《鄉民大學問EP.40》精彩片段|雙姝互嗆 火爆現場!王鴻薇高嘉瑜為徐巧芯吵成一團!京華城案 高嘉瑜怒爆:早就監督有問題?!質疑蔣萬安要為柯文哲解套? 黃暐瀚:毀柯召集人誕生!|NOWnews

NOW影音

更多NOW影音焦點

更多焦點-

政院通過「打詐新四法」!謝金河說話了:建議這招重罰臉書最有效

行政院會昨通過「打詐新四法」,包括《詐欺犯罪危害防制條例》、《洗錢防制法》、《科技偵查及保障法》與《通訊保障及監察法》,刑期提高至3年以上10年以下,3人以上複合不同詐欺手段,加重刑責二分之一,並提高

2024-05-10 08:53

-

百度「冷血」女副總璩靜離職!挨轟欠共情能力 新公司深圳已註冊

中國百度集團的公關副總裁璩靜,近期在抖音發布影片,內容聲稱:「為什麼要考慮員工的家庭」、「我們的關係就是僱傭關係」,「員工鬧分手提辭職我秒批」,挨批根本就是冷血慣老闆,她本人於9日凌晨發文道歉,並清空

2024-05-10 09:10

-

Lulu認了跟師父黃子佼斷聯 他送的「35萬愛馬仕柏金包」下場曝光

藝人黃子佼性騷女性、購買未成年不雅片的行為引發全網撻伐,他的徒弟Lulu(黃路梓茵)發文表明立場後,日前出席活動為了避免被媒體追問,她迅速逃跑讓記者追;今(9)日Lulu出席公益活動「不逃了」,乖乖坐

2024-05-09 16:33

-

桃園小二生「被逼脫光罰站」爆不當管教 鄰嘆:多次通報都沒轍

民進黨桃園市議員黃瓊慧昨(9)晚揭露一起虐童案,一名國小2年級的王姓男童疑遭父親不當管教,鄰居透露常看見男童在社區1樓罰跪、頂樓罰站,身上偶有不明瘀青,又被監視器拍下深夜全身赤裸跑下來,一臉無助地看著

2024-05-10 08:29

精選專題

要聞

更多要聞-

政院通過「打詐新四法」!謝金河說話了:建議這招重罰臉書最有效

行政院會昨通過「打詐新四法」,包括《詐欺犯罪危害防制條例》、《洗錢防制法》、《科技偵查及保障法》與《通訊保障及監察法》,刑期提高至3年以上10年以下,3人以上複合不同詐欺手段,加重刑責二分之一,並提高

2024-05-10 08:53

-

今日軍武/習近平到訪無用!塞爾維亞棄買梟龍 轉買法國飆風戰機

中國國家主席習近平5月5日至10日前往法國、塞爾維亞與立陶宛進行國是訪問。其中塞爾維亞與中國的關係極為緊密,習近平曾稱塞國為中國的「鐵桿朋友」,但是塞爾維亞在習近平訪問前宣布採購12架法國飆風(Raf

2024-05-10 08:33

-

民眾黨519綠營主堡踢館 綠委驚覺有貓膩「設計來失敗的活動」

民眾黨計劃在519號召民眾一起到民進黨中央黨部前遊行,向執政黨表達改革決心,對此民進黨立委林俊憲表示,怎麼看都像是故意把黨主席柯文哲僅存政治政治能量消耗殆盡,首先是辦在假日為了盡可能更多人參與,怎麼會

2024-05-10 08:00

-

藍白有異見!傅崐萁提花東建設3法案 黃國昌:不支持用特別預算

為改善花東交通,國民黨立院黨團總召傅崐萁提3案,包括《花東快速公路建設特別條例》、《環島高速鐵路建設特別條例》與《國道6號東延花東建設特別條例》,今(9)日由立法院長韓國瑜召集協商,不過歷時近3小時仍

2024-05-09 19:38

新奇

更多新奇-

變頻冷氣「吹錯電費差5倍」!師傅公開省電2招:台電、大金認證過

炎炎夏日即將到來,不少人都開始清潔自家冷氣以及汰換家中老舊冷氣,然而隨著今年電費飆漲,不少人也要研究「冷氣怎麼吹」才比較省電的議題。而過去電視台節目《台灣好吃驚》就實際到訪專做冷氣工程的店家詢問,結果

2024-05-10 08:33

-

7-11母親節賣康乃馨!「一朵120元」眾買過反讚爆 2優勢贏過花店

這週末就是一年一度的母親節,有不少人都會回家與媽媽團圓,並且贈送康乃馨等等禮物,然而近幾年超商也跟上鮮花熱潮,在特定節日開賣進口花朵,最近7-11、全家也都賣起了應景的康乃馨。然而就有網友分享去逛7-

2024-05-10 08:32

-

邀請過世外婆「變蝴蝶來我婚禮」!奇蹟影片全錄下 新郎崩潰大哭

科學真的無法解釋!近日在中國湖南有一名年輕男子舉辦婚禮,由於自己的外婆在婚禮前沒多久過世,讓該男子悲痛不已,但仍然非常希望外婆能在場看他完成人生大事,於是便傳訊息給過世的外婆,邀請她來參加自己的婚禮,

2024-05-10 07:14

-

菜市場西瓜貨車標價「1斤13元」超俗!真相大反轉:一堆婆媽上當

菜市場標價爭議又一樁!日前新北市蘆洲衛生所旁出現一輛賣西瓜的貨車,車上懸掛板子寫道「1斤13元」吸引婆媽,網紅Cheap卻戳破逆轉真相,感慨表示「很多婆媽被騙」。知名網紅Cheap今(9)日在臉書粉專

2024-05-09 18:50

娛樂

更多娛樂-

觀眾被界外球擊中!鏡頭一帶竟是「八點檔演員蘇炳憲」 傷勢曝光

中華職棒味全龍隊、樂天桃猿隊8日在台北天母棒球場對戰,沒想到,一記界外球意外擊中一名球迷,鏡頭一帶居然是知名八點檔演員蘇炳憲,他當場露出痛苦表情,雖然腰部紅腫一片還瘀青,本人仍笑說:「我是堅強的男子漢

2024-05-10 08:19

-

獨/李多慧拍廣告耍大牌?「不站C位就不拍」 慘被換角內幕曝光

啦啦隊女神李多慧從樂天女孩轉戰味全小龍女後,近來爭議不斷,先是傳出要求當啦啦隊長,《NOWnews今日新聞》再接獲讀者爆料,9日一場大型廣告拍攝現場,廠商找來中華職棒多隊的啦啦隊、共25名隊員合體助陣

2024-05-09 23:37

-

Makiyo暴瘦剩42公斤!坦言撫養小孩太操勞 粉絲嚇壞:去看醫生

女星Makiyo(川島茉樹代)在去年無預警宣布結束14個月婚姻後,獨自扛起扶養小孩的責任,日前在參加談話節目錄影時,被發現瘦了一大圈,還被外界誤會是否生病,但她很快否認,表示自己只是單純因為太累而瘦下

2024-05-09 22:17

-

《愛愛內含光》女星才激戰柯震東!再尬范少勳劉俊謙 揭他真面目

心動系電影《我在這裡等你》主演劉俊謙、范少勳、詹子萱,今(9)日出席首映會。因主演台劇《愛愛內含光》激戰柯震東爆紅的詹子萱,新片中也換上火辣比基尼飛撲范少勳,令劉俊謙大吃飛醋!她透露劉俊謙私下話超多,

2024-05-09 21:40

運動

更多運動-

金塊該怎麼限制Edwards?詹皇獻錦囊妙計:包夾他讓Gobert處理球

丹佛金塊在次輪季後賽陷入0:2落後,兩個主場都被明尼蘇達灰狼給攻破,衛冕之路陷入危機。在「詹皇」LeBron James和JJ Redick共同主持的節目《Mind the Game》第7集中,兩人對

2024-05-10 08:59

-

Frank Vogel被解雇!只待1年、9.58億合約放水流 新主帥人選曝光

鳳凰城太陽最終還是沒有留下Frank Vogel,畢竟總要有人為這一季負責,根據《The Athletic》記者Shams Charania報導,太陽已經將總教練Vogel給解雇,而新任主帥的領跑人選

2024-05-10 08:17

-

李亦伸專欄/Jalen Brunson主宰比賽 比顛峰James Harden還可怕

例行賽場均28.7分,投籃命中率4成8,季後賽目前場均35.6分,投籃命中率4成5,紐約尼克187公分後衛Jalen Brunson正在展現統治力,改變NBA籃球。尼克今年季後賽在Jalen Brun

2024-05-09 23:35

-

T1/林秉聖3戰砍69分!中信特攻「區域」守不住他 讓光哥傷腦筋

臺北台新戰神在季後賽G2以80:72擊敗新北中信特攻,距離取得隊史首個系列賽勝利只差一勝。戰神出色的運動能力和禁區尺寸,限制住了傷兵眾多的特攻進攻端的活力,大量的三分球出手頻頻「打鐵」,另外林秉聖在這

2024-05-09 22:49

財經生活

更多財經生活-

今天就衝!超商美式、拿鐵買2送2 全家母親節「咖啡18杯520元」

限時一天!OK超商今(10)日限定,指定咖啡買2送2優惠,包括美式、拿鐵都可選;全家今起開跑母親節優惠,美式、拿鐵第2杯10元外,APP寄杯咖啡組合只要520元,可選中杯單品美式10杯、中杯單品拿鐵9

2024-05-10 09:02

-

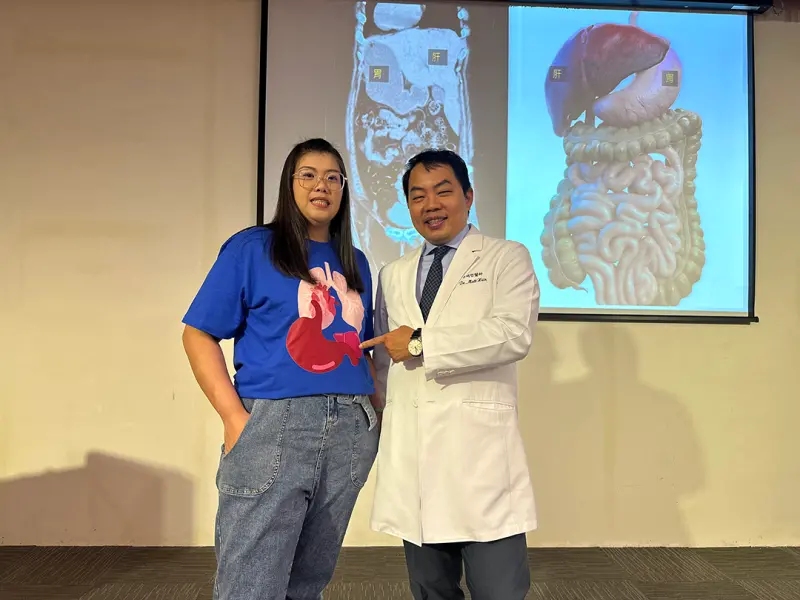

她車禍才發現「天生臟器顛倒」!產子後體重破百 醫助速瘦20公斤

35歲粉領族李小姐高中時曾遭遇重大車禍,那時才知自己的心、肺、胃等內臟,位置均與常人左右顛倒,有如「鏡面人」;近年結婚、產子後,她體重一路飆破100公斤,並引發脂肪肝等問題,經各種治療無效,決定接受「

2024-05-10 06:37

-

威力彩5/9頭獎槓龜!今彩539開1注頭獎 「最新開獎號碼」一次看

今(9)日晚間威力彩第113000038期開獎,本期頭獎為2億元,不過最終本期頭獎、貳獎皆未送出,獎金將累積至次期。今彩539部分,則開出一注8百萬元。5/9威力彩中獎號碼(第113000038期)第

2024-05-09 22:30

-

LOL/PSG雖敗猶榮!MSI「打滿5把」惜敗中國冠軍BLG 8強跌敗者組

LOL《英雄聯盟》2024年首場國際賽「MSI 季中邀請賽」目前正進行8強環節,今(9)日 PCS 賽區全由台灣選手組成的香港隊伍「PSG Talon」強碰中國 LPL 賽區冠軍 BLG,賽前各界普遍

2024-05-09 21:12

全球

更多全球-

封口費案川普再喊冤!律師質疑女方說詞露骨可疑:有無戴套非重點

美國前總統暨共和黨2024總統候選人川普(Donald Trump),自離開白宮後官司纏身,他與AV豔星「暴風女」丹尼爾斯(Stormy Daniels)的「封口費案」,審理進度更引發全美民眾關注。當

2024-05-10 07:24

-

iPad Pro新廣告挨轟!壓毀「吉他、鋼琴」創造力物件 蘋果道歉了

蘋果公司在本週舉行新產品發布會,然而,其中新款iPad Pro的廣告卻引來許多爭議,批評者控訴,廣告裡出現液壓機把吉他、喇叭、鋼琴等象徵人類「創造力」的物品壓爛,取而代之的是一台iPad Pro,踐踏

2024-05-10 06:21

-

美國就業市場降溫!市場重燃Fed降息預期 美股道瓊漲331點

美國勞工部最新數據顯示,美國就業市場呈現降溫、放緩跡象, 使得市場重燃聯準會(Fed)將降息的希望,美股主要指數9日幾乎全部收紅,其中道瓊工業指數更連續7個交易日都收漲。綜合《CNBC》等外媒報導,美

2024-05-10 05:56

-

真「自殺」!華納自殺突擊隊遊戲血賠2億美元 虧錢程度不輸電影

好萊塢影視巨頭華納兄弟(Warner Bros.)日前公布最新財報,令人驚訝的是最虧錢的項目不是電影,而是華納推出的遊戲「自殺突擊隊:戰勝正義聯盟」,這款今年1月底才推出的遊戲惡評不斷,導致華納虧損了

2024-05-09 23:18