《鄉民大學問EP.36》字幕版|韓院長的突襲!藍綠白委員見“韓國魚”驚呼!謝龍介不敢睡 稱愈晚愈high在忙那椿?葉元之公開立院頭號女戰神是“她”!王世堅自豪這點連韓國瑜也比不上!|NOWnews

NOW影音

更多NOW影音焦點

更多焦點-

外送員神助攻逮毒販「脖子手刀拍下去」 盧秀燕大讚如來神掌

台中警方日前追捕一名年輕毒販,年近60的吳姓外送員騎機車經過,自後朝嫌犯「脖子手刀拍下去」,對方踉蹌跌倒被警方逮捕。台中市長盧秀燕今(19)日對他90度鞠躬敬禮,感謝「如來神掌」協助維護治安。在台中勤

2024-04-19 18:55

-

中東緊張暫歇!華爾街鬆口氣美股道瓊開盤走高 但台積電ADR續跌

受到以色列襲擊伊朗的消息影響,亞洲股市19日哀鴻遍野,台股創下史上最大跌點,日本股市也大跌1011.35點。不過,以色列與伊朗後續反應趨於低調,中東局勢的擔憂暫消,華爾街投資人鬆一口氣,截至寫稿時間為

2024-04-19 22:59

-

陳亞蘭久違扮花旦索吻!莊凱勛粉墨登場「擔心遭影迷追殺」

推廣歌仔戲不遺餘力的陳亞蘭,與莊凱勛兩位金鐘視帝聯手合作,共演歌仔戲職人劇《勇氣家族》,今(19)日舉辦開播記者會,在劇中飾演夫妻的陳亞蘭及莊凱勛盛重以歌仔戲扮相出場,過去反串男性角色居多的陳亞蘭,久

2024-04-19 18:18

-

黃子佼緩起訴恐生變!持有7部少女不雅片 高檢署命北檢續行偵查

黃子佼緩起訴恐生變!藝人黃子佼遭控對網紅性騷擾、性侵,全案終結,性侵部分罪嫌不足。不過,在檢調搜索時,被發現其電腦硬碟中,存有購自「創意私房論壇」的7部未成年少女偷拍片,由於黃子佼認罪,台北地檢署依法

2024-04-19 21:13

精選專題

要聞

更多要聞-

黨部主委登記截止!余天退選新北蘇巧慧同額競選、台南2人登記

2年辦理1次的民進黨黨職幹部改選工作,今(19)日登記截止。新北黨部主委部分,在前立委余天宣布退選後,僅蘇巧慧一人登記;至於台南市黨部主委,則有立委郭國文、隸屬湧言會的前議員陳金鐘登記。余天原先表態參

2024-04-19 18:40

-

民進黨改選中投黨部「桶箍」換人做 彰縣主委楊富鈞尋求連任

2年辦理1次的民進黨黨職幹部改選工作,今天登記截止,中彰投3位主委僅綠色友誼連線、彰化楊富鈞尋求連任。台中市李天生已2任屆滿;南投縣則是有主委不尋求連任的傳統,現任主委縣議員蔡銘軒宣佈不參選,由綠色友

2024-04-19 17:40

-

3倍價民間購電挨批缺電 台電搬出台積電澄清:短時需量購電較好

特定人士質疑4/15夜尖峰時段,台電向用電大戶買電,每度12元,為成本3倍,其中包含半導體、電子、石化、鋼鐵業等10多家大型企業參與,而遭立委質疑凸顯政府電力供應不足。對此,台電今(19)日傍晚回應表

2024-04-19 17:38

-

徐巧芯大姑涉詐案延燒 林亮君:若「喬利息」恐代誌大條

國民黨立委徐巧芯大姑涉詐騙洗錢案延燒,徐巧芯聲稱,老公的姊夫杜姓男子,2021年開公司,向娘家借2000萬元,婆婆因錢不夠,找銀行貸款,後來還不出利息。她除了幫忙「墊付」100萬元利息,並說「有幫忙處

2024-04-19 17:01

新奇

更多新奇-

全美語幼稚園校外教學去資收場 家長氣炸:我小孩不會接觸這工作

孩子是國家未來的主人翁,不少幼稚園(幼兒園)會安排各項體驗活動,探訪警察局、走訪博物館,加深孩子對社會的了解。不過,一名家長近期抱怨,花大錢送孩子讀全美語幼稚園,結果校外教學居然去參觀資源回收場,質疑

2024-04-19 11:32

-

台大AV女優宣布徒步環台!首日狂走20公里「腳起水泡」 現況曝光

去年考上國立台灣大學的AV女優魏喬安,日前在社群平台上宣布要徒步環島旅行,第一天就狂走20公里,從台北車站走到三峽,也讓她腳上起水泡,再加上同行夥伴遭野狗咬傷,只能暫時回台北休養,不過她也強調,到下週

2024-04-18 20:05

-

一堆人到巴黎錢包被偷!黃大謙帶「8個錢包」實測 驚人結局曝光

法國的首都巴黎是擁有數千年歷史的古都,也是許多遊客到訪歐洲必去的浪漫城市。但當地治安卻總是亮起黃燈,一堆人都曾在當地錢包、財物失竊,當有人要去巴黎時,幾乎被提醒的第一句都是「小心錢包被偷」。對此,Yo

2024-04-18 18:38

-

佛心蛋「1顆賣1元」!每人限5顆 阿姨買100顆遭拒狂酸:還怕人買

不要糟蹋別人的心意!近期雞蛋價格雖然沒有去年「蛋荒」時昂貴,但想要買到一顆1元的雞蛋,仍可以說是天方夜譚。近期就有民眾表示,爸爸退休後迷上養雞、鴨,產生的蛋自家吃不完,就打算便宜販售,訂出「1顆蛋1元

2024-04-18 18:38

娛樂

更多娛樂-

泰勒絲有threads了!歌迷完成「1任務」即獲尊貴徽章 彩蛋全曝光

美國流行歌手泰勒絲(Taylor Swift)在今(19)日正式迎來最新專輯《THE TORTURED POETS DEPARTMENT》發行,有趣的是,社群平台Threads竟然特別為了她打造一個專

2024-04-19 21:54

-

遭謝和弦揭噁心性事!Keanna嗆「渣男幻想文」:回台灣後絕對提告

謝和弦前妻Keanna日前爆料,陳芳語與背著她與男方在錄音室發生關係,引發討論。陳芳語則是透過經紀公司發聲喊告,「內容純屬子虛烏有!」而謝和弦則回應是記錯人,並揭露Keanna私下的噁心行徑。對此,K

2024-04-19 21:32

-

NONO性騷後神隱!老婆朱海君「燦笑現蹤高雄」 友人曝她慘淡近況

知名藝人NONO自從去年捲入MeToo風波,遭多名女子控訴涉嫌性侵,目前還有官司持續偵辦中,而他的妻子朱海君則是照常工作,但從未對外發聲,舉動低調且神祕。近日,朱海君再度現蹤廟宇,並擔任高雄旗山天后宮

2024-04-19 21:08

-

獨家/遭葛斯齊質疑婚內出軌!大S「啪啪啪」曬高清圖:不想告了

大S徐熙媛與汪小菲離婚後,火速嫁給舊情人具俊曄,日前,具俊曄更在韓綜上獨家曝光與大S在電梯裡的甜蜜合照,怎料卻引來不少酸民質疑是大S離婚前拍的,讓「婚內出軌」四個字再登版面,就連狗仔葛斯齊都說「跟我想

2024-04-19 19:44

運動

更多運動-

中職快評/曾頌恩價值非凡的傳球!不只打擊猛 還救了中信兄弟

中信兄弟今(19)日擊敗台鋼雄鷹,最關鍵的Play出現在9局下,台鋼雄鷹靠著狀元曾子祐擊出右外野安打,可惜被曾頌恩的「雷射肩」,直傳本壘觸殺出局,曾頌恩不但攻守俱佳,還幫助中信兄弟拿下重要的勝利,堪稱

2024-04-19 23:39

-

PLG/林書豪替補攻下9分!國王93:97輸夢想家 近6戰僅1勝

P.League+周五由新北國王客場出戰福爾摩沙夢想家,這一場比賽國王明星後衛林書豪替補出戰,攻下9分,但球隊搞砸末節領先,最終以93:97吞下敗仗,最近6戰只有1勝。林書豪復出後連兩場替補出戰,國王

2024-04-19 21:56

-

王柏融開轟也沒用!遭再見阻殺戲劇化結局 台鋼2:3兄弟吞7連敗

中華職棒例行賽中信兄弟今(19)日對戰台鋼雄鷹,儘管台鋼「大王」王柏融在8局下轟出兩分砲,將分數追到1分差,把兄弟嚇出一身冷汗,但兄弟靠著4局建立的3分優勢,加上吳俊偉驚險關門,曾頌恩傳出再見阻殺,最

2024-04-19 21:55

-

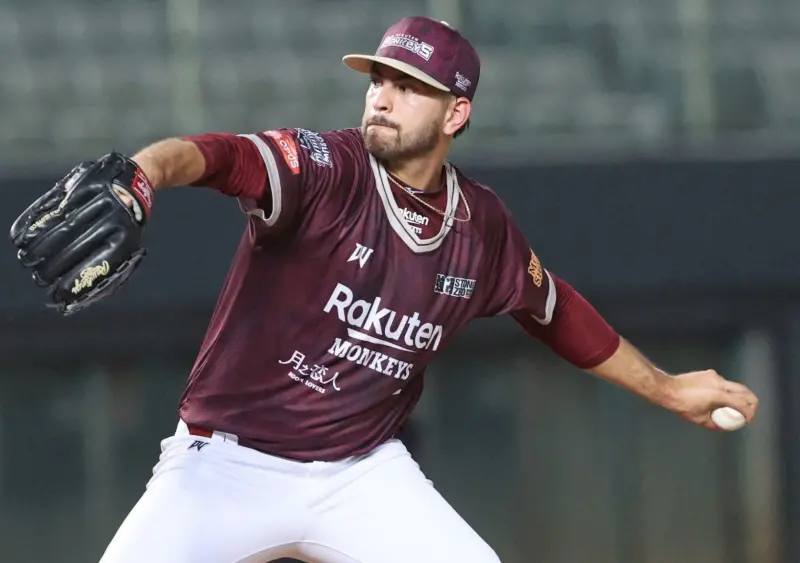

魔神樂初登板6.1局好投奪MVP!嚴宏鈞陽春砲 樂天3:0味全止3連敗

中華職棒例行賽樂天桃猿今(19)日作客味全龍,洋投魔神樂迎來初登板,先發6.1局僅被敲3支安打無失分,封鎖龍隊打線,嚴宏鈞配球引導有功之外,個人也貢獻2安打,包括一發陽春砲,終場樂天桃猿3:0擊敗味全

2024-04-19 21:28

財經生活

更多財經生活-

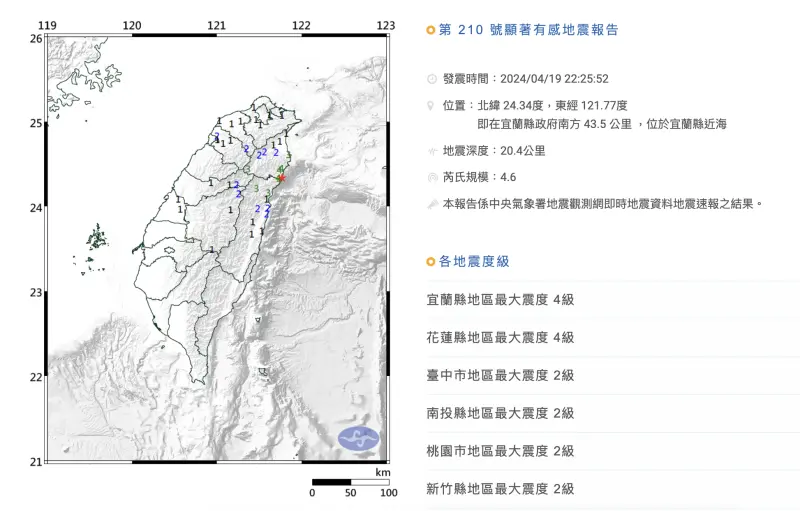

快訊/22:25宜蘭極淺層地震!「規模4.6」最大震度4級 台北有感

今(19)日晚間22時25分發生地震,本次地震芮氏規模4.6,地震深度為20.4公里,震央位於宜蘭縣近海(宜蘭縣政府南方43.5公里處)。本次地震屬於極淺層地震,最大震度為4級,分別出現在宜蘭縣澳花、

2024-04-19 22:39

-

大樂透4/19槓龜!下期頭獎「保證1億」 第113000045期獎號查詢

大樂透第113000045期今(19)日晚間開獎,本期頭獎為1億元,但派彩結果顯示,頭獎及貳獎均槓龜,台彩保證下期頭獎仍有1億。🟡4/19大樂透中獎號碼(第113000045期)由小到大依序為07、

2024-04-19 22:13

-

電影院看《柯南》!全影廳「iPhone同時被喚醒」超毛 真相曝光

知名動畫《名偵探柯南》劇場版《名偵探柯南100萬美元的五稜星》,於4月12日正式在日本上映,才3天就突破系列電影首週票房觀影紀錄。對此,一名日本網友分享,他在看電影時,發現裡頭角色名字發音與iPhon

2024-04-19 22:07

-

好市多洗衣膠囊出包!急發公告召回 會員「這區間購買」開放退貨

知名美式賣場好市多(COSTCO)近日發出最新商品召回公告,提醒會員若在2023年9月30日至2024年4月5日期間,曾購買「汰漬洗衣膠囊春天草地香」商品,因製造商發現產品包裝出現瑕疵,主動回收特定批

2024-04-19 21:10

全球

更多全球-

中東緊張暫歇!華爾街鬆口氣美股道瓊開盤走高 但台積電ADR續跌

受到以色列襲擊伊朗的消息影響,亞洲股市19日哀鴻遍野,台股創下史上最大跌點,日本股市也大跌1011.35點。不過,以色列與伊朗後續反應趨於低調,中東局勢的擔憂暫消,華爾街投資人鬆一口氣,截至寫稿時間為

2024-04-19 22:59

-

翻篇了?伊朗總統既定視察行程未受影響 最新發表談話未提遇襲

美國媒體今(19)日披露,伊朗中部城市伊斯法罕(Isafahan)遭到以色列襲擊,不過,以色列官方並未證實發動攻擊,伊朗也淡化了遇襲的影響,稱防空系統成功運作擊落數架無人機,沒有受到任何損傷,甚至未定

2024-04-19 22:00

-

以色列襲擊伊朗前是否知情?布林肯不願回答 僅重申美國沒有參與

G7外長今(19)日在義大利卡布里島(Capri)舉行峰會,以色列對伊朗實施的襲擊成為焦點問題,雖然伊朗官方淡化了襲擊的影響,以色列也並未證實發動攻擊。美國國務卿布林肯(Antony Blinken)

2024-04-19 20:34

-

北京馬拉松涉造假!主辦方:取消何杰和3非洲選手成績 追回獎金

4月14日舉行的北京半程馬拉松爆發假賽爭議,男子組由馬拉松中國全國紀錄保持者何杰奪冠,但原本領先的3名非洲選手,在比賽末端並未全力衝刺,更像在旁「護送」何杰奪冠,遭譏「半馬變伴馬」。雖然事後何杰與非洲

2024-04-19 18:40