《鄉民大學問EP.39》字幕版|#柯文哲 的三大案連環爆!涉貪污遭列被告 陳智菡曝內幕!蔡正元:離總統路更近!民眾黨再演宮鬥劇?柯文哲與黃國昌竟是這關係?#韓國瑜 立院霸氣喊“閉嘴” 2028真再戰?

NOW影音

更多NOW影音焦點

更多焦點-

證實出任教育部政次!台大教授葉丙成首發聲:目標打造更好的教育

台灣大學電機系教授葉丙成今(5)日證實將於520後,出任教育部政務次長,他透露未來目標是想打造更好的教育,讓少子化的台灣能有更多的人才,面對未來的挑戰。準總統賴清德以及準行政院長卓榮泰已陸續公布6波新

2024-05-05 20:47

-

今日來講股/區間高檔震盪做多安全 修正完畢這3大族群有機會

聯準會主席鮑爾釋出鴿派發言,激勵美國股市2日全數走高,帶動台北股市上週五(3日)走高,盤中一度上漲將近300點,可惜尾盤有壓,終場上漲107.88點或0.53%、來到20330.32點,成交量為404

2024-05-05 17:00

-

《不夠善良的我們》簡慶芬心經字超漂亮 導演曝抄寫人就是「她」

台劇《不夠善良的我們》上周末播畢後仍舊引發不少討論,尤其劇中的小細節,都是劇迷們討論的重點。倒數第2集中,由林依晨飾演的簡慶芬在抄寫心經,工整的字體十分漂亮,讓不少粉絲看到後都到導演徐譽庭的臉書留言,

2024-05-01 20:26

-

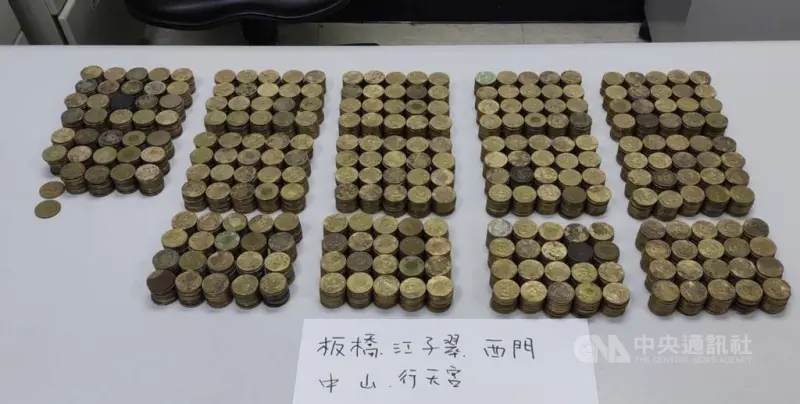

用捷運加值機洗錢!警方查獲大量瑕疵幣 兄弟檔詐欺等罪送辦

(中央社記者黃麗芸台北5日電)台北捷運站所設置的票卡加值機出現大量新台幣50元瑕疵幣,捷警隊偵辦發現是新北市蔡姓兄弟所為。蔡兄供稱是向回收業者逾半價購買,警方查獲5148枚中有33枚偽造幣,依法送辦。

2024-05-05 22:04

精選專題

要聞

更多要聞-

被指違反三權分立 沈伯洋籲陳昭姿:別被「為虎作倀」黃國昌綁架

民進黨立委沈伯洋提出民代赴中納管修法,被國民黨、民眾黨立委聯手退回程序委員會,民眾黨立委陳昭姿今(5)日說,沈的版本是違反三權分立。對此,沈伯洋則諷刺陳「不熟基本法學ABC」,如果司法院長去中國要聯審

2024-05-05 19:20

-

考察太平島獨缺民進黨立委 江啟臣:捍衛主權不應有朝野之分

立法院國防外交委員會召委馬文君16日將帶隊考察太平島,這次有20名藍白立委參加,卻獨缺民進黨立委。對此,立法院副院長江啟臣今(5)日指出,立法院前往考察建設、了解防務、慰勞官兵,就是傳達全體國人對領土

2024-05-05 17:26

-

合作公開透明?徐巧芯首曝台捷密件 千萬美元採購涉圖利恐沒人知

國民黨立委徐巧芯今(5)日揭露,外交部第三方援助烏克蘭計畫恐涉圖利,更曝光經手人身份,質疑恐介入捷克在地政黨政治,遭外交部駁斥「一切依法辦理」。對此,徐巧芯下午再度親上火線說明,更曬出112年12月3

2024-05-05 17:09

-

落選立委後接衛福部政次 林靜儀昔日「驚句」一次看!

新內閣各部會政務次長名單今(5)日公布,競選連任失利的前立委林靜儀將接任衛福部政務次長。林靜儀個性鮮明、驍勇善戰,勇於替執政黨執政辯護,也因此過去爆出許多「驚句」,包含「助理在大便」、「台中穿防彈背心

2024-05-05 16:10

新奇

更多新奇-

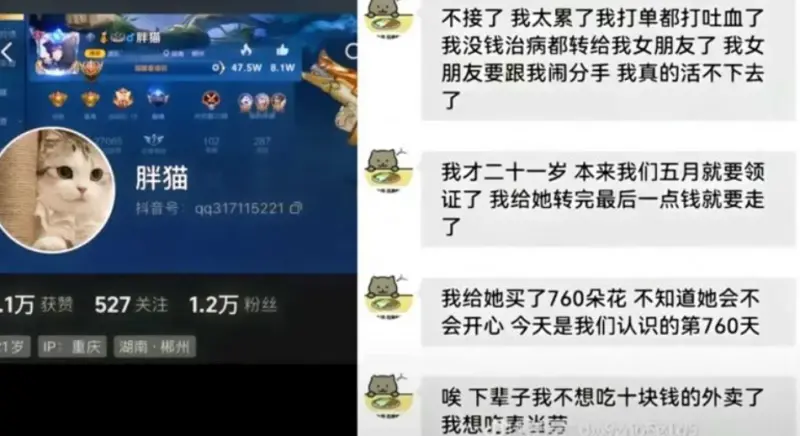

癡情男「胖貓」遭甩投江!前女友穿熱褲道歉被罵 親姊直播籲1事

21歲遊戲網紅「胖貓」4月從重慶長江大橋一躍而下,事後家人爆料,指控前女友「譚竹」兩年間拿了胖貓51萬人民幣(約新台幣232萬)之後,就以冷暴力方式逼迫分手,事件在中國大陸引發空前關注熱度,最近案情又

2024-05-05 21:16

-

超商拒換千元大鈔!他想到「1招」洗臉店員 全場罵翻:極致奧客

台灣的便利商店密度超高,常出現一條街上好幾間超商出現,相互競爭的現象,民眾的日常生活也離不開它們。超商服務相當多元,但換鈔這件事,一直以來都非正式項目,卻有民眾要求換鈔碰壁,竟想出「1招」成功換鈔順便

2024-05-05 20:39

-

公務員神卡「花蓮刷8000、發1萬6000」 一票怒:啥都要公務員扛

403花蓮大地震至今(4)餘震不斷,平日旅宿業住房率只剩1成,比新冠疫情期間更嚴重,學者估80億觀光產值蒸發,行政院砸15.84億要振興花蓮旅遊,而公務員人手一卡的「國民旅遊卡」也加碼了,要公務員持國

2024-05-04 17:11

-

高雄生態園區不忍了!6/15禁12歲以下入園 一票狂推:超贊成的啦

高雄大寮區開幕4年的多肉植物生態園區,昨(3)在臉書粉專發出公告,沉重宣布因為4年來遭受太多恐龍家長無理取鬧,放任孩子捉弄貓咪、拿石頭丟玻璃等脫序行為,勸說還會被家長反嗆「他只是孩子,跟他計較什麼」,

2024-05-04 16:12

娛樂

更多娛樂-

「真人版娜美」林明禎身體出狀況 自曝大小病復發:體驗各種痛

馬來西亞女星林明禎有著甜美臉孔及32E、22吋水蛇腰的魔鬼身材,被粉絲們封為「真人版娜美」。日前林明禎透露自己回老家休息,並在今(5)日坦言自己近期身體飽受各種疼痛,目前已經暫時停止工作。▲林明禎在I

2024-05-05 22:29

-

阿部瑪利亞遭問「有男友嗎?」 曖昧回應引粉絲暴動:蛇丸動作快

來自AKB48的日籍女星阿部瑪利亞從女團裡畢業後,來到台灣發展,加入網路熱門節目《木曜4超玩》成為固定主持人,以甜美的笑容與日本口音深得粉絲喜愛,每每在節目中出現,總能成為討論話題。她也經營個人You

2024-05-05 22:10

-

伊能靜自曝童年受虐經歷!全身潰爛長疹子 慘遭「浸泡雙氧水」

56歲女藝人伊能靜是圈內的美魔女代表,年過半百的她臉蛋及身材都保養得宜。近日,伊能靜與團隊前往香港工作,逛街時看到香港街道時,讓她回想起自己兒時在香港求學,既飽滿又孤單的回憶,並透露自己曾全身長滿爛疹

2024-05-05 21:46

-

嚴爵「退出歌壇7年」出現了!亮相健身比賽 親曝復出可能性

36歲男歌手嚴爵2009年出道,以文青形象走紅,2017年離開「相信音樂」後退居幕後,近年鮮少公開露面。今(5)日嚴爵難得現身好友張傑舉辦的健身比賽,已經結婚快4年的嚴爵表示目前正在與老婆積極備孕,並

2024-05-05 21:36

運動

更多運動-

快評/卡森斯展現不同的比賽面相 雲豹如何鎖死海神的擋拆進攻?

台啤永豐雲豹在季後賽首戰限制住例行賽場均得分破百的高雄全家海神,讓對手本場比賽只拿到76分,雲豹加拿大籍總教練查爾斯(Charles Dube-Brais)直言這是球隊「本季最佳的防守表現」。以查爾斯

2024-05-05 22:00

-

魔術、騎士搶七大戰!歷史數據:地主勝率75% 孤立戰再上演?

NBA魔術、騎士將在明早於季後賽首輪G7一較高下,過去NBA共出現了148次搶七大戰,主隊共拿下111勝,勝率達75%;本場擁有地主優勢的騎士被看好能突圍。兩隊實力相當,騎士本季對上東區球隊戰績是31

2024-05-05 21:24

-

PLG/總算連勝了!勇士79:74勝夢想家、搶季後賽門票僅剩1場勝差

PLG例行賽進入尾聲,目前排名第五的衛冕軍富邦勇士總算再嚐連勝滋味!今(5)日在主場和平籃球館碰上夢想家,富邦勇士3人得分達雙位數,其中洋將泰勒轟下22分,率勇士隊79:74獲勝。勇士元老級洋將塞瑟夫

2024-05-05 19:52

-

全大運/臺體大林琮憲撐竿跳破大會摘金連霸 老師一席話走出低潮

將地主壓力轉為助力,臺灣體大田徑選手林琮憲在113年全國大專校院運動會公開男生組撐竿跳高決賽以5公尺33留下金牌,超越個人最佳,同時也破大會紀錄(原紀錄為102年臺灣體大謝佳翰的5公尺32),晉升全國

2024-05-05 19:41

財經生活

更多財經生活-

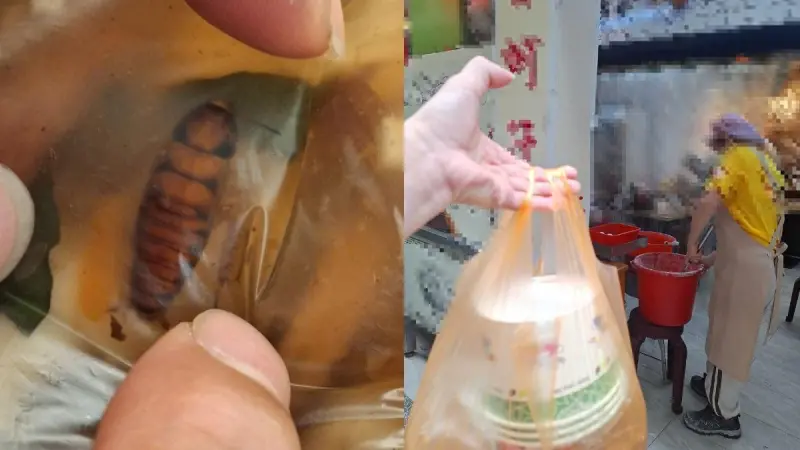

羹湯驚見整隻大蟑螂漂浮!老闆「冷回1句」整鍋繼續賣 顧客傻眼

今年以來台灣食安案件頻傳,讓外食族越來越注重食品衛生,店家儲放食物也該繃緊神經維護環境整潔。近期又有汐止民眾控訴,買到的羹湯內竟然有整隻大蟑螂漂浮,嚇得立刻告知店家,但老闆處理態度卻讓在地人十分傻眼。

2024-05-05 18:49

-

天氣預報/一週天氣出爐!鋒面、冷空氣接力 週三氣溫跌破1字頭

台灣天氣從明(6)日起仍有鋒面和東北季風影響,中央氣象署預報員張峻堯指出,未來一週東半部偶有降雨,週四(5/9)之後僅花東有零星雨,西半部方面,主要是北台灣受鋒面、海峽移入雲系影響,週一、週二(5/7

2024-05-05 17:24

-

台中男吃飯「拿筷子發呆」!一摸身體僵硬老闆急報警 病因曝光了

撿回一命!日前在台中市一處小吃店內,一位45歲江姓男子,看著滿桌菜餚,手持筷子卻一動也不動,老闆發現異狀上前關心,不料怎麼呼喚,江男都沒反應,讓店家嚇得立刻報警,真實病因也找出來了。位於台中南屯區的火

2024-05-05 13:44

-

「寶瓶座流星雨」5/6爆發!「時間、觀賞地點、方位、直播」一覽

明(6)日將迎接夏季首波流星雨「寶瓶座流星雨」,今年預估每小時天頂流星數可達50顆,輻射點約於凌晨1時30分左右東升,因此下半夜較適合欣賞,且越接近曙光前數量越多,月光干擾程度小,《NOWnews今日

2024-05-05 11:08

全球

更多全球-

印尼魯昂火山噴發不停歇!政府宣布「永久撤離」近萬名居民

印尼北蘇拉威西省首府萬鴉老(Manado,也稱美娜多)以北約100多公里處的魯昂火山(Mount Ruang),自4月17日以來持續噴發至今,當地政府上調警戒至最高級。目前風險持續升高,為顧及島上居民

2024-05-05 23:48

-

京都車站封鎖大亂!可疑背包寫「四塩化一黄酸」 結果虛驚一場

日本JR京都站今(5)日下午4時30分左右,傳出有乘客在車廂內發現可疑背包,車站隨即疏散進入月台的乘客,所有列車緊急停駛,京都警方獲報後立刻出動防爆小組處理,大陣仗打開背包,發現裡面僅裝有衣物,虛驚一

2024-05-05 23:04

-

美女教師偷吃「小5男學生」被捕!婚禮告吹 男童父親聞訊衝學校

《魔女的條件》在美國小學校園真實發生,美國威斯康辛一名24歲小學女老師柏格曼(Madison Bergmann),於當地時間1日因涉嫌與班上的5年級男學生多次「親熱」,被警方逮捕,引發譁然,與未婚夫原

2024-05-05 22:00

-

反指標又來?《富爸爸》作者警告市場崩盤開始 慘遭投資人狠打臉

狼又來了?以投資理財書《富爸爸,窮爸爸》聞名的作者羅伯特清崎(Robert Kiyosaki),近日又在社群平台X發文警告,市場崩盤已經開始,並分享應對市場崩盤的規則。然而,多年來不斷的反指標,也讓投

2024-05-05 19:57