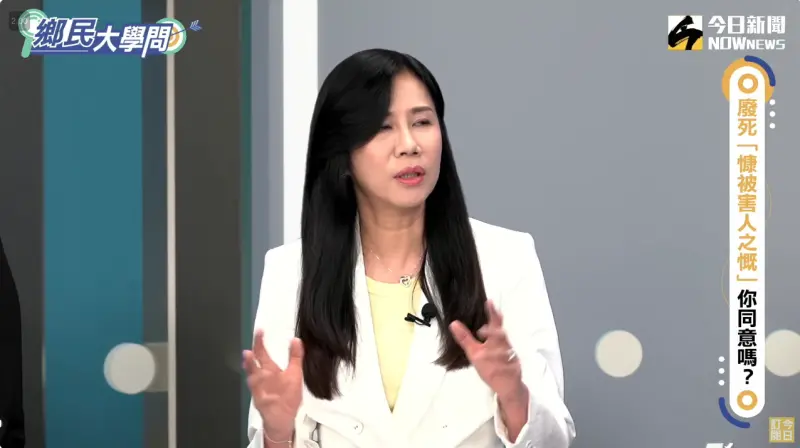

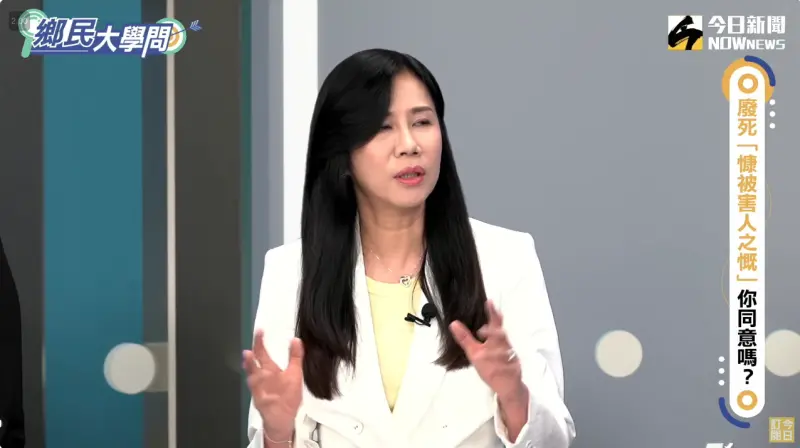

《鄉民大學問EP.38》直播|你反廢死嗎?歡迎來戰!廢死憲法法庭激辯!公投決定你支持?藍黨團提520後 邀賴清德立院國情報告!韓國瑜將正面對上 藍綠攻防?|NOWnews

NOW影音

更多NOW影音焦點

更多焦點-

他點名藍「3大咖」不退場2028恐泡湯 藍委急緩頰:大家都有貢獻

前立委沈富雄日前直言,前總統馬英九、國民黨立委傅崐萁和國民黨主席朱立倫這「3大咖」若不退場,國民黨2028也不用想再戰。對此,國民黨立委萬美玲今(25)日《NOWnews今日新聞》節目《鄉民大學問》中

2024-04-25 14:08

-

台股震盪心驚驚!專家曝股市進入修正 預期「還會再有高點」

台股近日於2萬點上下震盪,美股指數24日收紅,卻沒有同步激勵台股今(25)日表現,大型權值股如台積電、鴻海等紛紛下跌,加權指數開低走低,終場大跌274點,收在19857點,再度失守2萬大關,跌幅1.3

2024-04-25 14:15

-

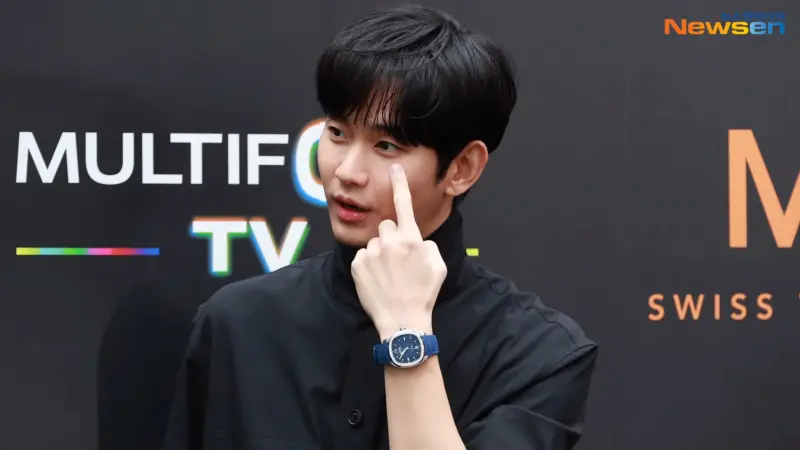

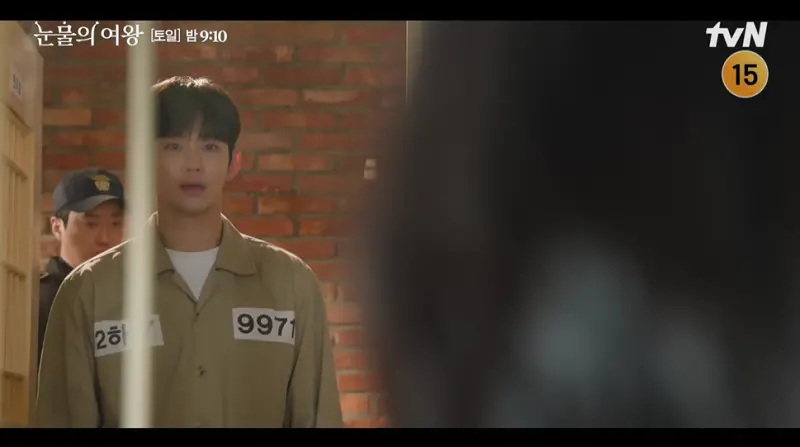

《淚之女王》金智媛結婚現場!韓劇CP御用飯店 玄彬孫藝真也愛這

金秀賢、金智媛搭擋的Netflix韓劇《淚之女王》,開播後一路維持高收視率,目前距離tvN電視台收視率第一的紀錄僅一步之遙。本週末《淚之女王》將播出完結篇,讓不少粉絲都十分期待金秀賢與金智媛這對CP可

2024-04-24 17:39

-

婦人醫院前遭砂石車輾過 三總:到院狀況不樂觀、急救後不治

今(25)日上午台北市內湖區三軍總醫院前發生嚴重車禍,一名婦人遭到砂石車輾壓,三總證實,承包醫院醫療重症大樓統包工程永青營造車輛壓傷民眾,傷者到院時狀況不樂觀,急救後不治。上午一名66歲女士前往三總進

2024-04-25 14:14

精選專題

要聞

更多要聞-

他點名藍「3大咖」不退場2028恐泡湯 藍委急緩頰:大家都有貢獻

前立委沈富雄日前直言,前總統馬英九、國民黨立委傅崐萁和國民黨主席朱立倫這「3大咖」若不退場,國民黨2028也不用想再戰。對此,國民黨立委萬美玲今(25)日《NOWnews今日新聞》節目《鄉民大學問》中

2024-04-25 14:08

-

顧立雄接「文人」防長 王鴻薇猛酸:國防部長還是對美軍購部長

準總統賴清德將於520上任,今(25)日他公布最後一波國安內閣人事,其中國安會秘書長顧立雄將接任國防部長,成為我國第7位文人國防部長。不過,國民黨立委王鴻薇質疑顧立雄接任國防部長後,許多國防自主項目能

2024-04-25 14:03

-

徐巧芯人設翻車?昔稱算10塊銅板苦過來的 今改口早餐店日賺2萬

國民黨立委徐巧芯近日因大姑夫婦涉嫌詐騙,一言一行都遭到放大檢視,也因此身陷輿論風波,不僅被披露全身行頭多為精品,還被抓到曾發文稱家裡沒錢,卻又說家裡早餐店一天可以賺2萬元,說詞反覆,引起關注。徐巧芯2

2024-04-25 14:01

-

傅崐萁會期中赴陸挨轟 美女議員:為何王定宇就可以率團去越南?

國民黨立法院黨團總召傅崐萁將在明天立法院會結束後,帶領黨籍立委赴陸,不過在花蓮餘震不斷情況下出國,遭綠營批「這時赴中毫無正當性可言」。對此,台北市議員鍾沛君今(25)日在《NOWnews今日新聞》節目

2024-04-25 13:40

新奇

更多新奇-

被《關鍵時刻》誤認成東大教授!有吉弘行看到了 本人回應超幽默

台灣政論節目《關鍵時刻》,由知名主持人劉寶傑領銜,時常針對各種時事進行語氣激昂的講解。不過近期在談論423地震話題時,誤將日本知名諧星主持人有吉弘行當成日本東京大學地震權威教授笠原順三,截圖瞬間在網路

2024-04-24 22:31

-

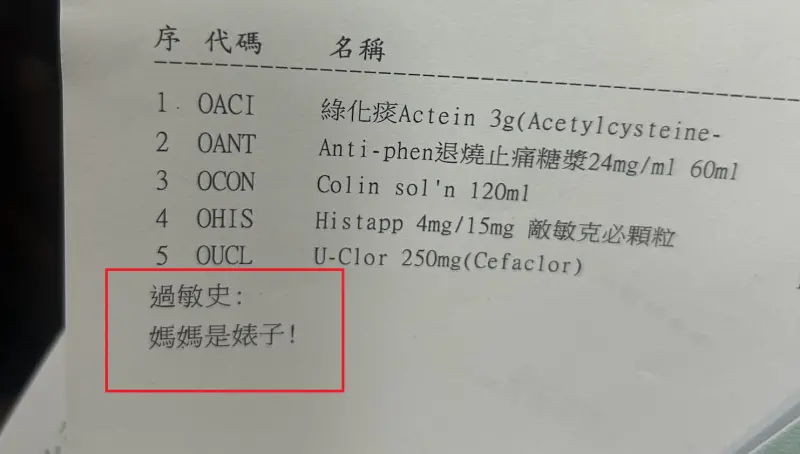

基隆醫院藥單上標註「媽媽是婊子」!人妻一看傻眼 護理師急道歉

(更新時間10:10)一位媽媽今(24)日帶著孩子前往衛生福利部基隆醫院看診,沒想到拿到藥單時,卻看到上面過敏史竟寫上:「媽媽是婊子!」讓她當場傻眼,詢問醫院究竟是怎麼回事,護理師同樣納悶,也立刻向她

2024-04-24 21:09

-

世界100大美食最新排行曝光!台灣竟成「吊車尾」:連英國都輸了

許多國際遊客來台一定會品嘗珍奶、小籠包、雞排、滷肉飯,甚至勇敢一點的還能嘗試看看臭豆腐。卻有國際美食榜單,將台灣美食排名列在榜單末端,甚至還有頗具權威性的美食評論刊物,2023年度最新榜單只給台灣第7

2024-04-24 18:43

-

全聯「稀有水果4顆99元」!隱藏福利曝:送保鮮盒 眾錯過再等1年

先別管60元便當了!全聯福利中心因為經常推出許多新品,或者是期間限定的產品,因此婆媽常常會在臉書社團上討論分享。然而近日就有不少人分享去全聯購買「寶石紅奇異果」,並且開箱分享口感,沒想到卻釣出內行婆媽

2024-04-24 18:29

娛樂

更多娛樂-

五月天甩假唱流言!北京鳥巢嗨唱10場 五迷憂:不想再看阿信吸氧

搖滾天團五月天為紀念出道25週年,舉辦「5525回到那一天」世界巡迴演唱會,昨(24)日所屬的相信音樂在粉專宣布,五月天將在5月18至6月1日重返北京鳥巢開唱,且一共唱10場,粉絲又開始擔心阿信的聲音

2024-04-25 13:20

-

丟丟妹沒運動1個月瘦20公斤!「減肥菜單公開」不復胖靠祕密武器

「直播天后」李明珊(丟丟妹)從爆紅之後,受到外界關注,有粉絲發現她從一開始臉蛋肉肉的形象,暴瘦到鎖骨顯而易見。近日她在IG上自曝,她靠著飲食控制,完全沒運動,一個月瘦下20公斤,令不少人稱羨,更透露還

2024-04-25 13:19

-

雷/《淚之女王》結局片花曝光!金智媛茫然探監金秀賢 劇迷崩潰

南韓影集《淚之女王》上週全國平均總收視率創新高,只差冠軍《愛的迫降》0.058%,可望榮登tvN電視台收視率最高的劇集,本週末將迎來大結局,官方搶先釋出1分12秒片花,金智媛到拘留所探監金秀賢,失去記

2024-04-25 12:28

-

《淚之女王》金智媛撞臉「J女郎」曾愷玹!4特質相似 對比照曝光

韓劇《淚之女王》自3月9日開播以來收視持續攀升,第12集播出後還擊敗《愛的迫降》成為韓國有線電視tvN電視劇在首都圈的收視冠軍,主演金秀賢、金智媛再度翻紅。J女郎曾愷玹也在追劇,她透露「最近也太多人跟

2024-04-25 12:18

運動

更多運動-

4/25NBA季後賽戰報/SGA狂砍33分 雷霆「電爆」鵜鶘取主場2連勝

2024NBA季後賽第二輪賽事,4月25日賽事,邁阿密熱火在「英雄哥」Tyler Herro帶領下,全場投進破紀錄的23記三分球,最終以101:111擊敗「綠衫軍」波士頓塞爾提克,系列賽被扳成1:1;

2024-04-25 14:11

-

周志豪宣布投入NBA選秀!本賽季率普渡闖冠軍戰 有望首輪就獲選

美國NCAA普渡大學中鋒「小姚明」周志豪(Zach Edey),稍早正式宣布將投入今年的2024年NBA選秀會,引發不小關注。有著華裔身分的周志豪,被許多專家視為繼「中國巨塔」姚明之後,下一個能在NB

2024-04-25 14:04

-

大谷翔平被盜5億沒差!不受水原醜聞影響 外媒揭代言收入逾21億

洛杉磯道奇隊球星大谷翔平日前經歷水原一平詐欺案,遭竊取超過1600萬美元(約新台幣5.2億)。帳戶憑空消失如此龐大的金額,而大谷本人卻毫不知情,也令外界十分納悶。結合日媒《full count》針對大

2024-04-25 13:47

-

湖人0:2陷出局絕境!Anthony Davis怒批攻守失序 主帥:我不同意

洛杉磯湖人隊在NBA季後賽首輪G2面對丹佛金塊慘遭絕殺,在系列賽處於0:2落後。賽後,湖人球星「濃眉」Anthony Davis顯然對2連敗相當失望,批評球隊進攻、防守失序,對於子弟兵的不滿情緒,湖人

2024-04-25 13:32

財經生活

更多財經生活-

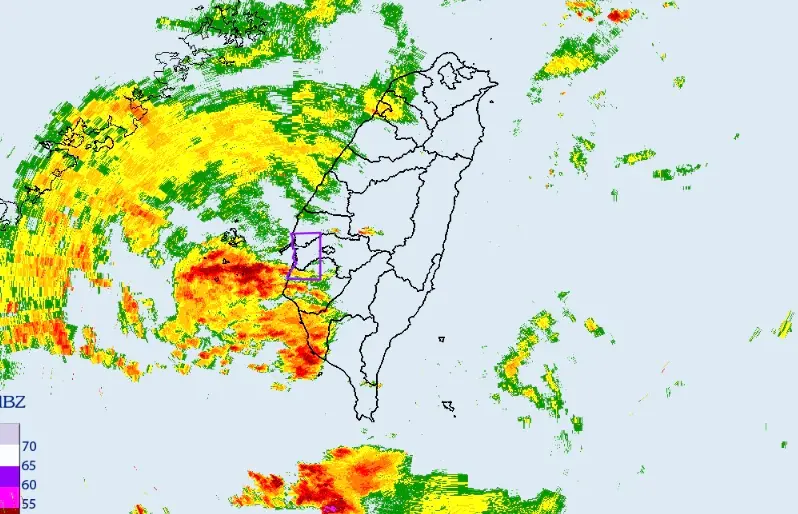

不斷更新/暴雨來了!台南等3縣市「大雷雨警戒區」 慎防9級強風

今(25)日另一鋒面逐漸接近,天氣不穩定,降雨範圍廣,西半部、東北部地區及澎湖、金門、馬祖有短暫陣雨或雷雨,並有局部大雨發生。尤其是台中以南暴雨來襲,中央氣象署也發布「大雷雨即時訊息」和災防告警資訊,

2024-04-25 13:56

-

獨/高三生太強!開發地震APP、合作氣象署 800元地震站能裝你家

繼921後,0403花蓮7.2地震成為近25年來最強震,不斷餘震更搞的人心惶惶,紛紛尋求能提早得知地震消息的管道,2023年上路且廣受好評的「DPIP災害天氣與地震速報」目前擁有破10萬使用者,而在這

2024-04-25 13:23

-

彩券行老闆娘輸錯1號碼!幸運兒「爽中一等獎」 獎金秒翻2800倍

許多人喜歡買彩券碰碰運氣,看是否能中大獎,中國就有一間彩券行,因老闆娘手誤輸錯客人指定的彩券號碼,沒想到竟因此讓該名客人幸運中了一等獎,獲得獎金844萬元人民幣(約3795萬新台幣),比起原先沒輸錯的

2024-04-25 13:06

-

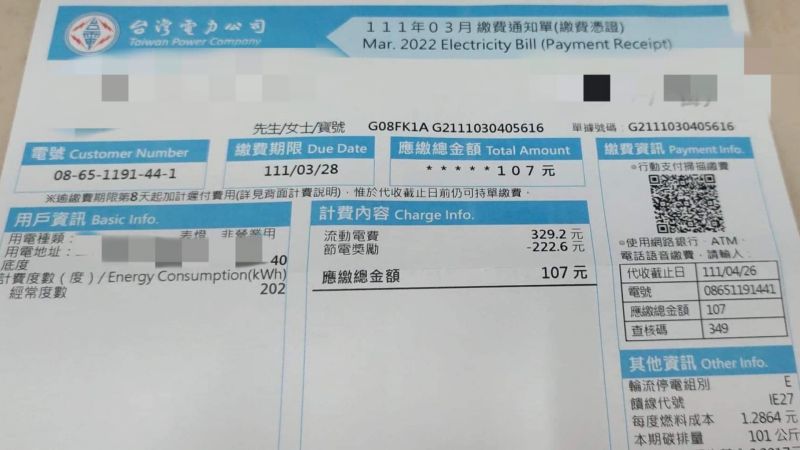

電費調漲也不怕!7-11「隱藏優惠」繳帳單賺回饋:2步驟爽領200元

夏季用電量大加上電價調漲,讓不少民眾看到帳單心驚驚,對此,7-11推出隱藏優惠,到門市繳費前先上網登錄活動,並且使用OPENPOINT繳費,即可獲得11%回饋,最多爽賺200點,相當於200元現金,除

2024-04-25 11:30

全球

更多全球-

日本自民黨再爆醜聞!已婚議員閃辭 被揭當乾爹頻點「外送茶」

日本執政黨自民黨籍眾議員、前防衛副大臣宮澤博行23日突辭去眾議員職務,傳出週刊將登出其醜聞,果不其然,日本知名爆料雜誌週刊文春隔日就揭露,已婚的且現年49歲的宮澤高調包養28歲年輕女子至租屋處,近期更

2024-04-25 13:56

-

日圓跌破155價位!「大拉麵指數」看遭低估74% 日銀干預機率增

日銀(BOJ、日本央行)在今年3月時睽違17年首度升息,但日圓匯率不升反貶,繼24日跌破155日圓價位後,25日開盤即貶破155大關,寫下34年來新低。美國金融科技公司DeepMacro引用「大拉麵指

2024-04-25 12:29

-

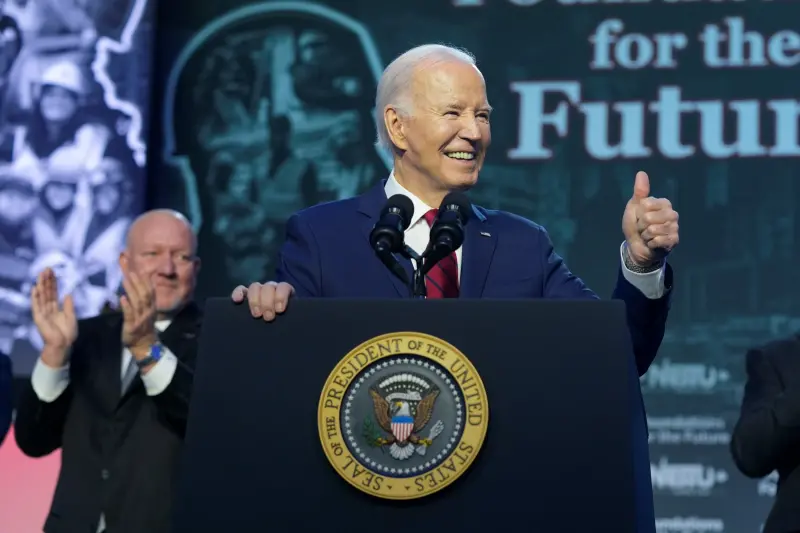

拜登又「凸槌」!競選演說疑似連讀稿機指令都唸 畫面瘋傳再惹議

高齡81歲的美國總統拜登,當地時間週三在華盛頓特區,出席北美建築工會(NABTU)的活動並發表演說,卻被抓包又出現言語上的失誤,疑似是看著讀稿機唸太順,結果連讀稿機指令也一併唸出。綜合《福斯新聞》、《

2024-04-25 12:24

-

華為新機AI修圖「一秒讓妹子變爆乳」惹議 公司承認:有漏洞

華為今年新機「HUAWEl Pura 70」本月18日正式開售,但近期被許多中國3C玩家和用戶發現,華為Pura70的「AI一鍵修圖」的功能,竟能讓原先穿著一般的妹子「一秒變低胸爆乳」,引發爭議。華為

2024-04-25 11:40