《鄉民大學問EP.38》字幕版|藍營2028的超級戰術!黃暐瀚:民調洩民進黨這弱點!廢死引爆民怨 是蔡英文挖坑給賴清德?台電屢跳電 萬美玲曝內幕:竟是小鳥惹的禍?!賴清德赴立院國情報告?將對上韓國瑜?

NOW影音

更多NOW影音焦點

更多焦點-

黃國昌一人綁架全黨?柯文哲讚「戰力強」:讓他盡量發揮

民進黨團昨日在立法院會變更議程,希望攸關國會性平、洩密等國會改革兩案逕付二讀,由於民眾黨8席立委未投票,遭到有人數優勢的國民黨團封殺。民進黨團幹事長吳思瑤不滿批評,民眾黨團總召黃國昌「一人綁架全黨」,

2024-04-27 11:13

-

台塑董事候選名單出爐!總經理郭文筆首次上榜、接董座呼聲高

台塑四寶今年有台塑(1301)、台化(1326)及台塑化(6505)股東會將進行董事改選。台塑昨(26)日公布董事候選名單,繼台塑化董事長陳寶郎退出台塑化董事候選名單後,林健男也退出台塑董事候選名單,

2024-04-27 09:57

-

張書偉、謝京穎公布婚期!深V性感婚紗曝光 「一家4口」甜蜜合影

藝人張書偉、謝京穎2人去年12月已完成登記結婚,今(26)日公開婚紗照,並選定4個對他們十分有意義的場景,來拍攝2人的甜蜜婚紗。其中,張書偉、謝京穎2人還與寵物貓「哥哥」、「呀呀」共同拍婚紗,謝京穎的

2024-04-26 19:46

-

花蓮醫出海賞鯨失去音信!背包、名片遺留船上 最後身影曝光

花蓮慈濟醫院一名56歲古姓醫師,21日前往礁溪參加醫學研討會後失聯,家屬焦急報案,經調閱監視器後發現,古男當日下午隻身前往登船賞鯨遊龜山島,船返程到港後卻不見人影,只留下背包和名片在船上,推測疑似落海

2024-04-27 10:35

精選專題

要聞

更多要聞-

傅崐萁訪中又碰地震 綠委批:習近平及中共政權比花蓮百姓重要

國民黨立法院黨團總召傅崐萁昨率團訪問中國,今(27)日凌晨花蓮卻發生規模6.1地震,引發關注。對此,民進黨立委許智傑批評,顯然在傅崐萁眼中,習近平及中共政權,比花蓮老百姓重要,國民黨這種背棄人民集體組

2024-04-27 10:18

-

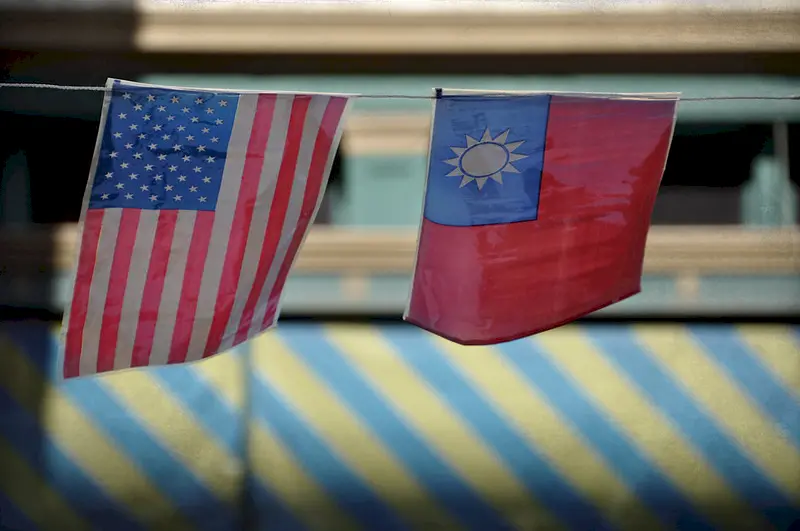

台美貿易倡議第2階段第2次實體談判 下周台北登場聚焦3議題

台美21世紀貿易倡議第二階段於去年8月在華府舉行首輪實體談判,台美雙方26日共同宣布,第二次實體會議將訂於4月29日到5月3日在台北舉行,並聚焦在勞工、農業、環境等三個章節進行討論。此次美方代表團成員

2024-04-27 10:03

-

高虹安愛將偷錄音公審部屬 竹市議員:柯文哲曾說偷錄音要槍斃

新竹市民政局長施淑婷不滿新竹市議員楊玲宜在政論節目上爆料,在臉書上秀出自己與部屬的錄音檔,證明楊玲宜所說並非事實,但也挨批是在公審自己部屬。新竹市議員曾資程說,民眾黨主席柯文哲在台北市長任內答詢時曾說

2024-04-27 09:55

-

民進黨在新北輸了快20年!備戰2026選舉 黃暐瀚建議蘇巧慧這麼做

民進黨新北市黨部主委選舉,民進黨立委蘇巧慧同額競選,已確定會當選,也非常有機會代表民進黨參選2026年新北市長選舉。資深媒體人黃暐瀚說,蘇巧慧要善用自己的網路行銷能力,配合勤跑地方,認真問政,努力在2

2024-04-27 09:05

新奇

更多新奇-

林叨囝仔七寶媽大翻車!3度道歉無法止血 臉書、IG深夜全關閉了

網紅「林叨囝仔七寶媽」Sydney近日在一場業配直播當中,提及「資源班」相關議題時,失言加上帶有恥笑的態度,引爆各界撻伐,不僅第一時間遭到許多合作廠商切割,更有許多網紅、藝人都跳出來痛批七寶媽「真的很

2024-04-27 06:40

-

台灣泡麵「隱藏王牌」爆出來了!每碗37元吃過上癮 老饕改買這碗

台灣泡麵在市面上販售的口味非常眾多,除了定期的新品之外,也有許多老字號的泡麵長年稱霸排行榜,成為台灣泡麵的一大特色。然而,近日就有網友分享一款台灣泡麵隱藏版,由於平常沒有在各大通路上架,因此只有內行人

2024-04-26 18:29

-

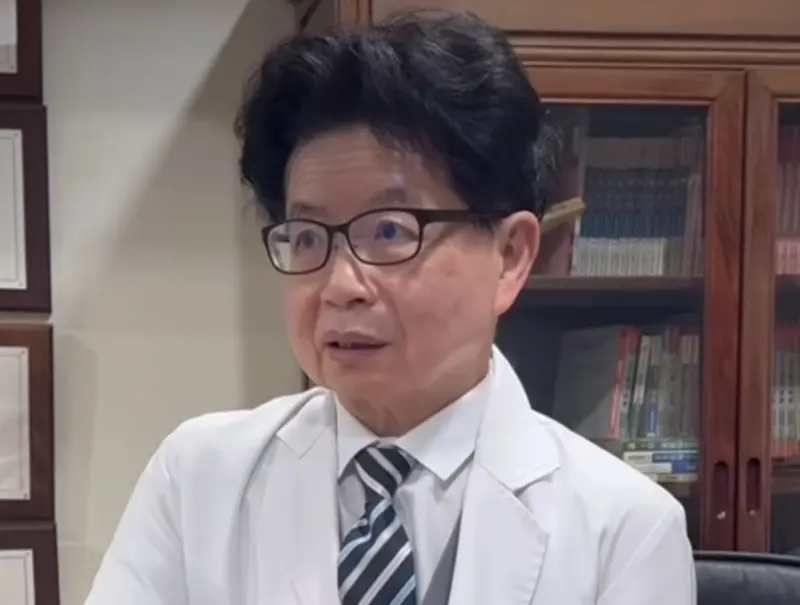

試管嬰兒站出來!婦產科蔡醫師迷因爆紅 本尊「是世界名醫」驚呆

2024最新迷因爆紅!最近在社群平台上,出現一名「活體迷因」,一位婦產科蔡醫師大爆紅,不僅有IG、Tik Tok的追蹤人數暴衝,甚至還有許多粉絲做了蔡醫師的各種周邊商品,由於過去蔡醫師還開投票讓粉絲表

2024-04-26 18:26

-

林叨囝仔七寶媽學歷曝!「最強外語」大學畢業 自嘲專長:生小孩

35歲的網紅「林叨囝仔」七寶媽(陳珮芬)歧視資源班言論遭炎上,不少人好奇七寶媽學歷為何?「七寶媽 學歷」在Google熱搜中快速飆升。據悉,七寶媽從小就是個學霸,國小到大學成績都名列前茅,她曾在部落格

2024-04-26 11:26

娛樂

更多娛樂-

7寶媽被13家廠商切割!4月訂單全取消了 道歉粉絲:會全數退款

親子網紅「林叨囝仔」7寶媽Sydney日前開直播介紹業配,聊到資源班話題數度放聲大笑,被質疑有歧視之嫌,見批判聲浪發酵,隔天才拍影片道歉,後來又刪掉影片,兩度發文致歉,昨(27)日凌晨關閉臉書、IG。

2024-04-27 10:43

-

火燒雲天有異象!KID曝「大自然變化」成地震預言家:花蓮人經驗

KID林柏昇昨(26)日在社群平台發文,曬出「花蓮火燒雲」景象,提醒大家要注意大自然變化;想不到,今日凌晨2點多,花蓮地區就出現芮氏規模6.1地震,令許多網友直呼KID是「預言家」,KID則回應說:「

2024-04-27 10:33

-

小龍女專訪/戶頭剩400元!小蛙淚揭《DD52》內幕:不敢跟爸媽說

味全龍啦啦隊「小龍女」成員小蛙(洪薏婷),過去曾在偶像選秀節目《菱格世代DD52》嶄露頭角,2022年加入小龍女後人氣迅速暴增,超強的舞功再配上可愛的娃娃臉,更擄獲許多球迷喜愛,女生也通通被她圈粉。事

2024-04-27 10:00

-

《特技玩家》片名暗藏玄機!艾蜜莉布朗、萊恩葛斯林激起超狂火花

艾蜜莉布朗和萊恩葛斯林主演《特技玩家》,英文片名「Fall Guy」在特技動作界擁有非常豐富的歷史,一開始是指為了創作電影魔法承受身體打擊的表演者。但導演大衛雷奇解釋,在本片還有「替死鬼」的意思。▲萊

2024-04-27 09:56

運動

更多運動-

NBA季後賽/Kawai、PG熄火!獨行俠101:90快艇 系列賽2:1領先

NBA美國職籃首輪季後賽G3今(27)日的第二場比賽,由達拉斯獨行俠在主場迎戰洛杉磯快艇隊,前兩戰雙方在快艇主場各搶下一勝,系列賽戰成1:1平手。此役獨行俠靠著球星Luka Doncic攻下全場最高2

2024-04-27 11:01

-

大谷翔平跟YOASOBI成了同門師兄妹?解密美國超大型娛樂龍頭CAA

日本超人氣音樂組合YOASOBI在2023年因為動漫《我推的孩子》主題曲《Idol》風靡全球,今年1月曾來台舉辦演唱會在開賣前造成網站系統癱瘓,瞬間秒殺一票難求,近日更傳出簽給美國大型事務所Creat

2024-04-27 10:50

-

大谷翔平本季第7轟!比肩隊史多項紀錄 道奇12:2打爆藍鳥5連勝

洛杉磯道奇「二刀流」日籍球星大谷翔平今(27)日隨隊出戰多倫多藍鳥,他首局就在藍鳥球迷的噓聲之下敲出個人本季第7發全壘打,隨之打破/追平多項紀錄,道奇隊此役團隊敲出19支安打,最終以12:2大勝對手,

2024-04-27 10:33

-

快評/Middleton空砍42分 公鹿被溜馬「下克上」的氛圍正在醞釀

密爾瓦基公鹿在印城深陷泥沼,在今天輸給溜馬隊之後,公鹿落入1:2劣勢,球隊已經彈盡糧絕,當家球星「字母哥」Giannis Antetokounmpo持續缺陣,主控Damian Lillard帶傷硬打,

2024-04-27 10:18

財經生活

更多財經生活-

花蓮頻繁地震能阻強震?美地質學者:1000次M5才抵1次M7地震能量

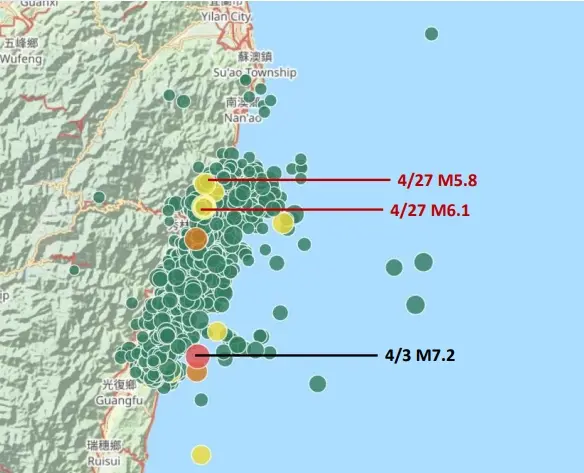

花蓮今(27)凌晨2時21分發生規模6.1地震,整夜震不停,氣象署一早說明,指此波地震序列仍屬於0403花蓮大地震餘震,還在做應力調整,現在移到較北邊來做能量釋放。頻繁地震料已釋放大規模能量,代表規模

2024-04-27 09:58

-

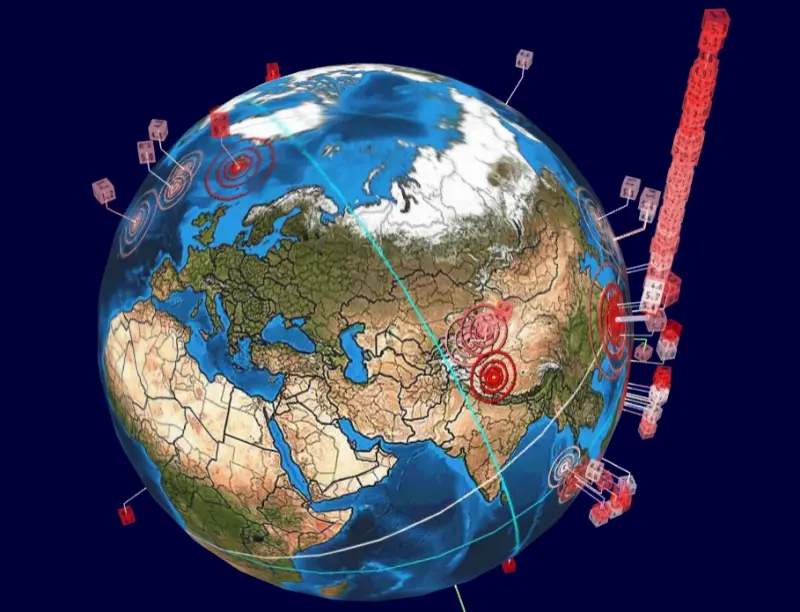

花蓮凌晨連7震!恐怖「地震摩天樓」再現 台灣人全傻:幫蓋101嗎

今(27)日凌晨台灣發生多起地震,其中2:21為規模6.1、2:49規模5.8兩個最有感。根據全球地震3D即時直播圖「Earthquake 3D Live」顯示,發現到台灣地震頻率又再度突破天際線,因

2024-04-27 09:30

-

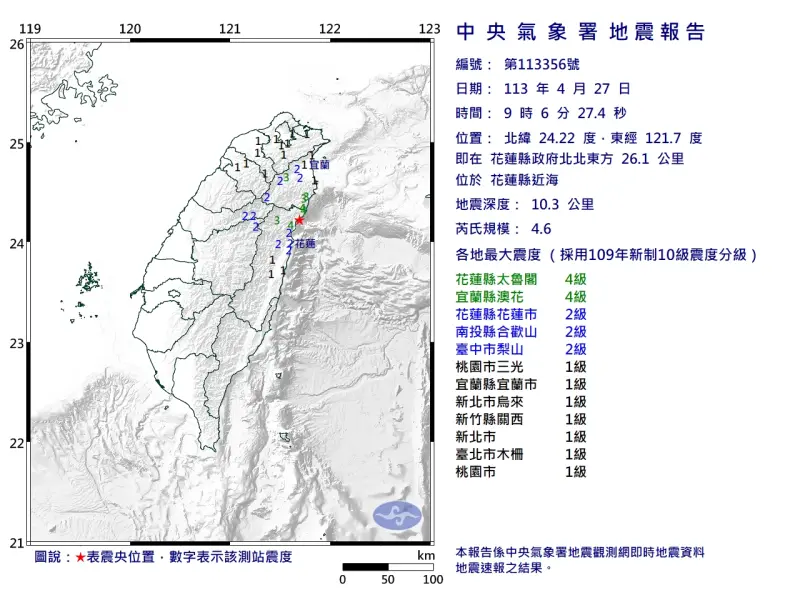

快訊/9:06規模4.6地震!花蓮、宜蘭最大震度4級 北部有明顯搖晃

有感地震又來了!4月27日早上9時06分,花蓮發生「芮氏規模4.6」地震,震央位置花蓮縣政府北北東方 26.1 公里 ,位於花蓮縣近海,地震深度10.3公里,花蓮縣、宜蘭縣最大震度4級,雙北地區也搖晃

2024-04-27 09:18

-

凌晨6.1地震台北有感!氣象署:應力調整移北邊 估餘震再搖半年

今(27)日凌晨2時21分,發生芮氏規模6.1地震,最大震度4級,全台有感地震;緊接著。中央地震測報中心說明,這一連串地震序列仍屬於0403花蓮大地震餘震,還在做應力調整,現在移到較北邊來做能量釋放,

2024-04-27 09:05

全球

更多全球-

布林肯會晤習近平!對話無交集 美中關係「急劇下滑到穩步惡化」

美國國務卿布林肯(Antony Blinken),26日下午於北京人民大會堂,與中國國家主席習近平會晤,不少專家學者都不看好這次會面,認為實際成果太少,美中關係只是從「急劇下滑」走向「穩步惡化」。根據

2024-04-27 09:43

-

「Telegram」平台大當機!多國癱瘓一度無法更新 X湧搞怪表情包

跨平台即時通訊軟體「Telegram」,27日凌晨一度傳出全球大當機,無法在App內更新,畫面顯示不斷轉圈,也不能傳送訊息,而且問題範圍不僅限於台灣。綜合外媒報導,追蹤網站「Downdetector」

2024-04-27 06:20

-

科技巨頭財報亮眼!美股上演大反彈 Google母公司股價漲近10%

26日在Google母公司Alphabet與微軟亮眼財報加持下,美國股市開出紅盤,標普500指數、納斯達克指數皆創去年11月以來的最佳單週表現,其中納指還創下自2月以來的最佳單日漲幅,達2.03%。綜

2024-04-27 06:02

-

Google、微軟帶頭衝鋒!美股一掃Meta重挫陰霾 華爾街開紅盤

美國股市26日一掃停滯性通膨風險與臉書母公司Meta昨日重挫的陰霾,在Google母公司Alphabet與微軟財報強勁推動下,華爾街開出紅盤,截至寫稿時間為止,道瓊工業指數上漲132.54點、約0.3

2024-04-26 22:50