《鄉民大學問EP.38》字幕版|藍營2028的超級戰術!黃暐瀚:民調洩民進黨這弱點!廢死引爆民怨 是蔡英文挖坑給賴清德?台電屢跳電 萬美玲曝內幕:竟是小鳥惹的禍?!賴清德赴立院國情報告?將對上韓國瑜?

NOW影音

更多NOW影音焦點

更多焦點-

不當「徐禁評」!徐巧芯改口「不告網友」:我本就可受公評

國民黨立委徐巧芯大姑與其丈夫涉詐騙洗錢案,後續相關發言持續引出案外案,徐巧芯大動作質疑罵她的人來自政府機關,但數位發展部調查發現,該IP源自彰化縣社頭鄉立圖書館,驚動鄉長趕緊報案找發文者,徐巧芯更揚言

2024-05-01 21:02

-

韓「人工智慧盛會」AI EXPO登場 如何應用AI成未來商機

韓國有意在2027年前躋身全世界3大AI強國,在AI發展成為各國你追我趕的激烈軍備競賽之際,由韓國人工智慧協會主辦、為期三天的「AI EXPO KOREA」今(1)正式登場,並有超過300多家企業和機

2024-05-01 20:13

-

《不夠善良的我們》簡慶芬心經字超漂亮 導演曝抄寫人就是「她」

台劇《不夠善良的我們》上周末播畢後仍舊引發不少討論,尤其劇中的小細節,都是劇迷們討論的重點。倒數第2集中,由林依晨飾演的簡慶芬在抄寫心經,工整的字體十分漂亮,讓不少粉絲看到後都到導演徐譽庭的臉書留言,

2024-05-01 20:26

-

6歲童遭狠父毆打!丟「水箱」溺斃 國民法官重判父親關16年

台中市豐原區徐姓男子,長年有家暴紀錄,去年間多次對6歲兒以衣架、藤條等物毆打,並使男童在水箱內溺斃,台中檢方依凌虐未成年人致死罪起訴徐男並請求重刑,台中市地院國民法官參審後,今(1)日依凌虐未成年人致

2024-05-01 20:37

精選專題

要聞

更多要聞-

不當「徐禁評」!徐巧芯改口「不告網友」:我本就可受公評

國民黨立委徐巧芯大姑與其丈夫涉詐騙洗錢案,後續相關發言持續引出案外案,徐巧芯大動作質疑罵她的人來自政府機關,但數位發展部調查發現,該IP源自彰化縣社頭鄉立圖書館,驚動鄉長趕緊報案找發文者,徐巧芯更揚言

2024-05-01 21:02

-

不告週刊告圖書館鄉民?律師嗆徐巧芯「擺明轉移焦點!」

國民黨立委徐巧芯大姑與其丈夫涉詐騙洗錢案,如今爆出丈夫劉彥澧與劉母早已知情,而徐日前揭露大姑遭家暴的錄音檔更是經過剪接,但徐巧芯並未對爆料的週刊提告,反倒是喊告網路批評的網友,對此律師黃帝穎今(1)日

2024-05-01 20:45

-

總統府駁斥喬NCC人事!黃國昌怒嗆蔡英文可恥:別躲在發言人背後

民眾黨立委黃國昌今(1)日在質詢時爆料,總統蔡英文3月中與民眾黨主席柯文哲會面時,竟直接喬NCC人事案,要給國民黨2席、綠白各一席,總統府駁斥,強調非事實,黃國昌立即再嗆蔡英文可恥,不要只敢躲在發言人

2024-05-01 20:22

-

蔡英文和柯文哲喬NCC人事?總統府:黃國昌未參與會面言論非事實

民眾黨立委黃國昌今(1)日爆料,總統蔡英文曾向民眾黨主席柯文哲提議,國家通訊傳播處(NCC)人事案,「國民黨2席、民眾黨1席、民進黨1席」。對此,總統府發言人林聿禪強調,黃國昌並未參與當天會面,所發表

2024-05-01 19:12

新奇

更多新奇-

日本又見「千年一遇美少女」!地下偶像側拍照爆紅:媲美橋本環奈

「千年一遇美少女」又出現了!近期在日本X社群上,有一位地下偶像的照片瘋傳,因為專注於表演時的甜美容貌,被認為像極當年被拍下「奇跡的一枚」的橋本環奈,而這位地下偶像的身分也曝光了。▲中川心目前是地下偶像

2024-05-01 22:36

-

停機車遭貼「5字貼紙」!女騎士錯愕 機車族一看開戰:有夠離譜

台灣一直以來都有「機車王國」的稱號,許多人上下班通勤都是依靠機車來代步,不過隨著機車量非常龐大,停車的問題至今仍然沒辦法全面解決。近日,就有網友分享,自己準備要牽車時,卻意外發現車輛的儀表板上面被貼了

2024-05-01 19:39

-

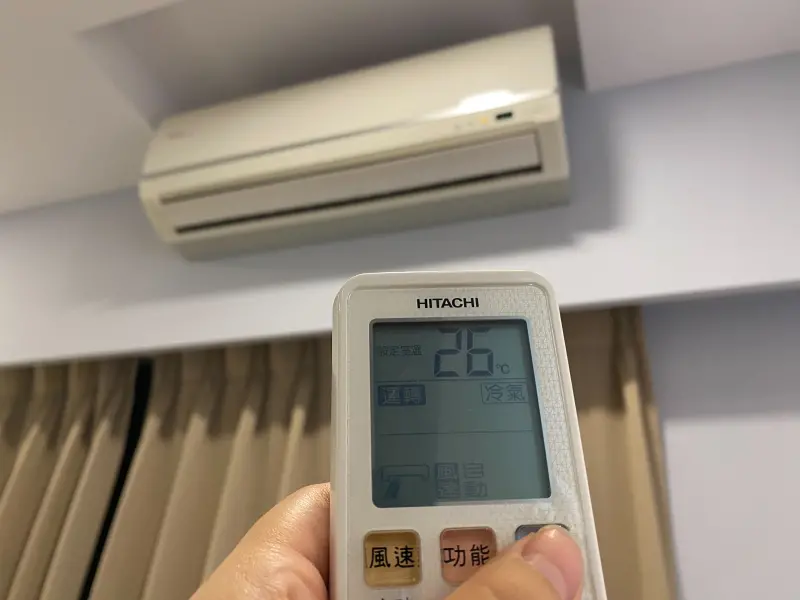

買冷氣「內行不選大賣場、連鎖店」!老闆揭真相:師傅之間都知情

炎炎夏日即將來臨,不少人為了夏季高溫在做準備,有人準備更換家中的老舊冷氣,也有人叫清潔公司來洗冷氣等等,然而擁有一台好的冷氣固然重要,但售後服務到底好不好、快不快速也是一大重點!近日就有網友討論「冷氣

2024-05-01 19:37

-

蘋果公司面試難題日本瘋傳!「123=4」如何成立 一票人被考倒了

再過不久畢業季就要到來,許多應屆畢業的大學生,也將進入職場工作,第一關就是將面臨人資的面試考驗。近期在日本社群上,就有一個號稱是「蘋果的入職考題」爆紅,會詢問面試者「123=4」如何成立?問題也讓一大

2024-05-01 18:31

娛樂

更多娛樂-

HYBE堅決提告閔熙珍!告贏可賤價「1000億降至32億」收購20%股份

南韓娛樂界龍頭「HYBE娛樂」與旗下廠牌「ADOR」代表閔熙珍的鬥爭持續延燒,根據韓國媒體報導,「HYBE娛樂」以「職務背信罪」向閔熙珍提告,一旦成功將導致閔熙珍要售出手上持有的18%「ADOR」的股

2024-05-01 22:29

-

邊荷律向經紀人抱怨「胸前肉肉很明顯」!不合身泳裝照曝光

中信兄弟啦啦隊Passion Sisters近期正在積極籌備2024女孩卡的拍攝事宜,其中一套必須穿上泳裝進行拍攝。不過,邊荷律似乎對於自己拿到的泳裝十分不滿意,並且透過翻譯向經紀人乖姐抱怨泳裝不合身

2024-05-01 21:26

-

鄭家純整件洋裝透視!沒穿內衣又不走光 揭小心機:幾乎看不出來

30歲鄭家純(雞排妹,改名鄭采勻)前年11月嫁給大3歲日籍醫生AKIRA,並為愛退出寫真界,她昨(30)日在臉書分享工作花絮照,穿一件全透視的洋裝,由於沒穿內在美,做足防護措施,卻又看不出破綻,網友一

2024-05-01 18:53

-

TWICE娜璉新造型「參考台灣商店破洞微波袋」?粉絲笑瘋:超級像

韓國知名女團TWICE近期推出的第13張迷你專輯《With YOU-th》成功登上了「Billboard 200」的冠軍一位,是韓國K-POP史上第3組成功登頂的女子團體。TWICE的日本官方帳號,也

2024-05-01 18:13

運動

更多運動-

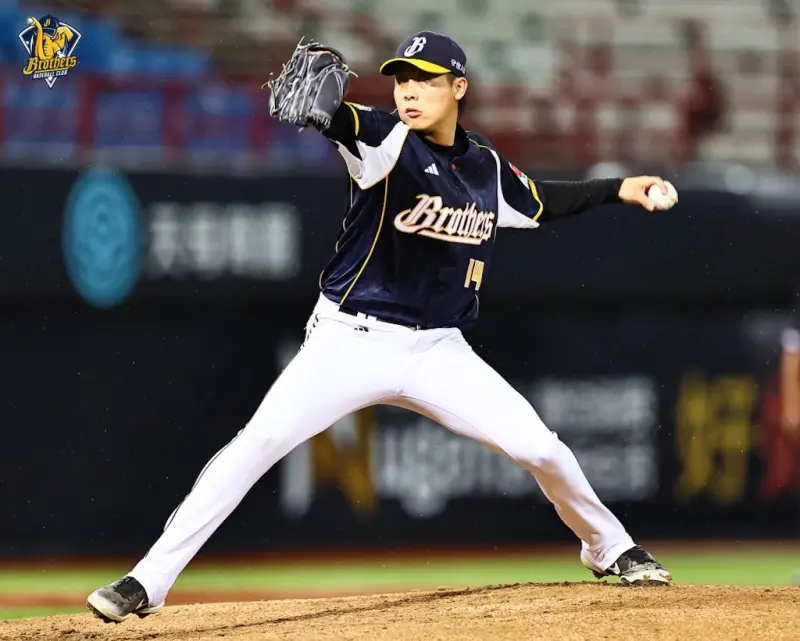

中職快評/兄弟崛起!本土先發更牢靠 盤點魏碩成拿勝投兩大關鍵

中信兄弟近況不差,近3場拿下2勝,之前與強敵統一獅戰成1平,加上拿新軍台鋼雄鷹進補,兄弟戰績11勝9敗,穩居第2,開季至今勝場數首度比敗場數多出2場,且是聯盟唯二勝率突破5成的球隊。兄弟後援投手穩定度

2024-05-02 02:23

-

李亦伸專欄/LeBron James生涯最終站 湖人、勇士、騎士三選一

湖人連續第二年被金塊淘汰,39歲「老詹」LeBron James未來還能不能帶領湖人奪冠?老詹今年夏天可以跳出合約,放棄最後一年5140萬美元,成為自由球員,投入自由球員市場。老詹也可能跟湖人續約三年

2024-05-02 01:59

-

影/怵目驚心!144公里速球直擊頭部 台鋼吳明鴻遭擔架抬出場

中華職棒新軍台鋼雄鷹近況低迷,今(1)日11分之差不敵統一獅,而且8局下捕手吳明鴻還遭到統一獅後援洋投裴瑞茲的頭部觸身球,畫面怵目驚心,當下他就被送往醫院,台鋼球團回應,「吳明鴻今晚被頭部觸身球直擊,

2024-05-01 23:23

-

5/1NBA季後賽焦點球星/貝佛利鎖住溜馬!Maxey關鍵7分轟爆尼克

20245/1NBA季後賽三場比賽都結束,分別是費城76人以112:106在延長賽擊敗強敵紐約尼克,Tyrese Maxey在第四節29秒連進7分,加上延長賽關鍵進球,成為致勝功臣。第二場賽事Evan

2024-05-01 22:42

財經生活

更多財經生活-

受瘦肉精風暴拖累 台糖1到4月肉品營收掉4000萬

台糖肉品之前被驗出含有瘦肉精,雖然後來證實食安沒有疑慮,但仍引發民眾恐慌,台糖董事長楊明州今(1)日表示,光是今年前4個月肉品營收就減少4000萬,不過預期端午節與中元節,肉品銷售將恢復正常水準,才有

2024-05-01 19:41

-

天氣預報/明全台有雨!週末趨緩「氣溫回飆30度」 下週又有鋒面

今(1)日梅雨季首波鋒面開始影響,全台各地陸續出現降雨,中央氣象署預報員曾昭誠表示,明(2)日水氣仍偏多,配合東北季風影響,各地持續有降雨影響,整個西半部也要小心局部大雨發生的機率,週末水氣才會明顯減

2024-05-01 17:16

-

綜合所得稅申報起跑!首報族必看6大問題 信用卡繳稅還能賺回饋

每年5月便是台灣的報稅季節,不少「報稅小白」對於第一次接觸到報稅規則、申報流程感到困惑,從申報方式到稅額的計算都是常見的問題。有社群媒體觀察,追蹤近一年「報稅問題」話題的網路聲量表現,發現「免稅門檻」

2024-05-01 16:56

-

快訊/入夜大雨續下!2縣市「大雨特報」 梅雨鋒面一路掃到明天

今(1)日受到梅雨季第一波鋒面影響,全台都有降雨機率,中央氣象署也發布「大雨特報」,提醒今(1)日晚至明(2)日晨臺中及南投山區有局部大雨發生的機率,山區請慎防坍方、落石及土石流。⚠️大雨特報📍大雨

2024-05-01 16:50

全球

更多全球-

美軍演訓照疑見「國軍特戰官兵」身影!粉專悄悄撤照 陸軍回應了

美國密西西比州國民兵(Mississippi National Guard)公關部門,近期在臉書粉專公布多張與其他單位演訓的照片,其中,有數張照片被發現疑似出現國軍身影。而在被發現後,粉專悄悄撤照,中

2024-05-01 23:44

-

Fed凌晨將公布利率決策!市場預料按兵不動 降息預測時間點發散

美國聯準會(Fed)預定美東時間1日下午2時(台灣2日凌晨2時)公布利率決策,市場預期利率將維持在5.25%至5.5%,然而,對於今年度降息時間點預測,卻相當發散。在美國聯準會會議後,主席鮑爾(Jer

2024-05-01 23:05

-

打起來了!美UCLA校園示威變分類械鬥 挺巴派大戰挺以群眾

美國大學校園挺巴勒斯坦示威活動愈演愈烈,繼昨日哥倫比亞大學發生抗議者破窗進入校園建築後。今日加州大學洛杉磯分校(UCLA)更是爆發了挺巴派與挺以色列的群眾之間的暴力衝突。綜合《美聯社》和《CNN》報導

2024-05-01 21:29

-

美國總統大選最新民調!川普男性支持者多 仍落後拜登1%

美國總統大選倒數約半年的時間,民主黨現任總統拜登將再度對決共和黨籍的前總統川普。根據最新民調顯示,皆陷入爭議的兩人與前次大選一樣勢均力敵,拜登僅領先川普1%。根據路透/易普索(Reuters/Ipso

2024-05-01 20:48