《鄉民大學問EP.36》字幕版|韓院長的突襲!藍綠白委員見“韓國魚”驚呼!謝龍介不敢睡 稱愈晚愈high在忙那椿?葉元之公開立院頭號女戰神是“她”!王世堅自豪這點連韓國瑜也比不上!|NOWnews

NOW影音

更多NOW影音焦點

更多焦點-

主席鍾佳濱不見了!羅智強諷「神盾局長」 製作協尋看板籲速現身

立法院司法法制委員會今(18)日初審民進黨立院黨團擬具《立法院職權行使法》部分條文修正草案,但周一時國民黨籍召委吳宗憲審查時,已先行完成審查,今換民進黨籍召委鍾佳濱也安排審查,藍綠對國會改革修法意見僵

2024-04-18 16:11

-

債券ETF還能買嗎?分析師曝4觀念「價格有吸引力」唯一缺點是這個

美國聯準會主席鮑爾在16日演說中,對何時降息三緘其口,無疑對今(2024)年大幅降息的希望一再潑冷水,也顯示短期內降息機會不大。這消息也讓有投資債券ETF的投資人,感到有些憂心,不知道是否要繼續在這個

2024-04-18 15:56

-

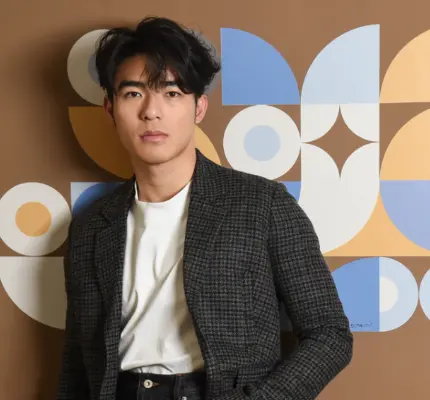

賀軍翔好暖!網紅曝妹妹離家出走 他一舉動「彷彿偶像劇情節」

40歲偶像劇男神賀軍翔,這次在電視劇《不夠善良的我們》大改昔日的帥氣形象,以白髮短平頭造型亮相,被網友形容是撞臉新北市長侯友宜,引發熱烈討論,一位親子網紅作家「焦糖綠玫瑰」提及私下對賀軍翔的形象就是「

2024-04-18 15:12

-

保母姊妹聯手虐死1歲童!4親人疑藏「愛的小手」滅證 檢另案偵辦

台北市1歲男童剴剴(化名)因外婆無力照顧,經安置後慘遭保母劉彩萱及胞妹劉若琳虐待3個月,不僅屁股雙腿骨折變形,牙齒被打到剩下8顆,手指甲也被拔光,終因營養不良死亡。台北地檢署署今(18)日偵結,依凌虐

2024-04-18 16:03

精選專題

要聞

更多要聞-

主席鍾佳濱不見了!羅智強諷「神盾局長」 製作協尋看板籲速現身

立法院司法法制委員會今(18)日初審民進黨立院黨團擬具《立法院職權行使法》部分條文修正草案,但周一時國民黨籍召委吳宗憲審查時,已先行完成審查,今換民進黨籍召委鍾佳濱也安排審查,藍綠對國會改革修法意見僵

2024-04-18 16:11

-

徐巧芯夫妻財產一年暴增415萬 李宇翔:一整年不吃不喝?

國民黨立委徐巧芯大姑與其丈夫涉嫌詐騙洗錢案,不法金流高達2700萬元,雖徐巧芯極力撇清稱不知情,但卻遭外界質疑在財產申報部分,一年暴增415萬元,但夫妻倆年薪僅420萬元,「難道兩人一整年都不吃不喝?

2024-04-18 16:03

-

揭徐巧芯勞力士鑽錶不只29萬!鄭家純稱無針對:代表台灣經濟好

國民黨立委徐巧芯捲入大姑夫婦涉詐騙、洗錢一案,遭北市議員苗博雅爆出身上行頭不斐,其中包括29萬勞力士鑽錶。網紅雞排妹鄭家純則查出正確價格,表示自己如果有看對款式,該錶為新台幣36.9萬元。並稱她是在監

2024-04-18 15:55

-

挑戰2026新北市長?李四川坦言「沒意願」 親曝2原因

新北市長侯友宜將於2026年卸任,任期剩下2年左右,接棒參選新北市長的人選近日也引發各界討論,其中台北市副市長李四川也被傳是人選之一,近日更盛傳立法院長韓國瑜明確勸進李四川參選新北市長。對此,李四川今

2024-04-18 15:41

新奇

更多新奇-

到巴黎玩錢包一定被偷?黃大謙帶「8個錢包」實測 驚人結局曝光

法國的首都巴黎是擁有數千年歷史的古都,也是許多遊客到訪歐洲必去的浪漫城市。但當地治安卻總是亮起黃燈,一堆人都曾在當地錢包、財物失竊,當有人要去巴黎時,幾乎被提醒的第一句都是「小心錢包被偷」。對此,Yo

2024-04-18 15:17

-

退休爸養雞賣佛心蛋!「1顆1元」每人限5顆 阿姨卻飆罵:怕人買

不要糟蹋別人的心意!近期雞蛋價格雖然沒有去年「蛋荒」時昂貴,但想要買到一顆1元的雞蛋,仍可以說是天方夜譚。近期就有民眾表示,爸爸退休後迷上養雞、鴨,產生的蛋自家吃不完,就打算便宜販售,訂出「1顆蛋1元

2024-04-18 13:48

-

政大景觀池命名票選!「金玟池」得票63%暫居第一 超紅原因曝光

韓流魅力真的太強了!近期國立政治大學要達賢圖書館旁的景觀池命名,更舉辦了人氣票選比賽,也開放校外民眾參加,沒想到除了許多諧音梗紛紛出籠之外,還有韓星「金玟池」的名字也在其中,甚至還突破6成得票率暫居第

2024-04-17 21:53

-

搭北捷親子友善車廂!她驚見「小孩全都站著」太諷刺 家長掀共鳴

台北捷運是雙北首都圈核心的大眾運輸工具,許多人上班、出遊都會搭乘到。近期卻有家長帶著孩子進入親子友善車廂,卻發現車上所有小朋友都沒有位置可坐,貼文隨即掀起大批家長共鳴。一位家長在社群平台Threads

2024-04-17 16:42

娛樂

更多娛樂-

林襄「0遮掩現身紫南宮」!超辣打扮引眾目 粉絲激動認出求合照

「超人氣啦啦隊女神」林襄近年除了啦啦隊應援以外,同時還跨足娛樂圈、時尚圈以及接下各種廣告代言,甚至還有不少海外工作,可謂工作行程滿檔。近日,林襄安排了2天1夜的假期,與閨蜜們驅車前往中台灣旅遊,行經紫

2024-04-18 15:17

-

日本樂壇Z世代鬼才imase宣布7/17登台開唱! 4/19快來搶票

日本樂壇Z世代鬼才 imase 看似平凡卻絕頂不凡,以洒落姿態與洗腦旋律在全球引爆現象級熱潮,imase 將於7月來台舉行首次個人演唱會,門票於明(19)日全面開賣。近期他也化身知名速食店大使推出新曲

2024-04-18 14:05

-

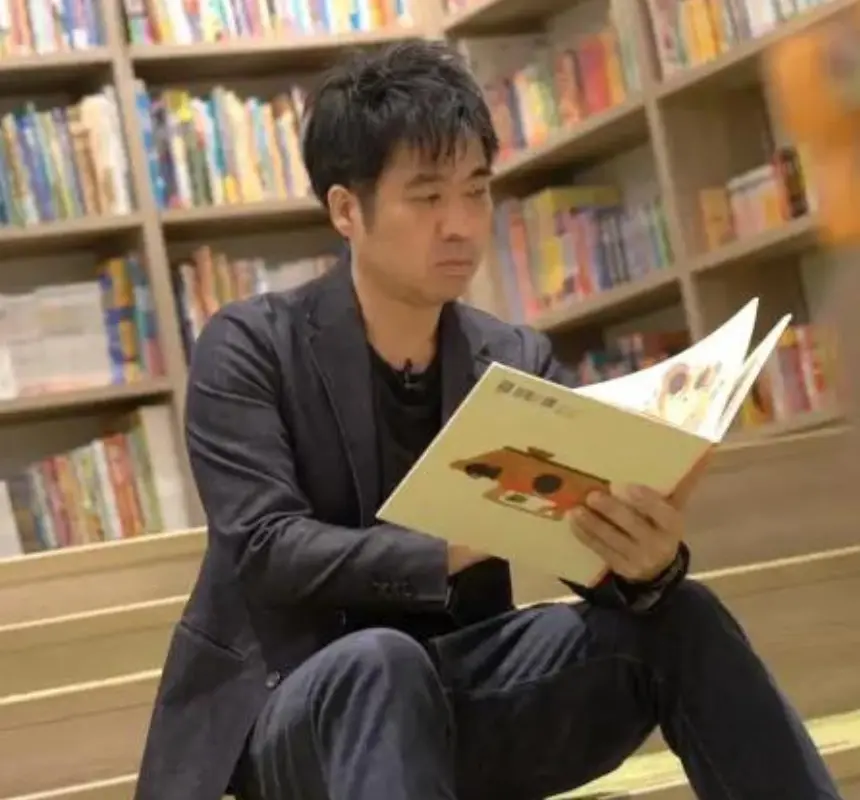

張小燕護航黃子佼有內幕!媒體人親揭「演藝圈生態」痛批還不解約

藝人黃子佼被爆出購買未成年少女影片後,遭到社會大眾撻伐,連師父張小燕也備受抨擊。媒體人兼作家莎莉夫人關注此事,先前曾發聲認為張小燕還護著黃子佼,希望她能公開呼籲黃子佼退出演藝圈,昨(17)日莎莉夫人再

2024-04-18 13:53

-

梁詠琪演唱會花海被酸像「告別式」 殯葬達人也傻眼:後勁太強了

香港天后梁詠琪出道28年,日前首度登上台北小巨蛋舉辦「時間遇上我們」演唱會,精選30首國語歌,她精心準備華麗服裝與舞台,不過其中一個花海場景卻讓人覺得怪怪的,連殯葬達人小冬瓜也說,「看到Gigi我感到

2024-04-18 13:49

運動

更多運動-

NBA/金塊剋死湖人!對戰7連勝、含季後賽橫掃 AD還遭Jokic打趴

NBA洛杉磯湖人在昨(17)日西區附加賽擊敗紐奧良鵜鶘,確定以西區第7種子晉級季後賽首輪,將交手西區第2的丹佛金塊,其中金塊從去年季後賽對陣湖人至今,已經取得7連勝的對戰優勢,對此主帥Michael

2024-04-18 16:06

-

MLB/水原一平可能刑責曝光!日本律師:他要還大谷翔平「5.2億」

洛杉磯道奇隊球星大谷翔平前翻譯水原一平,涉嫌竊取大谷1600萬美元(約5.2億台幣)用於非法賭博,已遭美國聯邦檢察官以詐欺罪起訴。根據日媒《週刊現代》報導,他們採訪了熟悉美國法律的村尾卓也律師,指出如

2024-04-18 15:48

-

Curry為何加入美國隊?當年奪冠後承諾:我得幫Kerr打奧運並奪金

在昨天金州勇士出局之後,Stephen Curry成為巴黎奧運美國男籃國家隊最早出局的球員,提期開始準備。今年的巴黎奧運,NBA球星興致很高,Curry與LeBron James、Kevin Dura

2024-04-18 15:16

-

MLB/大谷翔平躍升安打王!可望睽違14年 追逐鈴木一朗神紀錄

MLB洛杉磯道奇今(18)日在主場交手華盛頓國民,此戰道奇隊二刀流好手大谷翔平繳出三安猛打賞,是本次賽季第三次在同一場比賽中貢獻3支安打。開季至今已累積31支安打, 與隊友Mookie Betts、太

2024-04-18 15:00

財經生活

更多財經生活-

台積電3、5奈米需求強勁 Q2美元營收估約200億美元、季增6%

台積電今(18)日舉行法說會,第一季稅後純益約2254億9千萬元,每股盈餘為新台幣8.70元,優於市場預期。展望第二季,台積電指出3奈米和5奈米需求強勁,第二季合併營收估介於196億美元到204億美元

2024-04-18 15:30

-

恐怖炸物排行曝光!冠軍超意外「吸油率1500%」 專家:像顆油彈

鹹酥雞是台灣人宵夜首選,架上琳瑯滿目的品項,總是讓人看了食指大動。但營養師姚晴徽近日就統整出「油炸食物吸油率」列表,不只看似健康的蔬菜澱粉類,為隱形吸油熱量炸彈,炸海苔吸油率更是高達1500%,恐怖數

2024-04-18 14:47

-

日本工程師驚吐「台灣高鐵4祕密」!點名兩車廂最頂:商務艙同等

日籍正妹YouTuber「Mana」頻道擁有25.3萬訂閱數,她近日帶著爸媽來台灣體驗搭乘高鐵商務艙,她坦言自己住在台灣6年都沒搭乘商務艙,這次帶著工程師爸爸一起來體驗,爸爸也透露許多關於台灣高鐵的祕

2024-04-18 14:45

-

台積電好威!Q1 EPS 8.7元、優於市場預期 毛利率53.1%

台積電今(18)日公佈2024年第一季財務報告,合併營收約新台幣5926億4千萬元,稅後純益約2254億9千萬元,每股盈餘為新台幣8.70元(折合美國存託憑證每單位為1.38美元),優於市場預期。若以

2024-04-18 13:53

全球

更多全球-

美日韓財長會議關注匯率 日經:「美元獨強」成新興經濟體的逆風

美日韓首次3國財長會議於17日在美國舉行,會後3人發表聯合聲明,稱同意就外滙市場波動問題保持密切磋商,許多分析師解讀這意味著日、韓即將出手干預匯市。對此,《日本經濟新聞》指出,各國對美元獨自走強的警惕

2024-04-18 15:50

-

前友邦索羅門大選牽動對中關係 中國官媒在旁「煽風點火」

我國前友邦索羅門群島18日舉行大選,目前正進入計票階段,此次再度形成「親中」與「反中」陣營的對抗局面。未料,中國官媒竟在選舉前煽風點火,拋出陰謀論稱美國準備影響索羅門群島選舉。索羅門群島2019年與台

2024-04-18 15:38

-

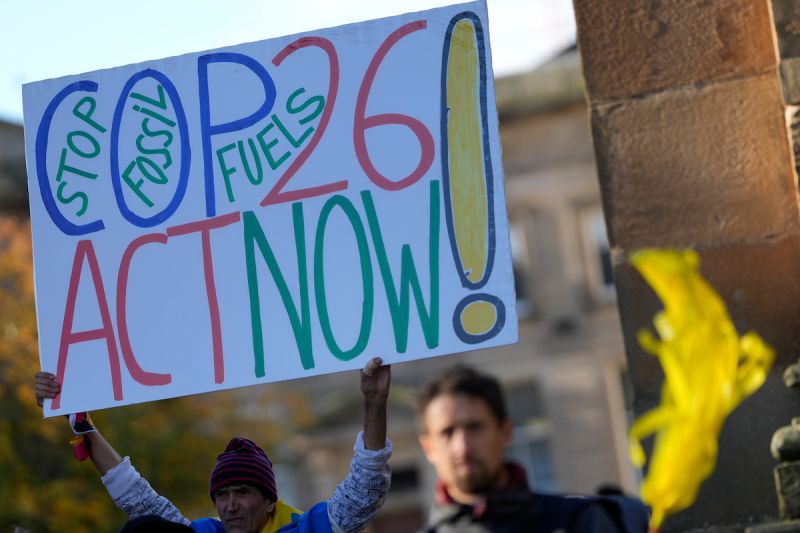

新一輪「太空競賽」?NASA署長:中國以民用太空計畫掩護軍事目的

美國航空暨太空總署(NASA)署長尼爾森(Bill Nelson)表示,中國透過民用計畫來掩護軍事目的,正在悄悄加強太空能力,華盛頓必須保持警覺。尼爾森是在出席眾議院針對NASA明年度的預算審議會議時

2024-04-18 14:56

-

馬斯克改抱印度大腿?外媒揭特斯拉將砸900億設廠

特斯拉(Tesla)執行長馬斯克(Elon Musk)將於22日訪問印度,與印度總理莫迪(Narendra Modi)會面,有外媒報導稱,馬斯克將在訪問印度期間,宣布投資20億至30億美元(約新台幣6

2024-04-18 14:19