《鄉民大學問EP.35》字幕版|韓國瑜被針對?!賴清德找卓榮泰掌政院 黃暐瀚:論功行賞?!為陳其邁鋪路?馬見習提九二共識 柯文哲:恐違主流民意?黃子佼事件登BBC 高嘉瑜表態 女大生嗆:閹割執法!

NOW影音

更多NOW影音焦點

更多焦點-

黃曙光證實了!透露請辭原因無關政治因素:是個人「身心俱疲」

國安會諮委黃曙光近期傳出已向蔡英文總統表達辭去國安會諮詢委員、以及潛艦國造專案召集人。此消息今(17)日獲其妹民眾黨立委委黃珊珊回應「階段性任務完成」,稍早黃曙光也發布聲明,強調「個人請辭是個人身心俱

2024-04-16 23:16

-

美中軍方重啟通話!美防長重申一中政策 強調台海和平重要性

美國國防部長奧斯汀(Lloyd Austin)和中國國防部長董軍週二(16)透過視訊會議進行了通話,這是兩國在過去1年多以來,尋求恢復軍事關係的首次接觸,也是兩國防長之間近17個月來的首次對話。對話中

2024-04-17 00:07

-

比汪小菲更甜!大S與具俊曄電梯玩自拍 「花式擁抱」羨煞旁人

大S(徐熙媛)和韓國歐巴具俊曄放閃不手軟,睽違20年的舊愛重逢,再婚2年依舊是蜜月期,具俊曄最近上韓國節目《脫掉鞋子恢單4Men》受訪,坦言兩人感情好到不行,每次外出時都會在電梯擁抱自拍,留下兩人甜蜜

2024-04-16 19:10

-

涉500萬助郭台銘連署!屏東縣議長周典論開庭喊冤稱「心臟不適」

(中央社記者李卉婷屏東縣16日電)國民黨屏東縣議長周典論涉以500萬元助郭台銘總統連署案,今天在屏東地院進行首次準備程序庭,周典論喊冤,過程中因心臟不舒服一度暫停,律師則盼視身體狀況予以交保。周典論為

2024-04-16 22:01

精選專題

要聞

更多要聞-

辦公室主任罵官員挨批 涂權吉回應了:已對言行用詞不當教育

立法院會衛環委員會昨天進行專報,國民黨立委涂權吉提案,要求衛福部長薛瑞元撰寫檢討報告,衛福部官員在休息之際欲找涂權吉說明,辦公室主任卻開罵「任何臨時提案都先通過我」,高分貝讓在場主席、立委、官員與議事

2024-04-16 18:59

-

吳宗憲譴責案自投反對!沈伯洋批「笑死人」 本尊嗆:要多唸書

立法院15日召開司法及法制委員會,針對藍白提出國會改革相關法案進行逐條審查,過程中民進黨逐條有異議卻直接送保留,引發民進黨不滿,為此提出對召委吳宗憲的譴責案,最後6比6戰成平手,吳宗憲以主席身份自投反

2024-04-16 17:53

-

巷仔內/楊寶楨合作基隆市政府!反罷免、爭曝光互蒙其利

民眾黨前發言人、立院黨團副主任楊寶楨2月落淚請辭黨內雙職務。基隆市政府今日舉行記者會,宣布楊寶楨5月中旬起將擔任「2024基隆政策推廣大使」。對於面臨罷免危機的基隆市長謝國樑、尋找政治舞台的楊寶楨,都

2024-04-16 17:20

-

批蔡英文搶先曝國安人士「2個不尊重」 黃揚明:賴清德皮繃緊了

準總統賴清德內閣人事尚未完全公布,總統蔡英文今(16)日上午接見外賓時,卻先宣布總統府秘書長林佳龍將接任外交部長,而外交部長吳釗燮將轉任國安會秘書長。對此,資深媒體人黃揚明認為,這事件凸顯蔡英文的2大

2024-04-16 17:08

新奇

更多新奇-

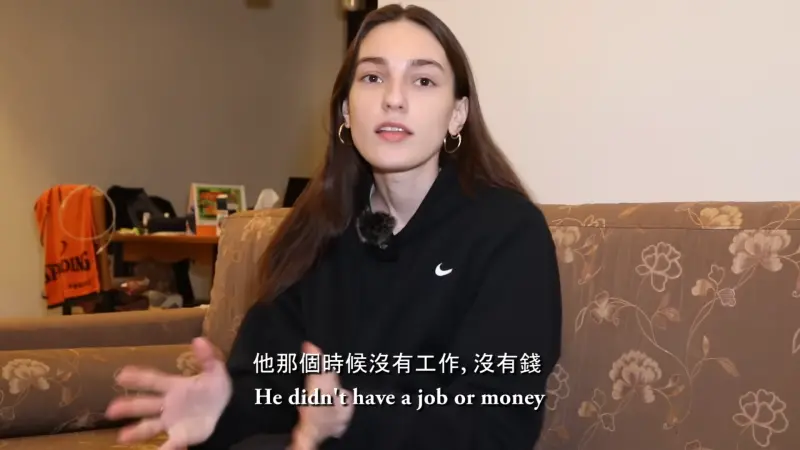

俄國妹領所有存款來台灣!向台籍男友求婚 霸氣喊「沒錢我養你」

為了追尋真愛勇氣十足!一位俄羅斯女孩Mila,透過交友軟體認識台灣男子,雙方迅速墜入愛河,後續Mila更直接帶了所有存款飛來台灣,還主動求婚,甚至霸氣喊「沒錢我養你」,主動追愛的過程曝光,也讓大批觀眾

2024-04-16 17:01

-

陸網紅Sean爆「兒子被台灣拒絕入境」!真相大反轉 台人失望退追

中國知名網紅「Sean」肖恩與好友「陳老師」去年數度來台旅遊,拍攝許多Vlog遊記,更因為談吐風趣而爆紅,但近期卻出現掉粉危機!4月11日時,Sean在個人頻道上發出影片,聲稱「兒子被台灣拒絕入境」,

2024-04-16 14:01

-

竊賊爽中1.6億樂透!苦主「信用卡遭盜刷」想分獎金 結局揭曉了

天上掉下驚喜橫財卻只能用看的!日前在英國有兩名竊賊,盜用他人信用卡拿去購買樂透彩券,卻意外贏得400萬英鎊(約新台幣1.6億元)大獎,後續遭警方查明真相後逮捕,並傳喚被盜刷的苦主嘉書亞(Joshua

2024-04-15 20:20

-

電線杆貼滿廣告紙!他撕毀遭警察制止「這樣是毀損罪」 真相反轉

台灣街頭巷尾能看到許多電線杆、變電箱,上頭常常會有許多白白的殘膠,因為常會有各種業者張貼小廣告,清除後又再度出現,造成市容髒亂,也讓相關單位煩惱不已。近期銀行家「尼莫」就目睹小廣告張貼的瞬間,並感慨「

2024-04-14 16:14

娛樂

更多娛樂-

直擊/捕獲野生孫藝真!現蹤台北101嗨嗑小籠包 1表情仙暈粉絲

南韓女星孫藝真今(16)日旋風來台,出席美妝品牌代言活動,也是她出道至今25年首度降臨台灣,令許多粉絲超級興奮。晚間,孫藝真終於結束她的101大樓行程,還吃到了心心念念的鼎泰豐小籠包,在保鑣的護送下心

2024-04-16 21:30

-

賴薇如做試管子宮外孕!痛苦喊「腹部劇痛出血」 救治過程曝光

前女子團體《七朵花》成員賴薇如腹部劇痛出血,昨(15)日突然到醫院掛急診,讓粉絲相當震驚。賴薇如與老公邱樂偉愛情長跑6年,今年1月宣布結婚,婚後兩人一直想生小孩,植入胚胎希望懷上龍寶寶,沒料到居然發生

2024-04-16 20:44

-

小賈斯汀慘變「獨臂流浪漢」!滿臉鬍渣現蹤音樂節 粉絲認不出來

加拿大流行歌手小賈斯汀(Justin Bieber)憑藉天籟歌聲與帥氣的外型,吸引大批歌迷支持,儘管隨著年齡漸增,個性、外型逐漸黑化,經常發生負面新聞,但人氣依舊不減。近日,就有網友發現小賈斯汀的風格

2024-04-16 20:39

-

金鐘女星曾激吻許光漢!自爆《全明星》鮮肉「頻繁進出」愛巢

《鬼天廈》導演謝志文,今(16)日率領眾演員黃瀞怡(小薰)、陳妤、潘君侖、戴平雅(白癡公主)、鄭茵聲、高慧君、游書庭出席首映會。陳妤曾與男神許光漢在《戀愛沙塵暴》中激吻、獲金鐘新進演員獎,這回與潘君侖

2024-04-16 20:21

運動

更多運動-

NBA附加賽完整賽程、戰況懶人包 勇士、國王殊死鬥!湖人拚老七

NBA附加賽「生死鬥」今(17)日上演,西區戰役率先上演!由洛杉磯湖人對陣紐奧良鵜鶘打頭陣,此役早上7:30開打;金州勇士則要在早上10:00挑戰沙加緬度國王,而勇士、國王也將「一戰定生死」,敗者直接

2024-04-17 03:18

-

足球/醞釀逾半年!國際足總人才發展計劃啟動、首站宜蘭開跑

台灣足球人才發展計劃在長達八個月的規劃後,2024年4月13日正式啟動!中華民國足球協會與國際足總(FIFA)合作的人才發展計劃(Talent Development Scheme,TDS)歷史性的第

2024-04-17 02:38

-

不用羨慕李多慧!台灣也有外援 MIT正妹邱品涵加入日職福岡軟銀

中華職棒第35年正式開打,球迷們也熱血投入,為自己支持的球隊加油。提到棒球,當然不能錯過日本,許多球迷會特地前往日本主要城市觀看棒球,而福岡更是日本目前最熱門的自由行之一。福岡擁有許多景點,包括九州最

2024-04-17 02:09

-

全中運射擊/桃園市囊括12金成大贏家 單日「雙破」大會紀錄

13年全國中等學校運動會射擊項目=進行最後一天賽事,桃園市國、高中在5天的比賽中,總計囊括12金、12銀、7銅,成為最風光的贏家。國中組女子10公尺空氣手槍決賽,由來自桃園市新明國中的葉采昕一路穩穩射

2024-04-17 01:49

財經生活

更多財經生活-

快訊/大樂透連三期開頭獎!4/16幸運兒獨得1億 獎落「這縣市」

大樂透連三期開出頭獎!繼4月9日開出新竹縣關西鎮開出頭獎為1.8億、4月12日新北市林口區開出頭獎1億之後,今(16)日大樂透第113000043期頭獎1億元再度送出,獎落臺北市,由萬華區康定路265

2024-04-16 22:16

-

花蓮強震善款還沒停!寶可夢公司、光榮特庫摩「各捐1千萬日圓」

台灣在4月3日受到芮氏規模7.2的強震侵襲,位於震央最近的花蓮,出現許多嚴重受創災情。在世界各國中,又以日本的捐款行動最為熱烈,許多民眾都表示想還台灣過去東日本大地震時的恩情。昨(15)日日本寶可夢公

2024-04-16 21:37

-

快訊/大樂透頭獎1億元!「4/16完整獎號」揭曉 中了就環遊世界

大樂透第113000043期今(16)日晚間開獎,本期頭獎保證1億元,就在剛剛完整獎號皆已開出,快拿起手邊彩券對看看財神是否降臨,拿到1億獎金去環遊世界!4/16大樂透中獎號碼(第113000044期

2024-04-16 20:48

-

世界地球日優惠!全家拿鐵5折、燕麥拿鐵特價 這家120杯免費咖啡

全家響應4/22世界地球日,於4月19日起至22日,搶泰式厚椰拿鐵、燕麥奶拿鐵限量優惠券外,年底前免費租借全家循環杯,可享特濃拿鐵、抹茶拿鐵半價優惠,即日起於「全家行動購」購買歐萊德零碳髮品,可享69

2024-04-16 18:14

全球

更多全球-

美中軍方重啟通話!美防長重申一中政策 強調台海和平重要性

美國國防部長奧斯汀(Lloyd Austin)和中國國防部長董軍週二(16)透過視訊會議進行了通話,這是兩國在過去1年多以來,尋求恢復軍事關係的首次接觸,也是兩國防長之間近17個月來的首次對話。對話中

2024-04-17 00:07

-

美「烏克蘭、以色列與台灣」援助法案 眾院最快週五表決

伊朗對對以色列發動大規模飛彈與無人機空襲後,美國眾院議長強生(Mike Johnson)表示,美國國會也將於眾院開始進行針對以色列、烏克蘭和包括台灣在內的印太地區盟友的援助法案的表決。這批法案預計將於

2024-04-16 23:28

-

還沒正式退出政壇!李顯龍交棒新加坡總理 轉任國務資政

新加坡總理李顯龍(Lee Hsien Loong)日前宣布將交棒給現任副總理兼財務部長黃循財(Lawrence Wong),消息一出新加坡將告別「李家天下」更一時蔚為討論。不過根據新加坡媒體報導,下一

2024-04-16 22:29

-

特斯拉宣布全球裁員10%!馬斯克放話:每5年就需重組和精簡

中國電動車強勢傾銷下,全球電動車競爭激烈,特斯拉日前宣布將在全球範圍內裁員10%,相當於裁減約1.4萬名員工,特斯拉執行長馬斯克(Elon Musk) 承認這是因應中國企業加入該產業帶來的衝擊,但也表

2024-04-16 20:11