《鄉民大學問EP.39》字幕版|#柯文哲 的三大案連環爆!涉貪污遭列被告 陳智菡曝內幕!蔡正元:離總統路更近!民眾黨再演宮鬥劇?柯文哲與黃國昌竟是這關係?#韓國瑜 立院霸氣喊“閉嘴” 2028真再戰?

NOW影音

更多NOW影音焦點

更多焦點-

藍委質疑桃園輪流限電 陳建仁:停電跟缺電不應混為一談

桃園單月停電35次,有國民黨立委質疑是否等同輪流限電?對此行政院長陳建仁今(8)日表示,台電已經對外說明得很清楚,停電跟缺電是完全無關,如果是事故引起的停電,在最短的時間內經由搶修後,就可以恢復供電;

2024-05-08 12:47

-

申報綜所稅注意!「保險給付」還列舉醫藥及生育扣除額恐遭補徵稅

報稅季已開跑,不少民眾開始申報綜合所得稅,不過,財政部中區國稅局提醒,若申報保險給付的醫藥和生育費用,都不能列報扣除額,以免重新計算稅額後予以補徵稅額。財政部中區國稅局表示,日前有一起案例,納稅義務人

2024-05-08 12:07

-

周杰倫點名好友挑戰經典歌曲!林書豪演唱影片曝光:來個8.7分吧

「亞洲天王」周杰倫與前NBA球星林書豪的麻吉情眾所周知,2人時常在社群平台上互動,展現好交情。近日,林書豪在比賽時遭對手撞傷,導致右側眉骨撕裂傷。昨(6)日林書豪臉上頂著腫包,深情演唱周杰倫的經典歌曲

2024-05-07 15:47

-

遭爆誘「刑事戰將」牽線博弈集團!徐培菁怒發聲明:子虛烏有

號稱「刑事戰將」的刑事警察局三線二星警政監林明佐,在本(5)月3日遭起底與博弈集團往來密切,涉嫌通風報信、包庇賭博不法,更有2000多萬不明金流,目前遭羈押禁見。今(8)日有週刊報導指出,林明佐反叛當

2024-05-08 12:33

精選專題

要聞

更多要聞-

藍委質疑桃園輪流限電 陳建仁:停電跟缺電不應混為一談

桃園單月停電35次,有國民黨立委質疑是否等同輪流限電?對此行政院長陳建仁今(8)日表示,台電已經對外說明得很清楚,停電跟缺電是完全無關,如果是事故引起的停電,在最短的時間內經由搶修後,就可以恢復供電;

2024-05-08 12:47

-

證實將與馮世寬共進退!退輔會副主委李文忠將暫離公職

退輔會主委馮世寬將於520後卸任,由嚴德發接任退輔會。退輔會副主委李文忠今(8)日證實,他將隨退輔會主委馮世寬共進退,暫離公職。不過,李文忠也指出,外界不需要急著將他退休,愛爬山的他說,只是想去攀登百

2024-05-08 12:35

-

盧秀燕接班人出現!江啟臣認了願選台中市長 「民意支持就去做」

台中市長盧秀燕2年後將卸任,未來的接班人選備受關注,藍營的中生代代表、立法院副院長江啟臣,已在台中立委四連霸,一直被點名會參選台中市長。江啟臣今(8)日受訪也承認,只要民意支持,就會參選。江啟臣今接受

2024-05-08 12:25

-

蘆洲案槓林淑芬!張益贍曝「岳父建案在旁」 黃國昌反嗆外遇開房

民眾黨立委黃國昌近日因蘆洲南北側都市計畫案槓上民進黨立委林淑芬,林淑芬下戰帖要求公開辯論,黃國昌則回擊對方含血噴人。前民眾黨中央委員張益贍表示,黃國昌岳父的恆合建設建案「i世紀社區」,就在三重果菜市場

2024-05-08 12:15

新奇

更多新奇-

好市多「隱藏好物」可當鞋櫃!會員愣:超聰明 內行一看急勸丟掉

美式連鎖賣場好市多(Costco)因為物美價廉,加上時不時就有新品推出,即便要有會員才能入內購物,仍然有大批民眾甘願加入會員。而近日,就有網友分享,自己利用好市多的「牛奶紙箱」來當作免費的鞋櫃,不僅環

2024-05-08 11:50

-

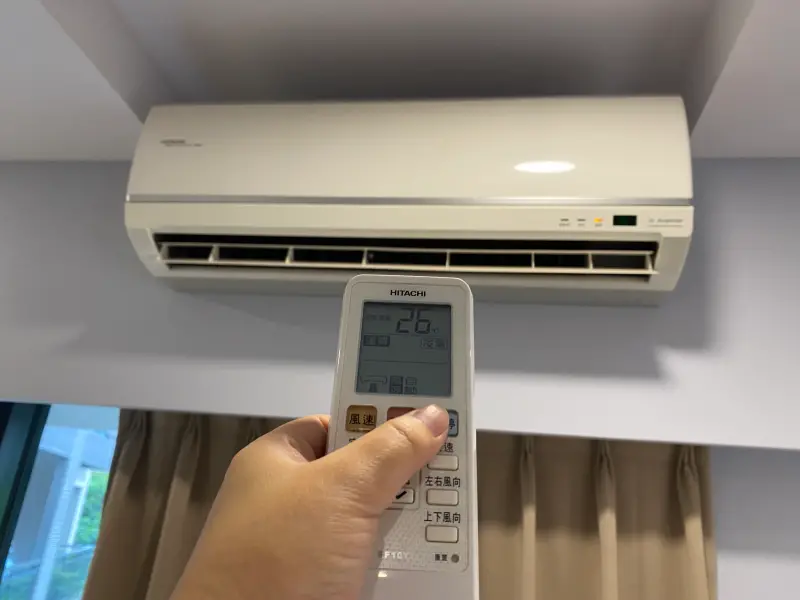

變頻冷氣「5大天王優點」公開了!維修率最低這2牌:老闆認證推薦

炎炎夏日即將到來,不少人都開始準備替換家中老舊的冷氣,在知道冷氣怎麼吹省電之前,家中擁有一台好用效能好的冷氣更加重要!而說到變頻冷氣的一線品牌,一定會有許多人想到「日立」、「大金」、「三菱重工」、「國

2024-05-08 10:22

-

爸爸、哥哥、男友全都劈腿!「3人同1職業」女震撼:英國研究真準

身邊3個男人全部都偷吃!一名女網友最近發文分享抒發心情,表示自己的父親、哥哥以及現在的男友,職業全部都是「銷售業務」,然而全部共通點都是有劈腿的不良紀錄,讓她感到非常的無力直言:「我們家不知道是中什麼

2024-05-08 07:50

-

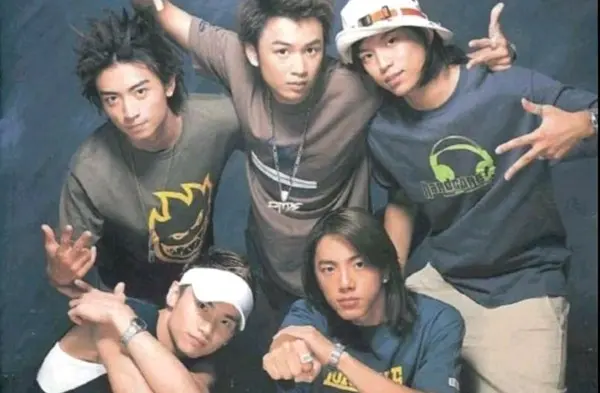

Energy坤達越老越帥!「21年前青澀照」出土 金秀賢也是同款男人

台灣男子團體Energy睽違20年合體復出,結果上週末在台北舉辦簽唱會,高人氣的他們竟然一路簽到凌晨三點,連團員坤達的老婆柯佳嬿都在社群平台上詢問:「簽完了嗎?」笑翻不少粉絲。然而,隨著Energy復

2024-05-08 07:11

娛樂

更多娛樂-

Energy TORO跳完16蹲「昏倒」!坤達只擔心這件事 粉絲一聽笑暈

Energy牛奶、阿弟、書偉、TORO、坤達各自單飛15年後,5人全員合體回歸樂壇,新專輯《HERE I AM》第二波主打歌〈星期五晚上〉自創「E16蹲」高強度舞步,TORO於簽唱會唱跳完這首歌還假裝

2024-05-08 12:23

-

劉俊謙《此時此刻》激戰郭雪芙爆紅!認「內耗太快」不敢追求名利

鄧依涵執導心動系電影《我在這裡等你》,由「港台男神」劉俊謙、范少勳聯合主演,揭露一段跨越10年的奇幻緣分。與郭雪芙共演《此時此刻》煲愛的劉俊謙接受《NOWnews今日新聞》專訪,他坦言沒想過突然間會在

2024-05-08 11:37

-

Energy當年不是坤達最紅?骨灰粉一面倒糾正「他才是」:妹子都愛

「最殺唱跳男團」Energy牛奶、阿弟、書偉、TORO、坤達2009年單飛不解散,相隔17年,本月初發行第七張專輯《HERE I AM》,不僅銷售開紅盤,兩場小巨蛋演唱會門票全被搶光,5日的簽唱會更重

2024-05-08 10:37

-

Energy「16蹲」舞步旋風全台!泌尿科醫師認證2大好處:性福加分

睽違21年,「最殺舞蹈男團」Energy終於再度合體,推出全新單曲〈星期五晚上〉展現「E16蹲」超狂舞步,引起眾多藝人和歌迷爭相模仿。然而,泌尿科醫師顧芳瑜也點出,勤練這款舞步的2大好處,除了可以讓「

2024-05-08 10:05

運動

更多運動-

山本由伸8局優質先發!大谷手感冷沒差 道奇8:2勝馬林魚收6連勝

MLB美國職棒大聯盟洛杉磯道奇今(8)日對上邁阿密馬林魚,道奇隊此役由山本由伸掛帥先發,他主投8局為個人旅美後最長的投球局數,被打5支安打、飆出5K、失掉2分,繳出優質先發內容,先發夠穩加上道奇打線本

2024-05-08 12:44

-

Derrick White近3戰場均29.3分!塞爾提克「贏球鐵律」全靠他多投

NBA美國職籃季後賽,波士頓塞爾提克在今(8)日以120:87擊敗克里夫蘭騎士,拿下系列賽首勝,此役先發出戰的Derrick White手感發燙,本場比賽繳出16投9中,三分球12投7中拿下25分5助

2024-05-08 12:33

-

NBA季後賽/雷霆117:95戰勝獨行俠!搶下G1 SGA瘋狂買犯攻下29分

NBA例行賽西區龍頭奧克拉荷馬今(8)日在次輪系列賽G1,於主場交手西區第5種子達拉斯獨行俠,此役雷霆靠著「SGA」Shai Gilgeous-Alexander瘋狂「買犯」、攻下29分,並貢獻9助攻

2024-05-08 12:23

-

衰爆!紅雀捕手Contreras妨礙打擊送打者上壘 左手還被打到骨折

MLB聖路易紅雀今(8)日在主場以5:7不敵紐約大都會,紅雀本場可說是賠了夫人又折兵,陣中明星鐵捕Willson Contreras因在比賽中妨礙大都會砲手J.D. Martinez打擊,導致左手臂被

2024-05-08 11:59

財經生活

更多財經生活-

母親節全家咖啡10元喝!美式、拿鐵限3天特價 寄杯咖啡18杯520元

迎接溫馨母親節,全家推出會員限定優惠,門市有美式、拿鐵、柳橙香柚綠茶都有第2杯10元優惠,還有含Fami!ce 霜淇淋第2支10元,再加10元贈Pocky香蕉棒一盒;APP隨買跨店取推出520元優惠組

2024-05-08 12:07

-

全聯177元「滅蚊神器」意外爆紅!婆媽見特價狂囤貨:蚊子不見了

炎熱夏天快來了!也代表著外面開始會出現許多小蚊蟲,防蚊、止癢成為民眾熱門討論議題,就有網友分享,睡覺時蚊子在耳朵旁邊嗡嗡叫超崩潰,剛好在全聯找到一款特價的液體電蚊香後,終於可以睡個好覺,熱心網友也認證

2024-05-08 10:52

-

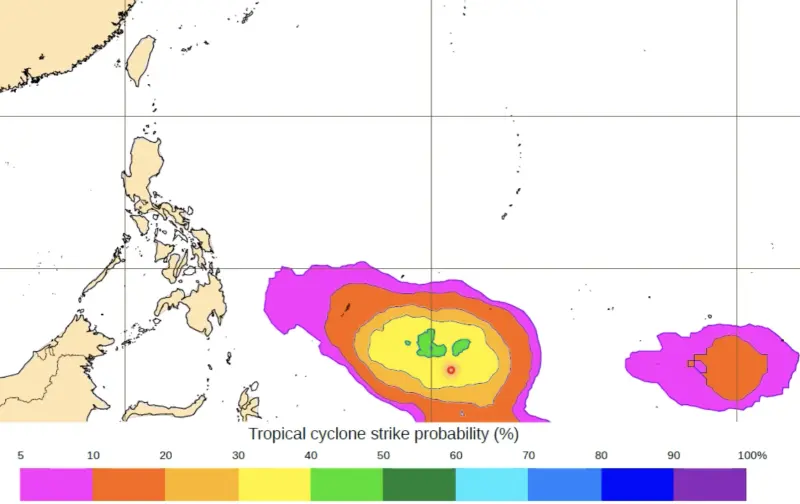

第1號颱風「艾維尼」要來了?賈新興揭生成機率 對台灣影響出爐

今年第一號颱風「艾維尼」(Ewiniar,米克羅尼西亞提供,原意為風暴之神)有機會在未來10天內生成,氣象專家、台灣整合防災工程技術顧問公司總監賈新興表示,目前各國預報模式分歧,以歐洲模式來看,在5月

2024-05-08 09:53

-

颱風「艾維尼」下週恐生成!今晚低溫跌1字頭 母親節後全台有雨

今(8)日東北季風增強、微弱鋒面通過,氣象專家、中央大學大氣系兼任副教授吳德榮表示,降雨主要集中在北海岸和東半部,山區午後有短暫陣雨,北台灣入夜氣溫驟降,低溫將來到攝氏19度左右,明後天(5/9、5/

2024-05-08 08:25

全球

更多全球-

巴哈馬承認巴勒斯坦為國家 稱「支持人民自由決定政治地位」

巴哈馬外交部7日發出聲明,宣布巴哈馬正式承認巴勒斯坦為一個國家,並稱支持巴勒斯坦人民自決,並重申支持兩國方案。巴哈馬外交部在聲明稿中表示,巴哈馬相信,承認巴勒斯坦國一事強烈表明,巴哈馬對《聯合國憲章》

2024-05-08 09:13

-

習近平的杯具頻受矚!訪法會談獨用「黑色水杯」 網:怕被下毒?

中國國家主席習近平近來展開五年來首次對歐洲國家的訪問行程,在結束對法國的國事訪問後,目前已經抵達塞爾維亞首都貝爾格勒。習近平這趟訪歐之旅,引起國際關注,除了到達法國時所承受的示威浪潮外,他在與法國總統

2024-05-08 08:44

-

台積電改變日本職場文化?鹿兒島企業嘆:年輕人跳槽門檻變低了

台積電於在日本熊本縣菊陽町設廠,成為近來台日工商業界的熱門話題。由於設廠帶來大量工作機會,有許多日本相關科系的學生,紛紛前往台積電日本廠求職。不過台積電熊本廠雖然帶來了錢潮,但也造成熊本縣其他企業面臨

2024-05-08 07:38

-

等重要經濟數據進入「冷靜期」!美股幾以平盤作收 道瓊連五紅

美國股市經過最近劇烈震盪後,在週二(7日)進入「冷靜期」,收盤接近開盤價。投資人正在等待將在本月公布的重要經濟數據。道瓊工業指數終場小幅收高32點,為連續第五個交易日收紅;標普500指數則為連續第四個

2024-05-08 06:28