《鄉民大學問EP.37》字幕版|台南政治版圖有變數?謝龍介有機會?黃偉哲全說了!台南市長前哨戰開打!陳亭妃、王定宇、林俊憲鴨子划水 邱明玉揭他勝算高!黃智賢轉綠?被哥哥盜帳號?黃偉哲霸氣回應現場笑翻!

NOW影音

更多NOW影音焦點

更多焦點-

到總統府僅5分鐘!共機離基隆41海浬 邱國正:國軍戰備監控防範

共機不斷擾台,日前距離基隆僅41海浬,前空軍副司令張延廷稱,這距離飛到總統府上空只要5分鐘。對此,國防部長邱國正今(24)日回應表示,國軍為何要戰備、監控,就是防止這些事情發生。立院今日審議「陸海空軍

2024-04-24 10:32

-

每位補助企業5.4萬訓練費!青艦計畫先僱後訓、助青年成副工程師

青年初入職場,因為工作經驗不足尋職時四處碰壁,可能很多人都曾經歷過,大學就讀化工系的陳靖,因為缺乏實務經歷,畢業後2次面試機會皆未獲錄取,因緣際會參加勞動部辦理的青年就業旗艦計畫,透過「先僱用後訓練」

2024-04-24 10:19

-

一粒姊姊甜蜜官宣男友宋嘉翔!現身樂天2軍球場 戀情早有跡可循

台鋼雄鷹啦啦隊成員「一粒」因「葉保弟應援曲」的魔性舞步爆紅,連帶仙氣十足的雙胞胎姊姊Joy也跟著爆紅。今(23)日,Joy也在IG上甜蜜公開球員男友,是樂天桃猿潛力「大物」捕手宋嘉翔。事實上,Joy早

2024-04-23 16:58

-

彰化三合院凌晨突發大火!99歲嬤逃生不及葬身火窟 家屬崩潰

彰化縣埤頭鄉堤頭路一處三合院民宅,今(24)日凌晨4時5分發生火警,火勢一發不可收拾,火光更穿透房頂,消防局獲報後立即到場,5時15分撲滅火勢,不過居住在屋內99歲陳姓阿嬤行動不便,逃生不及,救出時已

2024-04-24 10:13

精選專題

要聞

更多要聞-

生命權是人權的基石!人權會:死刑無法帶來「替天行道」的正義

憲法法庭昨進行死刑釋憲言詞辯論,國家人權委員會昨晚發新聞稿說,監察院許多調查報告顯示,死刑案件從偵查到執行階段,有侵犯人權的事實,如刑求及不公平審判;死刑在刑事制度上似乎為被害人家屬帶來「替天行道」般

2024-04-24 10:25

-

死刑辯論是留給賴清德的「坑」?郭正亮:這2人合謀搞的

國內37名死囚主張死刑違憲,向司法院憲法法庭聲請釋憲;死刑憲法辯論於23日登場,大法官7月將作死刑是否違憲的宣告。對此,前立委郭正亮認為,按照準總統賴清德的性子,不可能讓這種案子去憲法法庭辯論,認為死

2024-04-24 10:17

-

鐵飯碗更爽了?為「降低工時」 人事總處研議:調高特休補助額度

鐵飯碗更爽了?為降低工時,行政院人事總處研議公務員特休假完全休畢的獎勵或鼓勵制度,除了鼓勵公務人員事先規劃安排休假,並推動業務簡化以降低工時,使公務員有機會實施特休假,並同時審議研議是否適度調高公務員

2024-04-24 10:15

-

要不要廢死應由立法院決定 蔡清祥:法務部堅決主張死刑規定合憲

憲法法庭昨進行死刑釋憲言詞辯論,法務部長蔡清祥今(24)日在立院受訪說,法務部立場明確,堅決主張死刑規定合憲,但是要不要廢除死刑,是另外一個問題,應該由代表民意的立法機關來做決定。至於會中有大法官質疑

2024-04-24 10:13

新奇

更多新奇-

《池水抽光好吃驚》來台灣!抽光中興湖 驚見「激似鯊魚」外來種

日本知名綜藝節目《池水抽光好吃驚》在今年3月份來台灣,由主持人田村淳與興大生組成多達1百人的「池水台日隊」,抽光國立中興大學內的「中興湖」池水,結果捕撈出近3百隻生物,裡面甚至還有「激似鯊魚」的外來種

2024-04-23 18:07

-

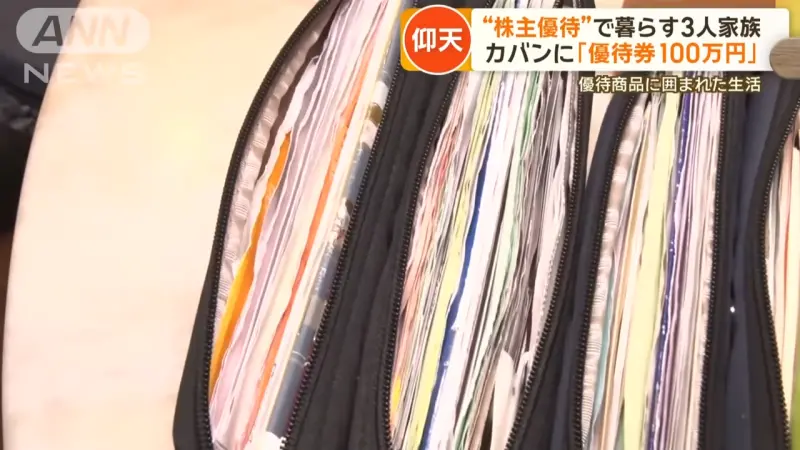

7年買710支股票不賣!1家3口靠「股東福利」活超爽:出門不用花錢

台灣進入股東大會旺季,各家公司開始發放股東會紀念品,例如六福(2705)會發放價值1199元門票給6萬名股東,中鋼(2002)則送出超實用的抗菌多功能不鏽鋼砧板組,總是引發廣大討論。而在日本,更有奇人

2024-04-23 16:56

-

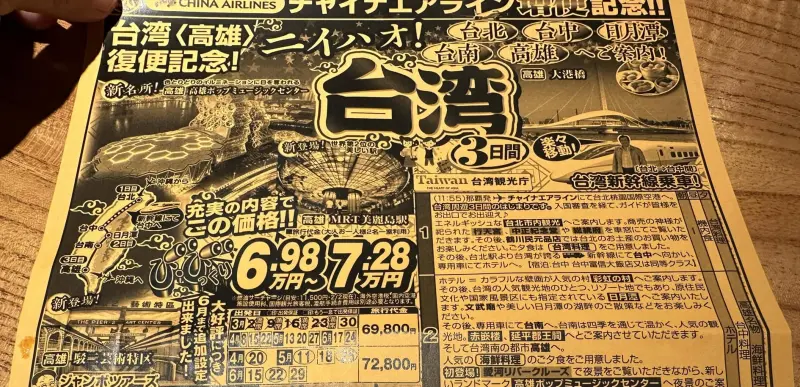

日本旅社推台灣3日遊!團費「不到1萬5」超俗 眾見完整行程嚇壞

這幾年台灣的國旅住宿價格備受關注,許多民眾皆抱怨「飛出國比在台灣玩便宜」,輿論持續發酵,也讓今年農曆春節連假時不少旅宿業者的訂房率慘澹。不過近期就有日本旅行社推出的台灣3天2夜的行程,團費竟然只要1萬

2024-04-23 16:09

-

統神YouTube頻道「經營6年失言遭刪」!火大發聲 申訴2次遭打槍

知名實況主「統神」張嘉航日前因為評論黃子佼爭議事件時,語出驚人講錯話,而引爆爭議,隨後不僅被多家遊戲廠商終止合作,經營6年的YouTube頻道更是直接被官方刪除。對此,統神22日晚間首度發文透露近況,

2024-04-23 08:28

娛樂

更多娛樂-

周星馳首度接下陸綜!3大新作曝光《喜劇之王》《食神》驚喜回歸

「喜劇天王」周星馳近年少有新作品推出,令大批「星爺」影迷想念不已,昨(23)日卻突然傳來好消息,周星馳在社群平台上分享一段宣傳影片,開心向外界宣布,他將首度接下中國大陸綜藝節目《喜劇之王單口季》的製作

2024-04-24 10:12

-

F.I.R.出道20週年!阿沁預約大巨蛋:建寧老師、詹雯婷不要吵架了

F.I.R.飛兒樂團昨(23)日迎來出道20週年,不過3位成員早已各奔東西,該團加入新主唱後,發表2張專輯宣布單飛不解散,吉他手阿沁轉為獨立製作人,原主唱Faye飛(詹雯婷)則和團長陳建寧撕破臉,兩人

2024-04-24 09:16

-

72歲張菲近照曝光!戴金錶看牙醫 何妤玟巧遇驚呼「體格壯碩」

綜藝大哥張菲(菲哥)2018年結束節目《綜藝菲常讚》主持工作後便淡出螢光幕,移居花蓮過著半退休生活,最近一次公開露面是去年3月替沈文程演唱會站台。女星何妤玟昨(23)日在粉專分享和張菲的親密合照,72

2024-04-24 08:05

-

許美靜演唱會挨轟划水 許常德逆風力挺「商演公司不專業」

49歲新加坡女歌手許美靜日前在中國南京舉辦「音樂見面會」,吸引不少粉絲購票入場,然而原定2個半小時的演出,實際演唱時間只有30分鐘,加上門票太貴,就連成名曲也是請伴唱老師代唱,讓不少粉絲非常不滿,紛紛

2024-04-23 22:26

運動

更多運動-

76人虧大了!NBA關鍵報告讓尼克得利 Maxey:我討厭他們決定比賽

NBA季後賽費城76人在昨(23)日首輪G2以101:104不敵紐約尼克,目前系列賽以0勝、2敗落後尼克,NBA官方也在今(24)日給出這場比賽最後2分鐘的裁判報告,更出現4次漏判,且其中3次都對76

2024-04-24 10:04

-

快訊/大谷翔平連2場開轟!生涯177轟出爐 擊球初速高達191公里

(更新:道奇以4:1獲勝)大谷翔平又開轟!洛杉磯道奇隊大谷翔平,今(24)日出戰華盛頓國民,大谷不但在9局上開轟,還是發191公里的超速全壘打,這發全壘打也是他首度到國民隊主場開轟,為自己自我介紹,道

2024-04-24 09:45

-

那個男人回來了!Kawhi Leonard第二戰回歸 快艇出戰獨行俠利多

快艇一哥雷納德(Kawhi Leonard)回歸!NBA季後賽洛杉磯快艇今(24)日將在第二場出戰達拉斯獨行俠,Kawhi Leonard確定將正式回歸出戰對手,而這也是他今年季後賽首戰,Kawhi

2024-04-24 09:10

-

徐基麟挑戰陳義信、風神等強投大紀錄!也是中信兄弟的救命仙丹

中信兄弟先發投手徐基麟,18日對富邦悍將繳出6局無失分的優質先發,開季3戰就拿3勝,若他在今(24)日對戰樂天桃猿贏球,就可追上過去1992年陳義信、1998年卡洛索、2002年風神、2015年克蘭頓

2024-04-24 08:49

財經生活

更多財經生活-

快訊/出門注意!雙北等10縣市「大雨特報」 嚴防雷擊、強陣風

今(24)日受鋒面影響,全台各地整天皆有降雨機率,中央氣象署發布「大雨特報」,提醒彰化以北民眾,鋒面影響易有短延時強降雨,務必注意雷擊及強陣風,且近期地震頻繁,山區土石鬆軟,非必要請勿前往,並留意慎防

2024-04-24 10:20

-

只有3天!7-11美式買1送1、韓國泡麵半價 拿鐵、珍奶第2杯10元

7-11超值五六日咖啡優惠曝光!限時3天有精品美式買1送1,還有韓國炸醬拉麵也買1送1,相當於半價優惠,並且今(24)日門市還有燕麥系列飲品「第2杯10元」優惠倒數,包括燕麥拿鐵、黑糖珍珠燕麥奶都含在

2024-04-24 08:41

-

國家級警報慢了!「地震速報APP」爆紅 開發者是17歲高中生驚呆

0403花蓮地震過後,每天都發生大小不一的餘震至今,22日甚至出現連續地震、23日凌晨還有兩起芮氏規模6以上的餘震,讓許多民眾嚇到不敢睡,也讓地震通知APP有了「大量需求」,不少網友都上網請益推薦的地

2024-04-24 06:58

-

LINE手滑傳錯醜照「無法收回」!女嚇壞急道歉 眾人用好幾年不知

LINE已經成為台灣人日常當中,最常使用的社群軟體,不論是在公事或者聯繫親友都非常的方便。然而每當我們傳錯訊息或者錯框的時候,總是會習慣使用LINE的「收回功能」,然而近日卻有網友發現,LINE的「官

2024-04-24 05:56

全球

更多全球-

希臘雅典迎致命夢幻橘光!北非沙塵暴襲來 當局發空汙警報

希臘在當地時間周二出現奇景,雅典全城被來自撒哈拉沙漠的沙塵吞噬,呈現一片如火星一般橘色,但當局提醒,這樣的空氣相當致命。根據《美聯社》報導,強烈的南風帶來了撒哈拉沙漠的沙塵,自北非跨過地中海,吞噬了希

2024-04-24 09:11

-

日本7月將換新鈔!日媒點出2大可能狀況 自動販賣機恐無法使用

日本將在7月3號正式發行新紙鈔,面額一萬、五千、一千將會改版,但舊鈔仍可持續使用。新鈔發行後將面臨哪些問題?日媒近日提到,可能將更加推進無現金交易的比例,同時,在街頭常看到的自動販賣機,也將面臨無法吞

2024-04-24 08:25

-

美股四大指數勁揚!特斯拉財報慘澹 盤後股價卻強漲10%

美股週二(23日)收盤再度收紅,四大指數紛紛勁揚,本週適逢美國企業的超級財報週登場,美股科技七雄有四家將在本周陸續公布,率先於盤後公佈財報的特斯拉狀況如預期的慘澹,但盤後股價仍硬聲漲了10%。許多大型

2024-04-24 06:54

-

聲音「AI化」算侵權?中國首例「AI聲音侵權」一審宣判配音員勝訴

人工智慧(AI)熱潮席捲全球,不少企業相繼推出AI相關業務,以減少人力支出,但在訓練AI期間可能產生的侵權爭議也開始出現。中國週二也審理了首樁「AI聲音侵權訴訟案」,作為配音師的原告稱自己的「聲音」在

2024-04-24 00:19