《鄉民大學問EP.36》字幕版|韓院長的突襲!藍綠白委員見“韓國魚”驚呼!謝龍介不敢睡 稱愈晚愈high在忙那椿?葉元之公開立院頭號女戰神是“她”!王世堅自豪這點連韓國瑜也比不上!|NOWnews

NOW影音

更多NOW影音焦點

更多焦點-

台灣角色IP發展求生路 產學合作不能斷鏈

台灣要發展角色IP產業,不只人才得向下扎根、打好基礎,產學之間的連結與合作也相當重要。《NOWnews今日新聞》採訪團隊走訪位在台南的長榮大學,該校是國內極少數擁有「動態立體捕捉技術虛擬攝影棚」的教學

2024-04-20 19:14

-

單日2位市長候選人橫死!墨西哥幫派毒梟暴力籠罩 最危險的大選

墨西哥將在今年6月2日舉行大選,然而政治人物遭遇攻擊事件頻傳,19日再度傳出2名市長候選人橫死遇害,讓墨西哥幫派暴力猖獗的問題引發外界關注。綜合外媒報導,墨西哥檢方證實塔茅利巴斯州(Tamaulipa

2024-04-20 19:06

-

陳亞蘭久違扮花旦索吻!莊凱勛粉墨登場「擔心遭影迷追殺」

推廣歌仔戲不遺餘力的陳亞蘭,與莊凱勛兩位金鐘視帝聯手合作,共演歌仔戲職人劇《勇氣家族》,今(19)日舉辦開播記者會,在劇中飾演夫妻的陳亞蘭及莊凱勛盛重以歌仔戲扮相出場,過去反串男性角色居多的陳亞蘭,久

2024-04-19 18:18

-

雨神蓄勢待發!最強鋒面襲台「連下5天雷雨」 雨最多地區一圖看

明(21)日天氣穩定偏熱,部分地區高溫飆破攝氏36度,氣象署針對雲林以南7縣市發布高溫特報。不過好天氣就快沒了,下週兩波鋒面接力影響,第一波在下週二(23日)、下週三(24日)影響最大,全台降雨機率高

2024-04-20 19:00

精選專題

要聞

更多要聞-

全台頻跳電!台電總經理引咎請辭 蔣萬安:不是換幾個人就可解決

近期傳出限電危機後又連日發生跳電事件,台電總經理王耀庭今(20)日向全民致歉並請辭,經濟部長王美花則希望能慰留。對此,台北市長蔣萬安表示,這不是換幾個人或是新的部長馬上可以解決。蔣萬安下午參加2024

2024-04-20 18:20

-

王耀庭請辭 張善政:於事無補!錯誤的能源政策不該只讓台電承擔

近日停電事件頻傳,桃園受影響戶數破萬,台電成眾矢之的,各界批評聲音不斷,台電總經理王耀庭今(20)日請辭負責。桃園市長張善政表示,這不是一個台電總經理可以解決的問題,也不該只讓台電承擔。張善政說,不覺

2024-04-20 18:05

-

投柯青年嗆民進黨只會抗中保台 鄭麗君「直球對決」回應

準副閣揆鄭麗君今(20)日出席民進黨舉辦「投資未來世代」青年論壇,與青年、專家學者對話。一名總統票投民眾黨主席柯文哲、政黨票投民進黨的青年質疑,民進黨除了抗中保台還剩什麼?對此,鄭麗君回應,她不是因為

2024-04-20 17:11

-

紅線長2140公里禁停車!駕駛怨氣炸鍋 蔣萬安:236處已改成黃線

北市在柯市府任內大量劃設紅線,國民黨台北市議員游淑慧日前在質詢時指出,台北市道路長1421公里,但禁止停車的「紅線」卻長達2140公里,不只職業駕駛人叫苦連天,也對民眾生活造成影響。台北市長蔣萬安今(

2024-04-20 17:09

新奇

更多新奇-

南韓旅客饒河夜市買「2樣水果400元」!網怒轟坑殺 老闆娘回應了

台灣夜市小吃價格再度引發話題!知名南韓YouTuber「韓勾ㄟ金針菇」日前帶著脫北正妹NARA前往台北的饒河夜市,品嘗各種美食,途中兩人光顧一個水果攤,沒想到買了釋迦與蓮霧各一份就要價400元,讓大批

2024-04-20 19:12

-

水煮蛋「最神煮法」!日本政府認證:省超多水跟瓦斯 台灣也適用

水煮蛋「最神煮法」找到了!日前日本政府農林水產省,在社群上發文分享能以最少用水、瓦斯煮出美味水煮蛋的方法,簡單步驟在台灣也適用,更讓數萬日本民眾大讚實用,懊悔沒早點學起來,「之前煮蛋浪費了太多水跟瓦斯

2024-04-20 14:10

-

全美語幼稚園校外教學去資收場 家長氣炸:我小孩不會接觸這工作

孩子是國家未來的主人翁,不少幼稚園(幼兒園)會安排各項體驗活動,探訪警察局、走訪博物館,加深孩子對社會的了解。不過,一名家長近期抱怨,花大錢送孩子讀全美語幼稚園,結果校外教學居然去參觀資源回收場,質疑

2024-04-19 11:32

-

台大AV女優宣布徒步環台!首日狂走20公里「腳起水泡」 現況曝光

去年考上國立台灣大學的AV女優魏喬安,日前在社群平台上宣布要徒步環島旅行,第一天就狂走20公里,從台北車站走到三峽,也讓她腳上起水泡,再加上同行夥伴遭野狗咬傷,只能暫時回台北休養,不過她也強調,到下週

2024-04-18 20:05

娛樂

更多娛樂-

Energy台北小巨蛋演唱會賣完!「7月28日加場」活動攻略亮點曝光

最殺的唱跳天團始祖Energy的復出演唱會《一觸即發》將在7月27日於台北小巨蛋開唱,門票今(20)日中午一開賣即完售,主辦單位對此宣布加開7月28日場次,搶票時間為4月27日中午11點於拓元售票系統

2024-04-20 18:59

-

李智凱差0.1分錯失奧運資格 《翻滾吧》導演:為45秒奮鬥20年

《翻滾吧!男孩》紀錄片中擔任主演之一的台灣「鞍馬王子」李智凱,昨(19)日晚間在杜哈的體操世界盃以0.1之差屈居亞軍,無緣提早獲得巴黎奧運門票。導演《翻滾吧!男孩》的導演林育賢也發文支持李智凱:「為4

2024-04-20 18:14

-

Energy登《綜藝玩很大》挑戰失敗!Toro苦訴吳宗憲:錢真的很難賺

超殺天團Energy在上週降臨《綜藝玩很大》,播出後大受好評,收視成績表現亮眼。本週延續特別企劃,Energy將迎戰人氣鮮肉男團FEniX和U:NUS,結果團員坤達、書偉、牛奶、阿弟、Toro挑戰倒立

2024-04-20 17:43

-

鄭中基首登高雄巨蛋開唱!1萬張門票30分鐘全賣完

鄭中基無預警驚喜宣布「Fragments of Wonder 世界巡迴演唱會」,將於今年9月28日移師高雄巨蛋舉行;出道近30年,這是他首度在高雄開個唱,不論是對他或歌迷而言,皆意義非凡。今(20)日

2024-04-20 17:40

運動

更多運動-

蘇建文引退重現經典場面!陳威成作勢摔帽揮拳 跨欄主角洪總蹲捕

中華職棒資深裁判蘇建文今(20)日在高雄澄清湖棒球場舉辦引退儀式,正式告別他長達33年的裁判生涯。引退儀式上,神秘嘉賓「威總」陳威成現身送上花束,兩人也重建20年前經典大場面,蘇建文站在一壘,「威總」

2024-04-20 19:10

-

楊勇緯再遭中村太樹挫敗!柔道亞錦賽屈居銀牌 苦吞對戰3連敗

「柔道男神」楊勇緯今(20)日在柔道亞洲錦標賽男子60公斤級金牌戰與日本好手中村太樹再度交手,但可惜他在黃金得分制被對方壓制,最終吞下對戰3連敗,屈居銀牌。楊勇緯本季首金雖還未出爐,不過個人目前在奧運

2024-04-20 18:15

-

T1/卡森斯回歸首戰就和強森互噴垃圾話 賽後直言:我很擅長這個

台啤永豐雲豹今(20)日以101:96擊敗臺北台新戰神,卡森斯回歸首戰攻下25分,他在場上也一度和戰神洋將強森有口角,對此卡森斯受訪時表示,「垃圾話也是場上的一部分」,自己很擅長這些,而且也認為這讓比

2024-04-20 18:04

-

卡森斯處理球能力出色!雲豹3位置戰力整齊 高錦瑋猛誇他掩護好

前NBA球星「表弟」卡森斯重回台灣籃壇,讓本來實力就很強悍的台啤雲豹變得更強,今(20)日再以101:96擊敗臺北台新戰神,取得近期5連勝。卡森斯加入之後,還在摸索球隊的打法和節奏,同時他的身體狀況和

2024-04-20 17:44

財經生活

更多財經生活-

比冷氣開幾度重要!吹電風扇有「3種狀況」別吹了 台電認超危險

隨著夏天逐漸逼近,最近應該有不少人都能感受到天氣越來越炎熱,也有許多人家裡的電風扇都已經打開來吹,甚至還有人忍不住都先開了冷氣!然而,你知道你家電風扇是否還「健康」嗎?台電粉絲團就特別分享,家中電風扇

2024-04-20 18:34

-

流浪貓身上「背滿沙包」閒逛!獸醫檢查被震撼:牠背了另一個自己

路上的流浪貓有些有好心貓奴會幫忙照料、餵食罐頭,而有些可就沒有這麼的幸運了!大陸近日有一隻流浪貓在路上被發現長得跟其他的浪浪不同,身上疑似掛了好幾個沙包一樣腳步非常的緩慢,經過好心的中途之家志工救援後

2024-04-20 18:30

-

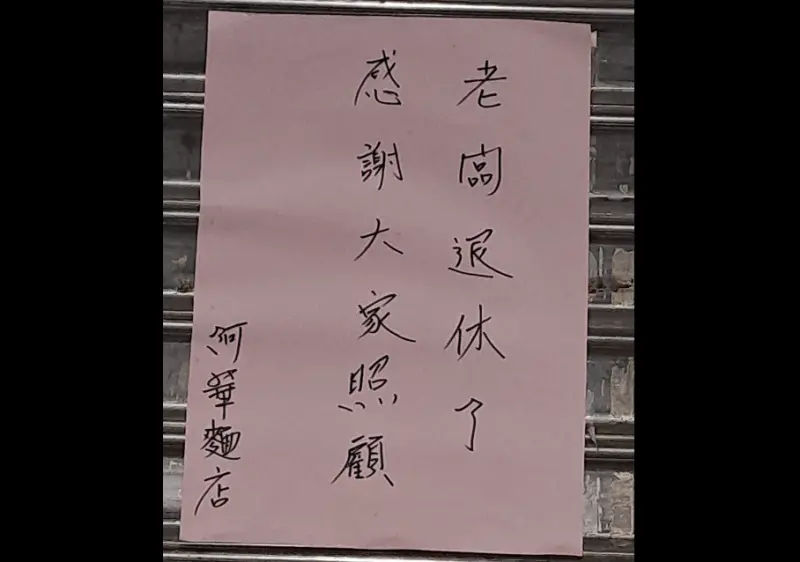

基隆60年「阿華麵店」結束營業!65歲二代老闆退休 在地人超不捨

基隆經營60年的巷弄美食「阿華麵店」公告結束營業,65歲二代老闆表示要退休,兒女也在外地工作,沒有回家接班的打算,讓大批基隆在地人直呼不捨,但同時也讓大批人搞混,以為是知名的「阿華炒麵」要關店,這可就

2024-04-20 16:27

-

台灣泡麵「廠商小心機」抓包!眾吃20年終於發現:幾乎沒一間例外

現在市面上的泡麵口味越來越多元,各家廠商都不斷做出新特色,每當外國客來到台灣遊玩時,也一定都要來碗台灣的泡麵嚐鮮一下,然而從小到大愛吃泡麵的你,是否發現了一項泡麵的「小小盲點」呢?近日就有網友討論「不

2024-04-20 15:04

全球

更多全球-

單日2位市長候選人橫死!墨西哥幫派毒梟暴力籠罩 最危險的大選

墨西哥將在今年6月2日舉行大選,然而政治人物遭遇攻擊事件頻傳,19日再度傳出2名市長候選人橫死遇害,讓墨西哥幫派暴力猖獗的問題引發外界關注。綜合外媒報導,墨西哥檢方證實塔茅利巴斯州(Tamaulipa

2024-04-20 19:06

-

沙漠城市杜拜缺乏排水系統!暴雨數天後積水仍未退 只能靠抽水車

阿拉伯聯合大公國16日遭遇暴雨襲擊,12小時內降下超過120毫米的雨量,超越杜拜一年份平均降雨量。暴雨釀成災情,且過了數天後積水仍未消退,杜拜國際機場仍然處於混亂狀態。有外媒指出,這是因為沙漠城市杜拜

2024-04-20 17:46

-

若日本物價持續上漲 日本央行行長:「非常可能」升息

日本央行行長植田和男19日在美國華盛頓發表演講,重申如果排除短期因素後,日本物價上漲的態勢持續,日本央行升息的「可能性會非常高」。根據《共同社》報導,植田和男沒有提及具體時間,但在基於日美利率差的日圓

2024-04-20 17:00

-

TikTok去中法案再度於美眾院表決!馬斯克表態反對:違背言論自由

封殺TikTok再度成為美國眾議院的討論焦點,今年3月13日眾議院已經通過法案要求字節跳動撤資,不過該法案在參議院並無進展,於是今(20)日眾議院將針對新版法案表決,主旨依然在於要求字節跳動撤資,否則

2024-04-20 16:05