《鄉民大學問EP.36》搶先看|韓國魚突襲立法委員辦公室!驚見不能說的秘密!謝龍介珍藏這個信物!王世堅突脫口:「你打過我們家的…」葉元之辦公室有美女助理群!范雲親教立院防身術|NOWnews

NOW影音

更多NOW影音焦點

更多焦點-

余天宣布不選黨部主委 蘇巧慧:感謝對後輩照顧與提攜

民進黨地方黨部主委從本周起開放領表登記,立委蘇巧慧與前立委余天表態參選新北市黨部主委,而未料余天今(17)日晚間突於社群平台發文表示,經過幾天長考與家人溝通後,將不會參選黨部主委。對此蘇巧慧也隨即發文

2024-04-17 22:39

-

沙烏地阿拉伯舉辦電競世界盃!賽事總獎金近20億元創史上新高

沙烏地阿拉伯近年來在體育賽事方面積極發展,今年更主辦電競世界盃(E-Sports World Cup)並於16日正式公開參賽遊戲名單,其中包含《英雄聯盟》、《Apex英雄2》、《快打旋風6》等19款熱

2024-04-18 00:11

-

都美竹遭控詐騙90萬!單親媽氣憤提告 釣出本人回應:她說不用還

一名身為單親媽媽的大陸網友「冰點人a冰點」近日在微博發文爆料,指控搞垮吳亦凡的網紅「都美竹」詐騙她20萬人民幣(約台幣90萬元),她聲稱,當初是因為都美竹表示自己生活困難,才給予她鼓勵,當時都美竹還時

2024-04-17 22:51

-

有夠噁心!台鐵自強號座位遭塗抹「黃金」 拉屎哥落網曝原因

台鐵305車次自強號列車,本月13日傳出乘客將穢物塗抹在座位上,清潔員發現後立刻報警,案經調查,警方迅速逮捕涉案的孫姓通緝犯(59歲),孫男落網後供稱,因一時忍不住拉在褲子裡,慌張之餘才會把「屎」亂丟

2024-04-17 21:27

精選專題

要聞

更多要聞-

余天宣布不選黨部主委 蘇巧慧:感謝對後輩照顧與提攜

民進黨地方黨部主委從本周起開放領表登記,立委蘇巧慧與前立委余天表態參選新北市黨部主委,而未料余天今(17)日晚間突於社群平台發文表示,經過幾天長考與家人溝通後,將不會參選黨部主委。對此蘇巧慧也隨即發文

2024-04-17 22:39

-

李亞萍不放行!余天宣布不選黨部主委 「有需要一定再相見」

民進黨地方黨部主委從本周起開放領表登記,立委蘇巧慧與前立委余天表態參選新北市黨部主委,而未料余天今(17)日晚間突於社群平台發文,表示經過幾天長考與家人溝通後,自己將不會參選黨部主委,也提及太太李亞萍

2024-04-17 21:56

-

吳靜怡狠酸:徐巧芯和柯文哲很像!透析兩人出事都愛用「這4招」

國民黨立委徐巧芯的大姑夫婦涉嫌詐騙洗錢引發熱議,日前名嘴溫朗東在臉書連珠砲發文猛轟徐巧芯。徐巧芯則在昨日指控溫朗東涉嫌逃避兵役,雙方引起隔空混戰。對此柯文哲前幕僚吳靜怡則表示「徐巧芯這個狀態跟柯文哲很

2024-04-17 20:07

-

蔡英文緊抓卸任前權力?郭正亮:賴清德大概只會尊重前總統一年

準總統賴清德政府人事陸續出爐,即將卸任的總統蔡英文昨搶先公布總統府秘書長林佳龍轉任外交部長、外交部長吳釗燮將轉任國安會秘書長,引發外界詫異。對此,前立委郭正亮今(17)日指出,林佳龍接外長是蔡英文在背

2024-04-17 19:44

新奇

更多新奇-

政大景觀池命名票選!「金玟池」得票63%暫居第一 超紅原因曝光

韓流魅力真的太強了!近期國立政治大學要達賢圖書館旁的景觀池命名,更舉辦了人氣票選比賽,也開放校外民眾參加,沒想到除了許多諧音梗紛紛出籠之外,還有韓星「金玟池」的名字也在其中,甚至還突破6成得票率暫居第

2024-04-17 21:53

-

搭北捷親子友善車廂!她驚見「小孩全都站著」太諷刺 家長掀共鳴

台北捷運是雙北首都圈核心的大眾運輸工具,許多人上班、出遊都會搭乘到。近期卻有家長帶著孩子進入親子友善車廂,卻發現車上所有小朋友都沒有位置可坐,貼文隨即掀起大批家長共鳴。一位家長在社群平台Threads

2024-04-17 16:42

-

俄國妹領所有存款來台灣!向台籍男友求婚 霸氣喊「沒錢我養你」

為了追尋真愛勇氣十足!一位俄羅斯女孩Mila,透過交友軟體認識台灣男子,雙方迅速墜入愛河,後續Mila更直接帶了所有存款飛來台灣,還主動求婚,甚至霸氣喊「沒錢我養你」,主動追愛的過程曝光,也讓大批觀眾

2024-04-16 17:01

-

陸網紅Sean爆「兒子被台灣拒絕入境」!真相大反轉 台人失望退追

中國知名網紅「Sean」肖恩與好友「陳老師」去年數度來台旅遊,拍攝許多Vlog遊記,更因為談吐風趣而爆紅,但近期卻出現掉粉危機!4月11日時,Sean在個人頻道上發出影片,聲稱「兒子被台灣拒絕入境」,

2024-04-16 14:01

娛樂

更多娛樂-

《康熙來了》鐵粉考卷瘋傳!蔡康永寫到崩潰了:是不准我再主持嗎

2004年開播的談話性節目《康熙來了》自2016年停播至今已經8年,仍讓不少觀眾感到可惜,紛紛懷念起主持人小S徐熙娣、蔡康永與來賓們創造的各種經典片段。近日,就有網友特別製作一份考卷來測試鐵粉,引發熱

2024-04-17 22:03

-

《大學生》晞晞爆身體突長3顆瘤!見健檢結果嚇到哭:我直接低潮

從《大學生了沒》出道的網紅晞晞(徐晞庭),靠著亮眼的外型,廣受大家喜愛。怎料,晞晞近日卻在IG上透露身體在前幾天被檢查出長了3顆線瘤,讓她心情相當難過,更整整低潮了兩天,「真是嚇壞了,還哭到隱眼差點戴

2024-04-17 21:05

-

Selina傳訊8字後斷聯 與黃子佼「超過20年交情」:應該不復出

Selina今(17)日出席母嬰用品品牌活動,被記者問到黃子佼事件,Selina和黃子佼已經認識超過20年,因此在新聞出來隔天就馬上傳訊息給他。Selina透露自己傳給黃子佼的簡訊內容:「勇敢面對,珍

2024-04-17 20:20

-

林嘉欣12年婚斷!名導前夫袁劍偉曝「私下互動」2個女兒是關鍵

港片《盜月者》集結香港男子樂團「MIRROR」成員呂爵安、盧瀚霆、姜濤,以及金馬獎「最佳男配角」白只與實力派男星張繼聰共同主演。《盜月者》受邀於2024金馬奇幻影展特別放映,香港導演袁劍偉今(17)日

2024-04-17 20:13

運動

更多運動-

足球/安聯小小世界盃再破千隊報名、創疫後新高 7月進行總決賽

全國最大幼兒足球盃賽「2024安聯小小世界盃」,今年邁入11週年, 全台共有1107支球隊報名!不僅二度刷新最高報名隊伍數,更創疫情後史上新高,各分區預賽將於5月陸續開踢,首場比賽就在5月4日至5月5

2024-04-18 03:26

-

高球/賴嘉一狂射2老鷹丶抓4鳥 單回合打出66桿、暫居首位

2024 ThreeBond TPGA挑戰巡迴賽開幕站在台南斑芝花球場進行首回合,賴嘉一獵鷹抓鳥,打出低於標準桿六桿的66桿,暫居首位;另有三位選手陳伯豪丶蘇晉弘與謝旻軒同以一桿之差的67桿,暫並列第

2024-04-18 02:19

-

暴龍Jontay Porter涉賭高達246萬!因違反NBA規定慘遭終生禁賽

多倫多暴龍隊前鋒Jontay Porter日前因為疑似涉賭,遭到NBA官方調查停賽,今(18)日NBA官方發出聲明,正式對Jontay Porter的賭博行為拍板,因為他涉賭罪證確鑿,將會被處以終生禁

2024-04-18 01:37

-

9屆PBA冠軍超狂後衛聯手230公分「巨獸」德古拉 TAT野馬戰力堅強

亞洲巡迴賽The Asian Tournament(簡稱TAT)臺灣野馬隊宣布,曾獲得9屆PBA冠軍、8次入選PBA全明星隊、1次PBA總冠軍賽MVP的菲律賓傳奇後衛卡巴諾特(Alex Cabagno

2024-04-18 01:35

財經生活

更多財經生活-

考試、求職必備!熊寶貝推出「芳香豆御守」 限時買1送1

又接近每年社會新鮮人的求職與考試旺季,看好「好運商機」,聯合利華旗下品牌熊寶貝,針對大考、求職旺季推出「衣の香御守」護衣芳香豆,特地採用花花造型,為面試、考試加「氛」,即日起全聯、寶雅、家樂福等各大通

2024-04-18 01:41

-

天氣預報/雨彈來襲!明雨區擴大「北部濕一片」 氣溫跌到1字頭

鋒面來襲,中央氣象署預報員劉宇其指出,明(18)日雨區範圍擴大,整個中部以北、東半部都有雷雨情況,中部以北還有局部較大雨勢,北台灣氣溫也將驟降,從近日攝氏30度的高溫降至攝氏24度,最低甚至可能跌到攝

2024-04-17 18:01

-

母親節別買草莓蛋糕!「這款口味」才是婆媽最愛:全聯榜單認證了

歡慶母親節的時光要來了,不論是買給媽媽,還是送給老婆安太座,要準備蛋糕可別再買草莓、巧克力蛋糕!根據全聯母親節熱銷榜單指出,連3年消費者最愛的口味是芋頭,其次是乳酪口味,尤其是「芋見幸福千層蛋糕」已經

2024-04-17 18:00

-

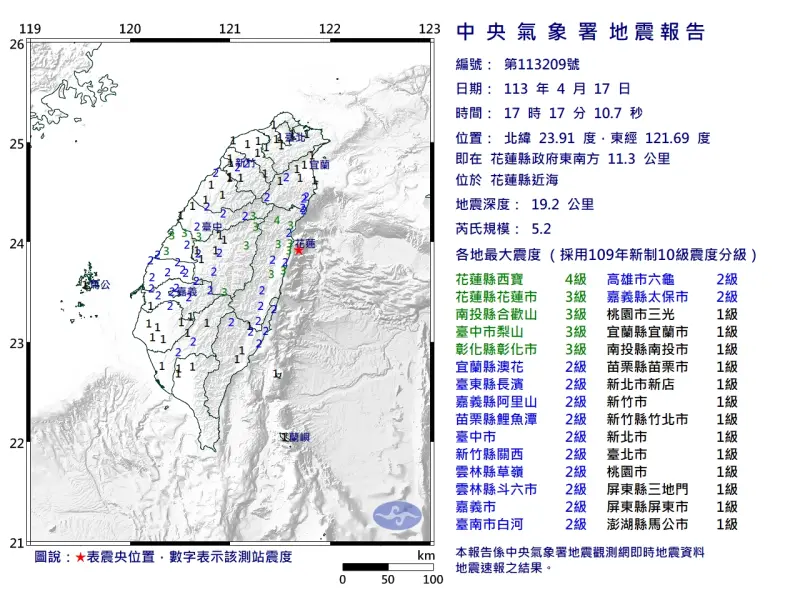

快訊/17:17花蓮地牛翻身!規模5.2「極淺層地震」 19縣市有感

中央氣象署地震測報中心表示,今(17)日下午5時17分左右,花蓮發生芮氏規模5.2有感地震,最大震度為4級,出現在花蓮西寶,震央位於花蓮縣政府東南方11.3公里的東部近海,地震深度19.2公里,屬於「

2024-04-17 17:21

全球

更多全球-

沙烏地阿拉伯舉辦電競世界盃!賽事總獎金近20億元創史上新高

沙烏地阿拉伯近年來在體育賽事方面積極發展,今年更主辦電競世界盃(E-Sports World Cup)並於16日正式公開參賽遊戲名單,其中包含《英雄聯盟》、《Apex英雄2》、《快打旋風6》等19款熱

2024-04-18 00:11

-

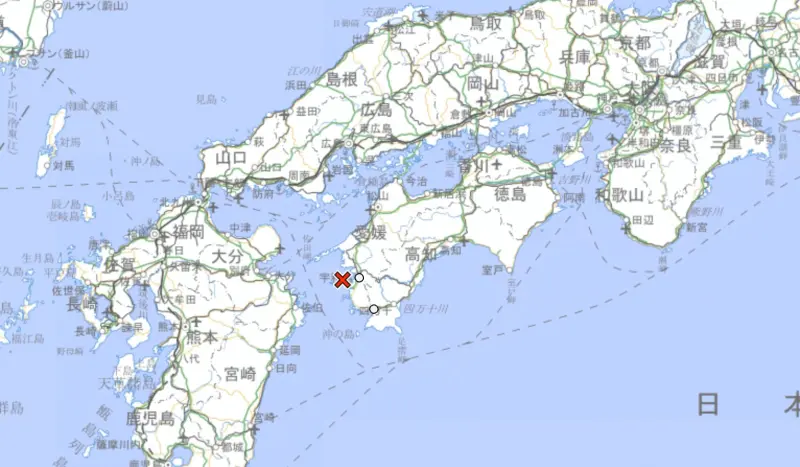

快訊/日本西部深夜傳「規模6.4地震」 半小時內又傳3次有感餘震

日本氣象廳週三(17)指出,日本西部豐後水道發生芮氏規模6.4地震,震源深度50公里,震央在九州跟四國之間的海域,包含愛媛縣、高知縣都觀測到最大震度6弱搖晃,目前並無發布海嘯威脅警報。根據日本放送協會

2024-04-17 22:45

-

日深山驚見焦屍!1男1女遭膠帶「呈X形」綑綁 頭部遭塑膠袋遮蓋

日本栃木縣那須町的深山日前遭人發現2具嚴重燒焦的遺體,經過警方調查發現死者生前皆遭到勒頸,兩具遺體被發現時遭膠帶緊緊纏繞,呈現「X」形堆疊且臉上覆蓋黃色塑膠袋,目前警方表示已經派出專業司法解剖和調查人

2024-04-17 22:26

-

泰國連6天潑水節「破千起交通事故」 至少243死、近2千人受傷

泰國今年擴大舉辦潑水節(Songkran)活動,自4月12日至4月16日一連五天在全國各地都有相關活動,泰國政府更估計迎來超過78萬名國際旅客參與潑水節,收益超過千萬元。不過隨著慶祝活動進入尾聲,官方

2024-04-17 21:29