《鄉民大學問EP.38》字幕版|藍營2028的超級戰術!黃暐瀚:民調洩民進黨這弱點!廢死引爆民怨 是蔡英文挖坑給賴清德?台電屢跳電 萬美玲曝內幕:竟是小鳥惹的禍?!賴清德赴立院國情報告?將對上韓國瑜?

NOW影音

更多NOW影音焦點

更多焦點-

侯友宜有意挑戰黨主席?邱毅分析4人選:最乾淨、最沒爭議的是他

新北市長侯友宜在競選2024總統大選失利後,近日有媒體報導他有意角逐下一屆國民黨主席之位,以便取得下一屆新北市長「提名權」。對此,前立委邱毅針對侯友宜、前總統馬英九、國民黨主席朱立倫以及孫文學校總校長

2024-04-26 16:44

-

開發金控公告新人事!王銘陽接任董事長、楊文鈞任總經理

中華開發金控啟動高階人事布局,今(26)日董事會通過董事長由王銘陽接任並由楊文鈞接任總經理一職。開發金控同時確立子公司董事長、總經理人選,凱基人壽董事長由王銘陽兼任,凱基人壽總經理一職則由郭瑜玲擔任,

2024-04-26 17:05

-

獨/神老師氣到發抖嗆林叨囝仔7寶媽!分享育兒經驗:不要看現在

「林叨囝仔The Lins'Kids」7寶媽Sydney,因直播中出現疑似訕笑「資源班」學生言論而遭炎上,對此,網紅作家「神老師&神媽咪」沈雅琪作為老師及特殊孩子的媽媽,忍無可忍發聲痛批:「憑

2024-04-26 12:36

-

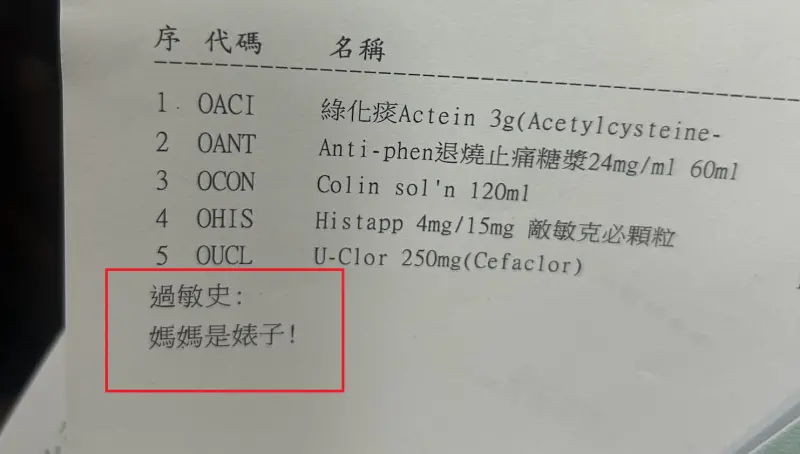

基隆醫院藥單標註「媽媽是婊子」!兇手是藥劑師 心情不好惹禍

一名基隆媽媽在社群爆料,24日帶著孩子到衛生福利部基隆醫院看診,拿起藥單時赫然發現寫著「媽媽是婊子」,醫護人員也立即道歉,但強調未鍵入相關字眼,不清楚為什麼會出現。後續基隆醫院立即展開內部清查,並表示

2024-04-26 15:56

精選專題

要聞

更多要聞-

侯友宜有意挑戰黨主席?邱毅分析4人選:最乾淨、最沒爭議的是他

新北市長侯友宜在競選2024總統大選失利後,近日有媒體報導他有意角逐下一屆國民黨主席之位,以便取得下一屆新北市長「提名權」。對此,前立委邱毅針對侯友宜、前總統馬英九、國民黨主席朱立倫以及孫文學校總校長

2024-04-26 16:44

-

遭恐嚇竟被當娛樂新聞處理!王鴻薇點名自由時報:一點專業也沒有

國民黨立法委員王鴻薇去年收到網友訊息,內容含有槍枝和子彈照片,嗆「你能吃幾顆子彈?」台北地檢署經1年後調查,涉案人簡男出租IP給客戶使用,但經協請美國FBI協助,查無簡男與實際發送訊息的人有犯意聯絡,

2024-04-26 16:17

-

17藍委啟程訪中!傅崐萁:代表民意進行破冰之旅 盼兩岸恢復交流

0403強震重創花蓮,為搶救花蓮農產品,促成陸客到花蓮觀光,國民黨立院黨團總召傅崐萁今(26)日率藍委訪問中國。傅崐萁在機場受訪說,國民黨代表民意到中國破冰,希望兩岸恢復交流,17名藍委會不怕網軍側翼

2024-04-26 16:08

-

賴清德內閣名單正國會僅一人會委屈嗎?林佳龍:不會啦!

總統當選人賴清德5月20日將就職,內閣名單陸續公布,屬民進黨內前三大派系的「正國會」,卻只有總統府秘書長林佳龍轉任外交部長,對此,是否感覺委屈?林佳龍今(26)日受訪時表示,不會,並稱會找時間和大家報

2024-04-26 16:02

新奇

更多新奇-

台灣泡麵「隱藏王牌」公開!每碗37元內行扛整箱 眾吃20年沒看過

台灣泡麵在市面上販售的口味非常眾多,除了定期的新品之外,也有許多老字號的泡麵長年稱霸排行榜,成為台灣泡麵的一大特色。然而,近日就有網友分享一款台灣泡麵隱藏版,由於平常沒有在各大通路上架,因此只有內行人

2024-04-26 14:20

-

林叨囝仔七寶媽學歷曝!「最強外語」大學畢業 自嘲專長:生小孩

35歲的網紅「林叨囝仔」七寶媽(陳珮芬)歧視資源班言論遭炎上,不少人好奇七寶媽學歷為何?「七寶媽 學歷」在Google熱搜中快速飆升。據悉,七寶媽從小就是個學霸,國小到大學成績都名列前茅,她曾在部落格

2024-04-26 11:26

-

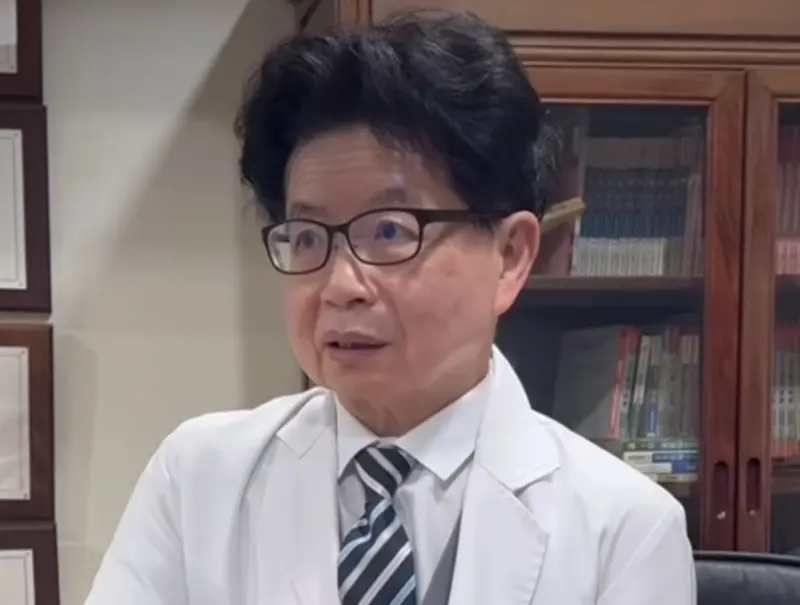

婦產科蔡醫師迷因爆紅!本尊是世界名醫 粉絲讚爆:我是試管嬰兒

2024最新迷因爆紅!最近在社群平台上,出現一名「活體迷因」,一位婦產科蔡醫師大爆紅,不僅有IG、Tik Tok的追蹤人數暴衝,甚至還有許多粉絲做了蔡醫師的各種周邊商品,由於過去蔡醫師還開投票讓粉絲表

2024-04-26 11:13

-

快訊/網紅七寶媽笑資源班遭轟!刪直播二度道歉:請原諒我的無知

網紅「林叨囝仔The Lins'Kids」七寶媽去年陷入多起爭議,好不容易才悄悄復出,結果日前直播上疑似嘲笑資源班的言論,讓她再度炎上。日前七寶媽Sydney深夜開直播道歉,但卻被批評是「把過

2024-04-26 09:15

娛樂

更多娛樂-

田馥甄到大陸開唱被轟「表態立場再來賺人民幣」 女神高EQ回應了

金曲歌后田馥甄(Hebe)今(26)日和林柏宏出席酒品代言活動,她5月將到大陸音樂節表演,部分大陸網友重提台獨疑雲,要田馥甄表態立場再來賺錢,對此,田馥甄低調表示:「能唱想唱的歌就覺得很珍惜。」▲田馥

2024-04-26 16:32

-

《雲之羽》女星證實未婚懷孕!金靖曝工作想吐「靠大笑掩飾害喜」

去年因熱播陸劇《雲之羽》受矚目的31歲大陸女星金靖,昨(25)日突發文自爆已懷孕,「一家四口一起迎接第五位家庭成員」,她也透露另一半為導演舒奕橙。金靖8年前以綜藝節目《今夜百樂門》出道,個性爽朗的她自

2024-04-26 15:46

-

鄭靚歆女女大婚!美魔女媽「透明薄紗內衣全露」 母女前晚爆爭執

28歲鄭靚歆(Jin)從節目《我愛黑澀會》出道,參加《全明星運動會4》收獲不少粉絲,她去年6月和大5歲德國女友采熙(Aky)登記結婚,今(26)日終於舉辦婚宴,鄭靚歆的美魔女媽媽胡文英透視薄紗裡只穿比

2024-04-26 15:29

-

啦啦隊一粒獲「輔大校花認證」!學生時期照曝光 貓耳造型超可愛

台鋼啦啦隊成員一粒(本名趙宜莉)因為其深邃的雙眼及高挺的鼻樑,再加上她的「葉保弟應援曲」魔性舞步。洗腦的歌曲加上好記的舞步,讓不少啦啦隊、網紅、藝人爭相模仿一粒的魔性舞步,就連日本AV女優也跟著模仿。

2024-04-26 15:11

運動

更多運動-

NBA季後賽/湖人就是打不贏金塊!李亦伸點主因:只有這3人在打球

NBA季後賽首輪G3由洛杉磯湖人對戰丹佛金塊,終場湖人以105:112輸給金塊,在這個系列賽中陷入連三敗的絕對弱勢。球評李亦伸直言,從目前戰況來看,幾乎可以斷定湖人隊在這個賽季是無緣季後賽了,因為從過

2024-04-26 16:43

-

林叨囝仔7寶媽一句「資源班」惹議!張進德也曾領有學習障礙手冊

網紅「林叨囝仔」7寶媽,近日在直播中嘲笑「資源班」,而他的小孩也無意以有問題的學生,來形容特教生,引發社會輿論撻罰,而所謂的「資源班」又可稱為特殊教育班,區分為:分散式資源班、巡迴輔導班、集中式特殊教

2024-04-26 16:15

-

Wembanyama防守有多恐怖?Wilkins盛讚:就算沒蓋鍋也影響了出手

聖安東尼奧馬刺超級新星Victor Wembanyama在生涯首季就繳出劃時代的數據,他在阻攻上的天賦,被看好競爭本季的年度最佳防守球員(DPOY)。近期來到台灣參加「2024 國泰NBA國際高中邀請

2024-04-26 15:45

-

NBA季後賽4/26戰報/湖人主場失守慘遭聽牌 Embiid 50分76人開胡

NBA在4月26日進行3場首輪季後賽的賽事,其中最受矚目的一場,無疑就是丹佛金塊在客場以112:105擊敗洛杉磯湖人,系列賽以3:0領先,成為本季首輪第一支「聽牌」的球隊。該場比賽「最強亞軍」Aaro

2024-04-26 15:33

財經生活

更多財經生活-

好勁道這款匠心之作搭上莆田奢華海陸盆菜 驚艷饕客味蕾

向來以優質好食材與匠心功夫手藝為核心理念的新加坡米其林一星品牌「莆田」,睽違兩年推出全新菜色,準備與饕客們來場舌尖上的春之盛宴。統一「好勁道」更首次聯手「莆田」,準備以匠心之作強強聯手,收服所有挑剔的

2024-04-26 17:00

-

7寶媽業配笑資源班!《讀書共和國》社長親道歉:沒慎選合作對象

網紅「林叨囝仔The Lins'Kids」7寶媽Sydney日前在與「讀書共和國」進行業配直播時,一度失言遭外界質疑恥笑、歧視「資源班」學生,隨即引起炎上風波。「讀書共和國」先是在臉書發出聲明

2024-04-26 16:53

-

LINE「Keep功能」取消倒數!用戶崩潰:資料超多 備份4招秒解決

通訊軟體LINE為台灣人最主要使用的APP之一,許多人透過LINE聯繫、存放資料,但LINE官方今年3月宣布重要功能Keep,即將於7月31日結束服務,引來大批用戶哀嚎。對此,Keep可以透過4個管道

2024-04-26 16:05

-

快訊/暴雨橫掃南部!高雄市1國小下午停班課 豪雨假標準一次看

鋒面挾帶強對流!中南部雷雨不斷,從25日0時至今(26)日下午13時10分,高雄鼓山累積雨量達193.5毫米,高雄市政府宣布,由於山區大雨,考量師生安全,桃源區寶山國民小學自15時起停止上班、停止上課

2024-04-26 15:22

全球

更多全球-

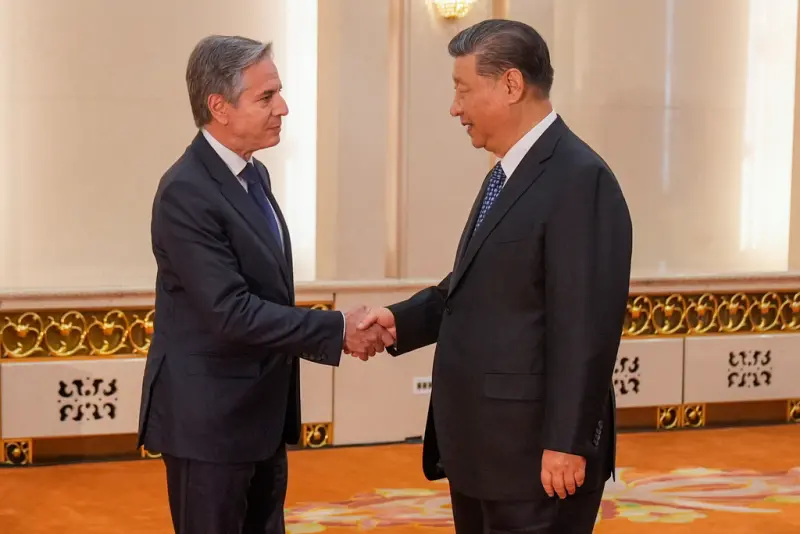

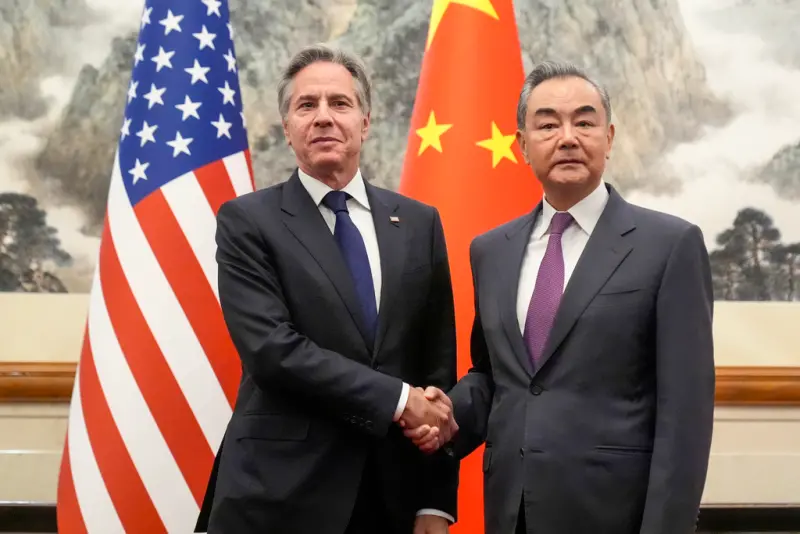

習近平晤布林肯!稱中美應做夥伴而非對手:不是「做一套說一套」

美國國務卿布林肯(Antony Blinken)今(26)日下午於北京人民大會堂與中國國家主席習近平會晤,根據央視新聞報導,習近平表示「兩國應該做夥伴,而不是當對手;應該言必信、行必果,而不是說一套、

2024-04-26 17:00

-

超美富士山打卡點恐消失!遊客太多生亂象 居民擬「黑幕」全遮住

橫跨靜岡縣和山梨縣的日本知名景點富士山,一直以來深受旅客歡迎,其中河口湖是觀看富士山美景的人氣旅遊目的地,而位於河口湖車站附近的LAWSON便利商店,也因為藍白相間的招牌再加上富士山絕景,近年成為河口

2024-04-26 16:59

-

布林肯確定今在北京見習近平!王毅再喊話美國:勿干涉中國內政

美國國務卿布林肯(Antony Blinken)今(26)日上午在北京與中國外交部長王毅會面,而中國官媒央視與美國國務院均指出,布林肯將在今日下午於北京人民大會堂與中國國家主席習近平會晤,而王毅在早上

2024-04-26 16:18

-

四面楚歌?哈薩克也在討論「封禁TikTok」 越來越多國家評估風險

美國國會本月表決通過熱門短影音平台TikTok的「去中國化」法案,要求TikTok與其中國母公司「字節跳動」(ByteDance)剝離,「字節跳動」需於9個月內出售在美國的資產,否則TikTok將被禁

2024-04-26 15:56