《鄉民大學問EP.38》字幕版|藍營2028的超級戰術!黃暐瀚:民調洩民進黨這弱點!廢死引爆民怨 是蔡英文挖坑給賴清德?台電屢跳電 萬美玲曝內幕:竟是小鳥惹的禍?!賴清德赴立院國情報告?將對上韓國瑜?

NOW影音

更多NOW影音焦點

更多焦點-

想爬山了!合歡山帥警像這3男星綜合體 長官親回:保7總隊的

今早有網友在臉書「路上觀察學院」PO上一張合歡山管理站前的帥警照,指是台灣最美的風景,年輕男警戴著墨鏡站在警車前,被網友形容為馮德倫、潘瑋柏、蘇有朋的綜合體,短短5小時吸引近萬人按讚,連保7總隊長吳敬

2024-04-26 14:13

-

台積電領電子股反攻!台股大漲263點、站回2萬點關卡

台北股市今(26)日回神反彈,開盤上漲236點、來到20094.17點,成攻站上2萬點關卡,隨後在電子、營建、航運股的力撐下,一度大漲368點、來到20226.29點,終場則是上漲263.09點或1.

2024-04-26 13:46

-

獨/作家氣到發抖嗆7寶媽!分享養特殊兒經驗:看以後不要看現在

「林叨囝仔The Lins'Kids」7寶媽Sydney,因直播中出現疑似訕笑「資源班」學生言論而遭炎上,對此,網紅作家「神老師&神媽咪」沈雅琪作為老師及特殊孩子的媽媽,忍無可忍發聲痛批:「憑

2024-04-26 12:36

-

再一起大雨「路樹倒塌」砸人!彰化郵差騎車無辜遭砸 搶救不治

台灣鋒面發威,大雨襲台,今(26)日中午12時30分許,彰化縣一名45歲的孫姓郵差,騎車行經芬園鄉彰南路一段600號附近時,路旁的黃花風鈴木倒塌,孫男瞬間被砸中倒地,當場血流滿面、失去呼吸心跳,送往草

2024-04-26 13:56

精選專題

要聞

更多要聞-

統測明日登場!台電「陪考」動員1098人次待命 確保穩定考場供電

113學年度四技二專暨二技統一入學測驗明(27)日起,連續舉行2天考試,近7萬名考生登場競試。為了確保考場穩定供電,台電表示,除了總處及各區營業處成立應變小組外,針對全國所有考場指派人員進駐,同時也在

2024-04-26 14:05

-

「怎會怕小兒科式霸凌」 徐巧芯斥王美花、顧立雄不用利益迴避?

國民黨立委徐巧芯近日因大姑夫婦涉嫌詐騙,一言一行都遭到放大檢視,甚至還哭倒在國民黨總召傅崐萁懷裡,近期作風也轉為低調。不過徐巧芯今(26)日滿血回歸,指經濟部長王美花傳出即將出任台新金的獨董,王美花與

2024-04-26 13:47

-

批黃國昌暴怒大吼超沒水準!黃捷:對同事情緒暴力如精神凌虐

立法院民進黨團今(26日)提案三案變更議程,其中與國會改革有關的兩案遭國民黨團提出異議,民進黨立委范雲因民眾黨團未對國會改革相關的反性騷擾案投票,進而與民眾黨團總召黃國昌起口角。對此,民進黨立委黃捷直

2024-04-26 13:38

-

被黃國昌咆哮 范雲還原經過:情緒控管有問題、形同恐嚇他人

立法院民進黨團今(26日)提案三案變更議程,其中與國會改革有關的兩案遭國民黨團提出異議,民進黨立委范雲因民眾黨團未對國會改革相關的反性騷擾案投票,進而與民眾黨團總召黃國昌起口角。對此,范雲還原事發經過

2024-04-26 13:31

新奇

更多新奇-

七寶媽學歷曝!從小是學霸「最強外語」大學畢 自嘲專長:生小孩

35歲的網紅七寶媽(陳珮芬)歧視資源班言論遭炎上,不少人好奇七寶媽學歷為何?「七寶媽 學歷」在Google熱搜中快速飆升。據悉,七寶媽從小就是個學霸,國小到大學成績都名列前茅,她曾在部落格自曝畢業於文

2024-04-26 11:26

-

婦產科蔡醫師迷因爆紅!本尊是世界名醫 粉絲讚爆:我是試管嬰兒

2024最新迷因爆紅!最近在社群平台上,出現一名「活體迷因」,一位婦產科蔡醫師大爆紅,不僅有IG、Tik Tok的追蹤人數暴衝,甚至還有許多粉絲做了蔡醫師的各種周邊商品,由於過去蔡醫師還開投票讓粉絲表

2024-04-26 11:13

-

快訊/網紅七寶媽笑資源班遭轟!刪直播二度道歉:請原諒我的無知

網紅「林叨囝仔The Lins'Kids」七寶媽去年陷入多起爭議,好不容易才悄悄復出,結果日前直播上疑似嘲笑資源班的言論,讓她再度炎上。日前七寶媽Sydney深夜開直播道歉,但卻被批評是「把過

2024-04-26 09:15

-

網紅7寶媽「嘲笑資源班道歉沒用」!遭切割拒合作 9家廠商一次看

網紅「林叨囝仔The Lins'Kids」7寶媽Sydney日前在臉書進行網路書店業配直播,然而卻在過程當中,出現疑似有恥笑、歧視「資源班」學生言語,讓大批網友感到非常不滿因而炎上。然而7寶媽

2024-04-26 08:23

娛樂

更多娛樂-

《不夠善良》揭林依晨出軌床戲秘辛!柯震東直男吻破許瑋甯嘴唇

夯劇《不夠善良的我們》明(27)日將播出大結局,林依晨在劇中背叛老公賀軍翔,與藍葦華那場連衣服都沒脫的出軌床戲,驚駭許多忠實觀眾,她也親自解讀劇中床戲密辛。而第7集預告中,「小奶狗」柯震東激情狠吻撞破

2024-04-26 14:04

-

短今PO居家照喊「沒有內衣的束縛」 粉絲一看:沒辦法專心上班啊

短今(鈑金、本名胡馨儀)在中信啦啦隊「PS女孩」服務8年,以173公分身高和34E、25、35傲人三圍,受封「極品大隻馬」、「中職啦啦隊小巨人」,曾經打敗峮峮、林襄等人,獲選《NOWnews今日新聞》

2024-04-26 13:42

-

7寶媽慘了!道歉兩次沒有用 臉書追蹤數「雪崩式掉粉1萬人」

網紅「林叨囝仔 The Lins' Kids」7寶媽Sydney 24日在直播中失言,提到資源班話題大笑,被質疑歧視資源班學生,見批判聲浪變大,隔天才拍影片公開道歉,後來又刪掉影片,發文二度致

2024-04-26 12:15

-

啦啦隊女神峮峮《飢餓遊戲》被電爆!3年來罕見飆淚大喊:很難過

啦啦隊女神峮峮跨界主持,與孫協志、王仁甫等人合作《飢餓遊戲》已3年,她在本周日即將播出最新1集中,竟罕見飆淚!原來她是為了玩節目遊戲得在臉上貼低周波片,一邊震動、一邊要用嘴把兵乓球吹進玻璃杯,短短2分

2024-04-26 11:43

運動

更多運動-

大雨下不停!中職樂天桃猿與台鋼雄鷹之戰 桃園球場宣布延賽

中職聯盟今天宣布,因為大雨滂沱的因素,桃園球場進行的比賽確定延賽,原訂今天由台鋼雄鷹出戰樂天桃猿之戰也被迫延到6月20日再舉行。樂天桃猿主場桃園球場原本要在3月31日啟用,但因為場地不允許,直到4月2

2024-04-26 14:02

-

U23亞洲盃足球/南韓爆冷輸印尼、止步八強!36年首度無緣奧運

U23亞洲盃八強賽由小組全勝的韓國迎戰印尼,被外界一致看好能強勢晉級的南韓,沒想到卻跌破眾人眼鏡,雙方以2:2平手一路戰到PK大戰,最終南韓以10:11敗下陣來,大爆冷輸給印尼,無緣踢進四強。不僅中斷

2024-04-26 13:52

-

NBA季後賽/湖人對金塊10連敗 球評:Jokic不退休、詹皇永遠無冠

NBA季後賽首輪系列賽G3,湖人陷入0-2落後,賽前湖人球星「詹皇」LeBron James更是放話「是時候開啟MVP模式」,但最終事與願違,金塊在Nikola Jokic「準大三元」帶領下,以110

2024-04-26 13:45

-

手心手背都是肉!Wembanyama和Gobert爭奪「DPOY」 Parker這樣說

聖安東尼奧馬刺新星Victor Wembanyama在「菜鳥年」發揮出色,超大的防守覆蓋範圍,讓他成為聯盟難得一見的阻攻天才,有機會來爭取今年的年度最佳防守球員(DPOY)。而近期來到台灣參加「202

2024-04-26 13:27

財經生活

更多財經生活-

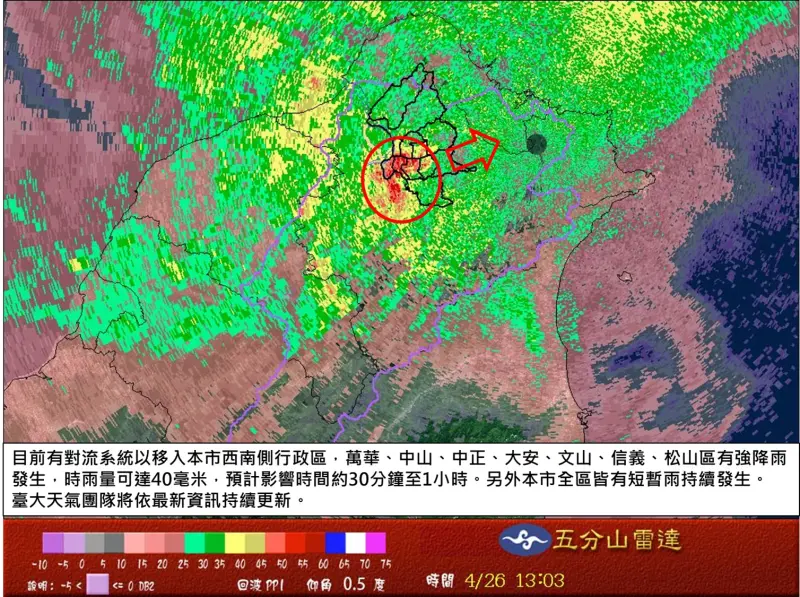

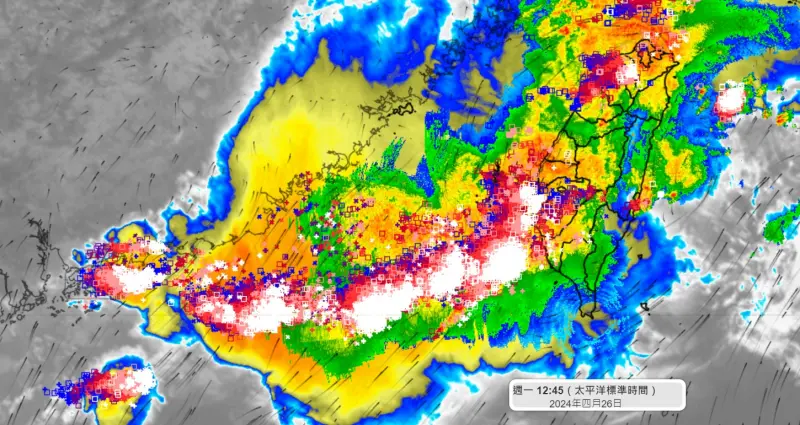

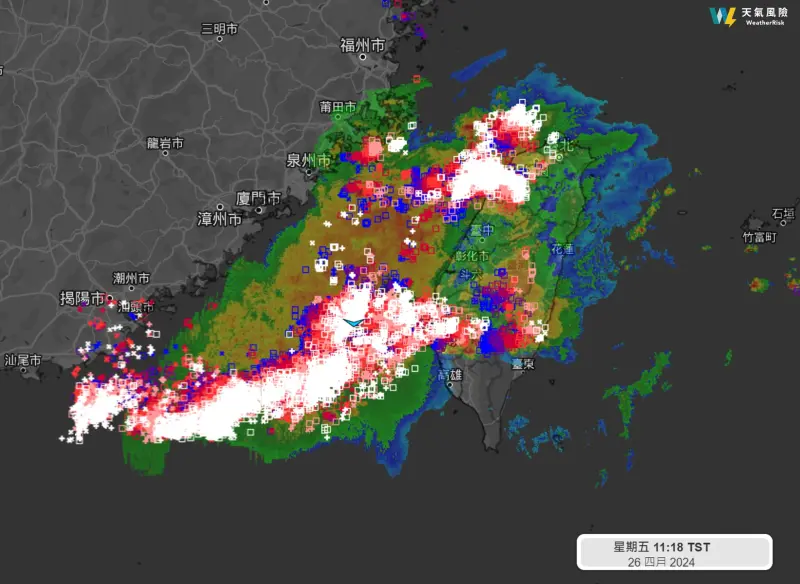

雷雨胞持續移入!南部降雨達194毫米 彭啟明:解渴致災一線之隔

鋒面挾帶強對流持續移入台灣上空,中南部雷雨不斷,從25日0時至今(26)日下午13時10分,高雄鼓山累積雨量達193.5毫米,台南、嘉義部分地區也在140毫米上下。氣象專家彭啟明表示,雷雨胞持續移入,

2024-04-26 13:46

-

「捲捲薯條」開賣2天完售!客買不到崩潰 麥當勞:銷售超過預期

知名速食品牌「麥當勞」近日重磅回歸的人氣商品「捲捲薯條」,24日起限量開賣,消息曝光後,隨即吸引大批顧客搶購。沒想到才短短2天,各地麥當勞門市就傳出「捲捲薯條」完售消息,讓許多買不到的民眾不滿,對此麥

2024-04-26 13:43

-

七寶媽歧視資源班言論傷害有多大?特教師悲曝教育現場血淚故事

35歲的網紅七寶媽(陳珮芬)歧視資源班言論遭炎上,這些歧視言論對特教生、特教生家長與特教老師傷還有多大?台灣特教工作專業人員協會理事金采蓁向《NOWnews今日新聞》分享教育現場小故事,透露她在特教學

2024-04-26 13:12

-

閃電列車出現!雷雨擴至苗栗以北 氣象署示警:今明防強風、冰雹

鋒面影響加上西南風增強助力,氣象署今早陸續發佈大雷雨、大雨警戒,台南、高雄先出現密集閃電,不過氣象粉專「天氣風險」表示,隨著對流網東北或東方向移動,苗栗到大台北、嘉南、高雄地區,強降雨/雷雨機會高,提

2024-04-26 12:57

全球

更多全球-

站著說話不腰疼?中國專家籲年輕人「別啃老」 網諷:養老金太多

中國經濟陷入困局,受到高房價、高失業率影響,「買房」對中國年輕人來說已經是遙不可及的夢想。但近日,中國一名經濟學專家公開呼籲年輕人,在買房的問題上不要焦慮,應該老實租房、不要啃老。這番言論引起網路討論

2024-04-26 12:37

-

波音出包、財務吃緊!美西南航空結束4機場服務 2千人丟飯碗

美國西南航空(Southwest Airlines)表示,由於波音(Boeing)延誤交付新飛機,導致公司成本上升,加上第一季財務虧損增加,將於今年底裁員2000人、結束4個機場的服務。根據《CNN》

2024-04-26 12:13

-

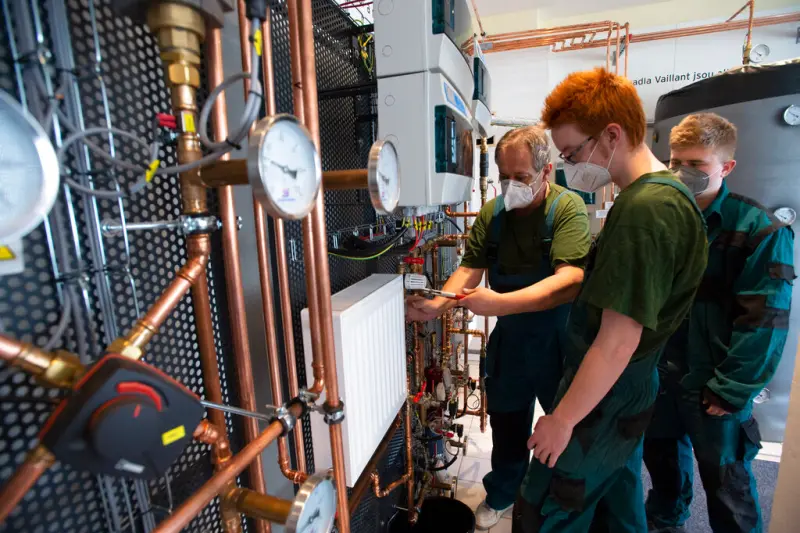

年薪漲幅逾7成!美國Z世代不當白領搶做水電工 還不用怕被AI取代

近年來不少年邁水電工、焊工退休,使得水電工短缺情況嚴重,也使得該行業薪資上漲,加上生成式AI發展迅速,在擔心自己的職業被取代的背景之下,水電工等藍領工作,在美國Z世代年輕人心中成了比白領更有保障的選擇

2024-04-26 10:58

-

無意妥協!傳北京字節跳動「寧可收掉美國業務」 也不賣TikTok

美國國會本月表決通過熱門短影音平台Tiktok的「去中國化」法案,要求TikTok與其中國母公司「字節跳動」(ByteDance)剝離,「字節跳動」需於9個月內出售在美國的資產,否則TikTok將被禁

2024-04-26 10:00