《鄉民大學問EP.38》字幕版|民進黨的弱點民調看端倪?黃暐瀚喊國民黨要往傷口灑鹽!廢死引爆民怨 蔡英文挖坑給賴清德?萬美玲嗆:容許暴力侵害被害人?鍾沛君質疑大法官預設立場支持公投廢死|NOWnews

NOW影音

更多NOW影音焦點

更多焦點-

花蓮震災專案募得13.3億愛心善款 日本政界、工商界也響應

花蓮0403強震釀成嚴重傷亡,今(25)日又傳出1人遭落石重砸後,昏迷22天導致器官衰竭不幸死亡,累計17死,賑災基金會今(25)日公告,花蓮賑災專案募款至今日下午4時募得約13.3億3241萬721

2024-04-25 20:41

-

小確幸!旅平險保費7月起可望調降1成 估千萬保額省60元

國人出國旅遊多數都會投保旅行平安保險,金管會今(25)日表示,已完成旅平險「意外死亡及失能給付」和「意外醫療給付」標準費率的檢討,這次調降意外死亡及失能給付標準費率表中各費率的10%,並適用自今(20

2024-04-25 20:29

-

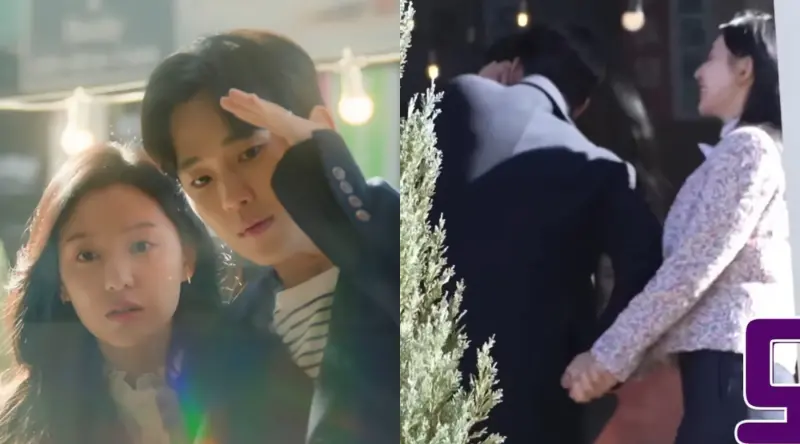

《淚之女王》金智媛結婚現場!韓劇CP御用飯店 玄彬孫藝真也愛這

金秀賢、金智媛搭擋的Netflix韓劇《淚之女王》,開播後一路維持高收視率,目前距離tvN電視台收視率第一的紀錄僅一步之遙。本週末《淚之女王》將播出完結篇,讓不少粉絲都十分期待金秀賢與金智媛這對CP可

2024-04-24 17:39

-

花蓮7.2強震!晶英酒店實習生雙腿遭巨石砸中 搶救22天宣告不治

花蓮近海地區本月3日發生芮氏規模7.2強震,當時一名準備前往太魯閣晶英酒店建教實習的黃姓高三生,在行經九曲洞附近時遭大量落石擊中,雙腿也因此遭巨石壓住,直至2天後才獲救,雖緊急送往醫院,但仍呈現昏迷,

2024-04-25 19:52

精選專題

要聞

更多要聞-

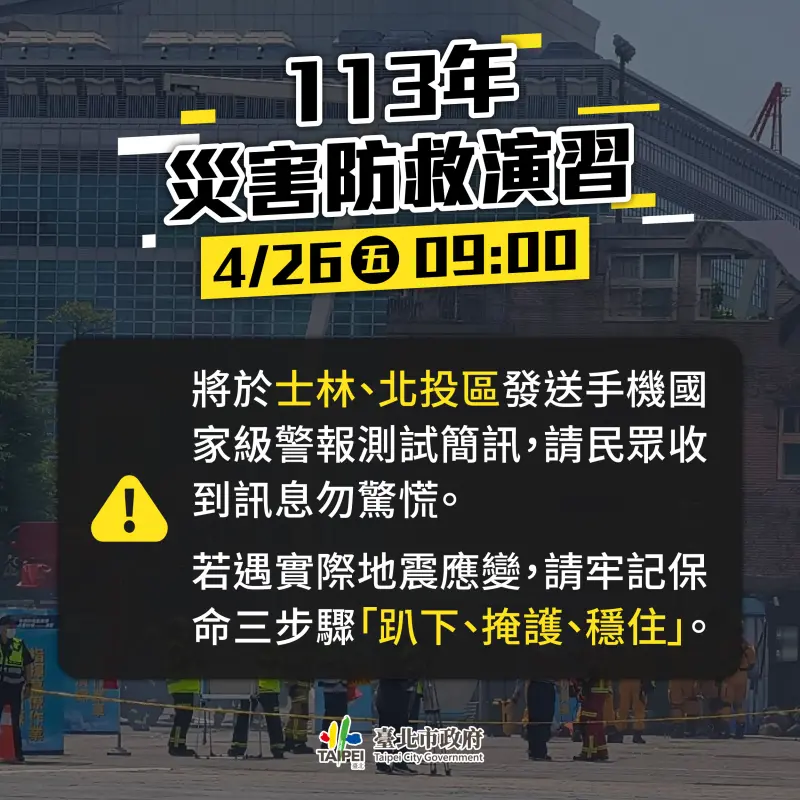

手機響別慌!北市北投、士林4/26上午9點「發布國家級警報測試」

0403花蓮7.2強震造成嚴重災情,台北市政府為「模擬山腳斷層南段發生規模6.6地震」災害防救演習,將於明(26)日上午9時,針對士林區、北投區發放手機國家級警報測試,提醒民眾接到測試警報後不用驚慌。

2024-04-25 20:19

-

行政院召開會議研擬「震災復原重建方案」 總經費超過200億賑災

為即刻完善0403地震災後復原重建工作迫切需求,行政院副院長鄭文燦今(25)日召開研商「0403震災復原重建方案」會議,邀集相關單位共同研議安全、有效、迅速「震災復原重建方案」,整合及運用中央與地方各

2024-04-25 19:55

-

司委會表決散會!吳思瑤嘆:國民黨認真撐不過3小時

立法院司法法制委員會今(25)日進行國會改革法案審查,最終國民黨在下午5時許提出散會動議並以5比4通過,對此民進黨立法院黨團幹事長吳思瑤嘆,國民黨認真果然撐不了3小時,又提散會動議沒收法案審查,而傅崐

2024-04-25 19:09

-

徐巧芯大姑涉詐騙洗錢 王世堅:代表政府打詐有一定成效

國民黨立委徐巧芯大姑與其丈夫涉入詐騙洗錢案,對此民進黨立委王世堅今(25)日表示,從徐巧芯家人的詐騙案就可以知道,政府打擊詐騙還是有一定成效,認為一切等司法調查就會有結果,徐巧芯現在講的都只是欲蓋彌彰

2024-04-25 18:24

新奇

更多新奇-

24歲台妹當性工作者!驚爆「每月薪水60萬」:台灣8成男人買過春

台灣知名脫口秀演員曾博恩昨(24)日推出新節目《初識啦!阿博》,試播集題材就相當辛辣,找來24歲的性工作者女子以及男友進行訪談,對方更驚爆「每月薪水60萬」,並認為台灣有8成男人買過春。▲可愛表示,現

2024-04-25 15:05

-

被《關鍵時刻》誤認成東大教授!有吉弘行看到了 本人回應超幽默

台灣政論節目《關鍵時刻》,由知名主持人劉寶傑領銜,時常針對各種時事進行語氣激昂的講解。不過近期在談論423地震話題時,誤將日本知名諧星主持人有吉弘行當成日本東京大學地震權威教授笠原順三,截圖瞬間在網路

2024-04-24 22:31

-

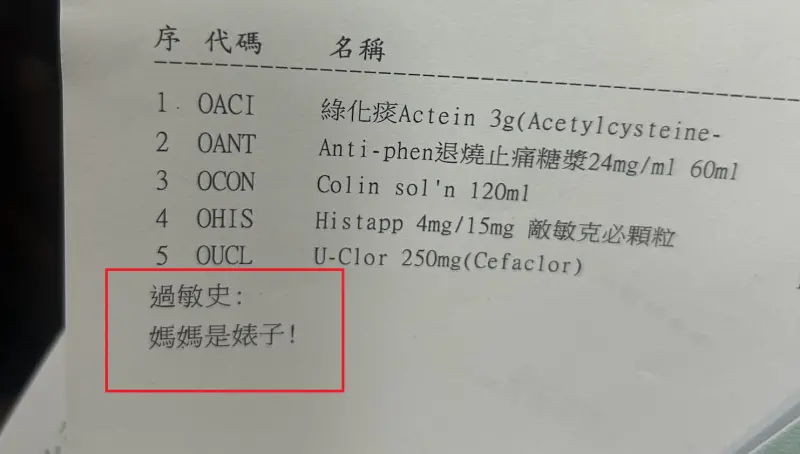

基隆醫院藥單上標註「媽媽是婊子」!人妻一看傻眼 護理師急道歉

(更新時間10:10)一位媽媽今(24)日帶著孩子前往衛生福利部基隆醫院看診,沒想到拿到藥單時,卻看到上面過敏史竟寫上:「媽媽是婊子!」讓她當場傻眼,詢問醫院究竟是怎麼回事,護理師同樣納悶,也立刻向她

2024-04-24 21:09

-

世界100大美食最新排行曝光!台灣竟成「吊車尾」:連英國都輸了

許多國際遊客來台一定會品嘗珍奶、小籠包、雞排、滷肉飯,甚至勇敢一點的還能嘗試看看臭豆腐。卻有國際美食榜單,將台灣美食排名列在榜單末端,甚至還有頗具權威性的美食評論刊物,2023年度最新榜單只給台灣第7

2024-04-24 18:43

娛樂

更多娛樂-

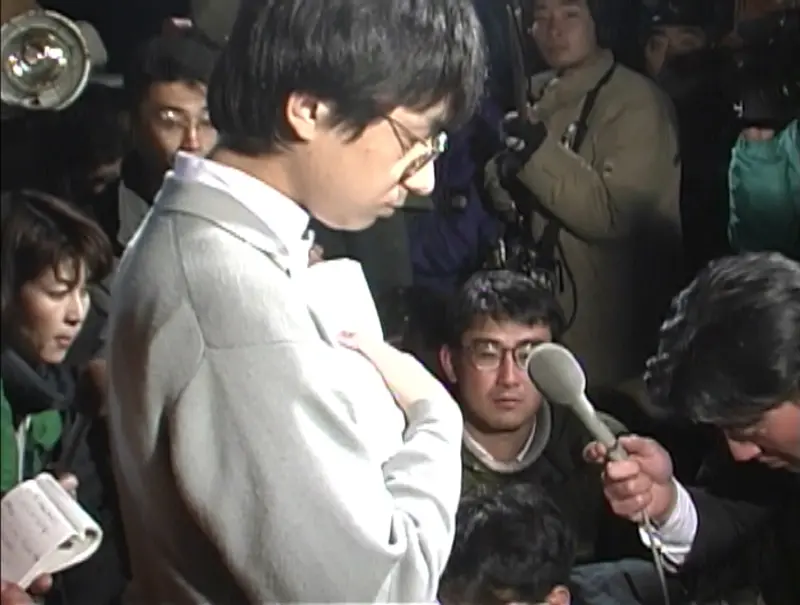

《A》揭邪教真面目!東京地鐵「放毒氣殺千人」29年前轟動全球

「台灣國際紀錄片影展(TIDF)」與國家影視中心共同企劃「記錄.紀錄:TIDF回顧精選」單元,精選6部各具特色與代表性的作品。紀錄片《A》、《A2》描述,日本奧姆真理邪教曾在東京地鐵放毒氣,造成上千人

2024-04-25 20:12

-

劉涵竹長9公分子宮肌瘤「與它和平共處」 會不會影響生育這樣說

42歲前主播劉涵竹去年3月做健檢時,發現子宮長6顆息肉還有9公分大的肌瘤,已經壓迫到膀胱,她今(25)日主持「響應『2024國際玫瑰斑月』避免玫瑰斑復發」活動,透露治療後子宮肌瘤已經縮小,目前與病灶和

2024-04-25 18:00

-

Selina「懷雙胞胎3個月」真相曝光!夢想成真當三寶媽:拚到停經

Selina生下兒子小腰果之後代言接不停,今(25)日出席孕產護理品牌代言活動,提到想要生第二胎這件事情,她坦言目前還沒有達成,但透露最近有夢到「胎夢」,夢裡面醫師告訴她懷了「雙胞胎」3個月:「我會拚

2024-04-25 17:25

-

張小燕被黃子佼害慘!許富凱公開兩人私訊內容:她不想要晚輩擔心

黃子佼涉嫌對年輕女孩伸狼爪、購買未成年少女不雅影片,負面形象波及恩師張小燕,她坦言後悔讓孟耿如嫁給黃子佼,心碎表示「一輩子沒有這樣怕見人」,至今沒公開露臉,與張小燕有私交的金曲台語歌王許富凱,今(25

2024-04-25 17:10

運動

更多運動-

日職/宋家豪化身「省球一哥」!只用14球中繼成功 樂天5:1火腿

日職樂天金鷲出戰北海道日本火腿隊賽事,台灣好手宋家豪在8局登板,面對火腿中心打線,他只用14球就解決3名打者,而且還是另類的三上三下,樂踢最終以5:1贏球,中斷火腿5連勝,儘管火腿全場12支安打,還是

2024-04-25 20:17

-

射箭/湯智鈞關鍵10分箭!大逆轉 中華隊險勝義大利、收下銅牌

中華射箭反曲弓男團傳捷報!2024射箭世界盃今(25)日在上海站開打,台灣三少湯智鈞、林子翔、戴宇軒在八強賽時力退地主中國隊,雖在準決賽時不敵南韓,不過銅牌戰在加射階段,靠著「湯包」湯智鈞1支關鍵10

2024-04-25 18:19

-

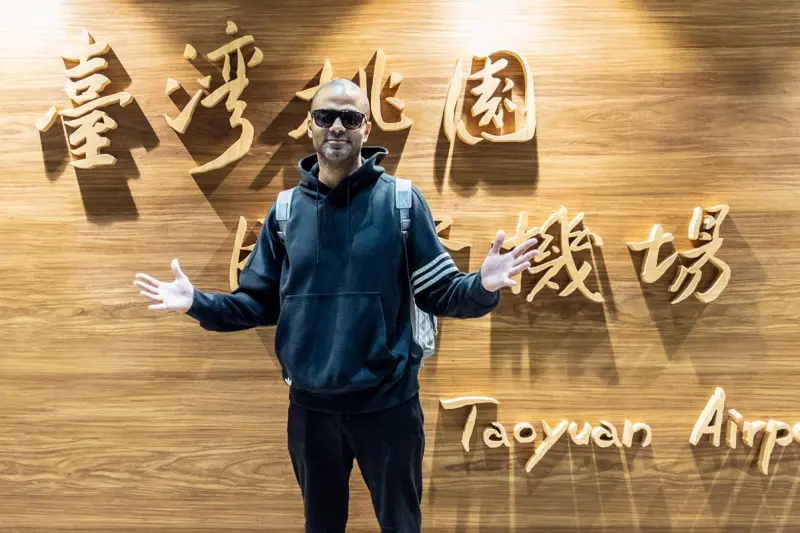

「法國跑車」Tony Parker抵台!與NBA傳奇Wilkins熱情幫粉絲簽名

前聖安東尼奧馬刺球星「法國跑車」Tony Parker以及亞特蘭大老鷹傳奇名將Dominique Wilkins今(25)日正式搭機抵台,他們將在明日舉辦抵台記者會,並將於4月26日至28日,參加在國

2024-04-25 17:29

-

中職/Lamigo「同樂會」回娘家 樂天本季桃園主場首戰、巧遇台鋼

樂天桃園棒球場明(26)日將迎來本季首戰,對上由洪一中領軍的台鋼雄鷹,這是「大王」王柏融自2018年10月13日後,睽違5年6個月再度回到這座熟悉的球場,令不少球迷相當期待。這場三連賽的系列戰桃園球場

2024-04-25 17:23

財經生活

更多財經生活-

快訊/威力彩頭獎保證2億!「4/25完整獎號」出爐 中了直接退休

威力彩第113000034期今(25)日晚間開獎,本期頭獎為2億元,就在剛剛「完整獎號」已經完全開出,快拿起手邊彩券對獎,看看是否有財神降臨吧!🟡4/25威力彩中獎號碼(第113000034期)第一

2024-04-25 20:48

-

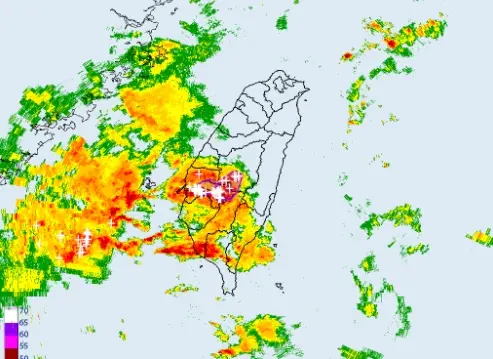

不斷更新/高雄外海出現渦旋!恐伴龍捲風、冰雹 影響範圍曝光

(更新時間:20:35)今(25)日另一鋒面逐漸接近,天氣不穩定,降雨範圍廣,西半部、東北部地區及澎湖、金門、馬祖有短暫陣雨或雷雨,並有局部大雨發生。尤其是台中以南暴雨來襲,中央氣象署也發布「大雷雨即

2024-04-25 20:38

-

半導體封測大廠京元電明暫停交易 重大訊息待公布

半導體封測大廠京元電今 (25) 日公告,因有重大訊息待公布,經證交所同意,上市普通股及以其為標的之認購 (售) 權證也同時暫停交易,待前開重大訊息公布後,再申請恢復交易,業界認為應與財報或併購有關。

2024-04-25 18:55

-

天氣預報/明天雨更猛!連2天雷雨「全台躲不過」 中南部防水災

明(26)日起至週六是這波鋒面雨勢最猛烈的時刻,各地都有降雨機會,尤其是中南部要留意豪雨致災,注意短延時強降雨伴隨雷擊和強陣風,劇烈降雨會持續到週六白天,入夜後降雨逐漸緩和,不過鋒面帶來的降雨會影響到

2024-04-25 18:46

全球

更多全球-

拋橄欖枝?哈馬斯官員:若讓巴勒斯坦「獨立建國」願解除武裝

以巴衝突持續,加薩地區遲遲不見和平曙光,各界期盼的停火協議遙遙無期。對此,《美聯社》今(25)日報導指出,哈馬斯(Hamas)高級官員哈亞(Khalil al-Hayya)透露,如果巴勒斯坦能夠完成獨

2024-04-25 19:18

-

打破紀錄!阿根廷環球小姐地區賽 60歲「美魔女」律師奪冠

阿根廷近日展開環球小姐地區選拔賽,在布宜諾斯艾利斯的地區賽中,一名美魔女律師打破年齡紀錄,以60歲的年紀勇奪后冠,將在5月與來自全國的佳麗一同競逐代表阿根廷參賽的資格。綜合外媒報導,在阿根廷一場環球小

2024-04-25 18:05

-

人力遭取代!印度IT專家:客服中心一年後會被AI「殺死」

AI人工智慧的技術應用是否會取代人力,一直是各行各業討論不斷的話題。對此,印度IT業者塔塔諮詢服務公司(Tata Consultancy Services)的執行長克里斯瓦桑(K Krithivasa

2024-04-25 17:57

-

影/鱷魚闖美空軍基地扮飛機「輪擋」 被五花大綁帶走

美國佛州佛羅里達州坦帕的麥克迪爾空軍基地,近日一隻短吻鱷悄悄闖入,未料,這隻鱷魚還躲到一架KC-135加油機的機輪下,看似成為「輪擋」,有趣畫面掀起網友熱議,空軍基地隨即聯絡當地動保單位,相關人員五花

2024-04-25 17:11