《鄉民大學問EP.36》字幕版|韓院長的突襲!藍綠白委員見“韓國魚”驚呼!謝龍介不敢睡 稱愈晚愈high在忙那椿?葉元之公開立院頭號女戰神是“她”!王世堅自豪這點連韓國瑜也比不上!|NOWnews

NOW影音

更多NOW影音焦點

更多焦點-

柯文哲2028不選了?他曝白營政治能量低原因:柯怕台智光案遭起訴

民眾黨主席柯文哲在2024敗選當晚就宣示2028年會捲土重來,但日前卻改口說「要看身體狀況」。對此,媒體人張禹宣指出,柯可能自知在台北市長任內有台智光、京華城等爛攤子,萬一被起訴就吃不完兜著走,現在是

2024-04-19 13:25

-

不敢相信!台股盤中一度跌1009點 台積電下殺54元、失守800元

美國股市昨(18)日跌多漲少,科技股幾乎收黑,其中台積電ADR下跌將近5%,拖累台北股市今(19)日開盤下跌410.92點或2.02%,來到19890點,失守兩萬點關卡,盤中更是傳出以色列發射飛彈消息

2024-04-19 13:52

-

Joeman風光回母校!求學弟Dcard護航被打槍 粉絲笑曝真相

百萬網紅YouTuber九妹(Joeman),以擅長拍攝開箱3C科技產品、房地產知名,尤其是奢華vs.平價對決系列點閱率超高,不過,去年捲入大麻風波後,讓他形象重創,一度面臨沒有業配的窘境,經歷過低潮

2024-04-19 11:40

-

參加同學會逃過火劫!夫逃生不及燒成焦屍 妻今早趕回家悲痛認屍

高雄三民區褒揚街266巷民宅深夜發生瓦斯氣爆案,造成1死7傷,其中死者為起火點隔壁棟75歲的顏姓老翁,因早睡導致逃生不及,當場命喪火海,現場一度傳出妻子失聯,後經確認為參加同學會逃過一劫。顏妻接獲噩耗

2024-04-19 13:05

精選專題

要聞

更多要聞-

柯文哲2028不選了?他曝白營政治能量低原因:柯怕台智光案遭起訴

民眾黨主席柯文哲在2024敗選當晚就宣示2028年會捲土重來,但日前卻改口說「要看身體狀況」。對此,媒體人張禹宣指出,柯可能自知在台北市長任內有台智光、京華城等爛攤子,萬一被起訴就吃不完兜著走,現在是

2024-04-19 13:25

-

打擊伊朗!台灣與以色列處境相似?蕭美琴:希望雙方國防合作增

今(19)日美國廣播公司(ABC)證實,以色列的飛彈在凌晨擊中了伊朗本土的1個據點。而日前副總統當選人蕭美琴才剛接見以色列國會議員訪問團,蕭美琴當天表示,台灣與民主國家正面臨威權主義的脅迫以及挑戰,台

2024-04-19 13:03

-

拋農業權「勿讓農業大縣變農業大限」 張嘉郡籲暫緩國土計畫

《國土計畫法》原訂明年4月30日上路,國民黨立委張嘉郡今(19)日表示,國土計畫的目的之一是保障糧食安全,卻讓雲林、嘉義、屏東等農業縣背負不可承受之重,雲林每人平均背負136平方公尺的農地責任額居全國

2024-04-19 12:57

-

「氣象達人」彭啟明任環境部長!卓榮泰盼:提升台灣防災應變能力

準行政院長卓榮泰今(19)日宣布第四波內閣人事,共公布5位內閣名單,分別為環境部長彭啟明、衛福部長邱泰源、客委會主委古秀妃、勞動部長何佩珊、原民會主委曾智勇;其中一大亮點,正是「天氣風險管理開發公司」

2024-04-19 12:39

新奇

更多新奇-

全美語幼稚園校外教學去資收場 家長氣炸:我小孩不會接觸這工作

孩子是國家未來的主人翁,不少幼稚園(幼兒園)會安排各項體驗活動,探訪警察局、走訪博物館,加深孩子對社會的了解。不過,一名家長近期抱怨,花大錢送孩子讀全美語幼稚園,結果校外教學居然去參觀資源回收場,質疑

2024-04-19 11:32

-

台大AV女優宣布徒步環台!首日狂走20公里「腳起水泡」 現況曝光

去年考上國立台灣大學的AV女優魏喬安,日前在社群平台上宣布要徒步環島旅行,第一天就狂走20公里,從台北車站走到三峽,也讓她腳上起水泡,再加上同行夥伴遭野狗咬傷,只能暫時回台北休養,不過她也強調,到下週

2024-04-18 20:05

-

一堆人到巴黎錢包被偷!黃大謙帶「8個錢包」實測 驚人結局曝光

法國的首都巴黎是擁有數千年歷史的古都,也是許多遊客到訪歐洲必去的浪漫城市。但當地治安卻總是亮起黃燈,一堆人都曾在當地錢包、財物失竊,當有人要去巴黎時,幾乎被提醒的第一句都是「小心錢包被偷」。對此,Yo

2024-04-18 18:38

-

佛心蛋「1顆賣1元」!每人限5顆 阿姨買100顆遭拒狂酸:還怕人買

不要糟蹋別人的心意!近期雞蛋價格雖然沒有去年「蛋荒」時昂貴,但想要買到一顆1元的雞蛋,仍可以說是天方夜譚。近期就有民眾表示,爸爸退休後迷上養雞、鴨,產生的蛋自家吃不完,就打算便宜販售,訂出「1顆蛋1元

2024-04-18 18:38

娛樂

更多娛樂-

謝和弦自爆出軌對象是女優「不小心露破綻」!一句話被抓包真實性

謝和弦前妻Keanna日前爆料,昔日陳芳語在錄音室趁著她離開後,與謝和弦發生關係。謝和弦透過經紀公司表示不回應,沉寂4天後在臉書上反擊,「記錯人了啦」,自爆親熱對象是以藝名「田井虹」拍日本AV出道的網

2024-04-19 13:22

-

鄭華娟追思會張清芳、萬芳無畏風雨齊聚!德籍老公來台道別愛妻

資深才女歌手鄭華娟上個月24日傳出過世消息,享壽60歲,滾石唱片也發文證實,鄭華娟於3月21日在德國辭世。昨(18)日滾石唱片在陽明山上為鄭華娟舉行追思會,她的德國籍丈夫Michael特別飛來台灣參加

2024-04-19 12:09

-

Keanna開戰陳芳語延燒!新歌挨轟難聽MV超尷尬「像遊覽車伴唱帶」

謝和弦前妻Keanna日前加入陳芳語與吳卓源的戰場,大爆陳芳語曾在錄音室跟謝和弦發生關係,雙方否認,Keanna堅稱自己有證據,拜託陳芳語授權給她公開。Keanna近日頻上新聞版面,有網友發現她2周前

2024-04-19 11:19

-

田馥甄曬亂髮照大嘆離譜!自比「王世堅髮型」 41歲素顏狀態曝光

女子天團S.H.E成員田馥甄(Hebe),近年來單飛後發行多張個人專輯,還拿下第32屆金曲獎金曲歌后,事業蒸蒸日上。田馥甄常在社群上跟粉絲分享生活日常,昨(18)日她開心曬出自己插花的照片,她不僅素顏

2024-04-19 10:12

運動

更多運動-

體操世界盃/「亞洲貓王」唐嘉鴻再創佳績!單槓預賽第1 拚第4金

「亞洲貓王」唐嘉鴻已經確定拿下奧運門票,今(19)日在體操世界盃卡達杜哈站男子單槓預賽表現亮眼,是全場唯一總分破15分的選手,續寫在國際賽中的好成績。目前單槓預賽暫排第1,緊跟在後的是2020 年東京

2024-04-19 13:15

-

影/19歲孫易磊生涯初登板解決37歲陽岱鋼!狂飆152公里速球勝出

日職二軍賽事,日本火腿鬥士隊今(19)日在主場出戰日本新潟天鵝皇隊,台灣好手陽岱鋼跟孫易磊的對決十分有趣,孫易磊今年才是以育成選手初登板,年僅19歲,陽岱鋼則是今年再度回到日職挑戰,年紀已經37歲,兩

2024-04-19 12:56

-

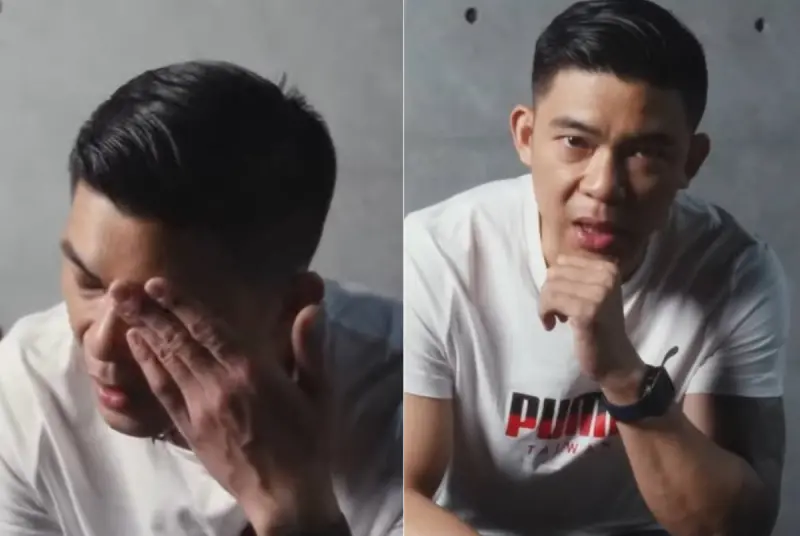

簡嘉宏「浪子回頭」!悔悟人生的眼淚最動人 讓許總失望他放不下

「浪子回頭金不換」,璞園前球星簡嘉宏曾經是正在升起的台灣籃壇明日之星,當年卻因涉入賭、毒而自毀生涯。如今事過境遷,他已有所悔悟,並重新在另一個領域再起,他唯一悔恨、感到對不起的是當年從再興中學一路將他

2024-04-19 12:50

-

Kuminga「錢景光明」!年薪上看9.7億 有望成勇士第2高薪球員

隨著NBA金州勇士在西區附加賽以94:118不敵沙加緬度國王,宣告本季結束提前放暑假,勇士球團也將在休賽季面臨是否重建還是繼續補強的抉擇,其中美媒《The Ringer》記者Logan Murdock

2024-04-19 12:44

財經生活

更多財經生活-

快訊/今起連3天好熱!「高溫飆36°C」警戒區曝 氣象署高溫特報

今(19)日鋒面遠離,水氣逐漸減少,各地溫度逐日回升,中南部則可以來到30到33度,週六、下週日(20日、21日)各地大多可來到33到35度。中央氣象署今(19)日中午發布高溫特報,包括臺南市、高雄市

2024-04-19 13:12

-

好市多斷貨夯品「快閃降價」!會員狂搬10盒 尿布、芳香豆也特價

美式賣場好市多(Costco)多元化的商品受到顧客喜愛,賣場也不定時推出快閃降價優惠,近期有會員發現,經常斷貨的「香皂組合」限時折110元,讓她一口氣爆買10盒,引發網友討論。《NOWnews》也額外

2024-04-19 12:15

-

台股重摔800點!科技高息ETF趁勢布局 專家:短期回檔不改AI成長

台股前些日子登上20796點寫下歷史新高,不過後續國際地緣政治紛擾、聯準會降息時點未明等影響下壓抑表現,再加上台積電法說會後出現失望性賣壓,台股今(19)日盤中10點40分過後一度大跌800點,下殺到

2024-04-19 10:46

-

藏壽司、壽司郎「神級服務」瘋傳!老饕眼睛全亮 店員認超多人點

台灣有不少人喜愛吃日式料理,以相對平價的日式料理來說,大家一定都會立刻想到「迴轉壽司」,近幾年知名連鎖品牌「藏壽司」、「壽司郎」就來台開設許多家分店,一家還比一家大間,每到用餐時段總是高朋滿座。然而,

2024-04-19 10:37

全球

更多全球-

伊朗官員聲稱防空系統擊落以色列無人機 對「核設施」影響曝光

中東衝突一觸即發,以色列今(19)日朝伊朗發射飛彈反擊,獲美國官員證實,伊朗方面也表示,已出動防空系統攔截以色列無人機,如今關於核設施的影響也曝光。伊朗半官方媒體官媒《法斯通訊社》(Fars)指出,伊

2024-04-19 12:15

-

美國不同意照打!以色列已預告將反擊伊朗 分析:釋放3項訊息

中東19日凌晨非常不平靜,以色列對伊朗發動飛彈攻擊,敘利亞、伊拉克等國也傳出爆炸聲響,伊朗多省啟動防空系統,並暫停境內多做機場的航班起降。美國官員向《CNN》證實,以色列已在當地時間週四預告,襲擊將在

2024-04-19 12:10

-

以伊中東戰爭風險升溫!避險日圓契機出現?日財長強調三國溝通

中東戰爭風險加劇,以色列今(19)日對伊朗發射飛彈反擊,獲美國官員證實。全球金融市場早上波動極大,台股更一度重挫990點。日圓兌美元則罕見未繼續探底。日圓兌美元匯率周四下跌0.1%,來到154.6日圓

2024-04-19 11:43

-

伊朗外長才喊「最大程度」反擊 以色列一發飛彈又轟入境內

中東戰爭一觸即發!以色列於當地時間今(19)日凌晨對伊朗展開反擊,但就在以色列反擊前,美媒CNN才釋出一段伊朗外交部長阿布杜拉希安(Hossein Amir-Abdollahian)的訪談,他表示,若

2024-04-19 10:56