《鄉民大學問EP.39》字幕版|#柯文哲 的三大案連環爆!涉貪污遭列被告 陳智菡曝內幕!蔡正元:離總統路更近!民眾黨再演宮鬥劇?柯文哲與黃國昌竟是這關係?#韓國瑜 立院霸氣喊“閉嘴” 2028真再戰?

NOW影音

更多NOW影音焦點

更多焦點-

證實出任教育部政次!台大教授葉丙成首發聲:目標打造更好的教育

台灣大學電機系教授葉丙成今(5)日證實將於520後,出任教育部政務次長,他透露未來目標是想打造更好的教育,讓少子化的台灣能有更多的人才,面對未來的挑戰。準總統賴清德以及準行政院長卓榮泰已陸續公布6波新

2024-05-05 20:47

-

今日來講股/區間高檔震盪做多安全 修正完畢這3大族群有機會

聯準會主席鮑爾釋出鴿派發言,激勵美國股市2日全數走高,帶動台北股市上週五(3日)走高,盤中一度上漲將近300點,可惜尾盤有壓,終場上漲107.88點或0.53%、來到20330.32點,成交量為404

2024-05-05 17:00

-

《不夠善良的我們》簡慶芬心經字超漂亮 導演曝抄寫人就是「她」

台劇《不夠善良的我們》上周末播畢後仍舊引發不少討論,尤其劇中的小細節,都是劇迷們討論的重點。倒數第2集中,由林依晨飾演的簡慶芬在抄寫心經,工整的字體十分漂亮,讓不少粉絲看到後都到導演徐譽庭的臉書留言,

2024-05-01 20:26

-

疑看導航分心!高雄男駕車突衝對向車道 無辜騎士慘遭撞飛受傷

高雄一名張姓男子(31歲),今(5)日凌晨開車行經仁武區後港巷時,疑因查看導航未注意路況,竟偏離車道衝往對向,撞翻吳姓騎士(38歲)後又撞上路邊燈桿,所幸吳男除全身多處擦挫傷外沒有生命危險。據了解,今

2024-05-05 21:31

精選專題

要聞

更多要聞-

被指違反三權分立 沈伯洋籲陳昭姿:別被「為虎作倀」黃國昌綁架

民進黨立委沈伯洋提出民代赴中納管修法,被國民黨、民眾黨立委聯手退回程序委員會,民眾黨立委陳昭姿今(5)日說,沈的版本是違反三權分立。對此,沈伯洋則諷刺陳「不熟基本法學ABC」,如果司法院長去中國要聯審

2024-05-05 19:20

-

考察太平島獨缺民進黨立委 江啟臣:捍衛主權不應有朝野之分

立法院國防外交委員會召委馬文君16日將帶隊考察太平島,這次有20名藍白立委參加,卻獨缺民進黨立委。對此,立法院副院長江啟臣今(5)日指出,立法院前往考察建設、了解防務、慰勞官兵,就是傳達全體國人對領土

2024-05-05 17:26

-

合作公開透明?徐巧芯首曝台捷密件 千萬美元採購涉圖利恐沒人知

國民黨立委徐巧芯今(5)日揭露,外交部第三方援助烏克蘭計畫恐涉圖利,更曝光經手人身份,質疑恐介入捷克在地政黨政治,遭外交部駁斥「一切依法辦理」。對此,徐巧芯下午再度親上火線說明,更曬出112年12月3

2024-05-05 17:09

-

落選立委後接衛福部政次 林靜儀昔日「驚句」一次看!

新內閣各部會政務次長名單今(5)日公布,競選連任失利的前立委林靜儀將接任衛福部政務次長。林靜儀個性鮮明、驍勇善戰,勇於替執政黨執政辯護,也因此過去爆出許多「驚句」,包含「助理在大便」、「台中穿防彈背心

2024-05-05 16:10

新奇

更多新奇-

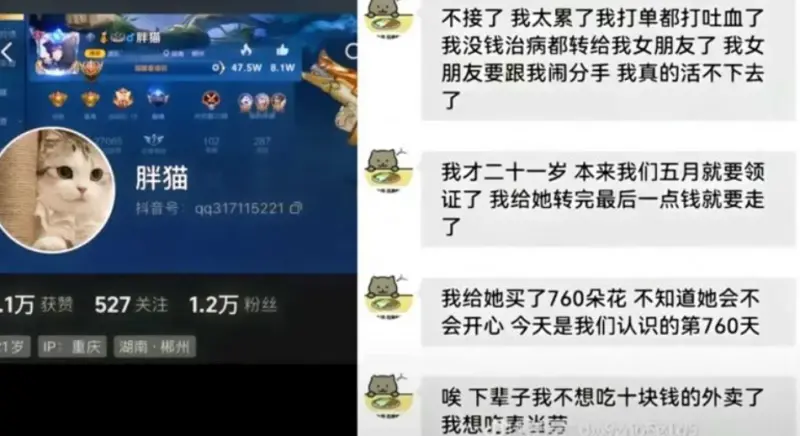

癡情男「胖貓」遭甩投江!前女友穿熱褲道歉被罵 親姊直播籲1事

21歲遊戲網紅「胖貓」4月從重慶長江大橋一躍而下,事後家人爆料,指控前女友「譚竹」兩年間拿了胖貓51萬人民幣(約新台幣232萬)之後,就以冷暴力方式逼迫分手,事件在中國大陸引發空前關注熱度,最近案情又

2024-05-05 21:16

-

超商拒換千元大鈔!他想到「1招」洗臉店員 全場罵翻:極致奧客

台灣的便利商店密度超高,常出現一條街上好幾間超商出現,相互競爭的現象,民眾的日常生活也離不開它們。超商服務相當多元,但換鈔這件事,一直以來都非正式項目,卻有民眾要求換鈔碰壁,竟想出「1招」成功換鈔順便

2024-05-05 20:39

-

公務員神卡「花蓮刷8000、發1萬6000」 一票怒:啥都要公務員扛

403花蓮大地震至今(4)餘震不斷,平日旅宿業住房率只剩1成,比新冠疫情期間更嚴重,學者估80億觀光產值蒸發,行政院砸15.84億要振興花蓮旅遊,而公務員人手一卡的「國民旅遊卡」也加碼了,要公務員持國

2024-05-04 17:11

-

高雄生態園區不忍了!6/15禁12歲以下入園 一票狂推:超贊成的啦

高雄大寮區開幕4年的多肉植物生態園區,昨(3)在臉書粉專發出公告,沉重宣布因為4年來遭受太多恐龍家長無理取鬧,放任孩子捉弄貓咪、拿石頭丟玻璃等脫序行為,勸說還會被家長反嗆「他只是孩子,跟他計較什麼」,

2024-05-04 16:12

娛樂

更多娛樂-

嚴爵「退出歌壇7年」出現了!亮相健身比賽 親曝復出可能性

36歲男歌手嚴爵2009年出道,以文青形象走紅,2017年離開「相信音樂」後退居幕後,近年鮮少公開露面。今(5)日嚴爵難得現身好友張傑舉辦的健身比賽,已經結婚快4年的嚴爵表示目前正在與老婆積極備孕,並

2024-05-05 21:36

-

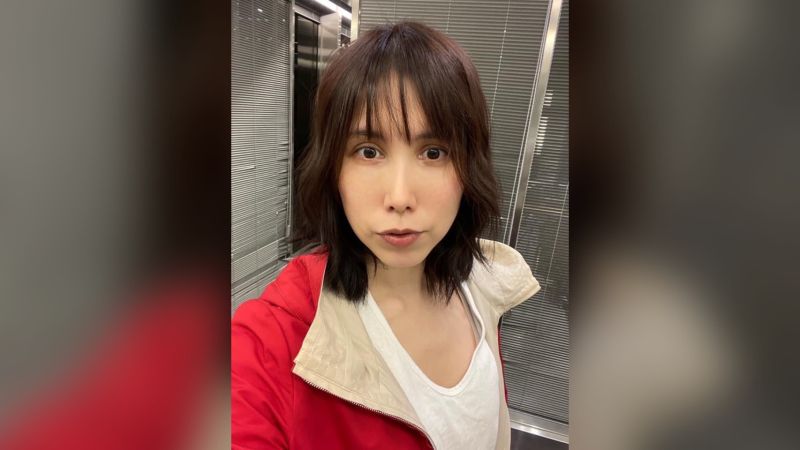

Makiyo不演了「其實不愛前夫」!閃離1年短命婚 嫁人原因曝光

39歲女藝人Makiyo在2022年5月19日宣布懷孕,隔天與金先生登記結婚,未料隔年7月14日就簽字離婚。Makiyo日前上節目《新聞挖挖哇》時坦承,自己其實根本不愛前夫,2人從分開至今,對方都沒有

2024-05-05 20:26

-

賴薇如打化療藥治療「子宮外孕」 吐求子挫敗:是時候停下腳步

39歲女星賴薇如近年積極備孕,3月做試管嬰兒時卻碰上機率極小的子宮外孕,導致腹部出現積血狀況。有醫生建議賴薇如立即開刀,但她仍堅持觀察,懷孕指數一度飆高。近期,賴薇如透露自己正在打化療藥物讓囊胚萎縮,

2024-05-05 19:32

-

沈建宏否認叫外送茶!還原出軌「醒來在她家」 喊話前任:別雙標

男星沈建宏先前被女友Bella痛批約砲、叫外送茶,甚至控訴他是劈腿慣犯,引起外界譁然。今(5)日沈建宏出席好友張傑的健身比賽活動,首度澄清此事,直言女方的控訴並不是真的,但因為酒後失誤也感到很抱歉,認

2024-05-05 18:20

運動

更多運動-

魔術、騎士搶七大戰!歷史數據:地主勝率75% 孤立戰再上演?

NBA魔術、騎士將在明早於季後賽首輪G7一較高下,過去NBA共出現了148次搶七大戰,主隊共拿下111勝,勝率達75%;本場擁有地主優勢的騎士被看好能突圍。兩隊實力相當,騎士本季對上東區球隊戰績是31

2024-05-05 21:24

-

PLG/總算連勝了!勇士79:74勝夢想家、搶季後賽門票僅剩1場勝差

PLG例行賽進入尾聲,目前排名第五的衛冕軍富邦勇士總算再嚐連勝滋味!今(5)日在主場和平籃球館碰上夢想家,富邦勇士3人得分達雙位數,其中洋將泰勒轟下22分,率隊79:74獲勝。富邦勇士相隔18場沒連勝

2024-05-05 19:52

-

全大運/臺體大林琮憲撐竿跳破大會摘金連霸 老師一席話走出低潮

將地主壓力轉為助力,臺灣體大田徑選手林琮憲在113年全國大專校院運動會公開男生組撐竿跳高決賽以5公尺33留下金牌,超越個人最佳,同時也破大會紀錄(原紀錄為102年臺灣體大謝佳翰的5公尺32),晉升全國

2024-05-05 19:41

-

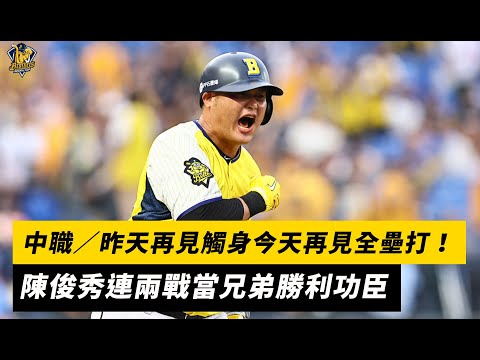

全大運/拿中信兄弟「安心亞」自嘲 清大邱于庭拚5屆標槍首奪金

清華大學邱于庭揮別全大運四連亞,今(5日)在113年全國大專校院運動會(全大運)公開女子組標槍決賽力壓全國紀錄保持人李慧君、新生代好手朱品薰,以55公尺14摘下金牌。回憶過往四年,總會遇到差一點的遺憾

2024-05-05 19:32

財經生活

更多財經生活-

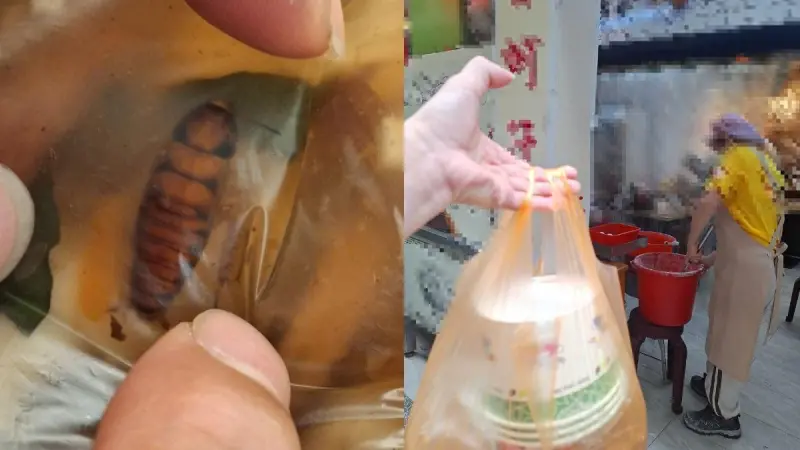

羹湯驚見整隻大蟑螂漂浮!老闆「冷回1句」整鍋繼續賣 顧客傻眼

今年以來台灣食安案件頻傳,讓外食族越來越注重食品衛生,店家儲放食物也該繃緊神經維護環境整潔。近期又有汐止民眾控訴,買到的羹湯內竟然有整隻大蟑螂漂浮,嚇得立刻告知店家,但老闆處理態度卻讓在地人十分傻眼。

2024-05-05 18:49

-

天氣預報/一週天氣出爐!鋒面、冷空氣接力 週三氣溫跌破1字頭

台灣天氣從明(6)日起仍有鋒面和東北季風影響,中央氣象署預報員張峻堯指出,未來一週東半部偶有降雨,週四(5/9)之後僅花東有零星雨,西半部方面,主要是北台灣受鋒面、海峽移入雲系影響,週一、週二(5/7

2024-05-05 17:24

-

台中男吃飯「拿筷子發呆」!一摸身體僵硬老闆急報警 病因曝光了

撿回一命!日前在台中市一處小吃店內,一位45歲江姓男子,看著滿桌菜餚,手持筷子卻一動也不動,老闆發現異狀上前關心,不料怎麼呼喚,江男都沒反應,讓店家嚇得立刻報警,真實病因也找出來了。位於台中南屯區的火

2024-05-05 13:44

-

「寶瓶座流星雨」5/6爆發!「時間、觀賞地點、方位、直播」一覽

明(6)日將迎接夏季首波流星雨「寶瓶座流星雨」,今年預估每小時天頂流星數可達50顆,輻射點約於凌晨1時30分左右東升,因此下半夜較適合欣賞,且越接近曙光前數量越多,月光干擾程度小,《NOWnews今日

2024-05-05 11:08

全球

更多全球-

反指標又來?《富爸爸》作者警告市場崩盤開始 慘遭投資人狠打臉

狼又來了?以投資理財書《富爸爸,窮爸爸》聞名的作者羅伯特清崎(Robert Kiyosaki),近日又在社群平台X發文警告,市場崩盤已經開始,並分享應對市場崩盤的規則。然而,多年來不斷的反指標,也讓投

2024-05-05 19:57

-

韓國旅遊哪裡不便?官方調查揭:購物價格、計程車不當收費最惱人

韓國是台灣人國外旅遊的熱門地點,在旅遊時是否有感受過任何不便的感覺?為了解決觀光客較差的旅遊觀感體驗,韓國觀光公社(旅遊發展局)5日發佈一項統計,整理出對於訪韓外國遊客的最不方便的體驗,結果顯示,主要

2024-05-05 18:23

-

金正恩新歌在Tiktok打敗泰勒絲?外媒分析Z世代為何狂熱

北韓於上月17日透過朝鮮中央電視台播出新的政治宣傳歌曲《和藹的父親》(Friendly Father),未料,這首偶像崇拜式的歌曲,竟在TikTok上竄紅,觀看次數迅速突破百萬,外媒也分析這首政令歌曲

2024-05-05 17:11

-

空氣清淨機也遭殃!日本黃金週亂象 電視機、備品被「打包」帶走

日本黃金週進入尾聲,不過在快樂出遊的民眾踏上歸途的同時,日本飯店與旅館業界卻面臨頭疼的問題。不少民眾在住宿後,會將備品一起帶回家,甚至失竊物品從電視到空氣清淨機都有。根據《朝日電視台》報導,一間位於櫪

2024-05-05 16:14