米高「地球」降臨信義區 和陳柏霖響應世界地球日!1動作抽夜燈

台北信義區又一個打卡新熱點!為了響應世界地球日,Discovery打造高達6米的巨型球體裝置藝術「地球.生之花」,即(19)日起至4月28日止,在台北市信義區香堤大道廣場展出「繁花盛開」意象打造的巨型

2024-04-19 19:19

-

極罕見「仙氣白蛇」降臨民宅!屋主見整條發亮嚇壞 全村搶看擠爆

印度南部孔巴托(Coimbatore)在大雨過後,竟有一條罕見的白化眼鏡蛇(albino cobra)被沖入民宅,雖然屋主嚇壞立即通報相關單位,卻吸引了當地村民爭相目睹「仙氣白蛇」的模樣。印度野生動物

2024-04-19 18:55

全球

更多全球-

以色列襲擊伊朗前是否知情?布林肯不願回答 僅重申美國沒有參與

G7外長今(19)日在義大利卡布里島(Capri)舉行峰會,以色列對伊朗實施的襲擊成為焦點問題,雖然伊朗官方淡化了襲擊的影響,以色列也並未證實發動攻擊。美國國務卿布林肯(Antony Blinken)

2024-04-19 20:34

-

北京馬拉松涉造假!主辦方:取消何杰和3非洲選手成績 追回獎金

4月14日舉行的北京半程馬拉松爆發假賽爭議,男子組由馬拉松中國全國紀錄保持者何杰奪冠,但原本領先的3名非洲選手,在比賽末端並未全力衝刺,更像在旁「護送」何杰奪冠,遭譏「半馬變伴馬」。雖然事後何杰與非洲

2024-04-19 18:40

-

伊朗不願證實以色列飛彈攻擊 外媒揭:尚無反擊計畫

以色列今(19)日凌晨朝伊朗發射飛彈,展開空襲反擊行動,美國官員向美媒證實此事。然而,伊朗官方從上到下態度低調,不願證實以色列飛彈攻擊,並向外媒表達,目前無反擊計畫。針對今早在伊朗伊斯法罕市軍事基地附

2024-04-19 17:46

-

以色列襲伊朗後油價大漲3%!分析師:突顯出中東局勢的脆弱性

美國官員透露以色列於當地時間19日凌晨朝伊朗發動空襲,引發民眾對中東戰爭擴大的擔憂,國際油價應聲上漲,漲幅一度超過3%,但隨著伊朗對遇襲的後續反應低調,油價漲幅收斂,布蘭特原油價格上漲約1.73%,美

2024-04-19 17:09