《鄉民大學問EP.37》字幕版|台南政治版圖有變數?謝龍介有機會?黃偉哲全說了!台南市長前哨戰開打!陳亭妃、王定宇、林俊憲鴨子划水 邱明玉揭他勝算高!黃智賢轉綠?被哥哥盜帳號?黃偉哲霸氣回應現場笑翻!

NOW影音

更多NOW影音焦點

更多焦點-

讓新北議長怒飆五字經 陳明義深夜發千字文「相互諒解釋懷了」

新北市議會昨日進行審查會抽籤,而國民黨議員陳明義不滿某些議員派出多人搶特定審查會,事後進行交換,因而在抽籤時拿走籤筒,此舉也讓同黨籍議長蔣根煌理智斷裂,不僅怒砸手機更飆罵五字經。對此陳明義今(24)日

2024-04-24 02:24

-

聲音「AI化」算侵權?中國首例「AI聲音侵權」一審宣判配音員勝訴

人工智慧(AI)熱潮席捲全球,不少企業相繼推出AI相關業務,以減少人力支出,但在訓練AI期間可能產生的侵權爭議也開始出現。中國週二也審理了首樁「AI聲音侵權訴訟案」,作為配音師的原告稱自己的「聲音」在

2024-04-24 00:19

-

一粒姊姊甜蜜官宣男友宋嘉翔!現身樂天2軍球場 戀情早有跡可循

台鋼雄鷹啦啦隊成員「一粒」因「葉保弟應援曲」的魔性舞步爆紅,連帶仙氣十足的雙胞胎姊姊Joy也跟著爆紅。今(23)日,Joy也在IG上甜蜜公開球員男友,是樂天桃猿潛力「大物」捕手宋嘉翔。事實上,Joy早

2024-04-23 16:58

-

屏東萬丹電器工廠火警!烈焰照亮漆黑夜空 大批警消全力灌救

一處位於屏東萬丹的家電工廠,今(23)日晚間7時許突然傳出火警,警消獲報後隨即出動各式救災車20輛、消防員39人前往搶救,到場時該建築已全面燃燒,所幸無人員受困,目前警消正全力灌救中,詳細起火原因還有

2024-04-23 22:36

精選專題

要聞

更多要聞-

讓新北議長怒飆五字經 陳明義深夜發千字文「相互諒解釋懷了」

新北市議會昨日進行審查會抽籤,而國民黨議員陳明義不滿某些議員派出多人搶特定審查會,事後進行交換,因而在抽籤時拿走籤筒,此舉也讓同黨籍議長蔣根煌理智斷裂,不僅怒砸手機更飆罵五字經。對此陳明義今(24)日

2024-04-24 02:24

-

影/黃智賢改批藍白被盜帳號?黃偉哲趣回:我行事光明磊落

台南市長黃偉哲日前特別抽空參加由《NOWnews今日新聞》所錄製網路節目《鄉民大學問》,資深媒體人邱明玉提問近期外界觀察胞妹黃智賢風格轉變,近期較常批評藍白,有網友笑稱是哥哥盜帳號,對此黃偉哲也打趣稱

2024-04-23 21:00

-

影/「賴青德」欽點2026卸任後入閣 黃偉哲反問:入什麼閣?

台南市長黃偉哲日前特別抽空出席由《NOWnews今日新聞》所錄製的網路節目《鄉民大學問》,並介紹台南近期舉辦許多大型活動,包括「台灣燈會」、「Pokmon GO City Safari」、「國際蘭展」

2024-04-23 21:00

-

影/民進黨延續政權有信心!黃偉哲評黨內3戰將「兄弟登山」

台南市長黃偉哲日前特別抽空參加由《NOWnews今日新聞》所錄製網路節目《鄉民大學問》,對於外界關注2026台南市長選舉,黨內各個選將動作頻頻,包括正國會立委陳亭妃、賴清德嫡系子弟兵林俊憲與湧言會立委

2024-04-23 21:00

新奇

更多新奇-

《池水抽光好吃驚》來台灣!抽光中興湖 驚見「激似鯊魚」外來種

日本知名綜藝節目《池水抽光好吃驚》在今年3月份來台灣,由主持人田村淳與興大生組成多達1百人的「池水台日隊」,抽光國立中興大學內的「中興湖」池水,結果捕撈出近3百隻生物,裡面甚至還有「激似鯊魚」的外來種

2024-04-23 18:07

-

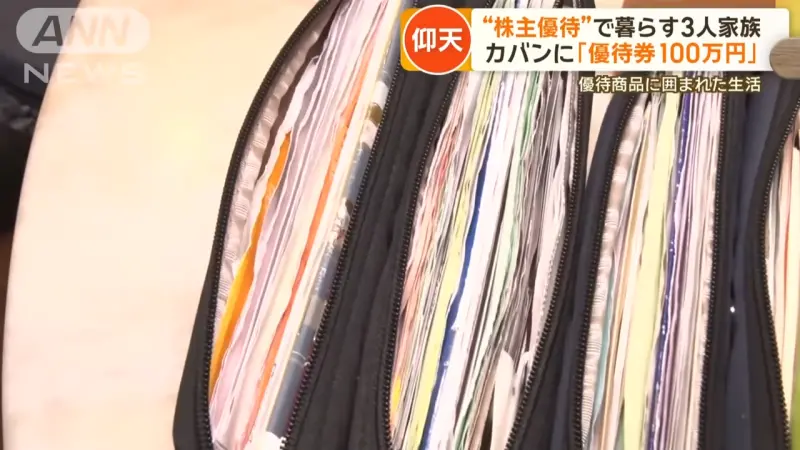

7年買710支股票不賣!1家3口靠「股東福利」活超爽:出門不用花錢

台灣進入股東大會旺季,各家公司開始發放股東會紀念品,例如六福(2705)會發放價值1199元門票給6萬名股東,中鋼(2002)則送出超實用的抗菌多功能不鏽鋼砧板組,總是引發廣大討論。而在日本,更有奇人

2024-04-23 16:56

-

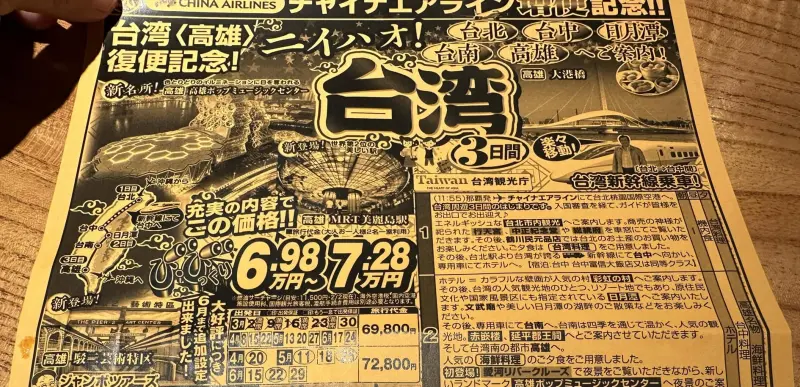

日本旅社推台灣3日遊!團費「不到1萬5」超俗 眾見完整行程嚇壞

這幾年台灣的國旅住宿價格備受關注,許多民眾皆抱怨「飛出國比在台灣玩便宜」,輿論持續發酵,也讓今年農曆春節連假時不少旅宿業者的訂房率慘澹。不過近期就有日本旅行社推出的台灣3天2夜的行程,團費竟然只要1萬

2024-04-23 16:09

-

統神YouTube頻道「經營6年失言遭刪」!火大發聲 申訴2次遭打槍

知名實況主「統神」張嘉航日前因為評論黃子佼爭議事件時,語出驚人講錯話,而引爆爭議,隨後不僅被多家遊戲廠商終止合作,經營6年的YouTube頻道更是直接被官方刪除。對此,統神22日晚間首度發文透露近況,

2024-04-23 08:28

娛樂

更多娛樂-

許美靜演唱會挨轟划水 許常德逆風力挺「商演公司不專業」

49歲新加坡女歌手許美靜日前在中國南京舉辦「音樂見面會」,吸引不少粉絲購票入場,然而原定2個半小時的演出,實際演唱時間只有30分鐘,加上門票太貴,就連成名曲也是請伴唱老師代唱,讓不少粉絲非常不滿,紛紛

2024-04-23 22:26

-

ILLIT粉絲名2度爆爭議!扯上前輩NMIXX、Lisa 公司緊急重選滅火

韓國新人女團ILLIT於4月21日時,透過Weverse直播公開粉絲名,經由成員們共同決定的粉絲名是「LILLY(릴리)」,也是百合的英文單字,象徵百合花語中不變的愛。然而公開後引發不少爭議,有粉絲指

2024-04-23 21:17

-

一粒「魔性應援曲」16年前就出現!TWICE、NewJeans都曾公開致敬

中職台鋼雄鷹啦啦隊員「一粒」(趙宜莉)過去幾周,在李多慧、安芝儇、李晧禎、邊荷律等韓籍啦啦隊等人洗版之際橫空出世,短短1個月IG粉絲暴增百倍。一粒憑藉著超洗腦的「葉保弟應援曲」魔性舞步一炮而紅,吸引不

2024-04-23 20:35

-

女星老家對面飯店傾斜!怕地震安危想安排母親北上:交通出問題

台灣今(23)日凌晨連續發生2起強震,因此導致花蓮市區的「富凱大飯店」傾斜倒塌,接下來預計將花2周時間進行清除,然而近期餘震不斷,也讓當地居民們都十分困擾。老家在富凱大飯店對面的女星楊麗菁也發文透露媽

2024-04-23 19:07

運動

更多運動-

亞洲最長距離、最大鐵人三項賽事在台灣 全球優秀跑將齊聚爭雄

2024 CHALLENGE FAMILY國際鐵人三項競賽台灣站(以下簡稱CHALLENGE TAIWAN,CT)將於4月25日至28日於台東開展年度賽事,近萬名鐵人選手齊聚臺東熱力爆發,其中職業選手

2024-04-24 02:55

-

全中運游泳/建中學霸張暐堂奪生涯首金 奪冠關鍵:奧運金牌秘笈

113年全中運游泳今(23)日進入第4天賽程,成績表現平平並無人能刷新大會紀錄,但地主臺北市學校表現突出,在今頒出的16金中囊括了9金,臺北市建國中學、臺北市西松高中國中部和臺中市大里高中各摘下2金最

2024-04-24 02:13

-

全中運田徑/台灣超級新星誕生!謝元愷110公尺跨欄再破全國紀錄

113年全中運田徑賽第三天再傳佳績,高雄市鳳山商工謝元愷在高男組110公尺跨欄決賽,以13秒39改寫自己保持的U20全國紀錄。新北市明德高中林子婕在國女組100公尺跨欄決賽,以13秒80破大會,躍居U

2024-04-24 01:51

-

全中運舉重/高雄市鼓山高中單日掃3金 曾靖淳奪金最佳生日禮物

全國中等學校運動會舉重項目,在台北市大直高中舉行4個量級比賽,高雄市鼓山高中曾靖淳在高女64公斤級摘下金牌,今天剛好是曾靖淳的生日,在旁的師長與同學一起為她唱生日快樂歌,鼓山高中曾靖淳說:「終於在全中

2024-04-24 01:36

財經生活

更多財經生活-

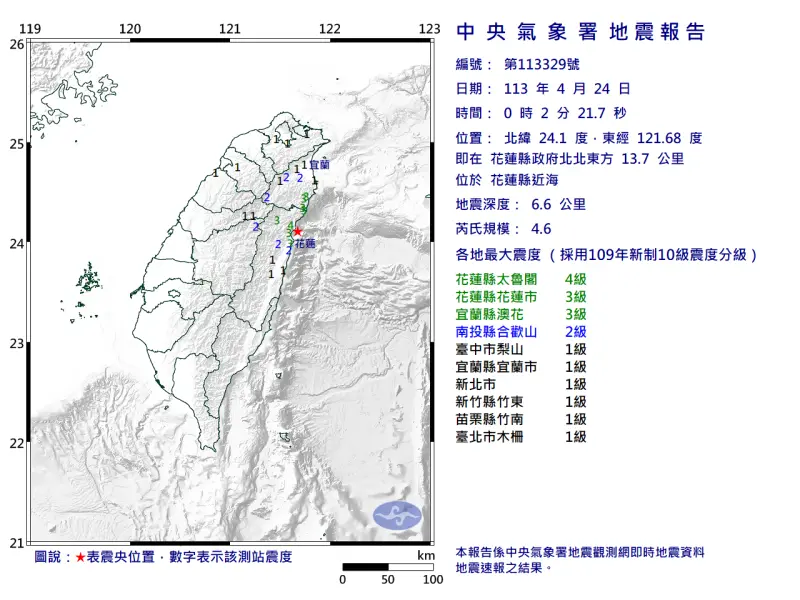

快訊/深夜又搖!00:02花蓮規模4.6極淺層地震 網哀怨:怎麼入睡

深夜地牛又醒了!今(24)日凌晨00:02,花蓮發生芮氏規模4.6地震,震央在花蓮縣政府北北東方 13.7 公里 ,位於花蓮縣近海,地震深度6.6公里,屬於極淺層地震。全台共有8個縣市有感搖晃。地震直

2024-04-24 00:10

-

武財神4/23生日發錢了!今彩539開1注800萬頭獎 最新獎號一次看

今(23)日恰逢農曆三月十五「武財神生日」,各種彩券也在晚間開出最新獎號,最終大樂透頭獎槓龜,但今彩539則開出1注800萬頭獎,快拿起彩券看看幸運兒是不是自己吧!4/23大樂透中獎號碼(第11300

2024-04-23 22:44

-

快訊/大樂透頭獎保證1億!4/23最新獎號出爐 武財神生日發大財

大樂透第113000046期今(23)日晚間開獎,本期頭獎為1億元,就在剛剛完整獎號皆已開出,恰逢農曆三月十五「武財神生日」,快拿出手邊彩券,看看財神有沒有現身發錢吧!4/23大樂透中獎號碼(第113

2024-04-23 22:39

-

全家5月霜淇淋口味!炭焙烏龍加竹炭香草 傳跨界聯名New Balance

全家霜淇淋5月新口味來了!根據網友爆料指出,本月新口味將是最受民眾喜愛的茶口味霜淇淋,由濃郁炭焙烏龍搭上竹炭香草,並且亮點是有機會首度跨屆聯名運動品牌「New Balance」,運動品牌與霜淇淋的結合

2024-04-23 19:13

全球

更多全球-

聲音「AI化」算侵權?中國首例「AI聲音侵權」一審宣判配音員勝訴

人工智慧(AI)熱潮席捲全球,不少企業相繼推出AI相關業務,以減少人力支出,但在訓練AI期間可能產生的侵權爭議也開始出現。中國週二也審理了首樁「AI聲音侵權訴訟案」,作為配音師的原告稱自己的「聲音」在

2024-04-24 00:19

-

華為迎頭趕上!蘋果在中國市占率降至15.7% 華為銷量成長7成

根據市場調查機構「Counterpoint」最新數據,蘋果(Apple)公司2024年第一季在中國市場出貨量,比起去年同期銳減至15.7%,創下2020年疫情爆發以後最糟糕的單季成績。相較之下中國本土

2024-04-23 23:33

-

聯準會若真降息?黑天鵝基金示警:就是美金融市場崩盤開始

傳奇避險基金「Universa Investments」創辦人、《黑天鵝》作者的門生史匹茲納格爾(Mark Spitznagel)認為,在眼下經濟樂觀情緒持續之時,應該充分利用這股樂觀情緒,因為「一旦

2024-04-23 22:44

-

德國連2天抓4名共諜!極右黨助理涉替中國傳送情報、監督反對人士

德國近兩日接連傳出中國間諜事件,一名德國極右派政黨「另類選擇黨」(AfD)的歐洲議會議員之助理涉嫌為中國從事間諜活動遭檢方逮捕,檢方聲明指出該名助理被控向中國提供情資,擔任「抓耙子」的角色監視德國境內

2024-04-23 22:08