《鄉民大學問EP.38》字幕版|藍營2028的超級戰術!黃暐瀚:民調洩民進黨這弱點!廢死引爆民怨 是蔡英文挖坑給賴清德?台電屢跳電 萬美玲曝內幕:竟是小鳥惹的禍?!賴清德赴立院國情報告?將對上韓國瑜?

NOW影音

更多NOW影音焦點

更多焦點-

擋不住連日餘震!花蓮今再增3件紅單戶 藍天麗池結構受損需拆除

花蓮0403發生規模7.2大地震後,至今餘震不斷,本(4)月23日晨發生2起規模6以上強震,造成多個大樓傾斜,花蓮縣府評估後,累計共有9棟建物需強制拆除,周邊道路將進行預防性封閉。花蓮建設處表示,截至

2024-04-26 18:24

-

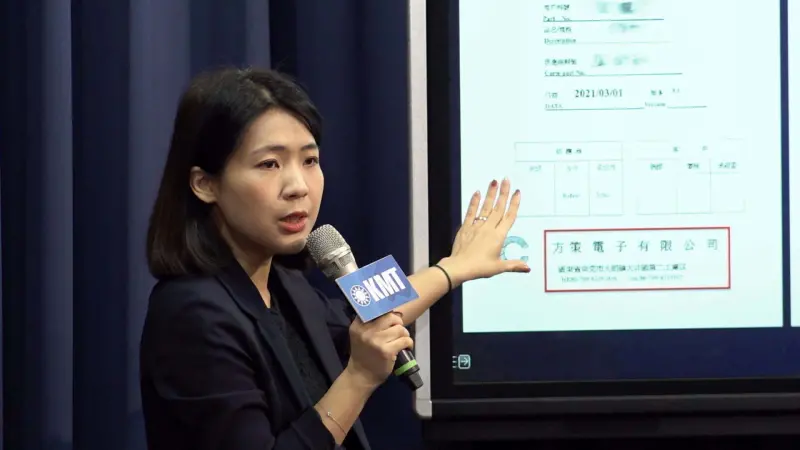

徐巧芯被質疑幫喬婆婆貸款還超貸 北富銀:無不合規定之情事

國民黨立委徐巧芯被指涉找台北富邦銀行替婆婆處理貸款,且疑以價值千萬的房子一屋三貸,貸了1450萬,超貸400多萬。為此,台北富邦銀行今(26)日發出聲明表示該個案並無不合規定之情事,亦無超貸、關說或例

2024-04-26 17:47

-

《淚之女王》金智媛長腿小白鞋!女神天王嫂愛用款 竟要價185萬

Netflix超火韓劇《淚之女王》本周末將迎來完結篇,在劇中飾演女強人的金智媛,一出場就霸道女總裁氣勢拉滿,在劇中的造型幾乎都是高跟鞋出場,不過她在自家百貨公司巡邏時差點跌倒的畫面,被飾演老公的金秀賢

2024-04-26 18:05

-

台大牙醫生是「攝狼」!學校女廁、咖啡店都受害 檢方聲押獲准

一名家住高雄的台大牙醫系3年級蔡姓高材生,被查出在台南某知名咖啡店女廁裝設針孔錄影機,警方前往其高雄住家查扣偷拍相關證據,追查之下發現台大女廁也受害,不過蔡男否認犯行,辯稱影片是網路下載,警方依涉妨害

2024-04-26 18:27

精選專題

要聞

更多要聞-

寶林茶室監測結案!疾管署:通報35例造成2死、仍有4人住加護病房

寶林茶室食物中毒案自3月底爆發至今已有1個月,疾管署表示,至今通報35例、2人死亡、33例邦克列酸(原譯米酵菌酸)陽性、2例陰性,目前仍有4人在加護病房治療中。「寶林茶室信義A13店專案」通報專區,通

2024-04-26 18:11

-

范雲稱被黃國昌噴滿臉口水!民眾黨批「造瑤累范」:停止巨嬰行為

立法院今(26)日再度上演表決大戰立法院,民進黨團提案三案變更議程,其中與國會改革有關的兩案遭國民黨團提出異議,民進黨立委范雲在提案遭封殺後,不滿民眾黨團未對國會改革相關的反性騷擾案投票,與民眾黨團總

2024-04-26 17:47

-

影/卸任倒數!蔡英文玩賽車遊戲機當飆仔 狂飆160公里超開心

即將在5月20日卸任的總統蔡英文,今(26)日出席活動時大玩賽車遊戲機,「駕駛魂」噴發的她,笑容滿滿地直接狂飆160公里;被問到好玩嗎?她豎起大拇指大讚「非常好玩」;玩完賽車機後,她也玩起夾娃娃機,夾

2024-04-26 17:42

-

咆哮范雲「我有欠你?」他酸:黃國昌球衣背號是73 原因曝光

立法院民進黨團今(26)日提案三案變更議程,民進黨立委范雲因民眾黨團未對國會改革相關的反性騷擾案投票,走到民眾黨團總召黃國昌座位旁問他為何棄權,遭對方怒吼「妳跑到我旁邊來吼什麼!我有欠你嗎?要玩程序自

2024-04-26 17:31

新奇

更多新奇-

台灣泡麵「隱藏王牌」公開!每碗37元內行扛整箱 眾吃20年沒看過

台灣泡麵在市面上販售的口味非常眾多,除了定期的新品之外,也有許多老字號的泡麵長年稱霸排行榜,成為台灣泡麵的一大特色。然而,近日就有網友分享一款台灣泡麵隱藏版,由於平常沒有在各大通路上架,因此只有內行人

2024-04-26 14:20

-

林叨囝仔七寶媽學歷曝!「最強外語」大學畢業 自嘲專長:生小孩

35歲的網紅「林叨囝仔」七寶媽(陳珮芬)歧視資源班言論遭炎上,不少人好奇七寶媽學歷為何?「七寶媽 學歷」在Google熱搜中快速飆升。據悉,七寶媽從小就是個學霸,國小到大學成績都名列前茅,她曾在部落格

2024-04-26 11:26

-

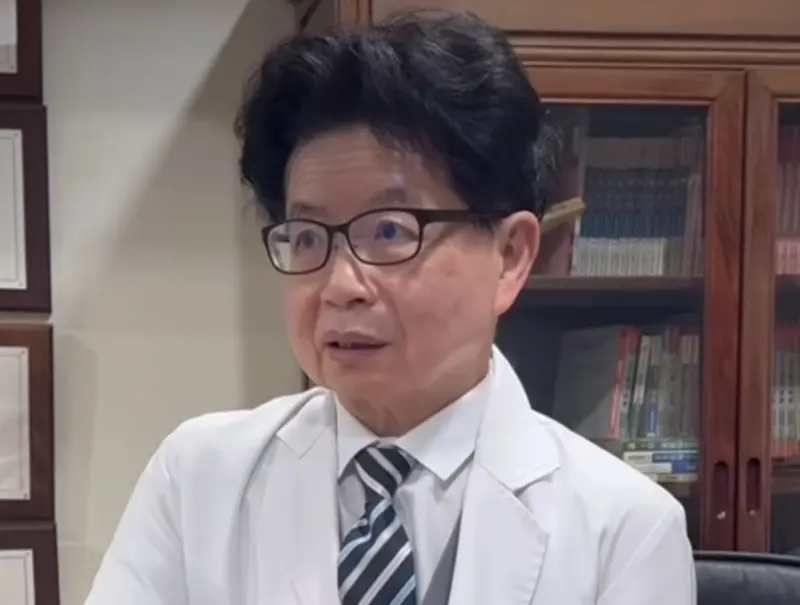

婦產科蔡醫師迷因爆紅!本尊是世界名醫 粉絲讚爆:我是試管嬰兒

2024最新迷因爆紅!最近在社群平台上,出現一名「活體迷因」,一位婦產科蔡醫師大爆紅,不僅有IG、Tik Tok的追蹤人數暴衝,甚至還有許多粉絲做了蔡醫師的各種周邊商品,由於過去蔡醫師還開投票讓粉絲表

2024-04-26 11:13

-

快訊/網紅七寶媽笑資源班遭轟!刪直播二度道歉:請原諒我的無知

網紅「林叨囝仔The Lins'Kids」七寶媽去年陷入多起爭議,好不容易才悄悄復出,結果日前直播上疑似嘲笑資源班的言論,讓她再度炎上。日前七寶媽Sydney深夜開直播道歉,但卻被批評是「把過

2024-04-26 09:15

娛樂

更多娛樂-

影/田馥甄到大陸開唱被轟:表態立場再來賺人民幣 女神高EQ回應

金曲歌后田馥甄(Hebe)今(26)日和林柏宏出席酒品代言活動,她5月將到大陸音樂節表演,部分大陸網友重提台獨疑雲,要田馥甄表態立場再來賺錢,對此,田馥甄低調表示:「能唱想唱的歌就覺得很珍惜。」▲田馥

2024-04-26 16:32

-

《雲之羽》女星證實未婚懷孕!金靖曝工作想吐「靠大笑掩飾害喜」

去年因熱播陸劇《雲之羽》受矚目的31歲大陸女星金靖,昨(25)日突發文自爆已懷孕,「一家四口一起迎接第五位家庭成員」,她也透露另一半為導演舒奕橙。金靖8年前以綜藝節目《今夜百樂門》出道,個性爽朗的她自

2024-04-26 15:46

-

鄭靚歆女女大婚!美魔女媽「透明薄紗內衣全露」 母女前晚爆爭執

28歲鄭靚歆(Jin)從節目《我愛黑澀會》出道,參加《全明星運動會4》收獲不少粉絲,她去年6月和大5歲德國女友采熙(Aky)登記結婚,今(26)日終於舉辦婚宴,鄭靚歆的美魔女媽媽胡文英透視薄紗裡只穿比

2024-04-26 15:29

-

啦啦隊一粒獲「輔大校花認證」!學生時期照曝光 貓耳造型超可愛

台鋼啦啦隊成員一粒(本名趙宜莉)因為其深邃的雙眼及高挺的鼻樑,再加上她的「葉保弟應援曲」魔性舞步。洗腦的歌曲加上好記的舞步,讓不少啦啦隊、網紅、藝人爭相模仿一粒的魔性舞步,就連日本AV女優也跟著模仿。

2024-04-26 15:11

運動

更多運動-

澄清湖球場驚見30公分鋼筋條!難怪洪總抓狂 花上億元整修成笑話

澄清湖球場真的很可怕!高雄市澄清湖棒球場在24日二軍比賽,發現比賽中一壘側有異物,經檢查後發現竟然是埋有30公分的鋼條,當下中職聯盟趕緊暫停比賽,但卻嚴重令人感到憂心,因為這裡不但是台鋼雄鷹大本營,台

2024-04-26 18:06

-

NBA季後賽/湖人就是打不贏金塊!李亦伸點主因:只有這3人在打球

NBA季後賽首輪G3由洛杉磯湖人對戰丹佛金塊,終場湖人以105:112輸給金塊,在這個系列賽中陷入連三敗的絕對弱勢。球評李亦伸直言,從目前戰況來看,幾乎可以斷定湖人隊在這個賽季是無緣季後賽了,因為從過

2024-04-26 16:43

-

林叨囝仔7寶媽一句「資源班」惹議!張進德也曾領有學習障礙手冊

網紅「林叨囝仔」7寶媽,近日在直播中嘲笑「資源班」,而他的小孩也無意以有問題的學生,來形容特教生,引發社會輿論撻罰,而所謂的「資源班」又可稱為特殊教育班,區分為:分散式資源班、巡迴輔導班、集中式特殊教

2024-04-26 16:15

-

Wembanyama防守有多恐怖?Wilkins盛讚:就算沒蓋鍋也影響了出手

聖安東尼奧馬刺超級新星Victor Wembanyama在生涯首季就繳出劃時代的數據,他在阻攻上的天賦,被看好競爭本季的年度最佳防守球員(DPOY)。近期來到台灣參加「2024 國泰NBA國際高中邀請

2024-04-26 15:45

財經生活

更多財經生活-

天氣預報/明暴雨還沒停!鋒面逐漸北移 「北台灣雨最猛」時機曝

明(27)日鋒面持續影響,各地都有降雨機會,今晚至明天白天降雨熱區為中南部,不過明晚到週日(28日)鋒面逐漸往北移動,降雨熱區轉為東部以北,留意短暫陣雨或雷雨,下週一(29日)為天氣相對穩定的一天,不

2024-04-26 18:08

-

家裡突冒小奶貓!調監視器驚見「浪貓指定她當鏟屎官」 影片曝光

被貓爸欽點了!美國女子伊莉莎白(Elizabeth Egeland)上個月在家中地下室,發現一隻才出生2週的白色小奶貓,調閱監視器查看後,才得知原來是照顧多年的流浪貓,親自叼著貓寶寶到地下室,似乎是想

2024-04-26 17:57

-

減輕身心失能者家庭租稅負擔!滿足3條件 照顧者綜所稅扣除12萬

五月報稅季即將來臨,為配合政府推動長期照顧政策,適度減輕身心失能者家庭的租稅負擔,財政部北區國稅局表示,自108年1月1日起,納稅義務人、配偶或受扶養親屬如為符合中央衛生福利主管機關公告須長期照顧的身

2024-04-26 17:23

-

好勁道這款匠心之作搭上莆田奢華海陸盆菜 驚艷饕客味蕾

向來以優質好食材與匠心功夫手藝為核心理念的新加坡米其林一星品牌「莆田」,睽違兩年推出全新菜色,準備與饕客們來場舌尖上的春之盛宴。統一「好勁道」更首次聯手「莆田」,準備以匠心之作強強聯手,收服所有挑剔的

2024-04-26 17:00

全球

更多全球-

澳洲大規模鯨魚擱淺!29頭不幸死亡 專家:救回130頭已屬了不起

澳洲西南部的托比灣(Tobys Inlet),週四驚見大規模鯨魚擱淺,約160頭領航鯨(pilot whales)在沙灘上動彈不得,參與救援的當地鯨魚研究員威斯(Ian Wiese)直呼從未見過如此多

2024-04-26 17:33

-

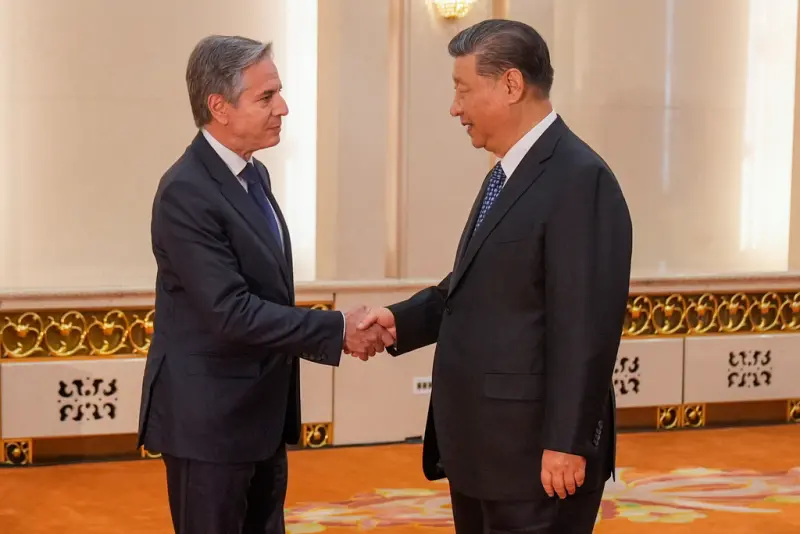

習近平晤布林肯!稱中美應做夥伴而非對手:不是「做一套說一套」

美國國務卿布林肯(Antony Blinken)今(26)日下午於北京人民大會堂與中國國家主席習近平會晤,根據央視新聞報導,習近平表示「兩國應該做夥伴,而不是當對手;應該言必信、行必果,而不是說一套、

2024-04-26 17:00

-

超美富士山打卡點恐消失!遊客太多生亂象 居民擬「黑幕」全遮住

橫跨靜岡縣和山梨縣的日本知名景點富士山,一直以來深受旅客歡迎,其中河口湖是觀看富士山美景的人氣旅遊目的地,而位於河口湖車站附近的LAWSON便利商店,也因為藍白相間的招牌再加上富士山絕景,近年成為河口

2024-04-26 16:59

-

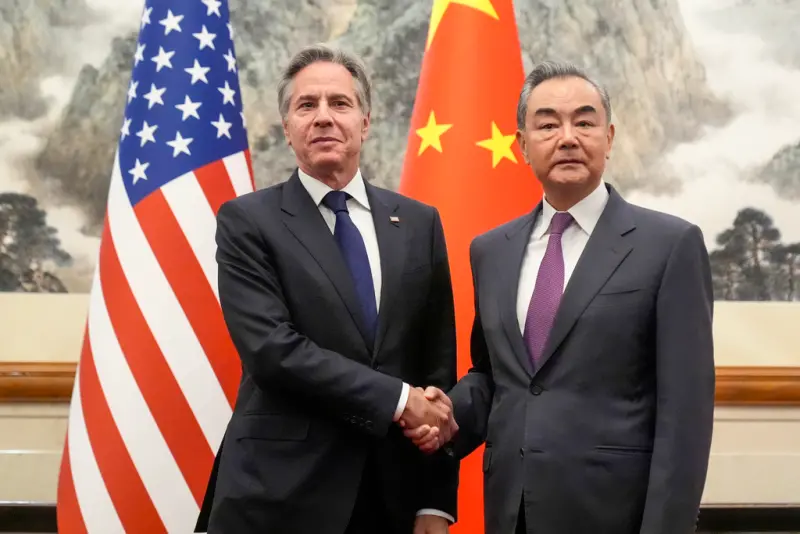

布林肯確定今在北京見習近平!王毅再喊話美國:勿干涉中國內政

美國國務卿布林肯(Antony Blinken)今(26)日上午在北京與中國外交部長王毅會面,而中國官媒央視與美國國務院均指出,布林肯將在今日下午於北京人民大會堂與中國國家主席習近平會晤,而王毅在早上

2024-04-26 16:18