《鄉民大學問EP.37》字幕版|台南政治版圖有變數?謝龍介有機會?黃偉哲全說了!台南市長前哨戰開打!陳亭妃、王定宇、林俊憲鴨子划水 邱明玉揭他勝算高!黃智賢轉綠?被哥哥盜帳號?黃偉哲霸氣回應現場笑翻!

NOW影音

更多NOW影音焦點

更多焦點-

監院約詢侯友宜查35年前舊案 陳建仁:稱追殺是過度解讀

監察委員高涌誠、林郁容今(24)日約詢新北市長侯友宜,調查35年前所發生的世台會總幹事羅益世回台遭強制驅逐出境案,藍營痛批這是對侯友宜的政治追殺。對此行政院長陳建仁表示,政院也有很多案子受到監院調查,

2024-04-24 13:50

-

Q1營收衰退盤後股價反彈12% 特斯拉在漲什麼?陸行之列舉6大觀察

特斯拉公布第1季營收下滑9%,也是自2012年以來最大衰減幅度,低於分析師預期,儘管如此,特斯拉股價大幅反彈12%、德州儀器也在盤後大漲逾7%。對此,知名半導體分析師陸行之整理出6大原因,並提醒投資人

2024-04-24 13:23

-

一粒姊姊甜蜜官宣男友宋嘉翔!現身樂天2軍球場 戀情早有跡可循

台鋼雄鷹啦啦隊成員「一粒」因「葉保弟應援曲」的魔性舞步爆紅,連帶仙氣十足的雙胞胎姊姊Joy也跟著爆紅。今(23)日,Joy也在IG上甜蜜公開球員男友,是樂天桃猿潛力「大物」捕手宋嘉翔。事實上,Joy早

2024-04-23 16:58

-

首次死刑存廢言詞辯論!律師分析:大法官著重2個面向作判決

台灣37名定讞的死囚,集體向司法院憲法法庭聲請釋憲,包括羈押最久的邱和順、年紀最大的王信福等,認為死刑剝奪生命權、生命尊嚴,又違反憲法比例原則,有違憲之虞,昨天憲法法庭開庭言詞辯論,死囚訴訟代理人、及

2024-04-24 13:43

精選專題

要聞

更多要聞-

監院約詢侯友宜查35年前舊案 陳建仁:稱追殺是過度解讀

監察委員高涌誠、林郁容今(24)日約詢新北市長侯友宜,調查35年前所發生的世台會總幹事羅益世回台遭強制驅逐出境案,藍營痛批這是對侯友宜的政治追殺。對此行政院長陳建仁表示,政院也有很多案子受到監院調查,

2024-04-24 13:50

-

花蓮餘震頻傳傅崐萁堅持赴中!洪孟楷:審重建條例才是當務之急

花蓮月初發生強震,釀成嚴重災情,近兩天仍餘震不斷,昨天花蓮市富凱大飯店也發生傾倒,不過立法院國民黨團總召傅崐萁日前規劃率同黨立委訪問中國,計畫「仍未取消」。對此,國民黨團書記長洪孟楷今(24日)表示,

2024-04-24 13:42

-

藍委推核電廠延役 綠委反對「國民黨要在執政縣市蓋新核電廠?」

國民黨立委擬提案修「推動核子反應器設施延役條例草案」,放寬核電廠延役規定。對此,民進黨立委林宜瑾今(24)日表示,她堅決反對老舊核電廠延役,因此非常認同本週六「427反核電延役」行動訴求,呼籲國民黨回

2024-04-24 13:27

-

李四川指柯文哲任內北士科案「大小眼」!白議員:內行人說外行話

前台北市長柯文哲任內士林北投科技園區T17、T18地上權案爭議延燒,北市副市長李四川昨日表示,該案有無弊端還要調查,但跟T16比較,給人「大小眼」的感覺。對此,民眾黨台北市議員陳宥丞今(24)日表示,

2024-04-24 13:24

新奇

更多新奇-

劉寶傑《關鍵時刻》誤植「有吉弘行」照片!粉絲笑翻:變地震專家

知名政論節目主持人劉寶傑所主持的《關鍵時刻》,因為語氣激昂的強烈風格,深獲許多民眾的喜愛。日前更因為談論天團BTS(防彈少年團)金泰亨入伍的片段,因此在南韓爆紅。不過沒想到近期《關鍵時刻》節目組卻在談

2024-04-24 13:39

-

別管60元便當了!全聯「買1水果」送保鮮盒 優惠瘋傳:錯過等1年

先別管60元便當了!全聯福利中心因為經常推出許多新品,或者是期間限定的產品,因此婆媽常常會在臉書社團上討論分享。然而近日就有不少人分享去全聯購買「寶石紅奇異果」,並且開箱分享口感,沒想到卻釣出內行婆媽

2024-04-24 11:57

-

王彩樺是「台灣諧音始祖」!12年前神講解爆紅 觀眾挖出影片服她

相信有不少人之都知道台灣人真的非常愛用諧音,不過是餐廳、手搖飲甚至是健身房的名字,都能利用諧音來取名,像是知名連鎖飲料店「可不可(渴不渴)」、「鶴茶樓(喝茶嘍)」都是諧音。然而,近日就有網友挖出國民岳

2024-04-24 10:53

-

《池水抽光好吃驚》來台灣!抽光中興湖 驚見「激似鯊魚」外來種

日本知名綜藝節目《池水抽光好吃驚》在今年3月份來台灣,由主持人田村淳與興大生組成多達1百人的「池水台日隊」,抽光國立中興大學內的「中興湖」池水,結果捕撈出近3百隻生物,裡面甚至還有「激似鯊魚」的外來種

2024-04-23 18:07

娛樂

更多娛樂-

星二代女兒全學霸!甄子丹愛女在學就出道 李連杰寶貝3名校爭搶

藝人小S的18歲大女兒許曦文(Elly),錄取南加州大學、加州大學伯克萊分校,將赴美國讀書。其實演藝圈學霸「星二代」,還有甄子丹女兒甄濟如 (Jasmine)與李連杰的大女兒Jane,分別就讀於伯克利

2024-04-24 13:46

-

小S大女兒是學霸!Elly錄取「這兩間頂尖名校」 媽不捨陪同赴美

綜藝天后小S(徐熙娣)結婚18年育有3名女兒,近日傳出18歲長女Elly(許曦文)將赴美攻讀名校南加大或加州大學,為名符其實的學霸,對此,媽媽小S證實此事,透露很替Elly開心,卻又不捨女兒到國外讀書

2024-04-24 12:40

-

許美靜開唱挨轟偷懶!伍佰、五月天「互動歌迷」反激起演唱會高潮

新加坡歌手「小王菲」許美靜唱紅〈城裡的月光〉、〈遺憾〉、〈蔓延〉等曲,日前在南京舉辦復出演唱會,被踢爆2個多小時的演出、只唱30分鐘,引發歌迷怒吼:「退票!」同樣喜歡在演唱會上「互動歌迷」的伍佰、五月

2024-04-24 12:07

-

小嫻不孕被問「為何不收養」 她無奈:公婆怎會要沒血緣的孩子?

小嫻(黃瑜嫻)14歲發現自己月經沒有來,檢查後被證實天生沒有子宮,右側卵巢也因為有良性畸胎瘤而切除,終身無法生育,她月初赴立法院參加「《人工生殖法》條文修正草案公聽會」,昨(23)日為自己及不孕女性發

2024-04-24 11:55

運動

更多運動-

英超/阿森納5:0大勝切爾西!領先曼城、利物浦 兵工廠有望奪冠

英超第29輪的補賽,「兵工廠」阿森納主場面對「切爾西,上半場,賴斯助攻特羅薩德小角度精采進球,傑克森射門中柱,隨後門前又錯失頭球機會,半場阿森納1球領先。然而90分鐘比賽結束,阿森納交出了一場難以置信

2024-04-24 13:35

-

NBA/Doncic、Irving合轟55分 獨行俠96:93勝快艇、系列賽扳平

NBA季後賽今(24)日由洛杉磯快艇在主場對陣達拉斯獨行俠,本場獨行俠除了靠著雙星Luka Doncic狂砍32分,聯手Kyrie Irving轟進55分,與在末節打出一波17:8的攻勢奠定勝基,終場

2024-04-24 13:23

-

NBA季後賽/太陽系列賽吞2連敗!Kevin Durant:還不是放棄的時候

NBA鳳凰城太陽今(24)日季後賽首輪G2,以93:105不敵明尼蘇達灰狼,太陽在系列賽大比分以0勝、2敗落後,雖太陽目前處於劣勢,但陣中球星Kevin Durant與Devin Booker在賽後記

2024-04-24 12:33

-

Jokic「大哥」與球迷爆發口角!還毆打湖人迷 聯盟決定介入調查

NBA美國職籃季後賽,在昨(23)日G2由洛杉磯湖人交手丹佛金塊,金塊靠著當家主控Jamal Murray中距離絕殺,以101:99絕殺湖人在系列賽大比分拿下2勝、0敗,雖金塊在這場贏下比賽,但卻在昨

2024-04-24 12:17

財經生活

更多財經生活-

快訊/雨勢升級擴大!13縣市「豪雨特報」 苗栗時雨量逼近60毫米

今(24)日受鋒面影響,全台各地整天皆有降雨機率,中央氣象署發布「豪雨特報」,提醒民眾,鋒面影響易有短延時強降雨,苗栗更是出現59.5毫米的時雨量,務必注意雷擊及強陣風,且近期地震頻繁,山區土石鬆軟,

2024-04-24 13:15

-

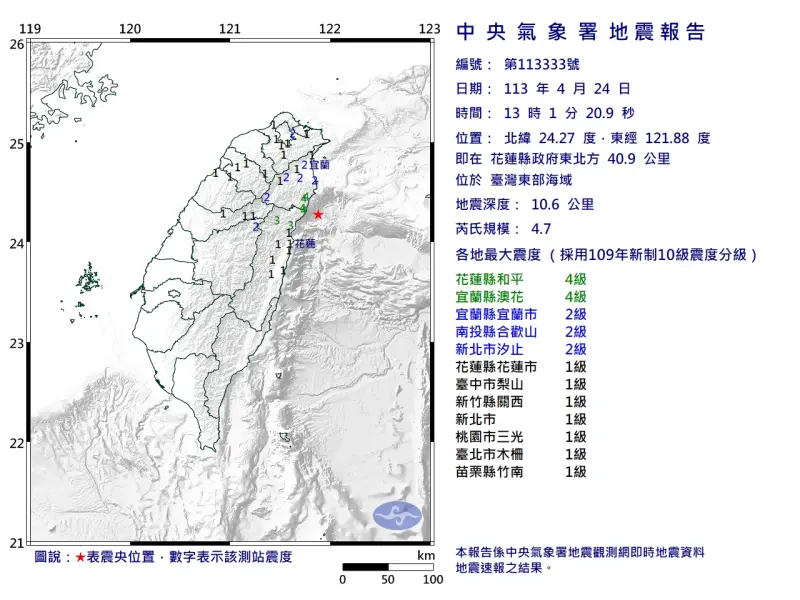

快訊/13:01「4.7極淺層地震」!花蓮最大震度4級 雙北也有感

中央氣象署地震測報中心表示,今(24)日下午1時01分台灣東部外海又發生芮氏規模4.7地震,震央位於花蓮縣政府東北方40.9公里 ,深度10.6公里屬於「極淺層地震」,測得最大震度在花蓮和宜蘭4級,其

2024-04-24 13:11

-

水庫救星快來!鋒面發威「石門水庫仍亮紅燈」 全台即時水情一覽

每年梅雨季前台灣會進入一波枯水期,上週石門水庫、寶山水庫、石岡壩、霧社水庫、仁義潭水庫等都亮起水情提醒,好消息是今(24)日起會有兩波鋒面接續襲台,為各地帶來高降雨機率,經過一早上的大雨特報,石門水庫

2024-04-24 12:32

-

水庫解渴就看這波!氣象署揭「豪雨轟炸」時間點 一週天氣一次看

全台水庫鬧水荒,急需降雨好好解渴,中央氣象署預報員徐仲毅指出,未來一週台灣天氣持續受鋒面影響較不穩定,明(25)日新一波鋒面接近,並在週五至週日(4/26至4/28)於台灣上空滯留徘徊,特別要留意週五

2024-04-24 12:12

全球

更多全球-

日本新世代不願再當社畜!日媒:企業正面臨職場革命

近日一名自新竹赴日工作的台積電員工訝異,看到日本同事時間到了就準時說要下班回家,顛覆了過去自己對於日本職場的印象。日媒也注意到近年來這樣的現象,隨著時代轉變,新一代員工更重視工作和生活的平衡,過去的企

2024-04-24 13:27

-

抗美援俄聯盟?北韓高官代表團罕見出訪伊朗 深化軍事合作掀關注

北韓對外經濟相尹正浩昨(23)日自平壤啟程前往伊朗,北韓官媒《朝中社》並未介紹此次行程的詳情與計畫,但這是北韓睽違5年再有高級官員出訪伊朗,時機恰逢伊朗與以色列緊張升溫之際,讓外界猜測北韓是否要與伊朗

2024-04-24 12:30

-

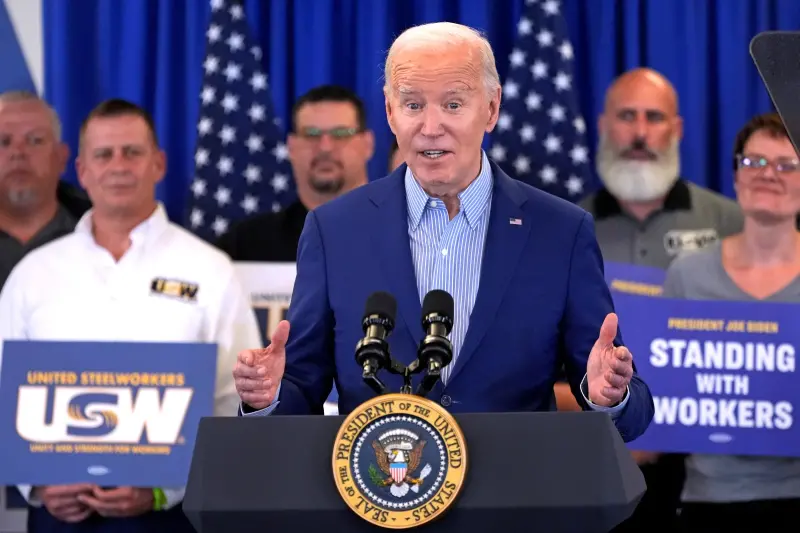

成功過關!美參院通過援以烏台法案 拜登迫不及待週三簽署

美國聯邦參議院23日以79票支持、18票反對,通過援助以色列、烏克蘭、台灣的包裹法案,該法案周三將上呈至拜登簽署。根據CNN報導,有15名共和黨人和3名民主黨人投下反對票,就在參議院通過後,美國聯邦參

2024-04-24 11:38

-

批美韓軍演是地區緊張禍首!金與正嗆:北韓將建立壓倒性軍事力量

北韓日前進行了首次核反擊演習,本月也曾發射測試大型彈頭的戰略巡弋飛彈,警告意味濃厚。而北韓領導人金正恩的胞妹金與正,今(24)日再度發表談話譴責美國和韓國頻繁聯合軍演,導致地區緊張局勢升級,揚言北韓將

2024-04-24 11:27