《鄉民大學問EP.38》字幕版|藍營2028的超級戰術!黃暐瀚:民調洩民進黨這弱點!廢死引爆民怨 是蔡英文挖坑給賴清德?台電屢跳電 萬美玲曝內幕:竟是小鳥惹的禍?!賴清德赴立院國情報告?將對上韓國瑜?

NOW影音

更多NOW影音焦點

更多焦點-

傅崐萁率藍委團訪陸!柯文哲喊不合理:顯然中方跟國民黨有默契

國民黨立法院黨團總召傅崐萁昨日率16名黨籍立委一起訪問中國,由於目前立法院仍未休會,如此大動作訪中引發各界討論。對此,民眾黨主席柯文哲今(27)日受訪時坦言,「這是不合常規」,顯然是中國方面應該跟國民

2024-04-27 12:14

-

日圓兌美元貶破158!市場關注聯準會、日本央行下一步

26日在紐約外匯市場上,日圓失守158日圓兌1美元的水平,是自1990年5月以來,日圓兌美元首度跌穿158關口。有分析指,市場比以往任何時候,都更關心日本政府和日本央行,是否會干預市場、阻止日圓貶值。

2024-04-27 11:50

-

張書偉、謝京穎公布婚期!深V性感婚紗曝光 「一家4口」甜蜜合影

藝人張書偉、謝京穎2人去年12月已完成登記結婚,今(26)日公開婚紗照,並選定4個對他們十分有意義的場景,來拍攝2人的甜蜜婚紗。其中,張書偉、謝京穎2人還與寵物貓「哥哥」、「呀呀」共同拍婚紗,謝京穎的

2024-04-26 19:46

-

寶林案再增1死!40歲馬籍工程師裝葉克膜搶救1個月 今凌晨離世

台北市遠百A13寶林茶室爆發食物中毒事件,個案皆檢出罕見毒素「邦克列酸」,台北市衛生局長陳彥元昨(26)日指出,4名重症患者已順利完成換肝1人,肝功能有在恢復,其餘3人仍在加護病房,皆有嚴重感染問題,

2024-04-27 12:20

精選專題

要聞

更多要聞-

傅崐萁率藍委團訪陸!柯文哲喊不合理:顯然中方跟國民黨有默契

國民黨立法院黨團總召傅崐萁昨日率16名黨籍立委一起訪問中國,由於目前立法院仍未休會,如此大動作訪中引發各界討論。對此,民眾黨主席柯文哲今(27)日受訪時坦言,「這是不合常規」,顯然是中國方面應該跟國民

2024-04-27 12:14

-

「難以理解民眾黨行徑!」 民進黨:選擇性國會改革已淪藍附庸

針對立法院民進黨團昨日在院會中所提的兩案國會改革「反性騷擾條款」、「反秘密會議洩密條款」被國民黨封殺一事,民進黨今(27)日嚴厲譴責國民黨反民主、反改革的作為,但在表決過程中,社會大眾也再一次看到民眾

2024-04-27 11:58

-

突拋「2026選不好可以收攤了」!柯文哲:2028前哨戰選不好就掛掉

民眾黨主席柯文哲昨日接受黃光芹節目專訪時表示,「2026就決定2028,如果2026選得很差,那(民眾黨)就可以收攤了」。不過,他也提到,民眾黨已啟動「第三代計畫」培育人才。柯文哲今(27)日受訪表示

2024-04-27 11:48

-

咆哮范雲「我有欠你?」黃國昌籲適可而止:不要再做不實操弄

立法院昨日再度上演表決大戰立法院,民進黨團提案三案變更議程,其中與國會改革有關的兩案遭國民黨團提出異議,民進黨立委范雲在提案遭封殺後,不滿民眾黨團未對國會改革相關的反性騷擾案投票,與民眾黨團總召黃國昌

2024-04-27 11:28

新奇

更多新奇-

林叨囝仔七寶媽大翻車!3度道歉無法止血 臉書、IG深夜全關閉了

網紅「林叨囝仔七寶媽」Sydney近日在一場業配直播當中,提及「資源班」相關議題時,失言加上帶有恥笑的態度,引爆各界撻伐,不僅第一時間遭到許多合作廠商切割,更有許多網紅、藝人都跳出來痛批七寶媽「真的很

2024-04-27 06:40

-

台灣泡麵「隱藏王牌」爆出來了!每碗37元吃過上癮 老饕改買這碗

台灣泡麵在市面上販售的口味非常眾多,除了定期的新品之外,也有許多老字號的泡麵長年稱霸排行榜,成為台灣泡麵的一大特色。然而,近日就有網友分享一款台灣泡麵隱藏版,由於平常沒有在各大通路上架,因此只有內行人

2024-04-26 18:29

-

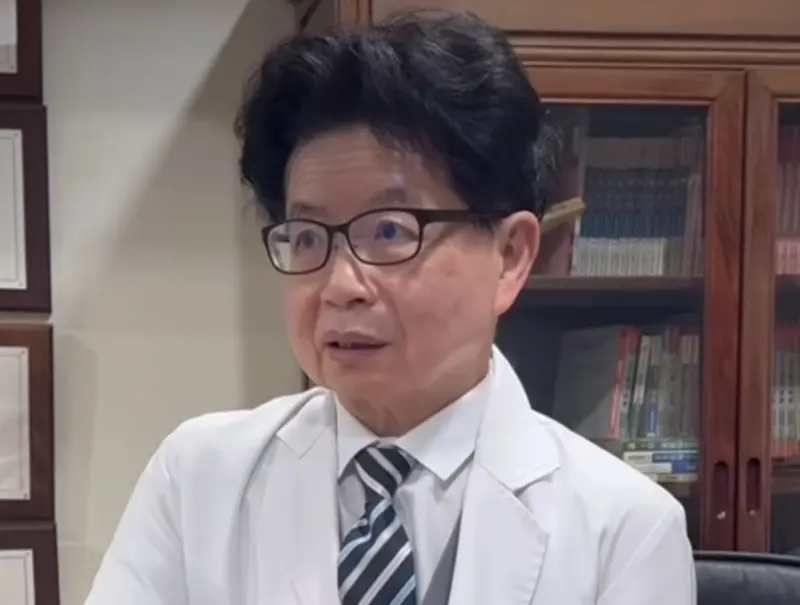

試管嬰兒站出來!婦產科蔡醫師迷因爆紅 本尊「是世界名醫」驚呆

2024最新迷因爆紅!最近在社群平台上,出現一名「活體迷因」,一位婦產科蔡醫師大爆紅,不僅有IG、Tik Tok的追蹤人數暴衝,甚至還有許多粉絲做了蔡醫師的各種周邊商品,由於過去蔡醫師還開投票讓粉絲表

2024-04-26 18:26

-

林叨囝仔七寶媽學歷曝!「最強外語」大學畢業 自嘲專長:生小孩

35歲的網紅「林叨囝仔」七寶媽(陳珮芬)歧視資源班言論遭炎上,不少人好奇七寶媽學歷為何?「七寶媽 學歷」在Google熱搜中快速飆升。據悉,七寶媽從小就是個學霸,國小到大學成績都名列前茅,她曾在部落格

2024-04-26 11:26

娛樂

更多娛樂-

林依晨看完《不夠善良的我們》大結局了!本人忍不住洩4字心得

台劇《不夠善良的我們》由金鐘導演徐譽庭編導,至今播畢6集,兩岸劇迷盛讚節奏引人入勝、林依晨演技封神、許瑋甯表演催淚,小奶狗柯震東和賀軍翔造型也成為話題。該劇今(27)日晚間9點迎來大結局,演小三被封為

2024-04-27 12:03

-

《不夠善良》結局!唐綺陽爆不只2女主是水瓶 還有最早進組的她

台劇《不夠善良的我們》本週末迎來大結局,林依晨(飾演簡慶芬)與許瑋甯(飾演Rebecca張怡靜)劇中充滿較勁,愛追劇的國師唐綺陽爆料,兩大女主角的星座設定,與最早進劇組、本劇配樂Tanya蔡健雅恰巧都

2024-04-27 11:48

-

7寶媽被13家廠商切割!4月訂單全取消了 道歉粉絲:會全數退款

親子網紅「林叨囝仔」7寶媽Sydney日前開直播介紹業配,聊到資源班話題數度放聲大笑,被質疑有歧視之嫌,見批判聲浪發酵,隔天才拍影片道歉,後來又刪掉影片,兩度發文致歉,昨(27)日凌晨關閉臉書、IG。

2024-04-27 10:43

-

火燒雲天有異象!KID曝「大自然變化」成地震預言家:花蓮人經驗

KID林柏昇昨(26)日在社群平台發文,曬出「花蓮火燒雲」景象,提醒大家要注意大自然變化;想不到,今日凌晨2點多,花蓮地區就出現芮氏規模6.1地震,令許多網友直呼KID是「預言家」,KID則回應說:「

2024-04-27 10:33

運動

更多運動-

台灣啦啦隊第一人!樂天桃猿女神壯壯 重磅加盟韓職足球隊水原FC

樂天桃猿棒球隊女團長「壯壯」今(27)日宣布,自己重磅加盟國足球隊水原FC,成為台灣啦啦隊前進韓職第一人,而這也是今年大舉外援加入中職啦啦隊後,首度有台灣啦啦隊員前進韓職足球隊。水原FC是一家位於南韓

2024-04-27 12:10

-

NBA/得0分又如何!湖人主帥仍對DLo有信心:我相信他G4會反彈

NBA美國職籃昨(26)日洛杉磯湖人在主場以105:112不敵丹佛金塊,系列賽遭到對手「聽牌」,湖人也成為本賽季季後賽上,第一支遭到對手以3:0聽牌的球隊。而本場比賽湖人後衛D'Angelo

2024-04-27 12:04

-

快評/獨行俠「細火慢燉」磨陣地戰 快艇的失誤成插在胸口的尖刀

Kawhi Leonard得9分、Paul George得7分,洛杉磯快艇90:101輸掉系列賽G3,他們在達拉斯獨行俠精心設計的「慢節奏」陷阱中越陷越深,全場19次失誤成為輸球關鍵,這讓他們因此丟掉

2024-04-27 11:54

-

NBA季後賽/Kawhi、PG熄火!獨行俠101:90快艇 系列賽2:1領先

NBA美國職籃首輪季後賽G3今(27)日的第二場比賽,由達拉斯獨行俠在主場迎戰洛杉磯快艇隊,前兩戰雙方在快艇主場各搶下一勝,系列賽戰成1:1平手。此役獨行俠靠著球星Luka Doncic攻下全場最高2

2024-04-27 11:41

財經生活

更多財經生活-

凌晨地震「往北移」!已釋45顆原子彈能量 專家:仍不及921一半

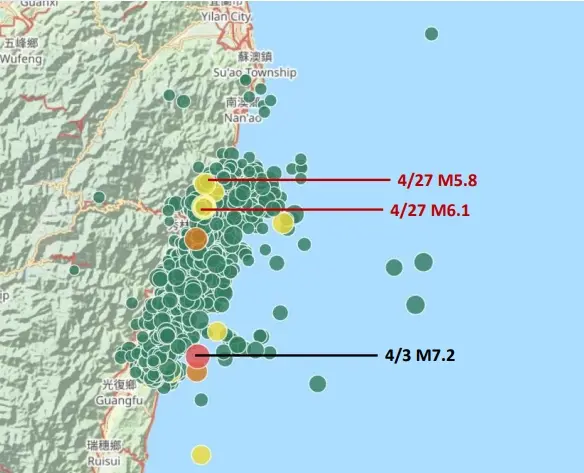

今(27)日凌晨發生規模6.1、5.8地震,中央氣象署說明為「0403強震」後的餘震序列。地震專家郭鎧紋表示,今天凌晨兩起地震加起來,威力相當於釋放1顆原子彈,而主震發生後北邊先發生過兩起芮氏規模6以

2024-04-27 11:52

-

花蓮頻地震「能量釋放」阻7級強震?美地質學者曝驚人能量潛規則

花蓮今(27)凌晨2時21分發生規模6.1地震,整夜震不停,氣象署一早說明,指此波地震序列仍屬於0403花蓮大地震餘震,還在做應力調整,現在移到較北邊來做能量釋放。頻繁地震料已釋放大規模能量,代表規模

2024-04-27 11:21

-

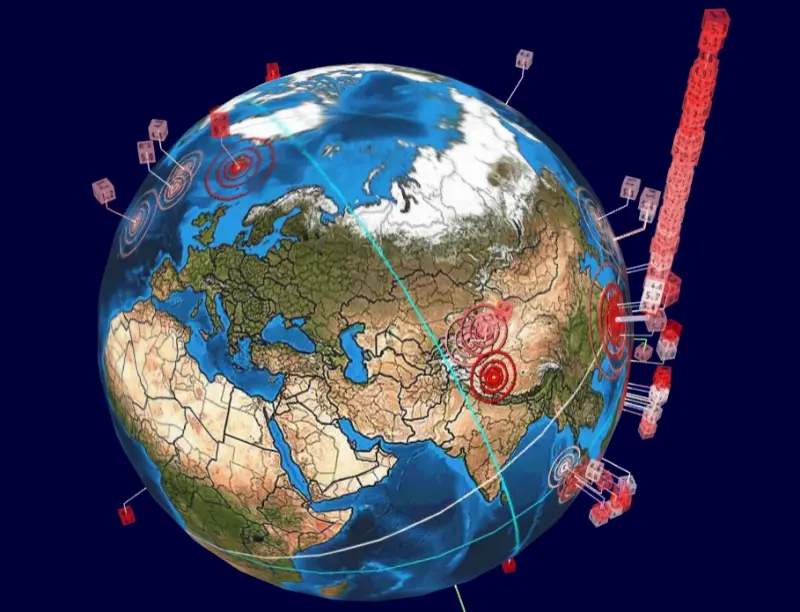

花蓮凌晨連7震!恐怖「地震摩天樓」再現 台灣人全傻:幫蓋101嗎

今(27)日凌晨台灣發生多起地震,其中2:21為規模6.1、2:49規模5.8兩個最有感。根據全球地震3D即時直播圖「Earthquake 3D Live」顯示,發現到台灣地震頻率又再度突破天際線,因

2024-04-27 09:30

-

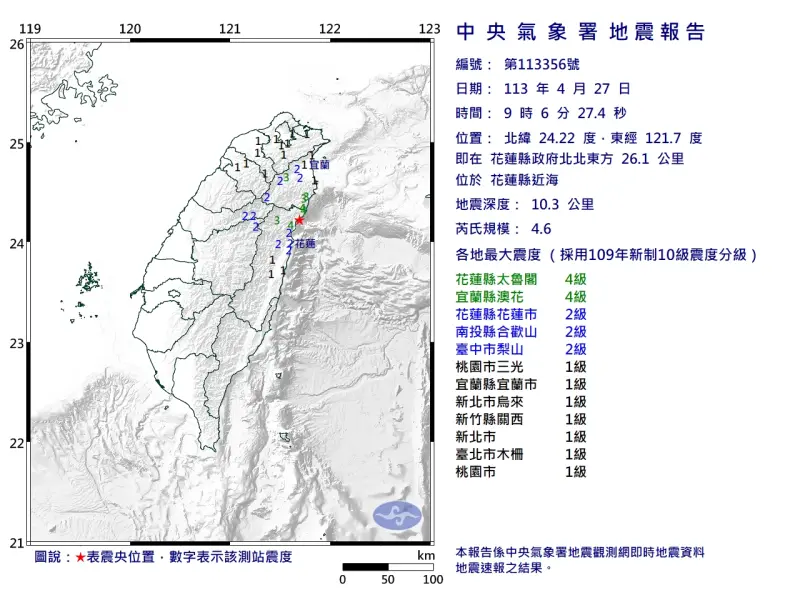

快訊/9:06規模4.6地震!花蓮、宜蘭最大震度4級 北部有明顯搖晃

有感地震又來了!4月27日早上9時06分,花蓮發生「芮氏規模4.6」地震,震央位置花蓮縣政府北北東方 26.1 公里 ,位於花蓮縣近海,地震深度10.3公里,花蓮縣、宜蘭縣最大震度4級,雙北地區也搖晃

2024-04-27 09:18

全球

更多全球-

日圓兌美元貶破158!市場關注聯準會、日本央行下一步

26日在紐約外匯市場上,日圓失守158日圓兌1美元的水平,是自1990年5月以來,日圓兌美元首度跌穿158關口。有分析指,市場比以往任何時候,都更關心日本政府和日本央行,是否會干預市場、阻止日圓貶值。

2024-04-27 11:50

-

布林肯會晤習近平!對話無交集 美中關係「急劇下滑到穩步惡化」

美國國務卿布林肯(Antony Blinken),26日下午於北京人民大會堂,與中國國家主席習近平會晤,不少專家學者都不看好這次會面,認為實際成果太少,美中關係只是從「急劇下滑」走向「穩步惡化」。根據

2024-04-27 09:43

-

「Telegram」平台大當機!多國癱瘓一度無法更新 X湧搞怪表情包

跨平台即時通訊軟體「Telegram」,27日凌晨一度傳出全球大當機,無法在App內更新,畫面顯示不斷轉圈,也不能傳送訊息,而且問題範圍不僅限於台灣。綜合外媒報導,追蹤網站「Downdetector」

2024-04-27 06:20

-

科技巨頭財報亮眼!美股上演大反彈 Google母公司股價漲近10%

26日在Google母公司Alphabet與微軟亮眼財報加持下,美國股市開出紅盤,標普500指數、納斯達克指數皆創去年11月以來的最佳單週表現,其中納指還創下自2月以來的最佳單日漲幅,達2.03%。綜

2024-04-27 06:02